- ETH long-term holders were more bullish than their BTC colleagues.

- ETH/BTC was at a pivotal point, but a strong rebound was yet to be triggered.

As a dedicated crypto investor, I’ve noticed a striking difference in the long-term investment strategies between Ethereum [ETH] and Bitcoin [BTC] holders. It seems that Ethereum’s long-term investors (LTH) are exhibiting a stronger bullish sentiment compared to their counterparts in Bitcoin.

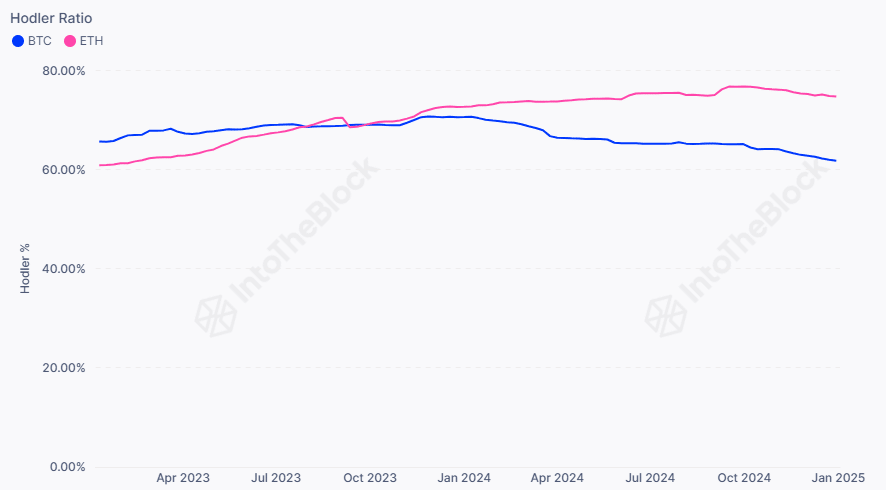

According to analytics company IntoTheBock, a significant change in the market started around early 2024 and continued through 2025. During this period, the Ethereum Long-Term Holder (ETH LTH) group increased their holdings and influence, reaching almost 75% of the market dominance.

Instead, it’s worth noting that the Long-Term Holder group of Bitcoin (BTC) has persistently sold off their assets. This action has caused their dominance to dip below 60%, a decrease from previous levels. The company announced this development.

As a crypto investor, I’m observing an interesting trend: a staggering 74.7% of Ethereum addresses are long-term holders, far surpassing the percentage for Bitcoin. This suggests that Ethereum investors are holding on tight and not showing any signs of letting go anytime soon. It’s reasonable to expect this trend to continue until Ethereum gets close to its all-time high, at which point some investors might decide to cash in their profits.

Will ETH gain ground in Q1?

It’s not shocking that the update comes about, given that the Ethereum price hasn’t matched Bitcoin’s pace since the start of 2024. In fact, Bitcoin surpassed its previous peak, hitting $108K, which essentially made everyone who held it profitable.

It seems that Ethereum hasn’t managed to reach the same level of success yet. Consequently, many who are optimistic about Ethereum may be hanging onto their investments, hoping for an upcoming surge that could allow them to realize a profit or at least recover their initial investment.

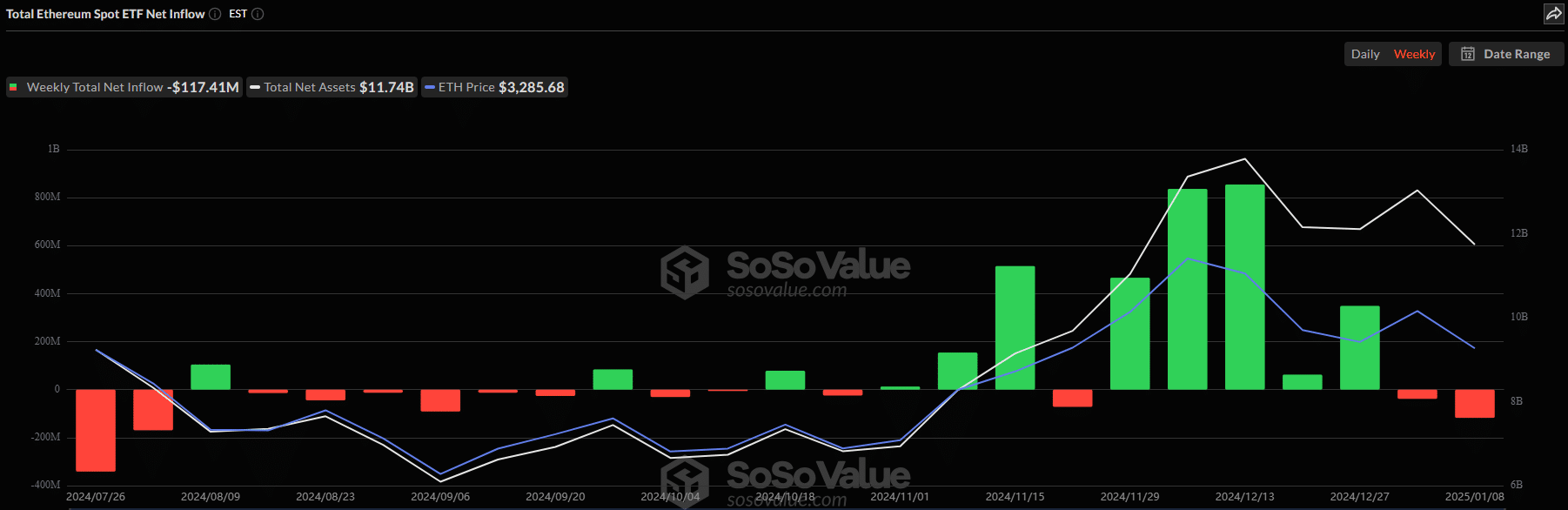

The institutional interest in Ethereum (ETH) and Bitcoin (BTC) shifted somewhat as we entered the new year. As per Soso Value’s data, ETH Exchange Traded Funds (ETFs) are predicted to end the second week with outflows, which is different from the inflows observed in November when these products recorded five consecutive weeks of increased investments.

