- PEPE’s OBV indicator at 1,827.73T revealed hidden strength despite price decline

- Critical price level at $0.000002000 could trigger relief rally to $0.000002500 if breached

Recently, the market for digital currencies, especially meme coins, has experienced significant fluctuations. Notably, PEPE has shown a decline in its trend as well. Despite some doubters suggesting decreasing energy, technical signals hinted at the potential for a shift in trend direction as of the latest news reports.

So, it’s beneficial to analyze the trends in PEPE’s pricing, taking into account crucial technical milestones and overall market setup, to determine if a resurgence might occur.

PEPE’s price action shows signs of weakness

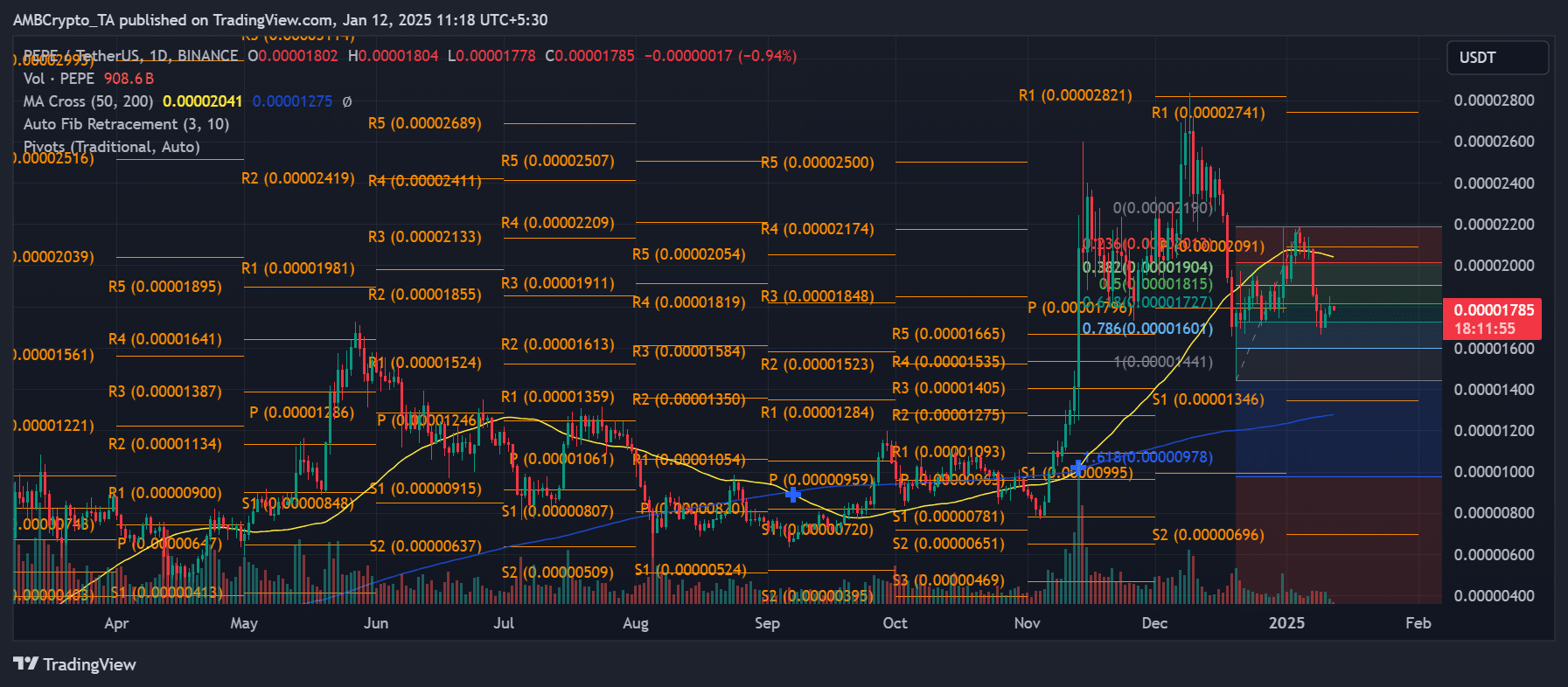

The well-known meme token PEPE has reached a crucial point due to intense selling, causing the price to approach important support points right now. At the moment, it’s being traded at $0.000001785, and it has lost around 1% of its value over the past day. This drop has made some traders look for signs that a turnaround might be coming.

