- Bitcoin could extend its price range in the short-term

- Coinbase analysts cited slow Fed rate cut path and increasing BTC sell pressure

According to experts at Coinbase, there may be some volatility or unpredictability in the Bitcoin market over the next few months.

In their weekly report, analysts David Duong and David Han pointed out two key factors influencing the market: the gradual pace of interest rate reductions by the Federal Reserve and the growing supply of Bitcoin.

In simple terms, the overall economic situation is showing some positive and negative aspects. The possibility of the Federal Reserve not lowering interest rates due to better employment figures and potential inflation concerns could affect the growth of risky investments for a while.

In simpler terms, the latest economic figures from the U.S show persistent price increases and robust employment sectors, which have led many to believe that the Federal Reserve may not lower interest rates anymore.

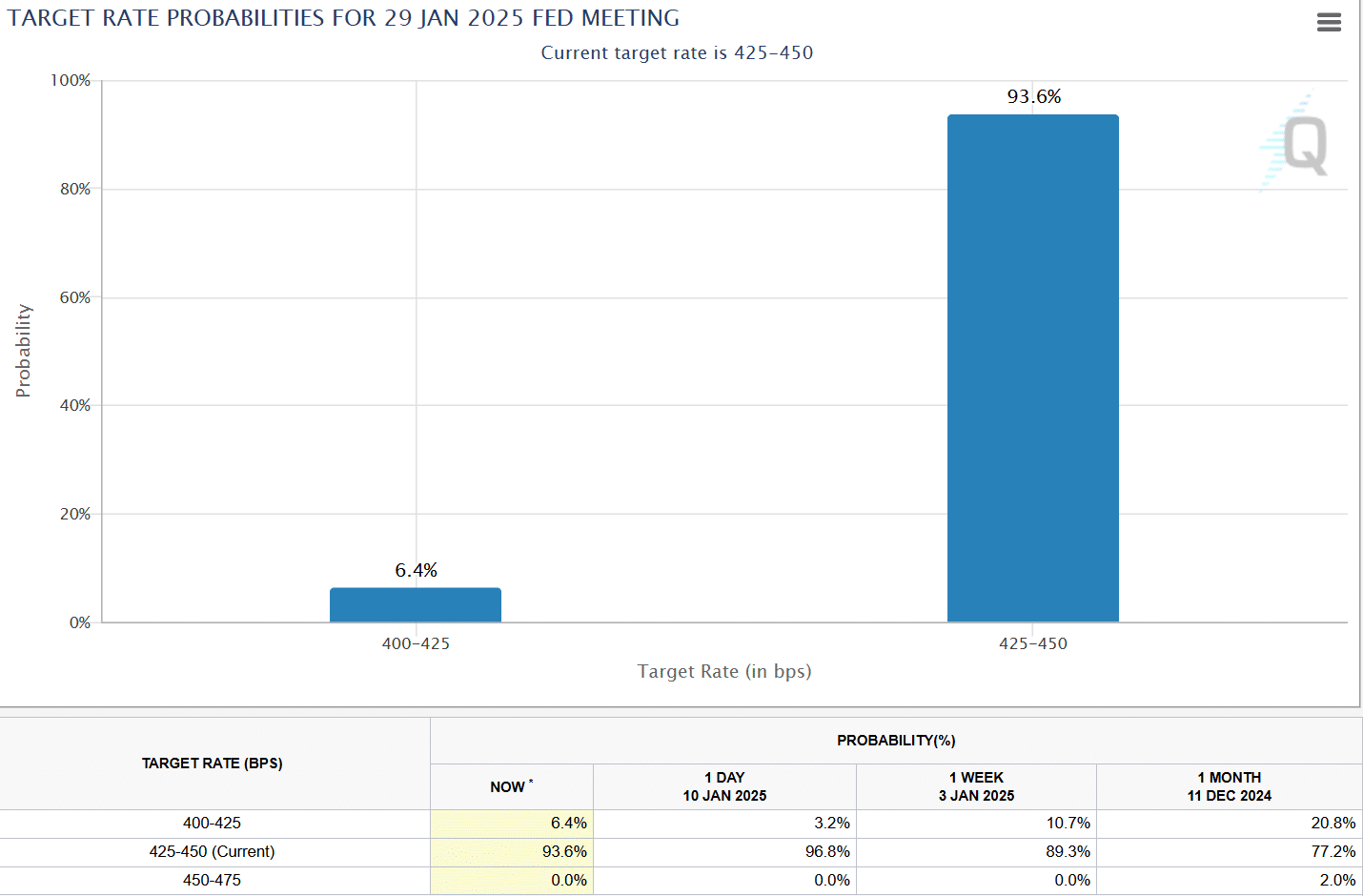

In reality, market participants are valuing the upcoming Federal Open Market Committee (FOMC) meeting in late January with an expectation that the interest rate will remain steady at 4.25%-4.50%.

