- A whale’s $19.7M long position on SUI was liquidated when price reached 4.56.

- SUI hovered around $4.52 but had surged past $5.36, suggesting robust movement.

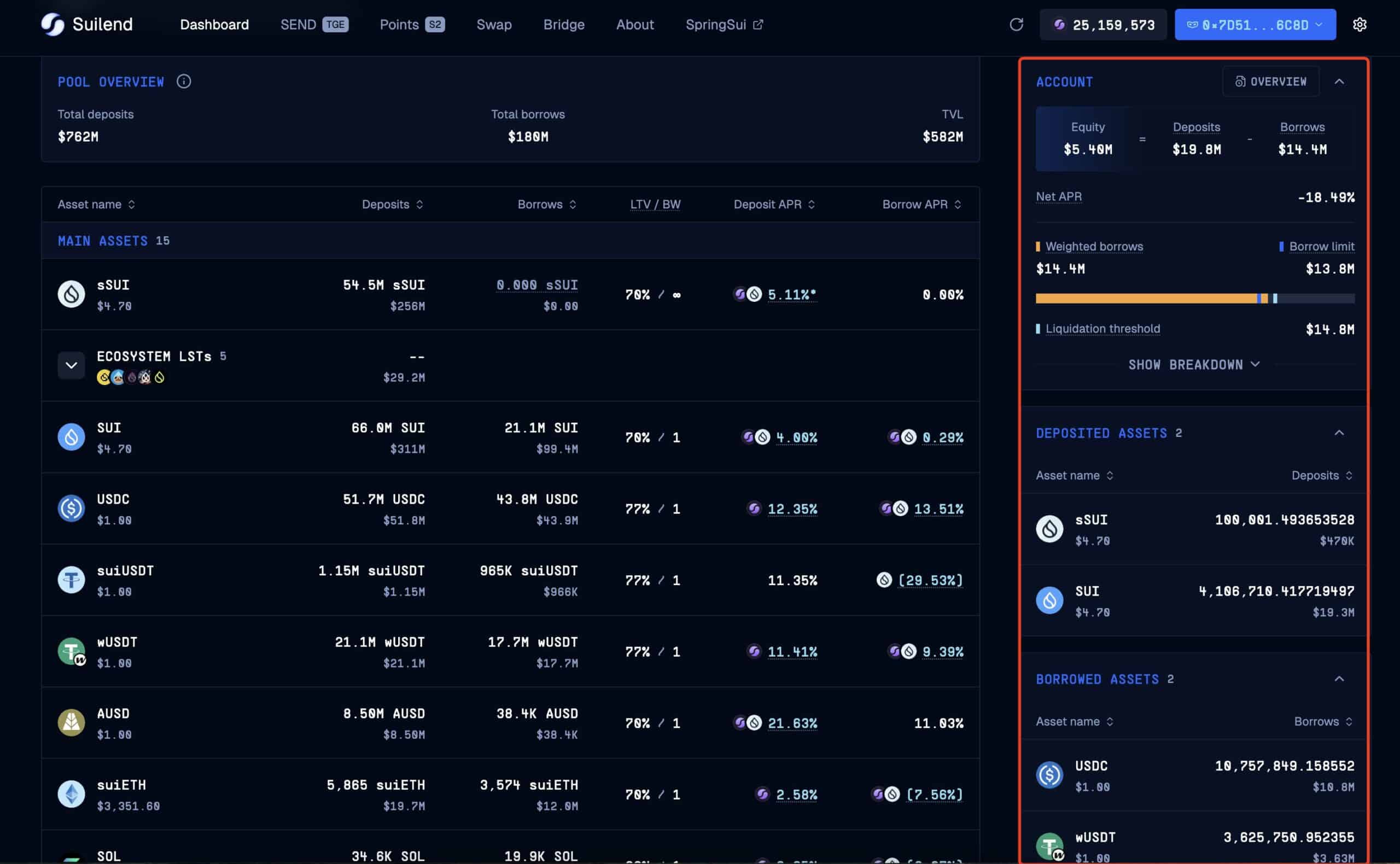

On the Suilend platform, an individual holding SUI tokens deposited a significant sum, roughly equivalent to 19.7 million dollars, into the lending pool. They then utilized this investment as collateral to receive loans in stablecoins.

