In recent weeks, the market has seen a noticeable shift in focus, with altcoins taking center stage amid growing optimism. As traders position themselves for potential gains, many are increasingly looking to long positions in altcoins, anticipating significant price movements.

Altcoins take center stage

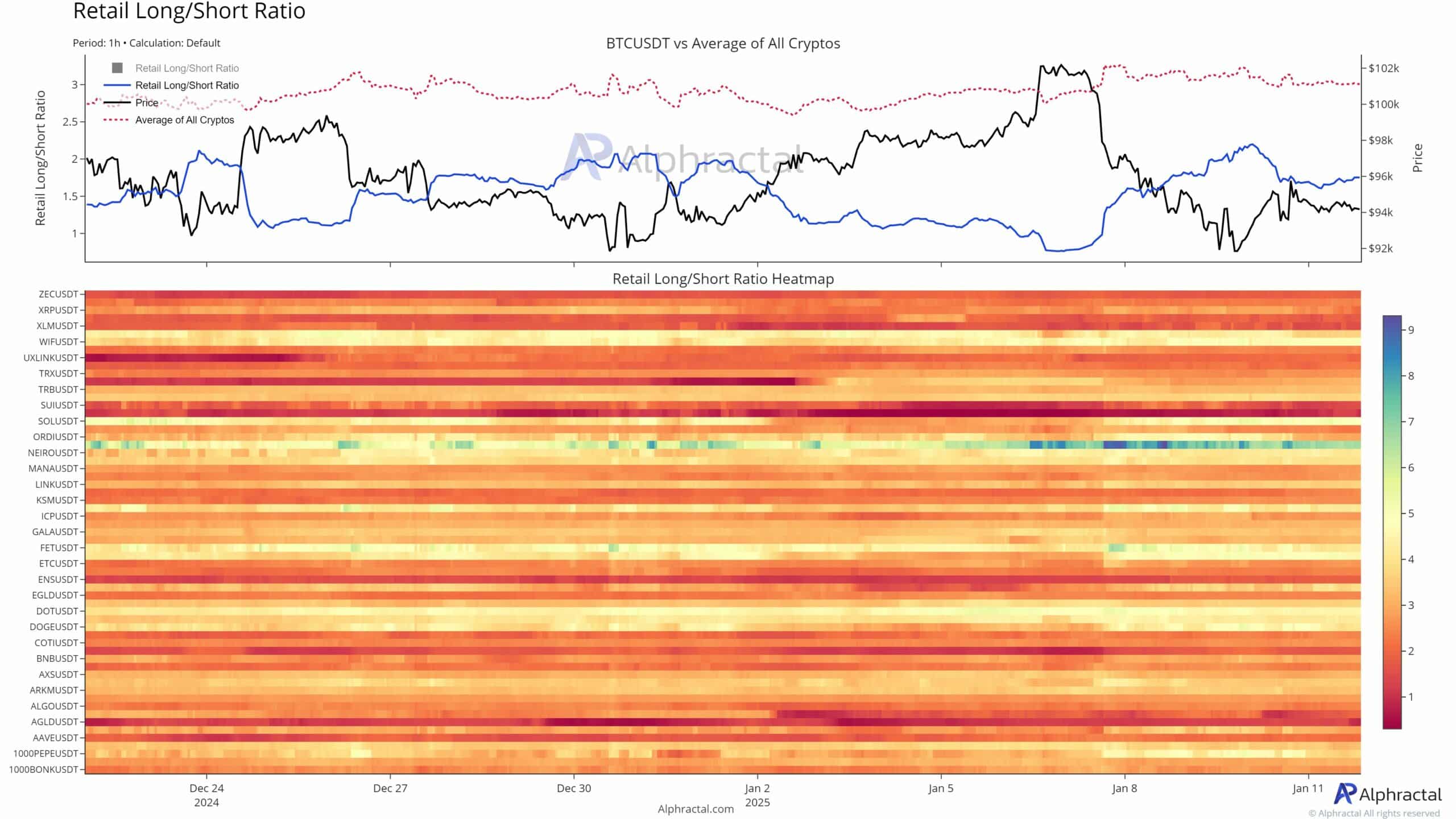

As an analyst, I’ve noticed some striking patterns emerging from the retail long/short ratio heatmap for altcoins. Notably, cryptocurrencies like SUI and SOL are dominating the long positions, which is evident by the prolonged green areas signifying a surge in retail bullish sentiment towards these assets.

Conversely, it appears that traders are anticipating a price drop for tokens such as TRX and XRP, as shown by increased bets on a fall in their prices (short interest).

