- If the head-and-shoulders pattern dominates ONDO, another 17% drop could be seen

- ONDO’s total addresses with balance over time reflected a steady hike

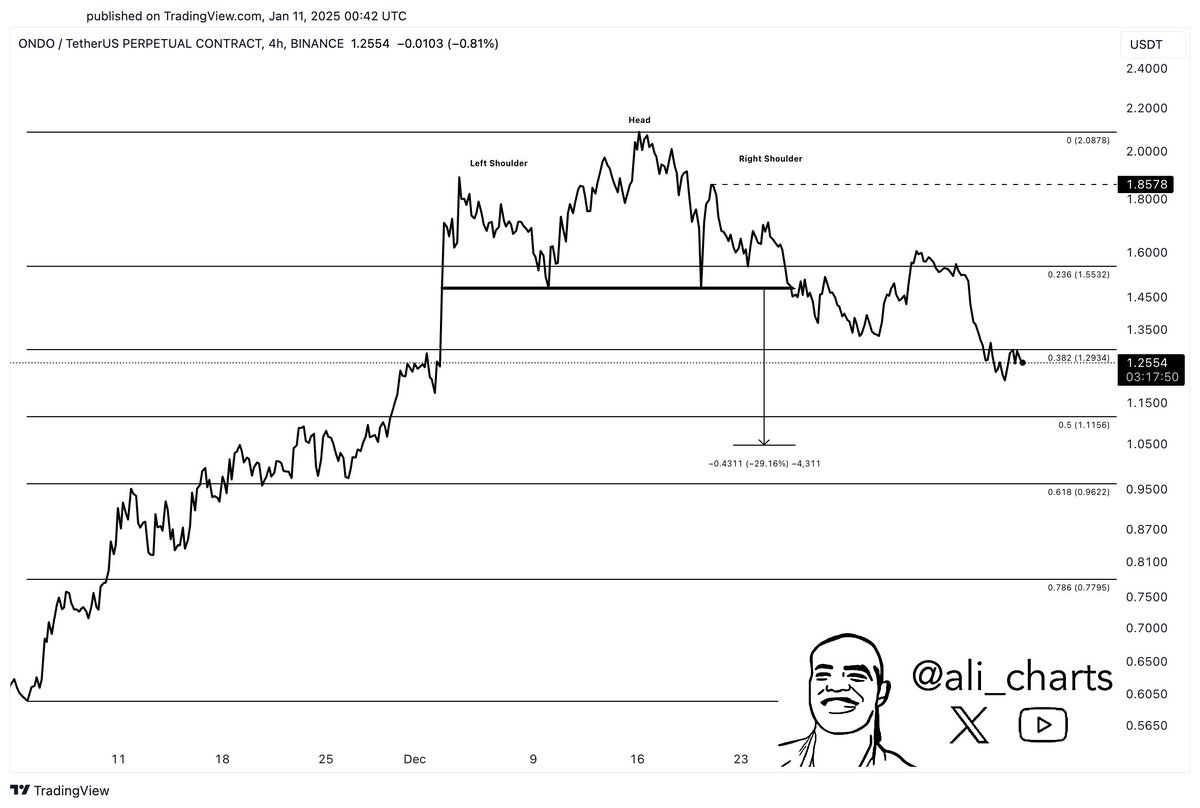

In simpler terms, the price movements of ONDO followed a pattern known as a “head-and-shoulders” on the 4-hour chart. The left peak occurred around $1.85, which is similar to the left shoulder in this pattern. Following that, there was a higher peak, or the ‘head’, at $2.09. However, the right shoulder, after reaching a level close to $1.85, failed to rise further. This failure confirms the bearish nature of the head-and-shoulders formation, suggesting potential future price decline for ONDO.

This resulted in a rupture at $1.55 below the neckline, which might support the expected 29% fall that would reach the $1.15 Fibonacci retracement point.

If the bearish trend continues, there’s a possibility that ONDO might drop by approximately 17%, potentially reaching around $1.05. This level aligns with the 0.618 Fibonacci retracement point. The $1.05 price point could be an excellent opportunity to buy as it belongs to one of the top RWA projects, offering potential for increased value.

Instead, if $1.55 is regained as a support level, it might contradict the current bearish viewpoint and trigger a possible upward trend towards $1.85. This shift could draw in buyers, aiming for the potential resistance area around $2.09.

Previously, the price followed the guidelines of Fibonacci levels, suggesting that traders were sticking to their technical strategies. The final results in both cases were largely influenced by the strength of momentum and overall market trends, underscoring the significant impact of this pattern on our future decision-making process at ONDO.

