- Avalanche celebrates healthy transaction growth, but it has been bleeding liquidity.

- AVAX demand cools off, but can the bulls make a comeback as price enters major short term support?

Currently, Avalanche (AVAX) is ranked 11th in terms of cryptocurrency market capitalization. With an increasing number of transactions, there’s a possibility that it could climb up to the top ten. However, market dynamics might also force it downwards.

The course of action for Avalanche primarily hinges on how the network functions, as a network evaluation produced some inconclusive findings.

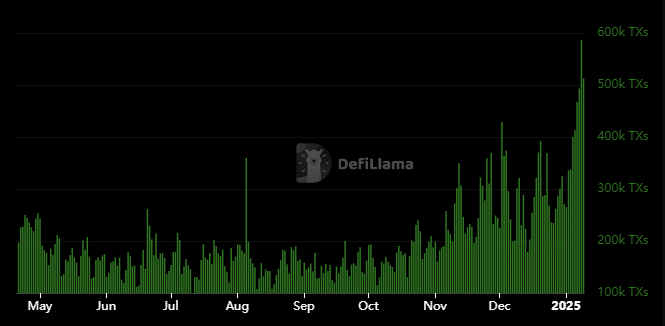

To illustrate, the Avalanche blockchain has been consistently recording an increase in daily transaction activity.

On the 8th of January, daily transactions hit a 10-month peak at 586,650, indicating robust expansion and increased usefulness of the network.

source: DeFiLlama

A consistently strong daily activity suggests the network might be headed in the right direction, but seizing growth potential demands something more: a rise in Total Value Locked (TVL) and maintaining a steady number of stablecoins.

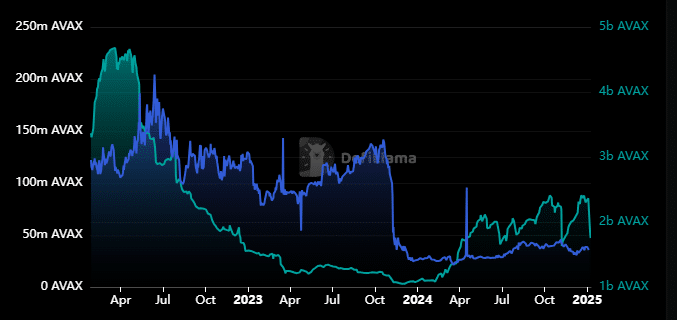

As reported by DeFiLlama, it’s been challenging for Total Value Locked (TVL) and the stablecoin market capitalization on the Avalanche network to consistently show a rise in value.

Speaking of Avalanche, it held around $1.375 billion in Total Value Locked (TVL), which is approximately 10% of the all-time high (ATH) it reached back in December 2021.

The liquidity within the Avalanche network has seen a decrease, with the total stablecoin market capitalization peaking at approximately $4.68 billion in March 2022, only to drop down to around $1.051 billion by the end of November 2023.

In the year 2024, it reached a peak of approximately $2.43 billion, however, this year, it started with substantial withdrawals.

By 2024, its value climbed up to nearly $2.43 billion, but at the beginning of this year, it experienced considerable outflows.

Over the past ten days, the total market capitalization of Avalanche’s stablecoin decreased by approximately $1 billion. Similarly, the Total Value Locked (TVL) within Avalanche dropped by around $140 million over the same timeframe.

AVAX approaches noteworthy support after recent dip

There was some uncertainty about how the increasing transaction numbers and decreasing stablecoins within the mixed network performance data might affect the value of AVAX.

The cryptocurrency’s price action has been moving in tune with the prevailing market conditions.