Maintaining the current position requires the price to remain over $4.56 to prevent it from being sold off, as the situation came very close to this point when the price was previously trading.

As an analyst, I noticed that a decline falling beneath a specific level initiated the liquidation of the ‘whale’s’ position. This event might have sparked a wave of market sentiment adjustments and potentially resulted in a temporary price drop, as the surge in supply could be swift due to the sudden liquidation.

Conversely, the whale’s liquidation potentially stabilized or even boosted market confidence.

As a researcher, I’ve recently observed an instance that underscores the intricate equilibrium whales maintain within cryptocurrency markets. This occurrence serves as a stark reminder of the substantial influence their activities exert over market liquidity and price stability.

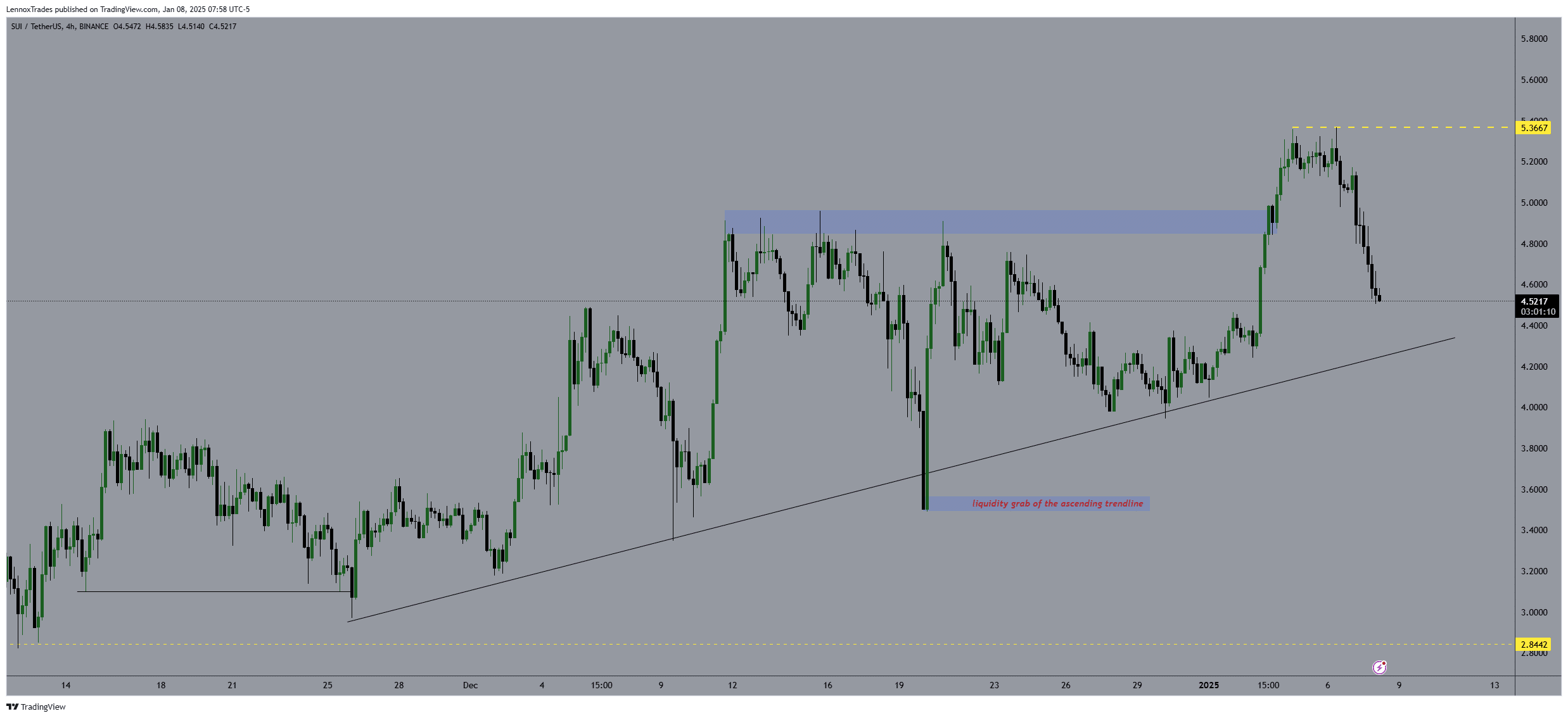

Price action and prediction

The behavior of SUI showed substantial shifts, as it appeared more often in longer investment positions. At first, the value of SUI was generally around $4.52, but later it spiked above $5.36, implying a strong level of resistance.

Following this peak, the price experienced a steep decline, descending back toward the $4.52 mark.

In this context, this pattern is a significant part of an upward trend, frequently perceived by traders as a region where they can accumulate more assets.

Based on its strong bounce back from the lower limit, the coin could present a profitable buying chance if it maintains this upward supporting trend.

Be aware that if the price falls beneath this upward trendline, it might reach around $2.84, signaling a substantial decrease. Such drops may influence the short-term direction of the price movement.