ONDO on-chain analysis show…

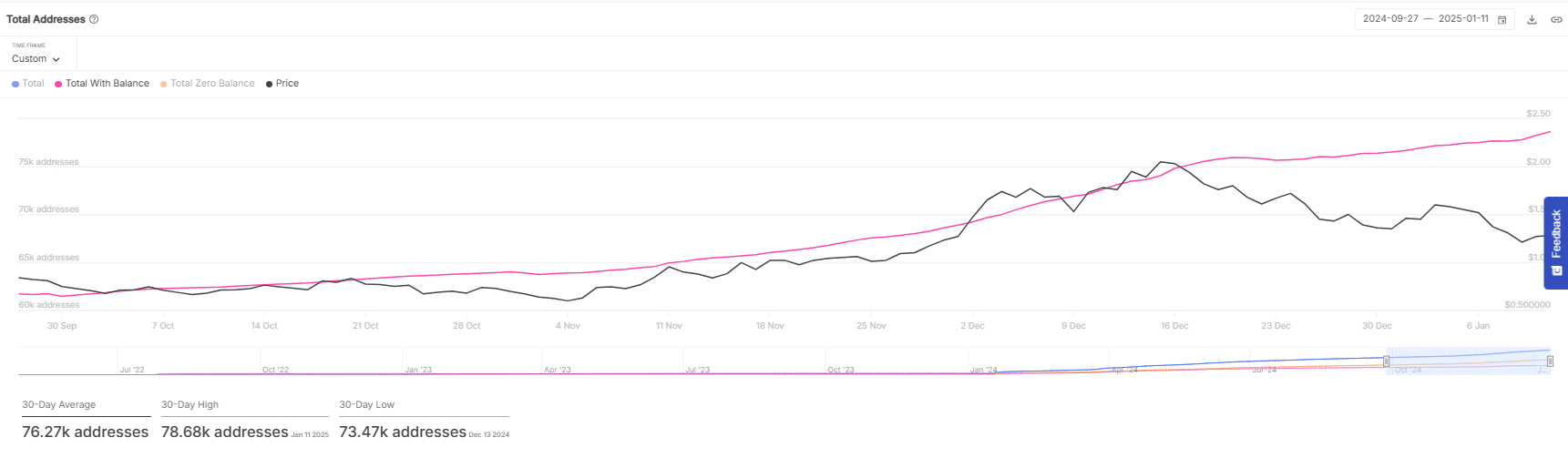

Tracking ONDO’s total addresses holding a balance through time showed a consistent rise, indicating increasing confidence among holders, despite the erratic price trajectory. This trend suggests accumulation, as the price dips are observed on the chart.

Historically, an increase in balanced addresses tends to come before stability or price increases in ONDO, suggesting it might offer protection against the predicted 17% fall.

If the current trend continues, ONDO may stabilize or recover at a faster pace than expected. However, if the number of addresses holding the cryptocurrency significantly decreases, this could intensify the price fall, supporting the pessimistic outlook.

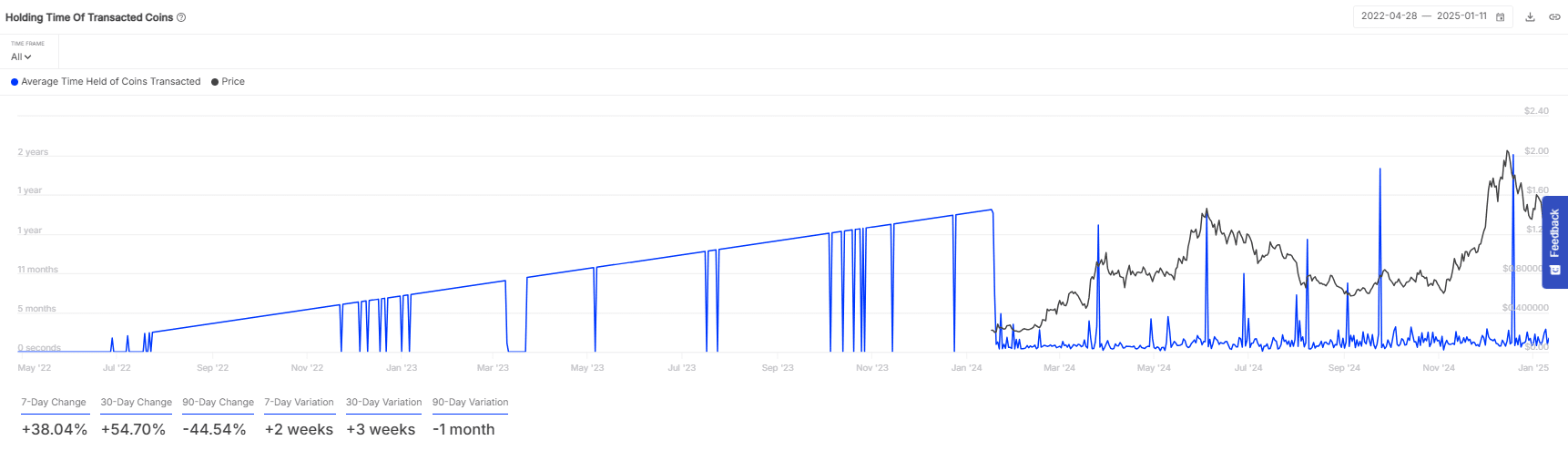

Furthermore, it appears that the typical duration investors held ONDO transactions showed signs of volatility due to their behavioral responses to market price changes. Notably, prolonged holding times during the mid-2023 to 2024 period corresponded with periods of price consistency or increases.

