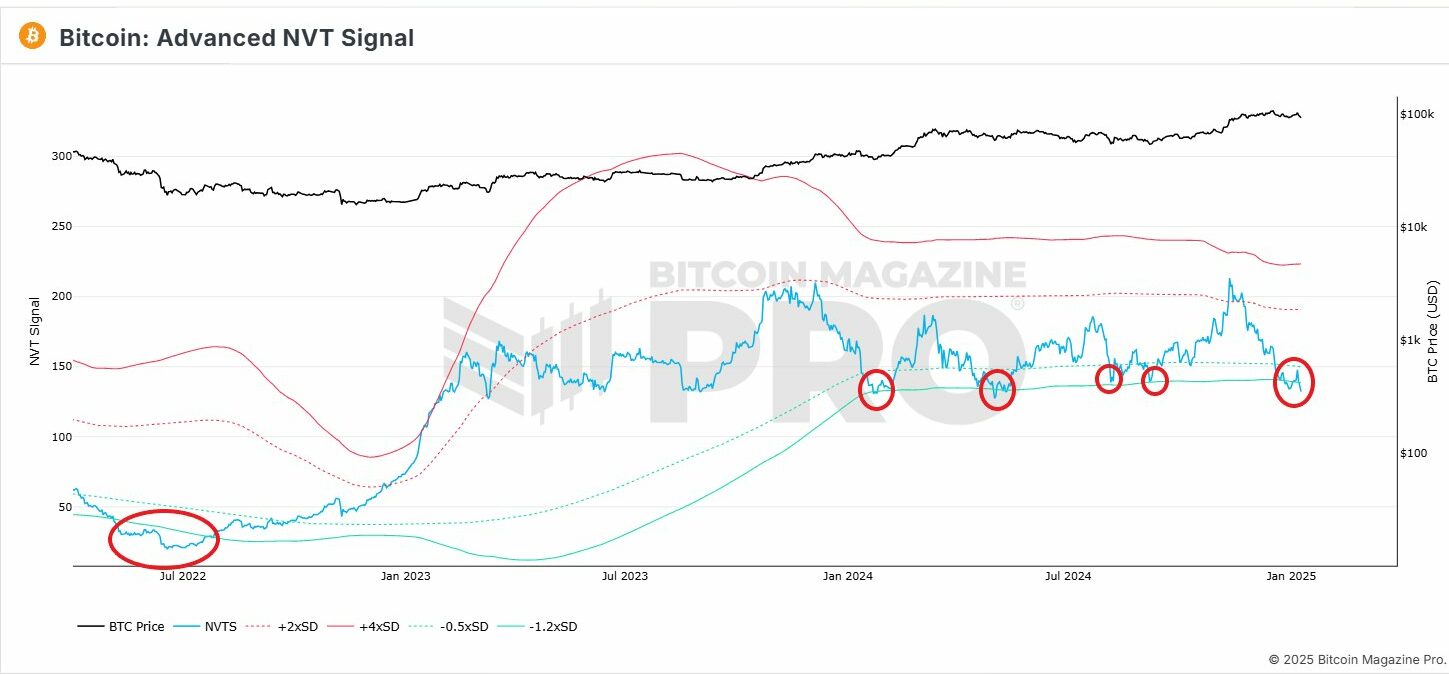

- Bitcoin’s Advanced NVT signaled a local bottom for the first time in 6 months

- BTC fell by 3.92% on the charts over the past week

For the past month, Bitcoin’s [BTC] graph hasn’t shown much upward progression. Instead, it’s been moving horizontally with significant swings in its price. As I write this, the digital currency is being traded at $94,532, a drop of nearly 4% from its weekly high.

Under current market trends, experts are discussing Bitcoin’s price fluctuations and predicting its future in the cryptocurrency sector. For example, Burak Kesmeci from Cryptoquant suggests that we might have reached a temporary low for Bitcoin, supported by his analysis using the Advanced NVT indicator.

Is Bitcoin’s Advanced NVT indicating a local bottom?

In his examination, Kesmeci proposed that Bitcoin might have reached a temporary low point. He suggests this idea because the Advanced NVT indicator hints at the same observation for the first time in six months.

Historically, when this signal appears, Bitcoin tends to see substantial increases in its price chart. When an asset reaches a temporary low point, it often signals increased buying activity by the market.

As demand for purchasing Bitcoin increases while sellers are leaving the market, prices begin to rise again. If this represents the current lowest point in Bitcoin’s local market trend, it suggests that investors see the current prices as undervalued and may soon be opening new buying positions.

Despite Bitcoin not maintaining the pace seen in November, it’s premature to predict the dominant market direction. In fact, Kesmeci suggests that there might be potential for further growth as indicators like the Advanced NVT suggest this could be possible.

