- Bitcoin faces critical resistance as market dynamics hint at potential volatility ahead.

- Stablecoin dominance and fear indicators spotlight growing investor caution in the crypto market.

The current state of the cryptocurrency world is significant, as investors are considering if a larger market downturn might occur. Bitcoin’s [BTC] efforts to reclaim crucial support points are proving challenging, and many altcoins are starting to show signs of exhaustion. This has sparked worries about an impending crypto market crash.

As an analyst, I delve into crucial market metrics and sentiment trends to gauge potential risks and foresee plausible scenarios, whether a downturn might be on the horizon or not.

Bitcoin’s price struggles to hold key levels

Bitcoin’s latest price fluctuations underscore the instability in the market. According to AMBCrypto’s examination, the digital currency dipped beneath the significant $95,000 threshold, causing concern about potential additional declines.

Even though the price of Bitcoin continues to stay above its 200-day moving average, the Relative Strength Index (RSI) at 46.77 shows a decrease in momentum, edging towards bearish conditions. If the $97,500 resistance level isn’t reclaimed, it may cause Bitcoin to enter a more significant correction phase.

Market cap trends signal consolidation

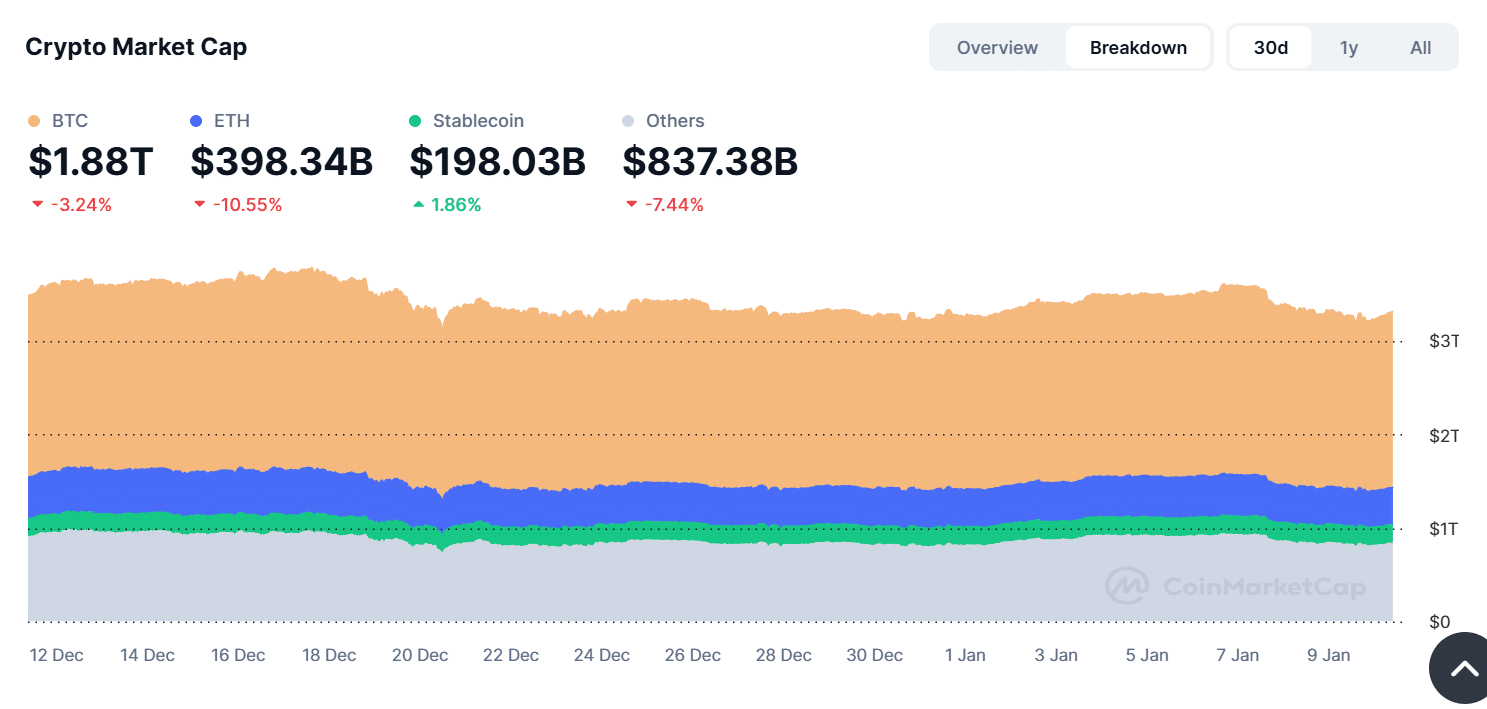

The current value of all cryptocurrencies combined is approximately $3.24 trillion, as demonstrated on the Crypto Total Market Cap graph. Over the last month, this figure has dropped by about 3.24% due to a period of market-wide consolidation.

