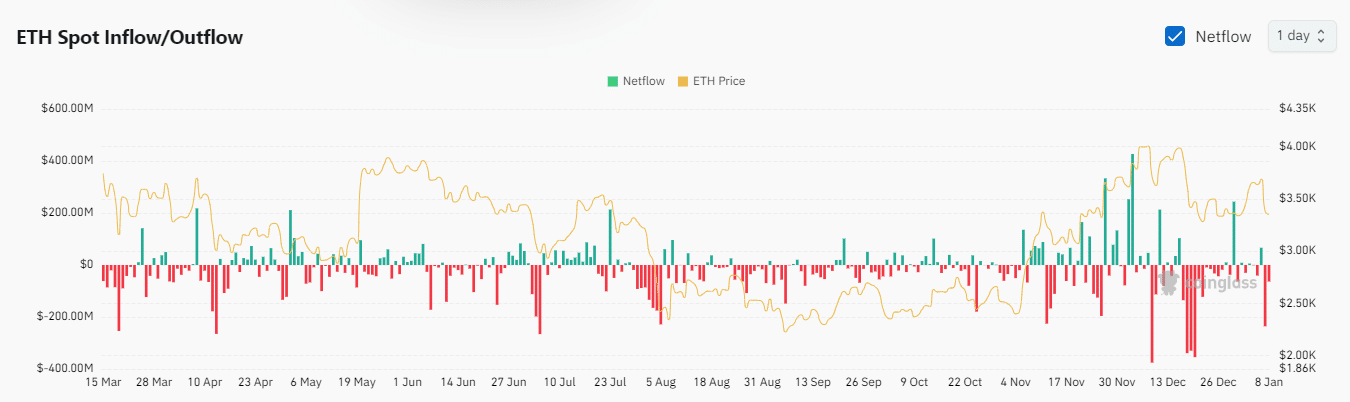

- Spot flows, including ETFs, turned negative, wiping out recent gains.

- Why a short term leverage shakedown played out recently and what’s next as whales make a comeback.

Unexpected selling activity has erased the initial growth Ethereum [ETH] experienced during the start of January.

There were several factors contributing to the selling activity, such as the need to reduce leveraged positions and withdrawals from the spot market, along with some additional reasons.

The outflows from the ETH spot ETF this week were perhaps the most significant indication of selling pressure. This sell-off started with $128.7 million in inflows on January 6th, following inflows on January 3rd.

This might have given an illusion of reassurance, leading to a panic selling spree filled with fear, uncertainty, and doubt (FUD), following the shift in ETF strategies on the 7th of January.

Or:

This could have provided a misleading feeling of comfort, leading to a frantic sell-off driven by fear, uncertainty, and apprehension (FUD) after Exchange Traded Funds changed their approach on the 7th of January.

Contrary to the negative trend for Ethereum, Bitcoin ETFs managed to stay positive over the past 24 hours. This underscores the current dominance dynamics between these two cryptocurrencies.

On January 7th, ETH ETF withdrawals amounted to approximately $86.8 million, mirroring the overall negative withdrawal trend seen on trading platforms during that timeframe. The outflow reached its highest point of $235.66 million on this particular day.

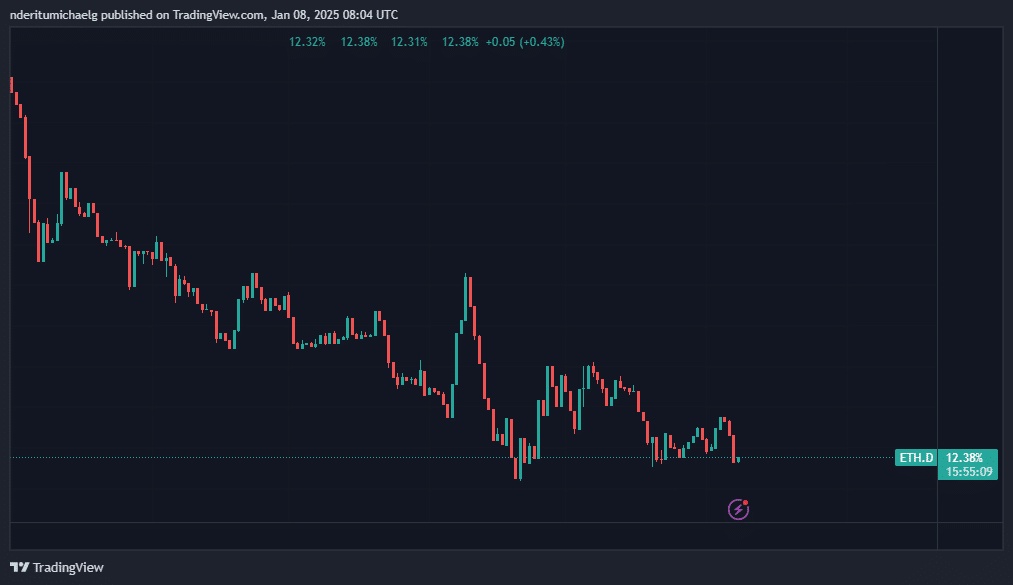

ETH dominance dips, but could be ready to pivot

Over the past while, intense selling has caused a drop in Ethereum’s market dominance, which had earlier surged to 12.87% during the weekend. Lately, developments have pushed it down even further to 12.32%.

