- Crypto markets face heightened volatility as $443M in long positions are liquidated following robust U.S. jobs data.

- A strong labor market signals fewer rate cuts, pressuring Bitcoin, Ethereum, and risk-on assets.

On the 9th of January, the cryptocurrency market experienced a dip due to a double impact: robust U.S. economic figures that exceeded expectations and major liquidation incidents, both of which contributed to a pessimistic outlook among investors.

As a crypto investor, I’ve noticed that the market has taken a dip, affecting heavyweights like Bitcoin [BTC] and Ethereum [ETH]. This downturn has stirred up doubts about the market’s capacity to maintain its current pace.

Stronger-than-expected U.S. jobs data sends shockwaves

On January 8th, the U.S. Bureau of Labor Statistics published the most recent Job Openings and Labor Turnover Survey (JOLTS), reporting a staggering 8.096 million job vacancies for November 2024. This number surpassed the expected 7.605 million, indicating a strong demand in the labor market.

The robustness of recent employment figures indicates that the American economy continues to show strength, disregarding worries over decelerating expansion. This positive development bodes well for the overall economy, but carries substantial repercussions for monetary policies.

A robust job market tends to decrease the chances of drastic interest rate reductions by the Federal Reserve, a situation often favorable for speculative investments such as cryptocurrencies.

As investors expect interest rates to remain high for an extended time, they’ve been moving their investments away from riskier assets like cryptocurrencies, which could be one reason for the recent drop in the crypto market.

Liquidations amplify the downturn

Adding to the pressure, the crypto market experienced its largest liquidation event of the year.

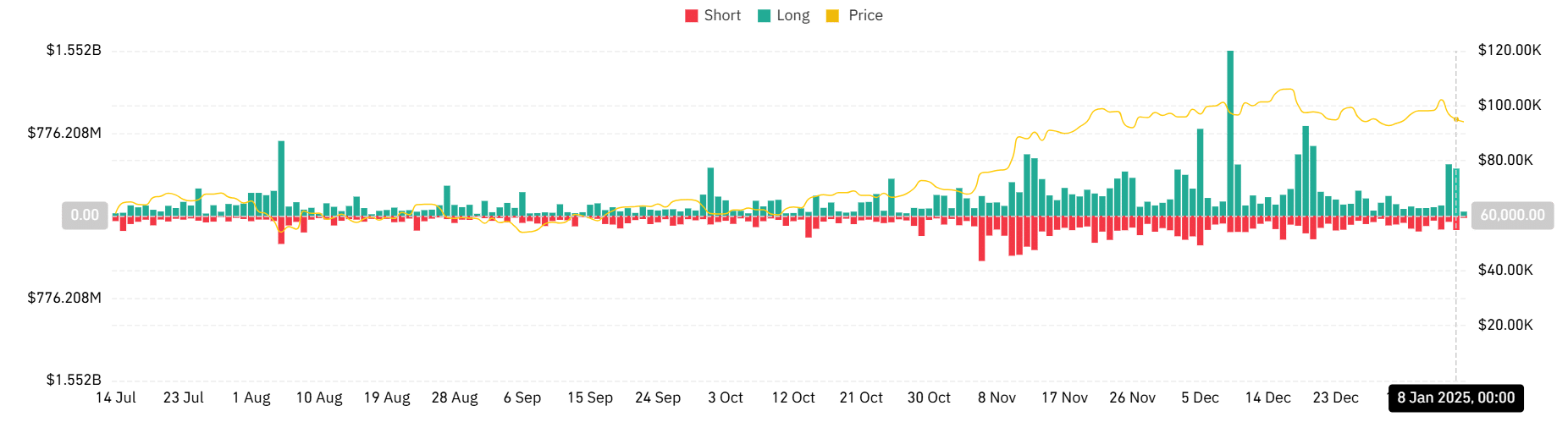

Over the past day, data shows that the amount of funds tied up in long liquidations was an astounding $443,023,000, contrastingly, short liquidations accounted for $135,539,000.

Or more concisely: In the last 24 hours, long liquidations totaled $443,023,000 compared to short liquidations at $135,539,000 according to the data.

According to AMBCrypto’s examination of the liquidation graph, significant peaks are observed, with more frequent losses occurring on long positions as prices plummeted rapidly. These massive liquidations suggest that many traders have taken on too much leverage, amplifying market turbulence during price drops.

These enforced sell-offs are contributing to a continued decline in the prices of Bitcoin, Ethereum, and other significant cryptocurrencies.

The study revealed that Bitcoin experienced the biggest withdrawal, amounting to more than $143 million. Meanwhile, Ethereum followed closely behind with over $97 million in withdrawals recorded.

Why the crypto market is down today: The broader context

The drop in prices occurs during times when there are wider economic and political issues at play. Lately, a decrease in technology stocks and lingering doubts about international markets have made conditions particularly difficult for cryptocurrencies.

OR

Prices are falling due to a combination of economic and geopolitical worries. Recent declines in tech stocks and ongoing uncertainty within global markets have created a tough situation for cryptos.

In simpler terms, when central banks are being cautious (hawkish) with their monetary policies and there’s less money flowing around (reduced liquidity), the cryptocurrency market could be at risk from larger economic changes or shocks.

During this time, stablecoins have demonstrated a degree of robustness, becoming more popular as indicated by a modest growth in market share. This shift suggests that investors are gradually moving towards relatively secure cryptocurrencies.

On the other hand, it’s been the more volatile altcoins that have suffered the most during this downturn, experiencing substantial declines overall.

What’s next for crypto markets?

Today’s crypto market decline underscores the sector’s sensitivity to macroeconomic developments.

After analyzing the recently released employment figures and their potential impact on Federal Reserve actions, the focus will now be on forthcoming economic happenings. These include the ADP employment report in December and the release of official jobs data on a Friday.

It’s wise for market players to anticipate ongoing price fluctuations, since the relationship between global economic indicators and the behavior of cryptocurrencies is still a significant factor.

At present, it’s advisable to approach trades with caution while keeping a keen eye on international economic fluctuations. These factors are expected to significantly influence the market’s future actions.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-09 23:04