- Raoul Pal’s “Banana Zone” predicts Bitcoin’s consolidation phase, before transitioning into “Banana Singularity”

- Bitcoin’s price action ahead of Trump’s inauguration could trigger a rebound or panic sell-off.

Bitcoin (BTC) has seen renewed interest following its surge past $94,000, recovering from a momentary dip under $92,500. The erratic price fluctuations have led to speculation among investors about where the cryptocurrency might head next, as market turbulence continues to mount.

Raoul Pal on current market condition

Introducing an intriguing new concept, Real Vision’s founder Raoul Pal referred to it as the “Banana Zone” in a recent podcast discussion. He expanded on this notion in a subsequent post on platform X, using enigmatic language to describe it as follows:

“We are still in the Banana Zone.”

This event has sparked a flurry of discussion among the community regarding potential implications for Bitcoin’s future direction.

As a researcher, I’ve been exploring the intriguing notion coined by Pal, the “Banana Zone.” This term refers to an extraordinary spike in the value of cryptocurrencies, where their price graph takes on a banana-like shape. It’s fascinating stuff!

Later on, Pal clarified that the market is now undergoing a period of consolidation, having moved past what he terms “Phase 1 of the Banana Zone,” characterized by a significant price surge from the previous year.

He compared this phase to the market conditions seen during the 2016-2017 cryptocurrency boom.

Is altcoin season around the corner?

Pal thinks that the current consolidation period won’t persist for too long, and he expects the market to move into what he calls “Banana Zone Phase 2” – or the “Banana Singularity.” He foresees this phase as a point that will spark an altcoin boom.

As per the most recent information from BlockchainCenter.net, we’re not quite in an ‘altseason’ yet. The current index reading of 51 suggests this condition has not been met.

During this phase, as Pal points out,

“everything goes up (followed by a bigger consolidation).”

Additionally, Pal proposed that the market might progress into “Banana Zone Phase 3,” a period he refers to as the “consolidation stage.” During this time, leading contenders significantly escalate and establish higher highs. This phase is anticipated to signify the culminating growth spurt in the cycle, with certain cryptocurrencies reaching unprecedented pinnacles.

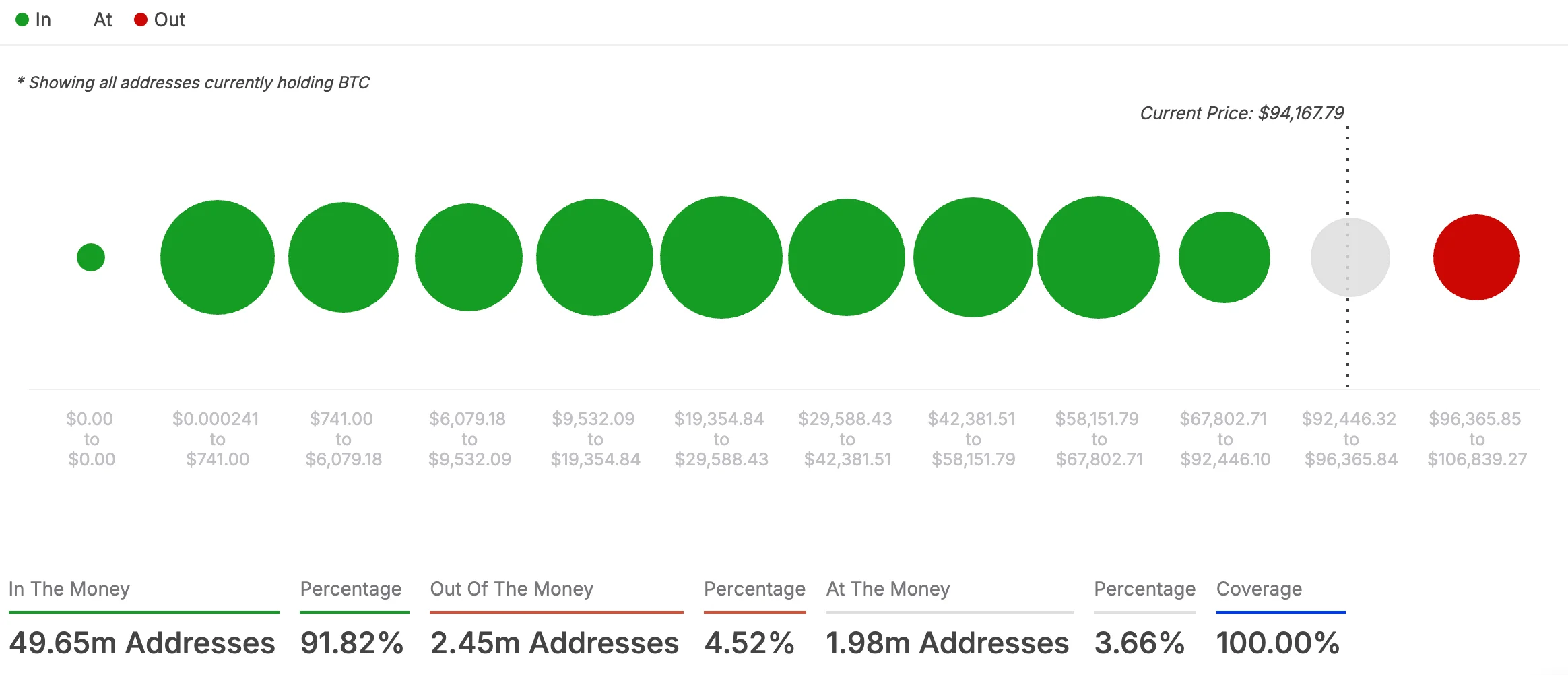

According to a study by AMBCrypto, utilizing data from IntoTheBlock, approximately 91.82% of Bitcoin owners currently possess Bitcoin that is valued higher than what they initially paid for it.

The large number suggests strong optimism in the market, adding credence to predictions of a significant price rise. On the other hand, merely 4.52% of Bitcoin owners are experiencing losses, as they own cryptocurrency worth less than what they initially paid for it.

As an analyst, I’m observing a significant lead by Bitcoin in the cryptocurrency market, which implies that other digital assets are likely to mirror its performance in the short term. In simpler terms, it seems we might be on the brink of a broad crypto market rally, with the majority of coins gearing up for an uptrend.

Will Trump’s entry to the White House change crypto market dynamics for good?

With Bitcoin standing at a crucial juncture just prior to Donald Trump’s presidential inauguration on January 20th, it’s hard to predict its price trend. However, should Bitcoin hold its ground above the $88k mark either before or after this event, analysts are optimistic that a significant recovery might ensue.

Conversely, if the price drops below $88k, there could be a mass panic selling from short-term holders, which might further push the price downward.

Consequently, it might be wise to stay patient and observe future developments. This is particularly important given the upcoming market fluctuations and political occurrences that could significantly influence Bitcoin’s short-term trajectory.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2025-01-13 01:11