- Bitcoin Cash has formed a sell signal on its MACD indicator, which could cause a price decline to $365.

- Despite the bearish trends, traders on Binance are betting on further price increases.

At the moment of reporting, Bitcoin Cash (BCH) had experienced a minor increase of 0.1%, trading at approximately $430. However, over the past week, this digital currency has shown a decline of 6.5%, indicating a predominantly bearish pattern in the overall cryptocurrency sector.

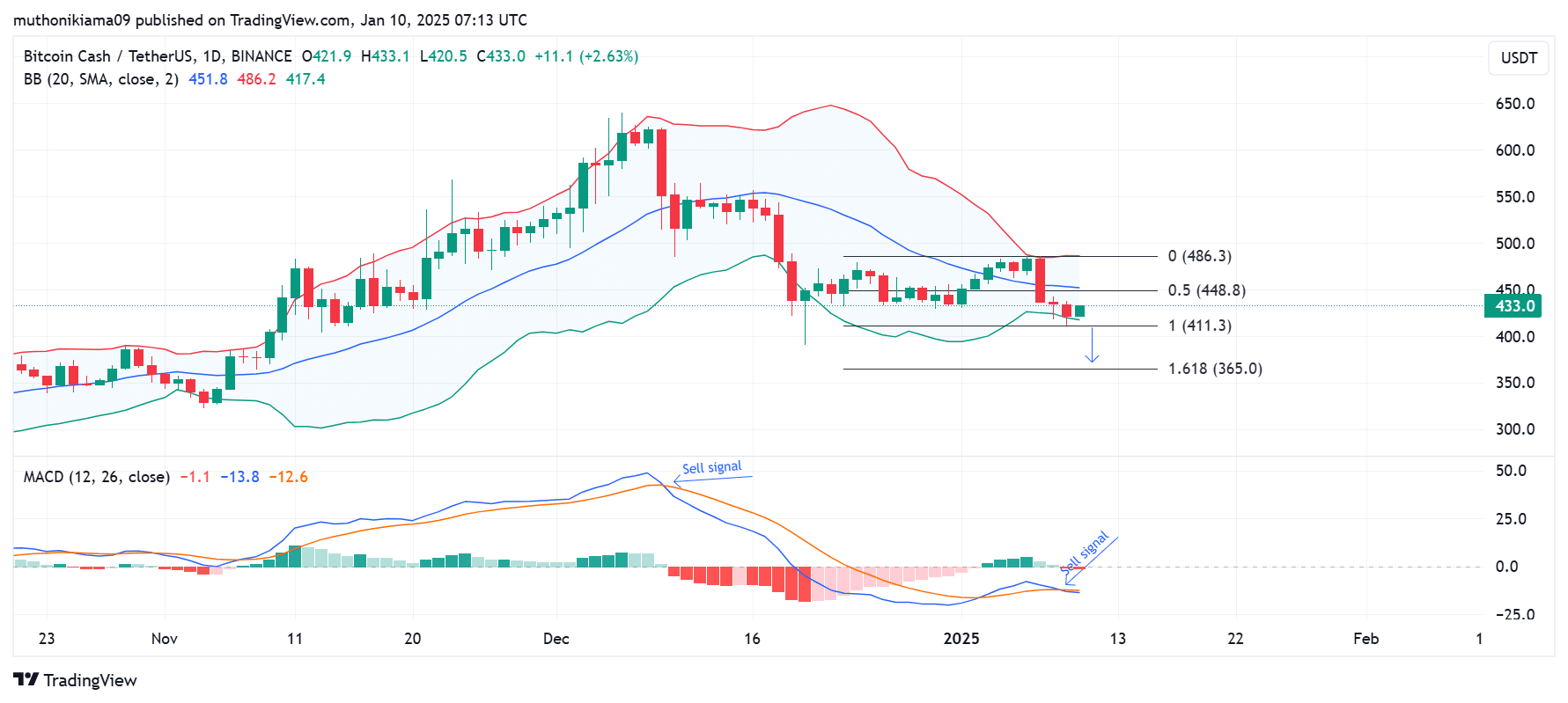

On the graphs, the bears continued to dominate Bitcoin Cash’s price movements, as demonstrated by the Moving Average Convergence Divergence (MACD) tool. This was suggested by the downward direction of the MACD line and the histogram bars, which signified a bearish trend.

When the MACD line drops beneath the signaling line, it often generates another sell signal. Previously, such sell signals have typically led to a significant drop in the value of BCH.

The significant support zone for Bitcoin Cash is found at the bottom of its Bollinger Band, around $417. If Bitcoin Cash manages to break below this point, it might trigger a drop towards the 1.618 Fibonacci level, which lies approximately at $365.