AMBCrypto’s technical analysis revealed a complex picture for PEPE’s short-term trajectory.

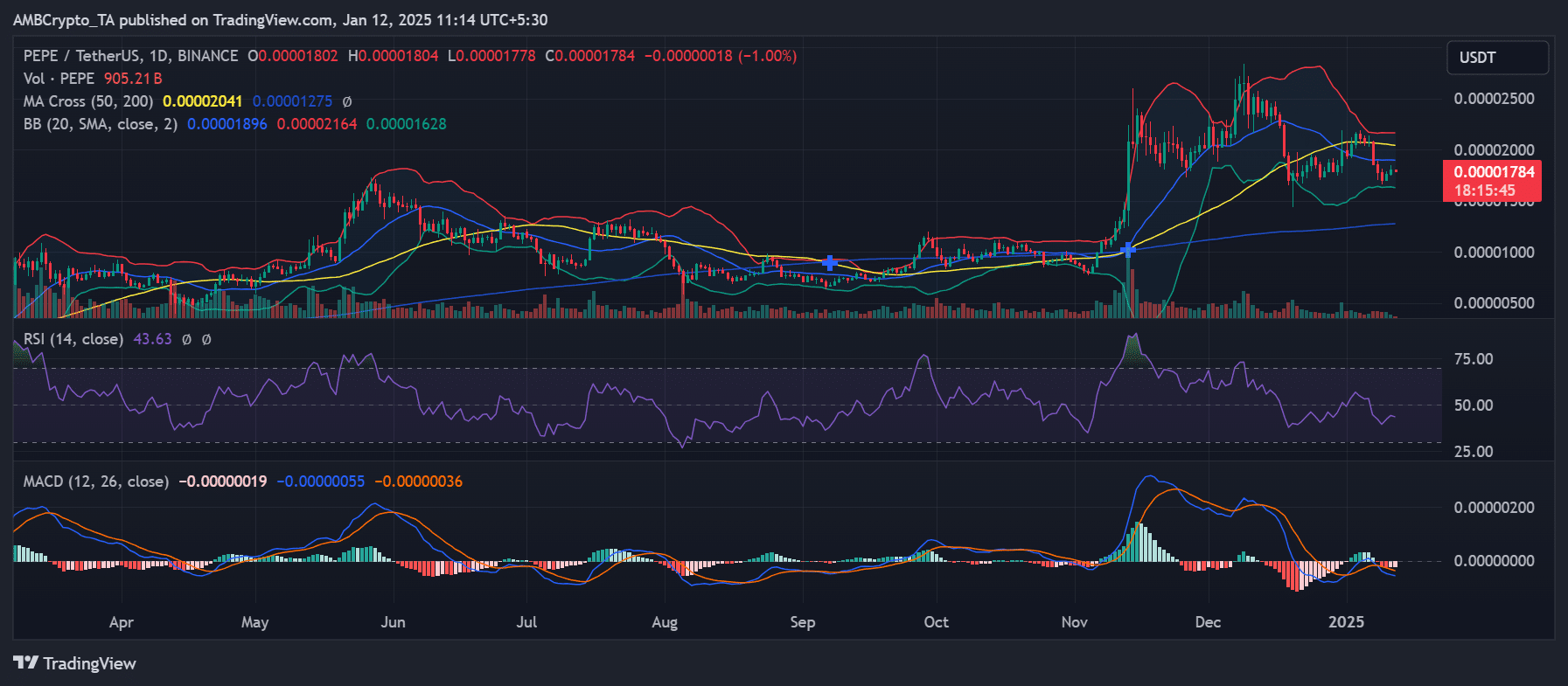

As I analyzed the market trends, it appeared that the 50-day moving average was consistently sitting above the 200-day moving average, indicating a resilient bullish market structure, even amid recent downturns. However, the shrinking difference between these markers hinted at a possible slowdown in momentum.

Technical indicators paint mixed picture for PEPE

In simpler terms, the Relative Strength Index (RSI) is currently at 43.63, which means it’s getting close to being considered oversold but hasn’t reached extreme levels yet. This moderate RSI value suggests that there might be more room for the market to fall or potentially rebound, depending on future market trends.

PEPE’s price trend has been marked by a succession of lower peaks starting from December’s maximum, while the Moving Average Convergence Divergence (MACD) line indicates an increase in bearish pressure.