BTC sell pressure soars

Analysts also pointed out that an increase in Bitcoin’s supply might limit the strong upward movement shown on the price charts.

In simpler terms, we believe that the high volume of bitcoin currently being moved might dampen some short-term price growth expectations. The quantity of active bitcoin (transferred on the blockchain within the past three months) has risen significantly to about 4.6 million, compared to just 2.7 million in October 2024.

The analysis shows that long-term Bitcoin holders have sold approximately $90 billion of their holdings, reaching the $100,000 level as a significant area where early investors have supplied more Bitcoin. Analysts suggest this increased supply from long-term holders might limit Bitcoin’s price movement within a specific range.

The way things are going with Bitcoin’s supply, it seems likely that we might experience a prolonged phase of stability or slow growth – much like what we saw when Bitcoin reached its peak in March 2024 based on the on-chain signals.

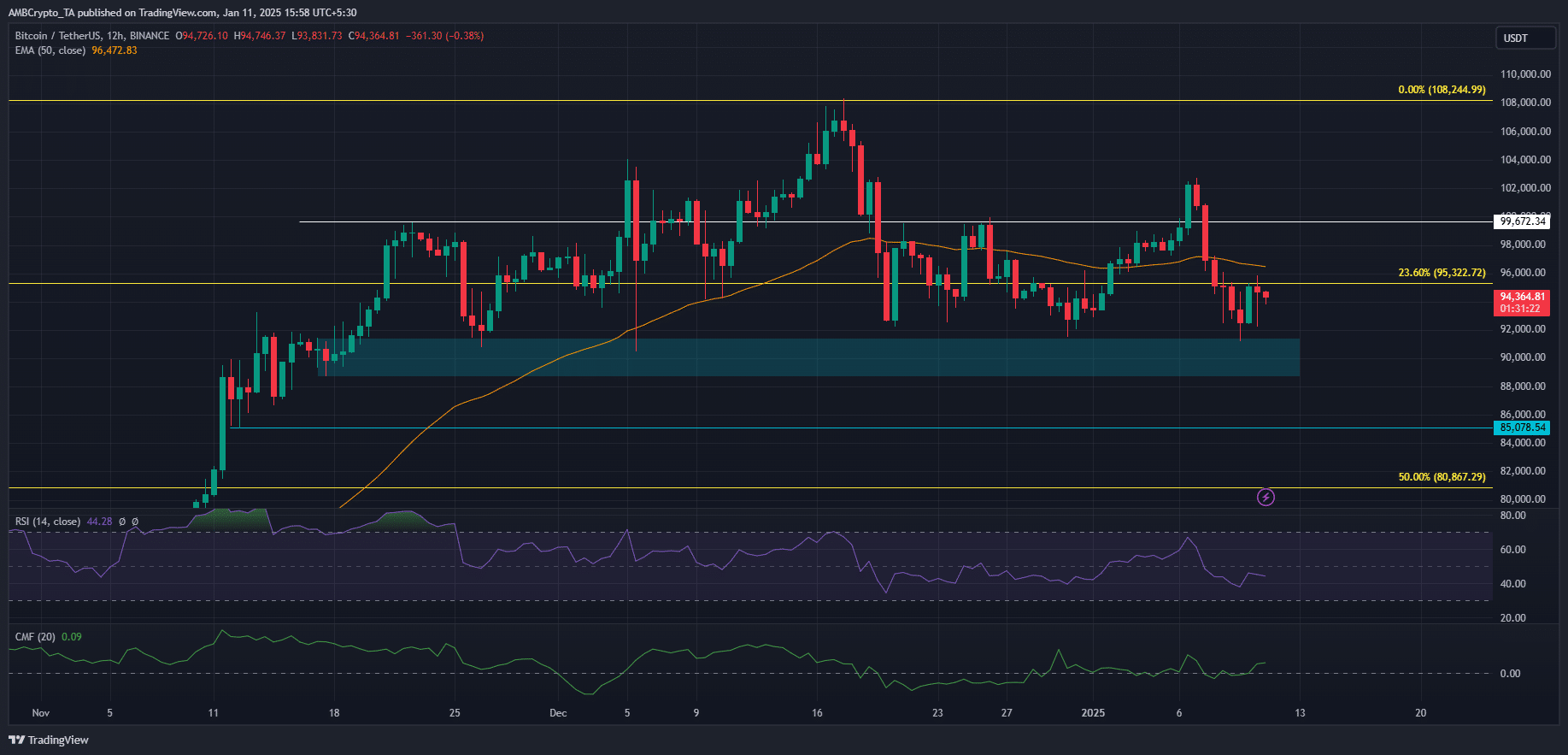

While BTC was testing its lower price limits and rebounded, however, the upward momentum halted around $95,000. This behavior solidified the predicted consolidation zone of $90,000 to $100,000 as discussed by the analysts.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2025-01-12 08:07