As a researcher, I’ve noticed that while Bitcoin continues to hold its ground, Ethereum [ETH] and other altcoins have experienced steeper drops, contributing significantly to the overall market compression. This downturn has sparked concerns about the robustness of the broader market, particularly if the bearish sentiment lingers.

Over the last month, there’s been an increase of approximately 1.86% in the share of the overall Cryptocurrency Market Cap held by stablecoins. Meanwhile, Bitcoin and Ethereum have experienced a dip, suggesting that investors are moving towards stablecoins as a safer option to safeguard their investments.

The increase in investments in stablecoins indicates a rise in cautiousness, which is typically a warning sign that could lead to wider market volatility in the future.

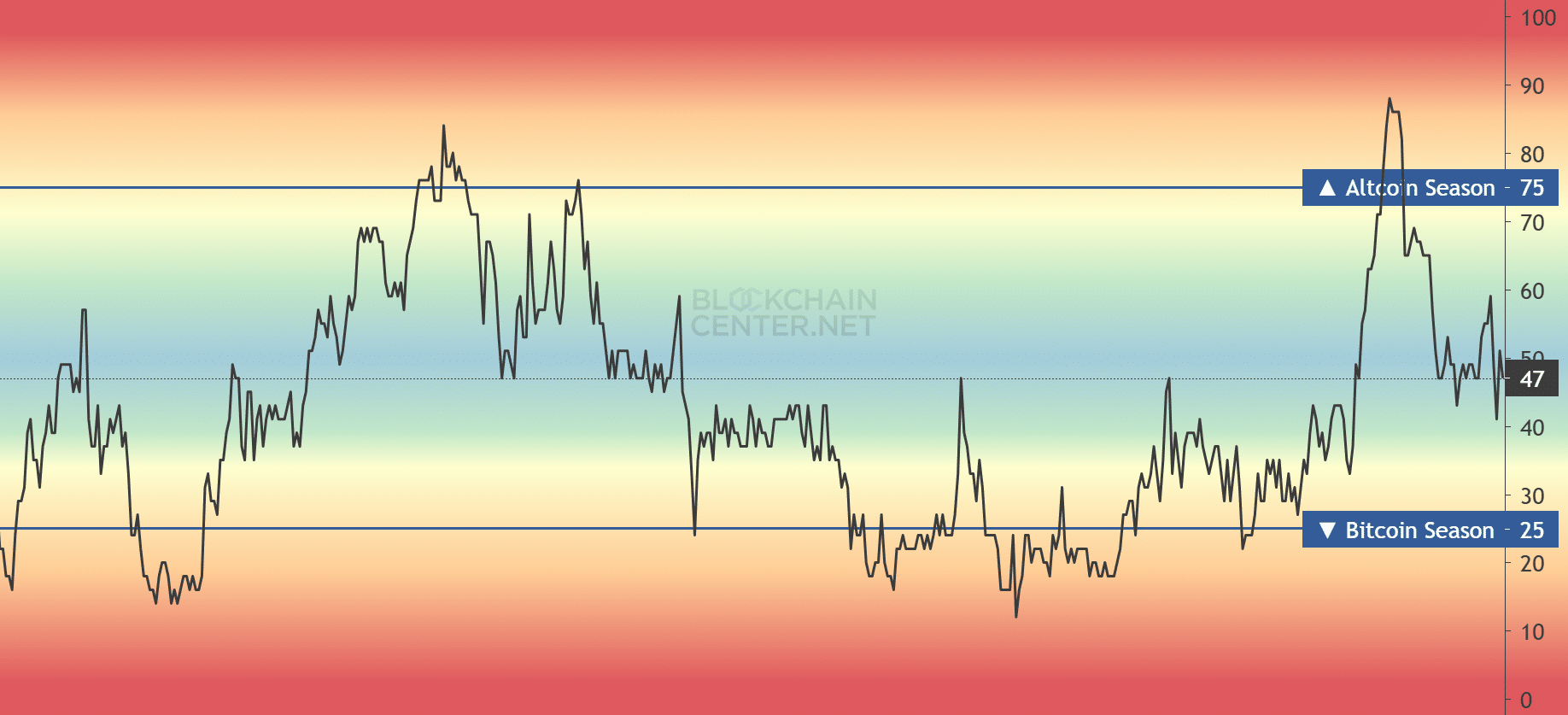

Altcoin Season Index reflects neutral sentiment

According to the Altcoin Season Index, it currently stands at 47, indicating a neutral position. This suggests that the cryptocurrency market isn’t clearly favoring Bitcoin or altcoins, instead showing increasing signs of ambiguity.

Historically, impartial readings often come before the market undergoes a shift, and it’s usually altcoins that are more susceptible during periods of correction.

This ambiguity increases the stress on the performance of altcoins, making it more probable that a decline will occur if Bitcoin does not spearhead a market rebound.