ETH could potentially try to regain a stronger position starting from its current level, as this region has shown signs of providing support in the past.

The ongoing dominance in ETH’s market position coincides with a potential retest of its price trend. However, it remains uncertain whether the recent price downturn has concluded or if we might see further drops.

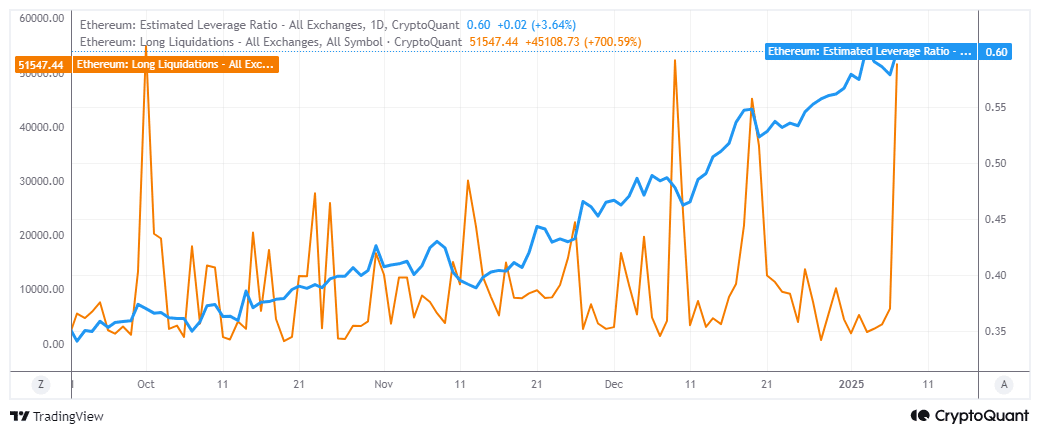

As an analyst, I suspect that the recent surge in sell pressure over the past two days might be attributed, at least partially, to leveraged long liquidations. This means that traders who had taken on larger positions (long) by borrowing funds (leveraging) might have been forced to sell their holdings due to market conditions, which in turn intensified the selling pressure we’ve witnessed.

Over the past couple of months, there’s been a growing interest in taking on more debt (or “leverage”). In fact, the number of long positions being liquidated has skyrocketed by more than seven times since January 3rd.

Over the past 24 hours, there were over $173 million in asset sales due to market forces. This could indicate that the recent market surge at the start of January might have been a prelude to a shakeout involving excessive borrowing.

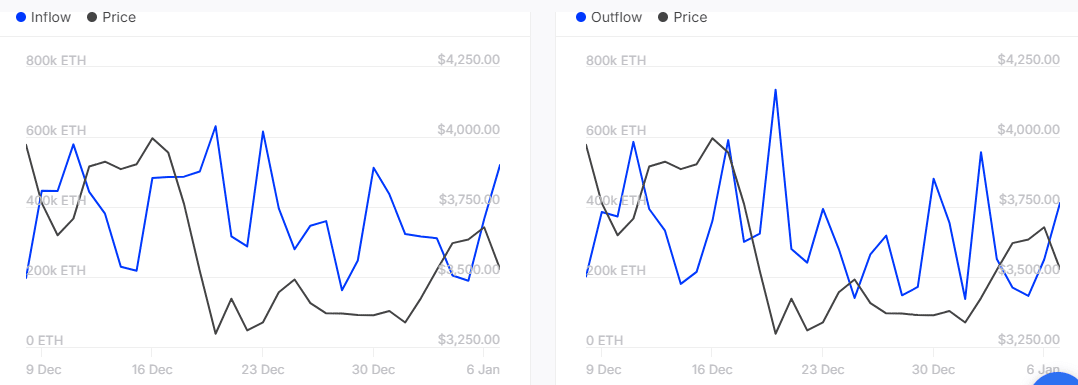

Could it be possible for the price of Ethereum (ETH) to rebound during the latter part of this week, given a significant finding that might suggest its future direction? This is speculated due to an ongoing trend: large investors, or “whales,” have been offloading their ETH holdings since early January.

Read Ethereum’s [ETH] Price Prediction 2025–2026

However, recent data reveals that they have been accumulating during the latest dip.

On the 7th of January, large ETH investors (known as “whales”) purchased approximately 519,620 ETH, while they only sent out 411,300 ETH. This suggests that whales have been taking advantage of price drops and could contribute to a recovery in the middle of the week.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2025-01-08 23:03