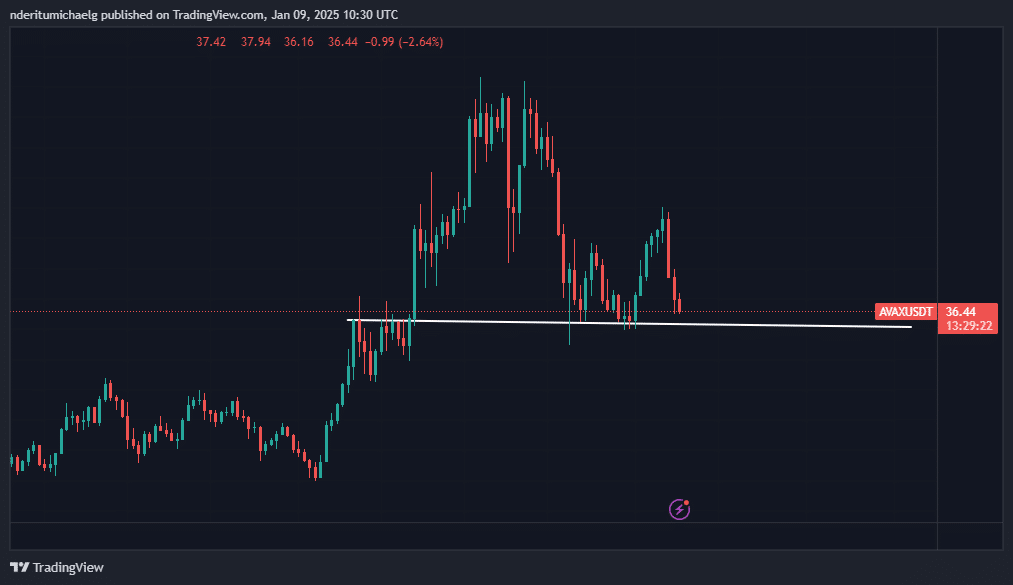

AVAX exchanged hands at $36.46 at press time after tanking by 18.7% since the start of the week.

As Avalanche (AVAX) nears a temporary supportive level around the $35 price mark, it could signal an upcoming short-term rebound. By examining past distribution patterns, we might gain valuable insights into current market demand trends.

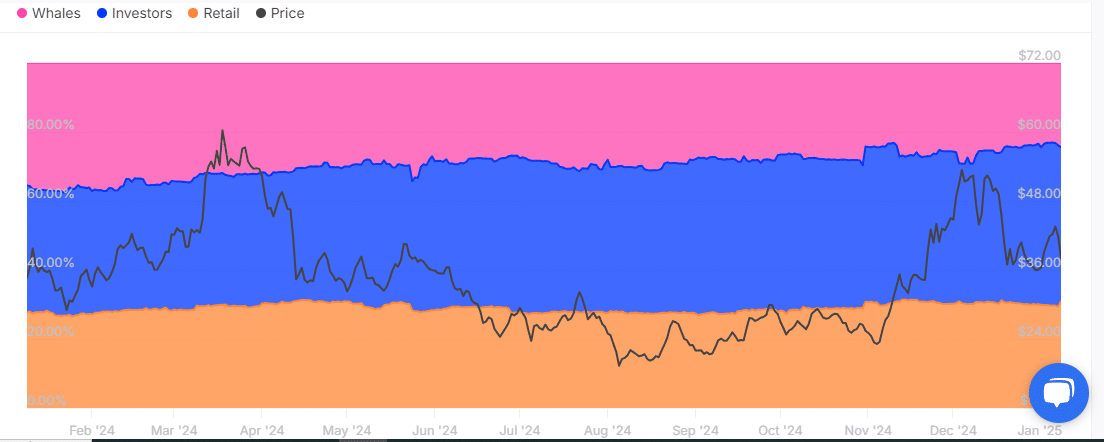

As an analyst, I observed a significant increase in whale holdings of AVAX tokens, with a total of approximately 26.53 million AVAX (up by 24.42%) on the 1st of January. However, by the 8th of January, these holdings had decreased slightly to around 25.59 million AVAX (a drop of 0.07 million AVAX or 0.67%, representing a decrease of 24.35% from their initial value).

The significant change occurred in the investor group, being the largest holder of AVAX.

Investor holdings were down from 49.59 million coins (45.65%) to 47.06 million coins (47.78%).

Read Avalanche’s [AVAX] Price Prediction 2025–2026

During that timeframe, I reduced my AVAX holdings from approximately 32.51 million (29.93%) to 32.43 million (30.87%). This adjustment in my portfolio reflected my investment strategy and market conditions at the time.

The historical data on concentration showed a trend of withdrawals from all traditional investment categories, suggesting that investors have adopted a more conservative approach.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-10 00:07