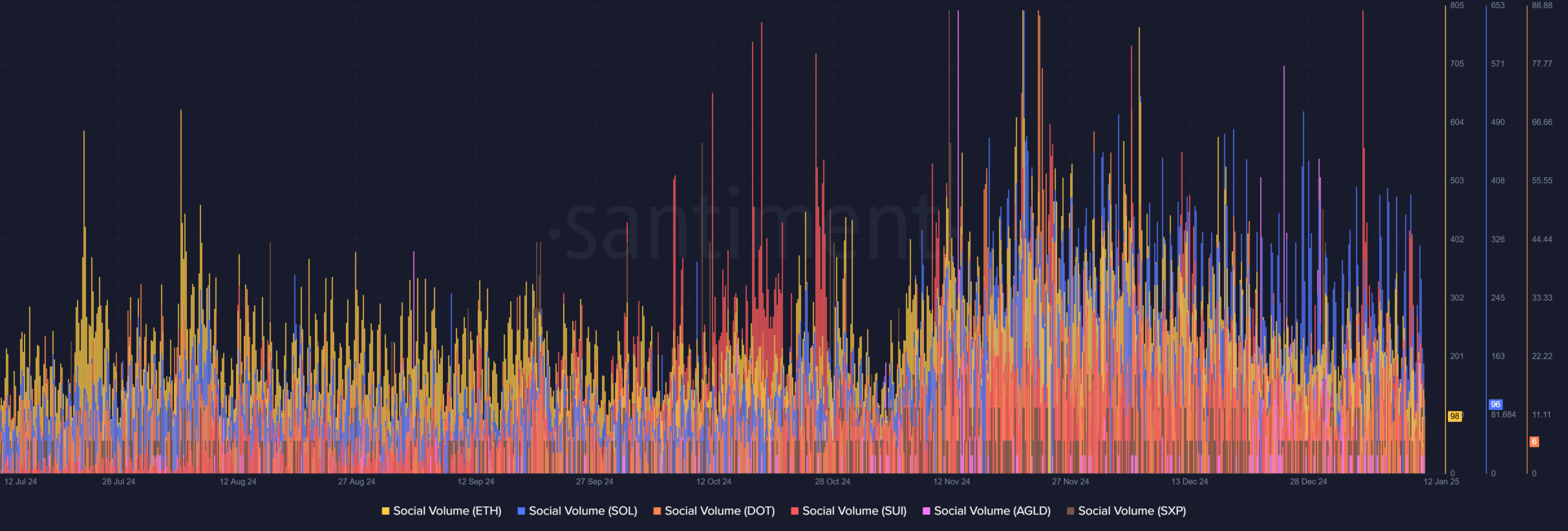

The data on social interaction mirrors this feeling. As you can observe from the graph, Ethereum [ETH] has consistently high interaction rates, but SUI and Solana are quickly catching up due to advancements within their networks and heightened excitement among their communities. Additionally, altcoins such as DOT and AGLD have experienced increased chatter, which suggests a growing interest in trading talks about these coins.

Although there’s a sense of enthusiasm towards altcoins, Bitcoin seems to be leaning slightly towards the bear market, with its current state being neutral at best. The balance between long and short positions among retail traders, as indicated by the average long/short ratio, is approaching equilibrium, suggesting that traders are adopting a cautious approach due to reduced price momentum.

The gap we’re seeing is indicative of changing market conditions – Investors are looking for opportunities with higher potential returns in alternative cryptocurrencies (altcoins), as Bitcoin’s influence lessens amid increased excitement for speculation. For the time being, the surge in altcoins appears to be fueled by both retail investors’ speculative enthusiasm and a more positive overall social atmosphere.

Bitcoin’s long/short ratio signals caution

The balance between Bitcoin’s long and short positions underscores its compatibility with the broader economic instability and traders’ inclination towards a secure investment environment.

In simpler terms, traders seem uncertain about the direction of prices, as they’re not seeing clear trends or strong indications for movement. Instead of making big predictions (directional bets), they prefer to minimize risk by using protective strategies (hedging) rather than taking aggressive positions (speculative plays).