What does it mean for BTC’s price charts?

It’s important to examine additional market signals besides the analysis given earlier, as they might provide further insights.

Based on AMBCrypto’s interpretation, while the Advanced NVT ratio might imply an impending upward shift, other metrics seem to paint a contrasting picture. Essentially, these indicators hint that Bitcoin might experience a deeper decline before potentially turning around and rising on the graphs.

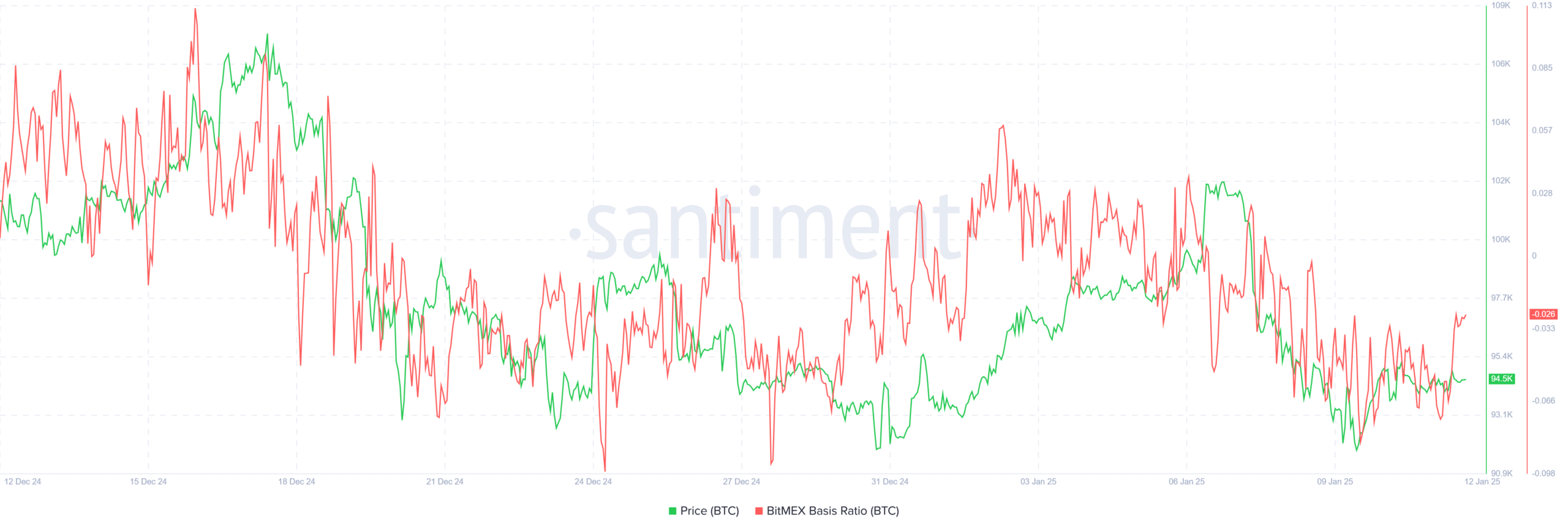

Initially, it’s worth noting that Bitcoin’s Bitmex basis ratio has stayed below zero for the last four days. When this happens, it signals a condition known as contango in the market, where future prices are lower than current (spot) prices. This situation suggests that investors foresee a possible price drop because the market is essentially betting on near-term bearish trends.

