- Fidelity contributed to the weekly sell pressure by offloading $213 million worth of ETH

- A short term bullish relief may already be playing out

It’s possible that Ethereum [ETH] could bounce back following its recent surge, yet doubts have arisen due to a substantial sale. Interestingly, it seems that an account linked to Fidelity has allegedly sold a large quantity of ETH.

According to a recent analysis from Lookonchain, Fidelity moved approximately 64,997 Ethereum to Coinbase last Friday. The value of this transferred ETH exceeded $213 million. This transaction took place following a bearish week and after Ethereum had already experienced a significant decline during that period.

Transferring Ether from a personal wallet to an exchange may indicate that Fidelity is selling off its ETH. This action took place on the same day as Ethereum ETFs experienced a combined net withdrawal of $159.4 million. It’s worth noting that Fidelity’s FETH ETF had the largest outflow among all Ethereum ETFs on Thursday, amounting to $147.7 million in withdrawals.

Is Fidelity’s ETH sale a reflection of market sentiment?

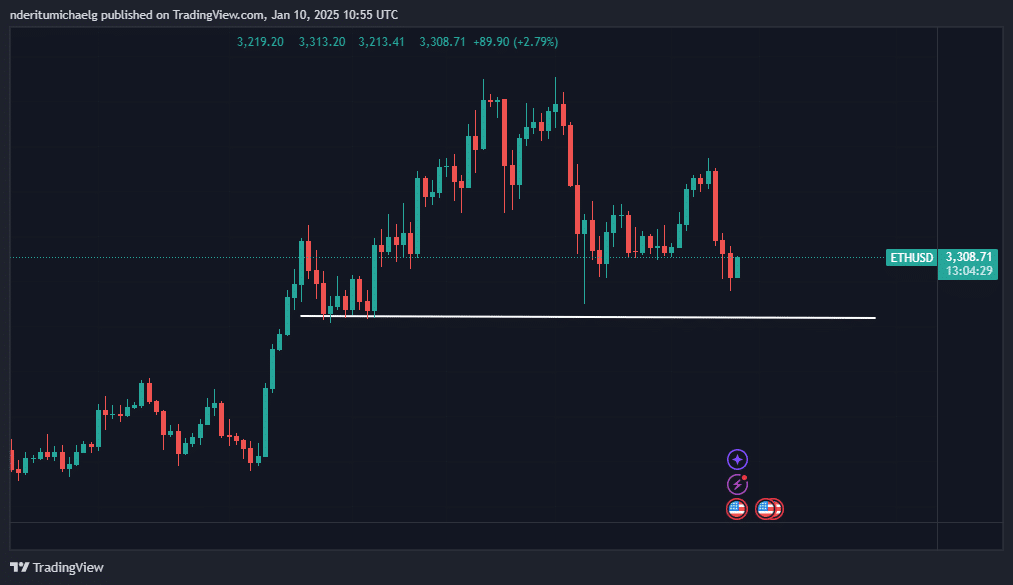

Since Tuesday, Ethereum (ETH) has consistently shown a net selling tendency, and this pattern continued on Friday – the same day Fidelity moved the mentioned coins. This action led to ETH experiencing a 15.54% decline from its peak for the week to its lowest point during the same period.

source: TradingView

At the moment of publication, Ethereum (ETH) was worth approximately $3,308, thanks to a 2.89% increase over the last 16 hours. This minor rise hints at renewed demand following Friday’s close, suggesting that some accumulation took place after the weekly decline.

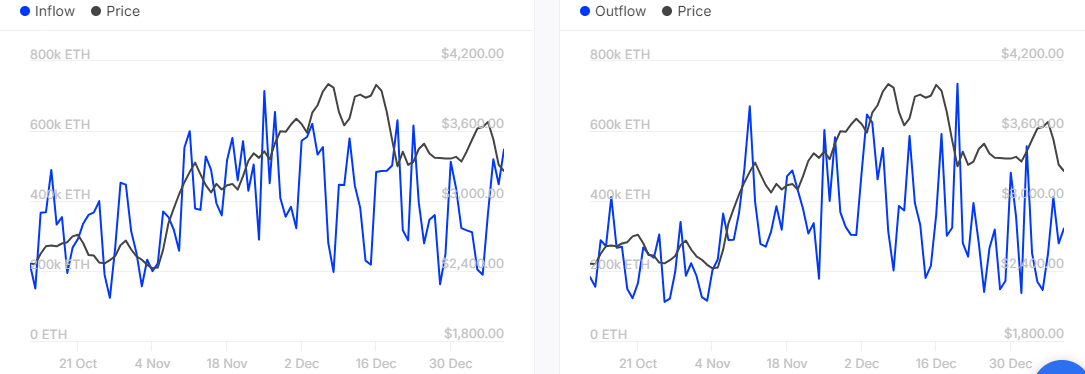

It’s worth considering whether this surge in cryptocurrency can be maintained. The answer lies in the level of demand and who is driving it. Evidence from on-chain data indicates that whales have been taking advantage of recent dips to buy more. For instance, a significant inflow of 547,230 ETH was observed among large holders on January 9th, while outflows only amounted to 321,650 ETH during the same period.

An increase in whale interest might pave the way for Ethereum (ETH) to experience a minor rebound over the weekend. The movement of cryptocurrency on exchanges hints at a possibility that ETH could see a resurgence in demand.

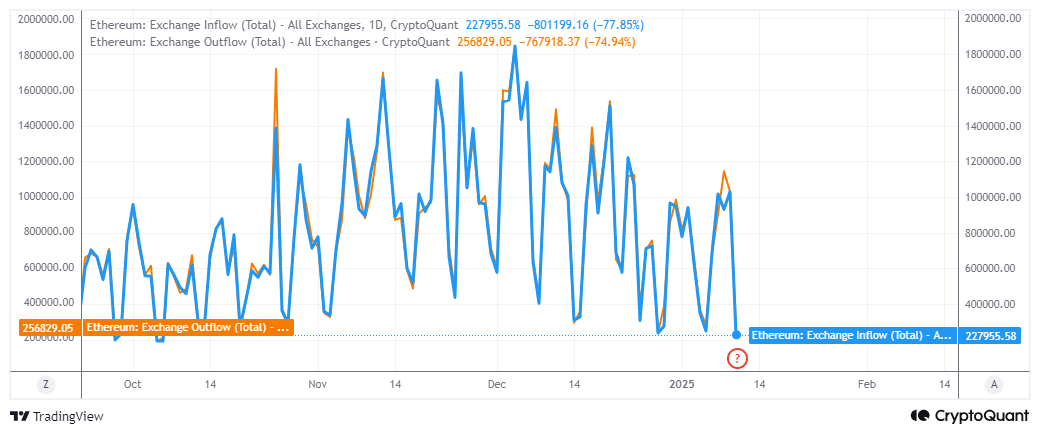

The recent transfer volumes on exchanges have dropped to a point similar to early November. As per CryptoQuant’s data, exchange withdrawals amounted to approximately 256,829.05 Ether, which is slightly more than the 227,955.58 Ether recorded at the time of this writing.

source: CryptoQuant

The pattern of trading data appears to align with the current upward trend, suggesting a potential rebound. Yet, it’s important for investors to remain cautious as there could still be further price drops.

To put it simply, if Ethereum (ETH) doesn’t manage to sustain sufficient demand at its current price point, there’s a possibility it might fall back to around $3,033, which is the next significant support level on its daily chart.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-11 09:14