The latest intersection of MACD lines below zero adds credence to the growing downward trend, even though past trends have typically signaled upcoming dramatic upturns following such conditions.

PEPE’s volume analysis and market structure

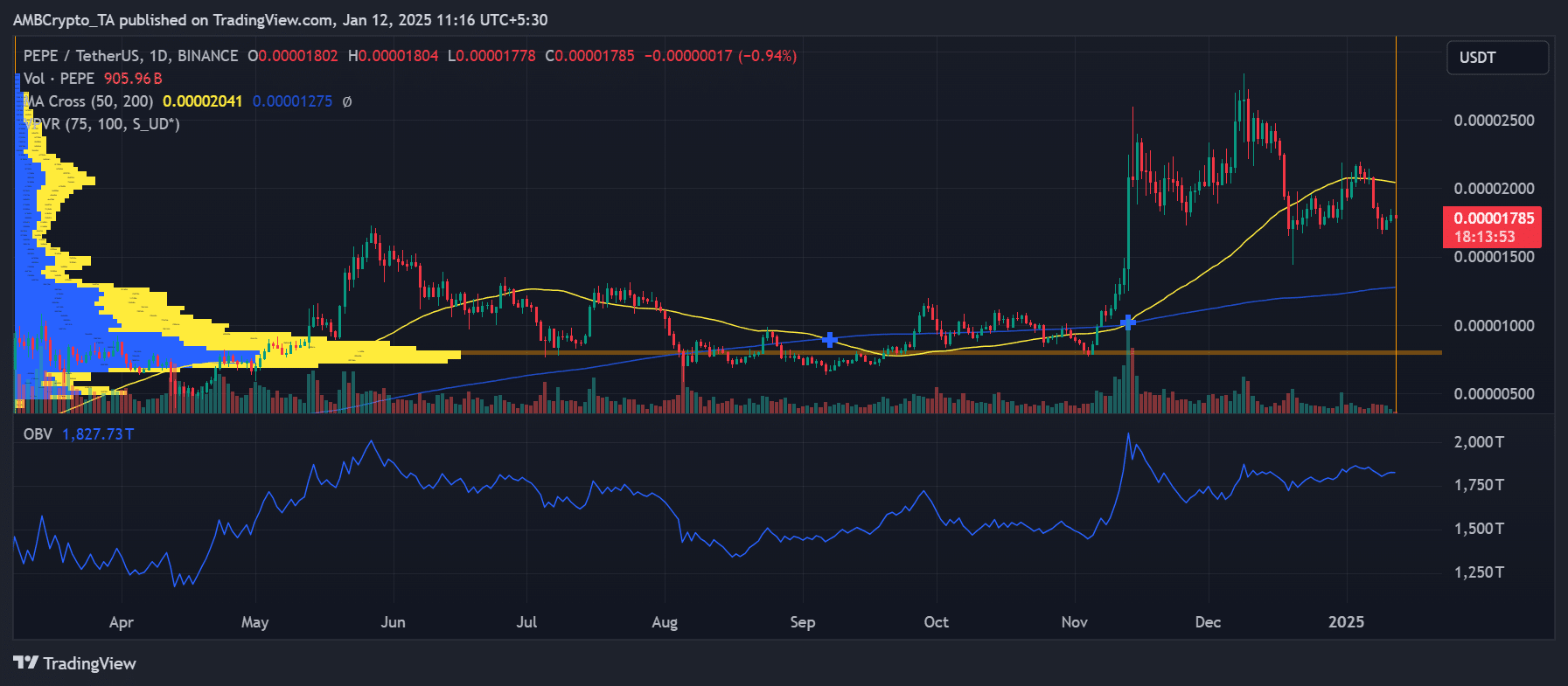

Through analyzing volume using the On-Balance-Volume (OBV) indicator, we observed a reading of 1,827.73T, suggesting persistent accumulation, even amidst weak pricing for the token. This divergence between the token’s price movement and OBV might hint at undiscovered strength within the token’s value that has yet to be reflected in its current price.