Towards the latter part of 2024, there was a noticeable decrease in holding durations that appeared to coincide with price drops, implying an increase in selling activity.

A decline in the length of time people are holding onto assets might be an indication that a larger price decrease could follow. Historically, longer stretches with shorter average holding durations have frequently been followed by price reductions.

Instead, a rise in holding periods might suggest the possibility of price stability or recuperation, which is crucial for compensating the anticipated 17% decline.

Social activity

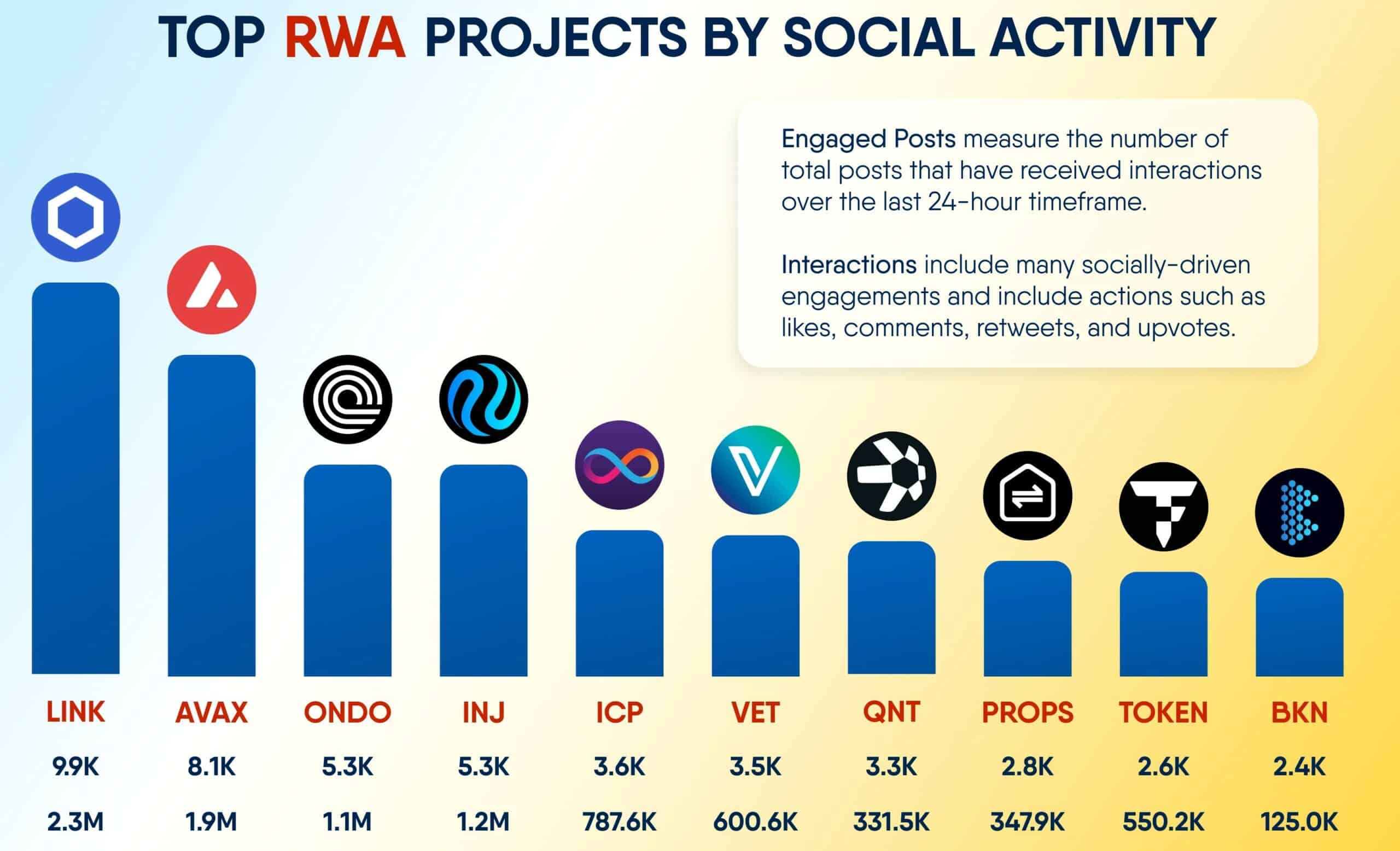

In the current standing, ONDO continues to be a strong competitor, maintaining its third place spot. With an active post count of approximately 5,300 and an impressive total of around 1.1 million user interactions, it’s clear that ONDO is keeping its audience engaged.

Despite the possibility of decreases in ONDO’s price, its strong social appeal may indicate durability and sustained investor interest, which might lead to a halt or even a reversal of the predicted 17% decline in value.

This persistent social influence could indicate hidden resilience, thus positioning ONDO as an essential observation point in the rapidly changing cryptocurrency environment.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-12 16:07