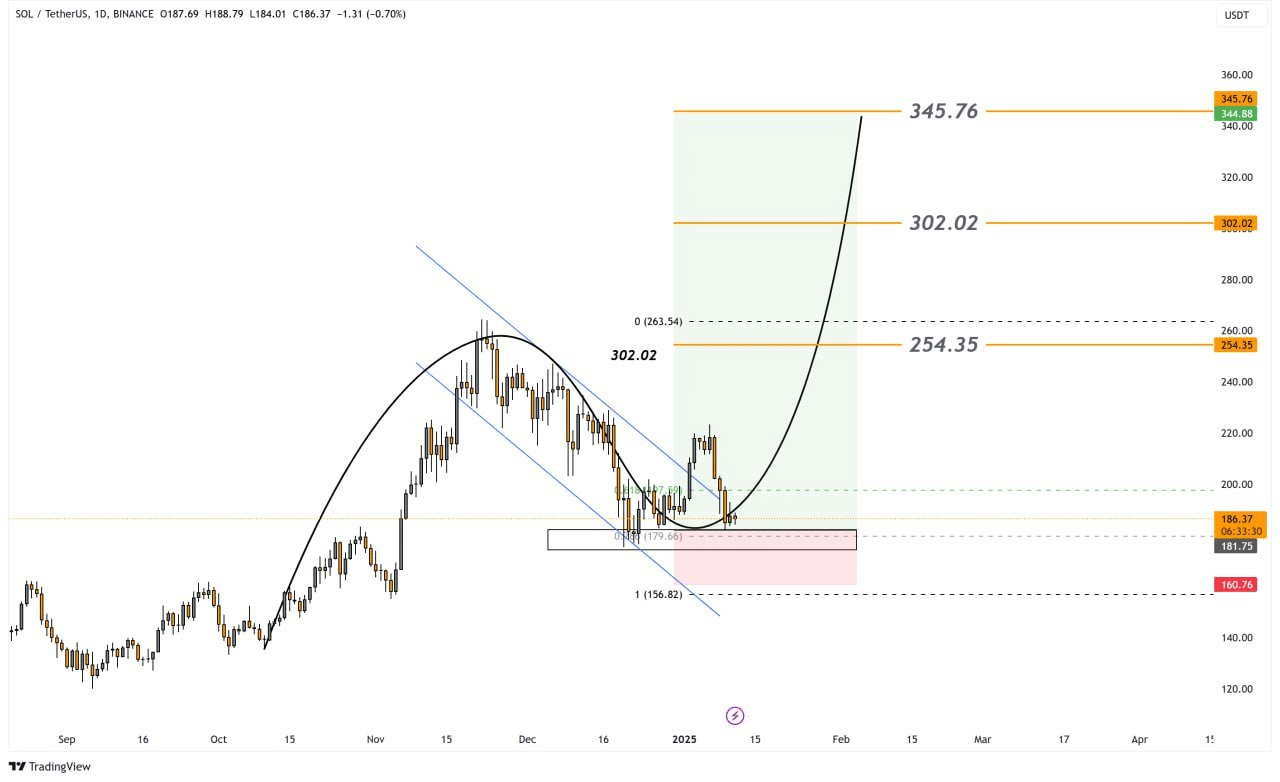

- Solana’s price action has seen a strong recovery from the key support level of $179.66, a point well-aligned with the 61.8% Fibonacci retracement zone

- Solana’s technical and fundamental indicators alluded to a promising bullish rally

In the past few weeks, Solana (SOL) has caught the eye of many traders due to its impressive V-shaped bounce back. Its latest price movements have shown strength, as important levels of support coincide with potentially bullish objectives, in line with technical analysis tools.

Key support and Fibonacci Retracement levels

The price of Solana has bounced back significantly from its crucial support at around $179.66, which is also in line with the 61.8% Fibonacci retracement zone – a significant location for spotting changes in trends.

Historically, this pullback point tends to attract buyers once the downward pressure starts easing.

The recent jump in the price of this altcoin from its current level not only confirms the strength of the support area, but also sets Solana up for a potentially substantial rise, aiming at the bullish objectives of $254.35, $302.02, and $345.76 – in accordance with the Fibonacci projections.