Contrary to the recent trend, Bitcoin has experienced more money flowing into it over the last fortnight. If this pattern of institutional interest continues, Bitcoin might surpass Ethereum in terms of price performance.

As a crypto investor, I’ve been keeping an eye on the ETH/BTC ratio, which compares the price of Ethereum to Bitcoin. Recently, this indicator has hinted at a possible turning point for Ethereum, as it plunged to a four-year low of 0.30. This suggests that Ethereum’s performance relative to Bitcoin has been lackluster over the past few years.

However, the pattern developed as a double bottom, hinting at an impending rise and suggesting a possible transition towards ETH’s favor within the market.

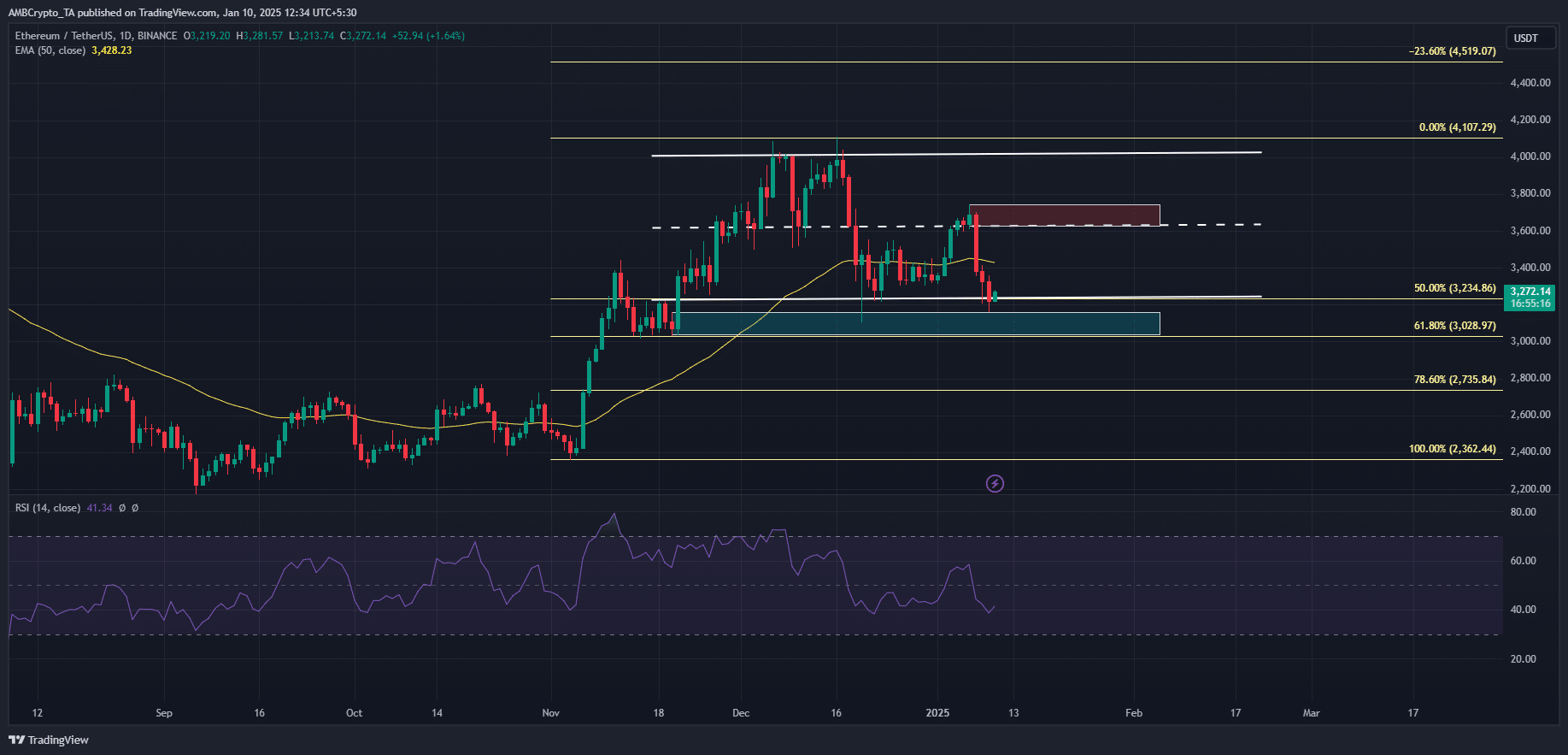

In simpler terms, the recent market downturn caused Ether (ETH) to drop back down to levels not seen since December, above $3,000. However, there’s a possibility that ETH could attempt to bounce back from its support area around $3,000-$3,300, with the potential for reaching $3,600 in the near future. This perspective is similar to what some Ethereum traders on platform X (previously known as Twitter) have been saying.

Read Ethereum’s [ETH] Price Prediction 2025–2026

However, ETH’s likely recovery could be further strengthened if it reclaimed the 50-day EMA.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2025-01-10 12:07