Key resistance level to watch

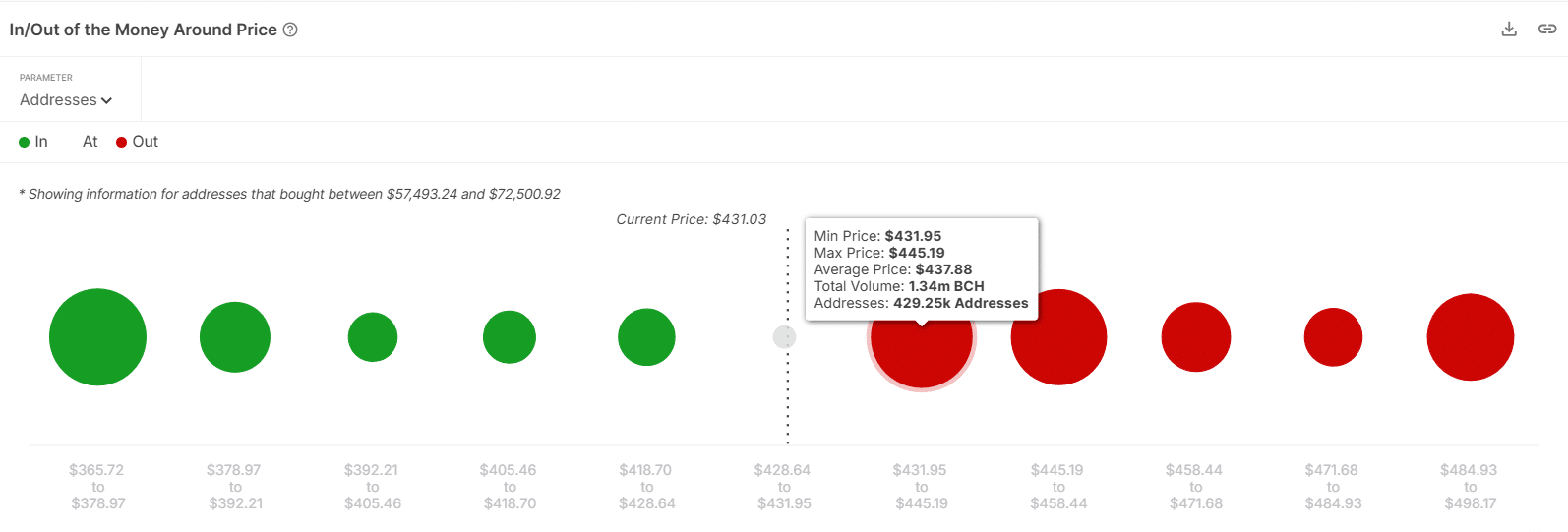

The IOMAP (In/Out of the Money Around Price) indicator highlights an essential barrier of resistance for Bitcoin Cash (BCH) approximately ranging from $432 to $445.

Approximately 429,000 addresses bought the token at these prices. If they decide to cut their losses, this could lead to an increase in selling activity.

Due to the heavy losses occurring at this supply area, traders might consider it an unattractive place to enter, which could potentially hinder any upcoming price increase.

Traders increase bullish bets

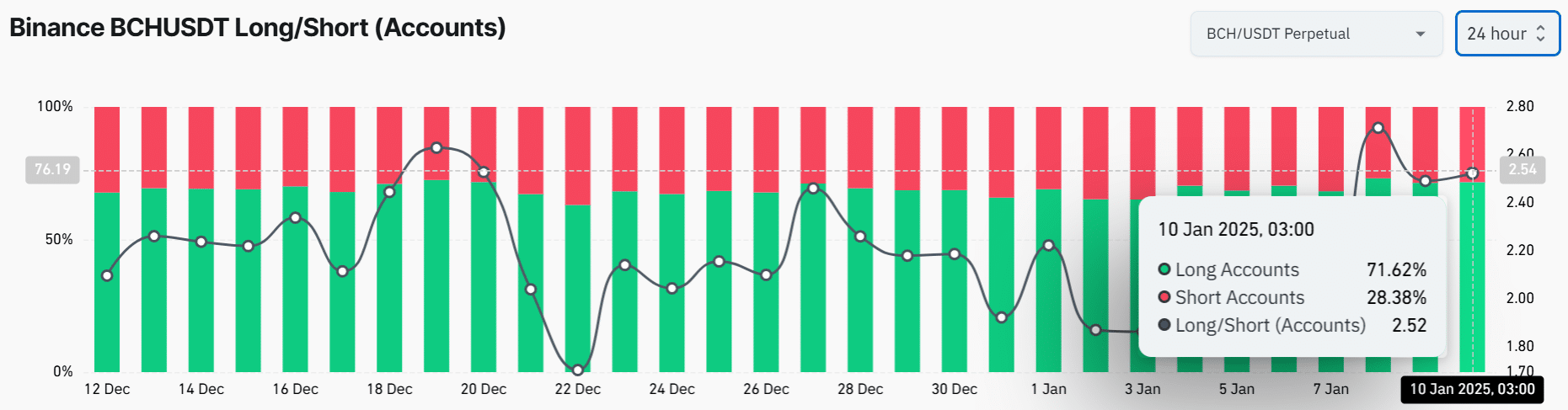

On Binance, there’s a strong optimism towards Bitcoin Cash among traders, even though its one-day chart indicates a negative trend. Interestingly, the number of traders who are betting on a rise (long positions) in BCH has climbed up to 71%, while those betting on a fall (short positions) stand at only 28%.

A large percentage of traders holding long positions indicates a widespread belief that BCH may increase in value. Yet, these positions might get closed if there’s another price decline, potentially intensifying the downward selling trend.

The decrease in funding rates to 0.0076% on Coinglass is fueling the desire for long positions, suggesting that traders are currently spending less on upkeeping their active trades.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

The one-day graph for Bitcoin Cash indicates predominant bearish movements. Additionally, a sell indication on the Moving Average Convergence Divergence (MACD) might intensify the price drop, potentially leading to a deeper decrease in value.

As a crypto investor, I find it encouraging to observe a bullish inclination in the Long/Short Ratio, suggesting optimistic market feelings. Yet, it’s crucial to remember that such a positive outlook might not translate into higher prices if a downturn triggers compulsory long liquidations, leading to increased selling activity.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2025-01-11 00:07