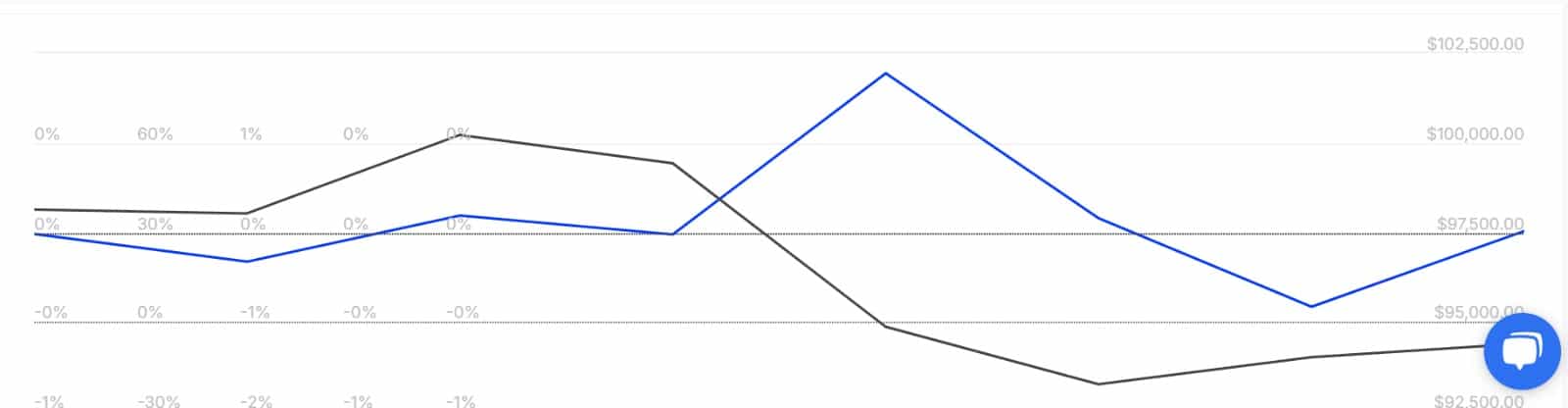

The tendency towards bearishness is particularly noticeable among significant investors. As per IntoTheBlock’s analysis, the ratio of Large Holders Netflow to Exchange Netflow has significantly increased, moving from -0.33 to 0.01. When this figure becomes positive, it suggests that larger holders are transferring more Bitcoin to exchanges than they are withdrawing.

This often precedes selling activity which may result in downward pressure on the asset’s price.

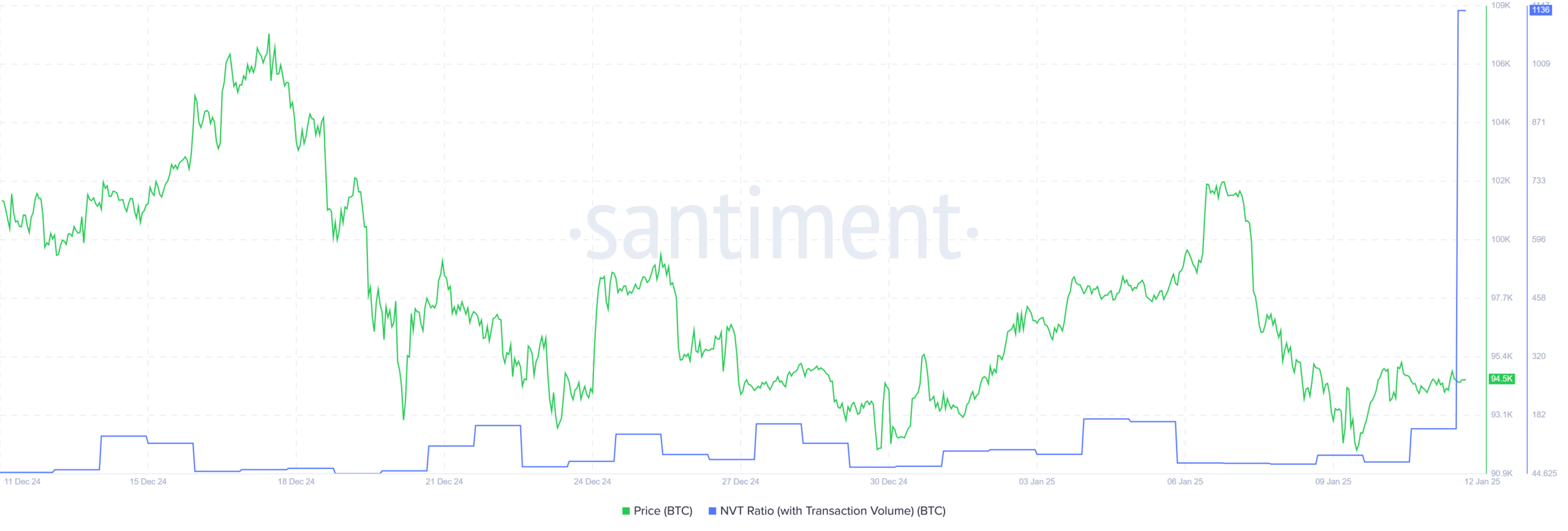

Finally, Bitcoin’s NVT ratio with transactions surged to extreme levels, hitting 1136.

This sharp drop indicates a decrease in on-chain transactions, with a lower number of trades compared to Bitcoin’s market worth. This discrepancy could potentially lead to questions about overvaluation, and the price might adjust to align with the real market demand.

From my perspective as an analyst, while the Advanced NVT could indicate a potential local bottom, it’s essential to note that Bitcoin might experience further declines before aiming for another upward trend.

Given recent negative sentiment among market participants, Bitcoin (BTC) might dip down to around $92,480. But if a bottom is reached locally and an uptrend follows, BTC could recover its value above $96,000 in the near future, before aiming for $98,700 later on.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-13 03:03