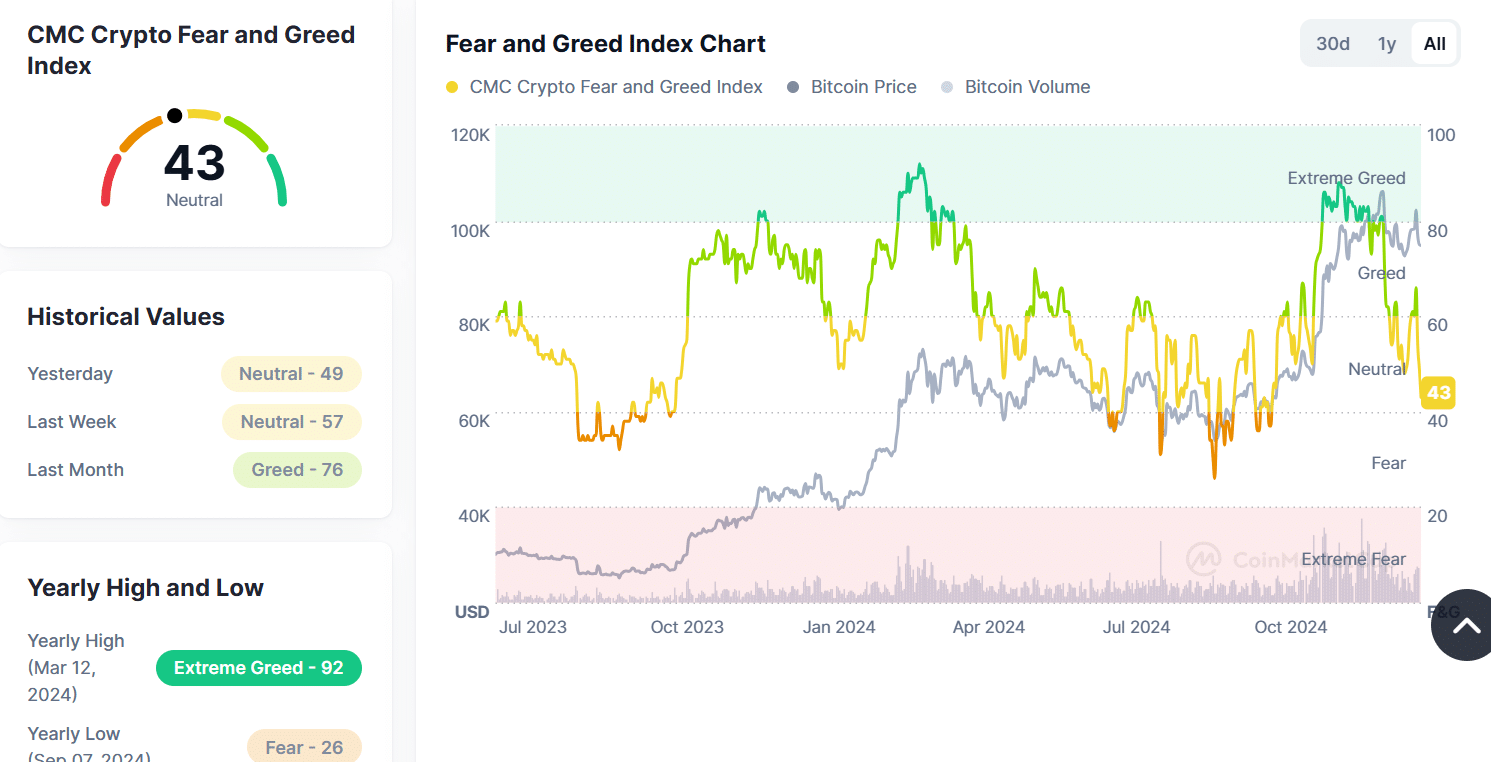

Sentiment weakens: Fear vs. Greed Index

Confidence among investors has noticeably decreased. The Fear and Greed Index has fallen considerably, now standing at 43 – a considerable decrease from the 76 it was at last month, which signified “Greed.

Moving towards a neutral position indicates that investors are becoming more cautious, implying that they might be selling off their investments. In the past, similar shifts in sentiment have frequently signaled an increase in market turbulence and possible drops in stock prices.

Is a crash likely?

Although a definite market crash isn’t imminent, signs are pointing towards the need for more careful investment strategies. The difficulties Bitcoin faces in regaining crucial thresholds, along with a market that’s holding steady and negative investor sentiments, suggest a potentially unstable situation.

In simpler terms, altcoins continue to be at risk, whereas investors seem worried as they are increasing their investments in stablecoins instead.

The likelihood of a major drop depends on Bitcoin maintaining its position above crucial support points. Given the potential for increased market fluctuations, investors are advised to ready their portfolios for turbulence and employ careful risk mitigation tactics during this volatile phase.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-10 23:03