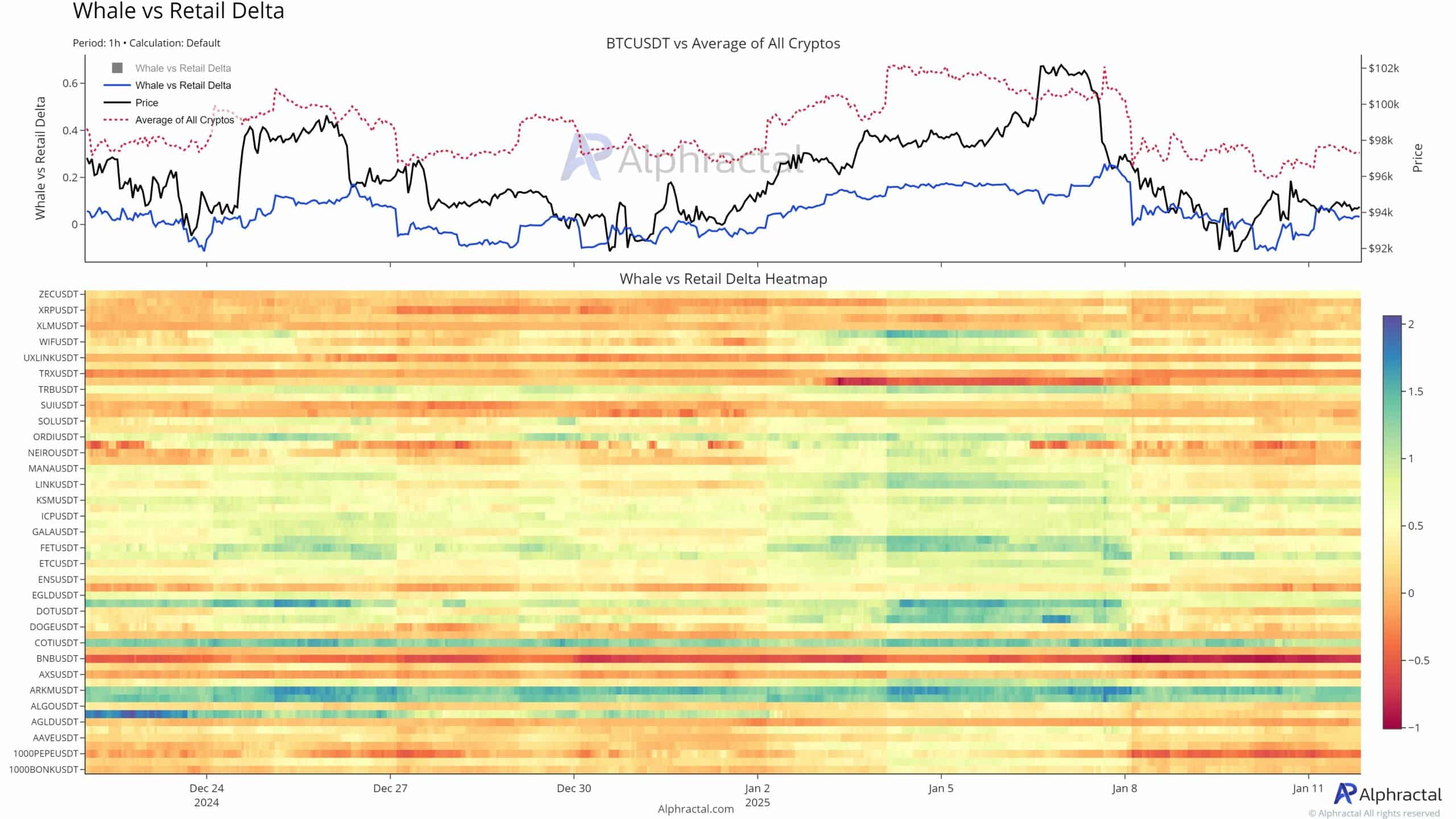

The Whale vs. Retail Delta heatmap showed a subdued level of whale involvement in Bitcoin compared to other cryptocurrencies, suggesting that major investors aren’t actively buying or selling large amounts. Instead, it appears their actions are more focused on preserving balance rather than intensifying market fluctuations.

Unlike coins such as TRX or GALA, which frequently experience more dramatic price fluctuations due to high retail activity that is not always counteracted by large-scale trading from ‘whales’, this one tends to have more stable price movements.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Diverging optimism – Altcoins and market stability

As a researcher studying the altcoin market, it appears we’re standing at a significant juncture. While coins like SUI and SOL are experiencing focused bullish surges, not every corner of the market shares this optimism. The increasing bearish sentiment towards assets such as TRX and XRP indicates a growing level of doubt in certain areas of the crypto sphere.

This division suggests a potential tug-of-war over liquidity, with overly optimistic trades in specific altcoins potentially magnifying the transfer of volatility. For the sake of market stability, this divergence in opinion poses risks.

If sudden withdrawal of excitement towards specific altcoins occurs, it might decrease overall trust and spark ripples of impact (contagion). On the flip side, persistent positivity surrounding chosen assets may lure idle funds, igniting a broader surge.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-13 02:15