This study, concentrating on the possibility of reduced entry levels for SUI, is consistent with wider market insights and typical tactics used in unstable digital currency markets when it comes to trading.

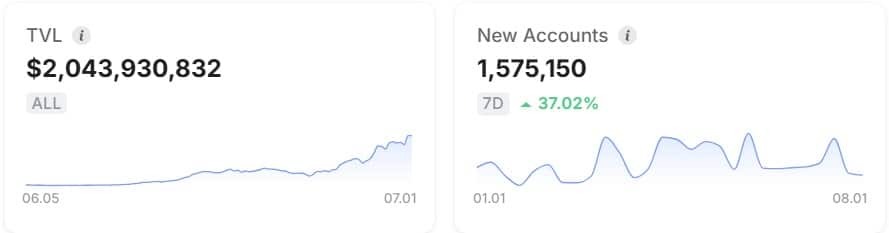

SUI’s on-chain analysis

As TVL reaches $2 billion and there’s a 37% surge in new accounts on a weekly basis, this suggests robust user interaction within the network, even amidst broader market adjustments.

Historically, when positive metrics are observed, it could indicate an upcoming increase in the coin’s value due to growing acceptance. This widespread use might offset any existing downward trends.

As a researcher, I’ve noticed an increase in new account registrations during market downturns. This surge might suggest that people are showing more faith and curiosity towards SUI, potentially providing a protective buffer against steeper declines and paving the way for a subsequent recovery.

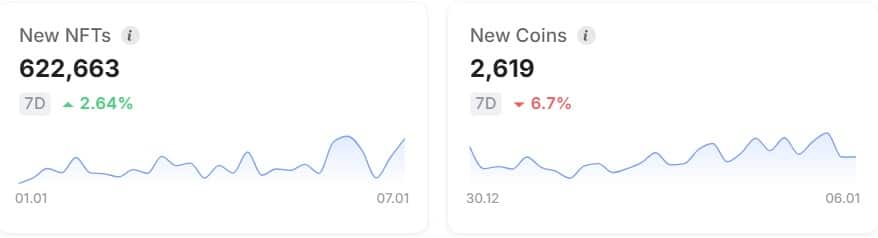

Over the last week, there’s been a 2.64% rise in the number of newly minted NFTs on the SUI blockchain, while the production of new coins decreased by 6.7%. This suggests that developers are now prioritizing non-fungible tokens over traditional coins, even amidst the ongoing market adjustment.

The growing interest in NFTs on the SUI platform could indicate a rise in activity, which may lead to a steady or even higher valuation for SUI as more investors and users interact with NFT-focused initiatives.

This change might protect SUI’s price from being influenced too much by wider market fluctuations, as long as Non-Fungible Tokens (NFTs) remain popular and continue to receive interest and funding within their community.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-09 10:15