- Data revealed a pattern of capital rotation from one altcoin to another, with minimal liquidity entering the overall altcoin market this cycle

- A significant decline in liquidity within the broader crypto market has also contributed to this trend

For the past day, there’s been minimal change in the broader cryptocurrency market, with a small increase of 0.11%. However, trading activity significantly decreased, dropping by approximately 3.57%, to reach $153.08 billion.

Over the given time frame, notable cryptocurrencies like Ethereum, XRP, and Dogecoin have experienced noticeable drops. Specifically, Ethereum dipped by 0.81%, XRP fell by 0.54%, and Dogecoin decreased by 0.34%.

Even though the market seems to be moving towards a recovery, as assets gradually regain their lost worth, it appears that the altcoin boom – a time when altcoins significantly outperform Bitcoin – may still be postponed.

The cause for this delay might stem from the absence of substantial shifts in crucial market indicators such as trading volume (liquidity flow) and overall market attitude (sentiment).

Capital redistribution keeps altcoins under pressure

Based on a comment from a Twitter analyst, it appears that altcoins are currently experiencing a standstill, as there’s not much fluidity moving into these digital assets. Consequently, the eagerly awaited ‘altseason’, where altcoins usually experience strong growth, has been postponed due to this situation.

The graphs shown indicate that the total value of altcoins (as depicted on the right) has only moderately increased, hovering around $1.6 trillion. This level appears to be similar to the high points reached during the altcoin boom between 2021 and 2022.

Instead, Bitcoin followed a distinct pattern. Since reaching its prior record high in 2022, its market cap has almost doubled and now surpasses the $2 trillion mark.

In essence, we’re observing a trend where Bitcoin is dominating the current market phase, as most new investment funds are flowing into it rather than alternative cryptocurrencies. This change can be linked to the emergence of institutional investors, notably with the debut of Spot Exchange-Traded Funds (ETFs) in the U.S.

The fact that the total value of altcoins isn’t growing much implies that investors are simply moving their funds from one altcoin to another, without significantly more money coming into the market.

Should this pattern continue, we can expect the altseason to be postponed further. Altcoins might experience modest increases or brief spikes in value due to the current market stories.

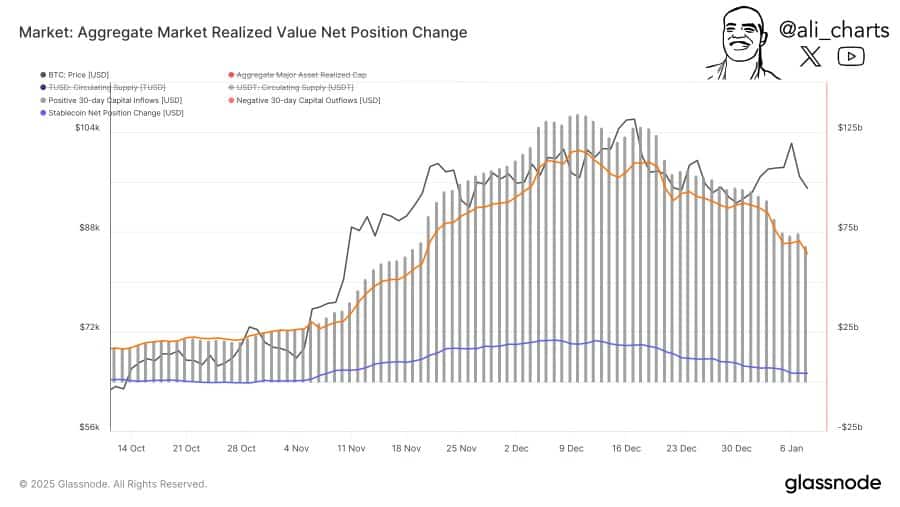

In recent times, the overall cryptocurrency market has experienced a significant drop in liquidity as well. As per the Aggregate Realized Value Net Position Change metric by Glassnode, this decrease in liquidity amounts to 49% over the past month, with the figure dropping from $134 billion to $68 billion.

It’s clear that the market is still feeling the effects of a liquidity shortage, as numerous altcoins have yet to regain their highest ever values, which they reached towards the end of 2024.

High Bitcoin dominance delays altcoin momentum

As a seasoned crypto investor, I’ve noticed that a substantial dip in Bitcoin’s dominance has historically signaled an altcoin rally. This is usually preceded by a series of upward movements across the entire altcoin market.

The concept of Bitcoin’s dominance refers to the percentage of overall value within the crypto market that is controlled by Bitcoin compared to other cryptocurrencies, often referred to as altcoins. An uptrend in Bitcoin’s dominance usually means that altcoins are not performing well, due to a shift in investment towards Bitcoin. This trend can be observed in the current market situation.

Currently, Bitcoin’s dominance on CoinMarketCap is significantly high, standing at approximately 56.72%. If this were to decrease to roughly 45%, it could signal a change in the balance of power within the market, leaning more towards altcoins. This shift might even trigger an upsurge for altcoins, referred to as an “altcoin rally.

In other words, until important factors like the proportion of total cryptocurrency market value held by Bitcoin (Bitcoin dominance), investment flowing into the market, and the availability of funds for trading alternative coins (altcoins) enhance, the much-awaited surge in the value of alternative coins (altseason) may be postponed.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Moana 3: Release Date, Plot, and What to Expect

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2025-01-10 17:11