Examining Solana’s broader market pattern, the appearance of successive higher bottoms during its recovery indicates growing investor enthusiasm. If this trend continues, it might signal the possibility of a breakthrough, provided the ongoing direction remains consistent.

Consequently, it’s possible that the $179.66 mark serves as a base for SOL, with a fall below this point potentially disrupting the current bullish trend. If market sentiments stay positive, Solana might aim for its initial objective of $254.35 within the upcoming weeks.

MVRV Ratio analysis

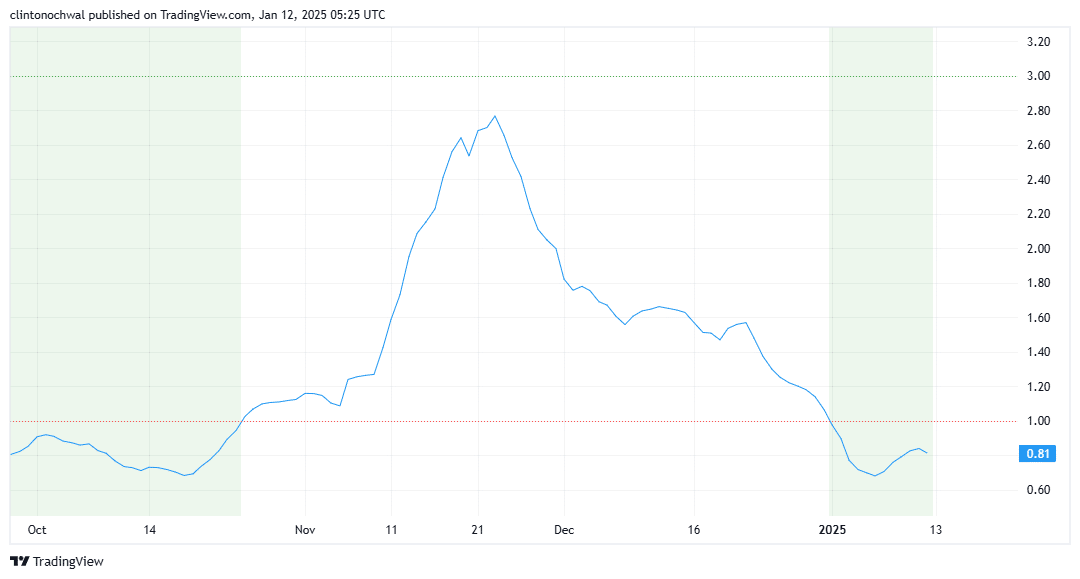

Currently, when I’m typing this, the MVRV (Market Value to Realized Value) ratio of Solana appears to indicate a period of recovery, implying that many investors who bought during previous accumulation stages are now either breaking even or making small profits.

Lately, Solana’s MVRV ratio has been gradually increasing and approaching a zone that indicates neither excessive undervaluation nor overvaluation. This suggests that new investors are joining the market, buoyed by optimism stemming from the recovery above the $179.66 support level.

If the trend keeps rising, it could indicate growing optimism about the asset’s performance, possibly mirroring the bullish predictions derived from our Fibonacci study.

Yet, an unexpected surge in the MVRV ratio approaching overbought levels might necessitate caution due to the likelihood of profit-taking activities following such highs. On the other hand, a sustained MVRV within a balanced range of 1.0 to 2.5 suggests a persistent bullish trend.

RSI Analysis

The Relative Strength Index (RSI), another vital tool, lends credence to the optimistic viewpoint about Solana.

Current RSI readings hint at a favorable-to-bullish situation for the asset, as the values hover between 55 and 60. This range suggests that Solana hasn’t exceeded overbought levels yet, implying there’s still potential for upward momentum.

At past gatherings, Solana’s Relative Strength Index (RSI) has frequently reached levels between 70 and 75 before seeing declines. This situation presents an opportunity for purchasers to potentially drive the price upwards significantly, as the current state does not suggest overbought conditions that might lead to a reversal.

Based on Solana’s technical and fundamental analysis, there seems to be a strong possibility for an upward price trend in the near future. Important levels to monitor include $179.66 as a potential support level, Fibonacci retracement points, a rising MVRV Ratio, and a RSI that leans towards bullish, collectively pointing towards further price growth.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2025-01-13 00:07