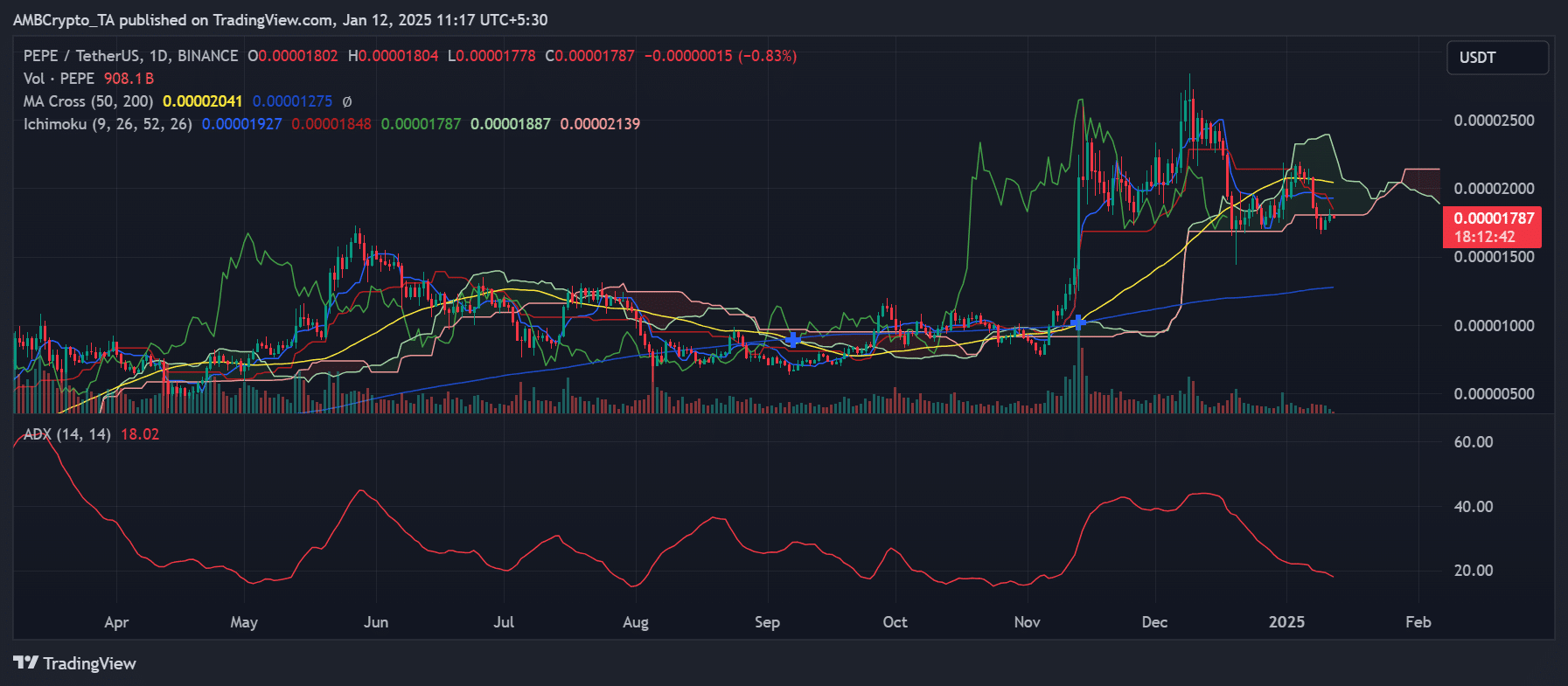

In simpler terms, the Ichimoku Cloud chart showed a conflicting prediction, as the price was touching the lower limit of the cloud at 0.000001887.

This area has traditionally functioned as a flexible area of resistance or support, making it an essential spot for traders to keep an eye on.

What’s next for PEPE’s price action?

Moving forward, PEPE may encounter resistance at approximately $0.000002000, which aligns with the upper Bollinger Band. If it manages to surpass this barrier, it could lead to a bullish momentum pushing the price up towards its recent peak of $0.000002500. However, if it doesn’t manage to maintain its current support level, there’s a possibility that the price might dip down to the significant level of $0.000001500.

The reading of 18.02 on the Average Directional Index (ADX) points to a weakening trend, hinting that the market could be about to change direction. When the strength of this downward trend lessens, as indicated by the ADX, and the Bollinger Bands become more squeezed, it frequently signals impending substantial price fluctuations.

Keeping a close eye on volume trends and possible turning points is advisable as PEPE nears its crucial support area. Even though technical signals lean slightly bearish, the token’s past price fluctuations hint at sudden rebounds after prolonged downtrends.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-12 20:07