- LINK’s descending wedge pointed to a bullish breakout, with $23.92 resistance as the critical level

- Market sentiment strengthened as Open Interest rose and exchange reserves continued to decline

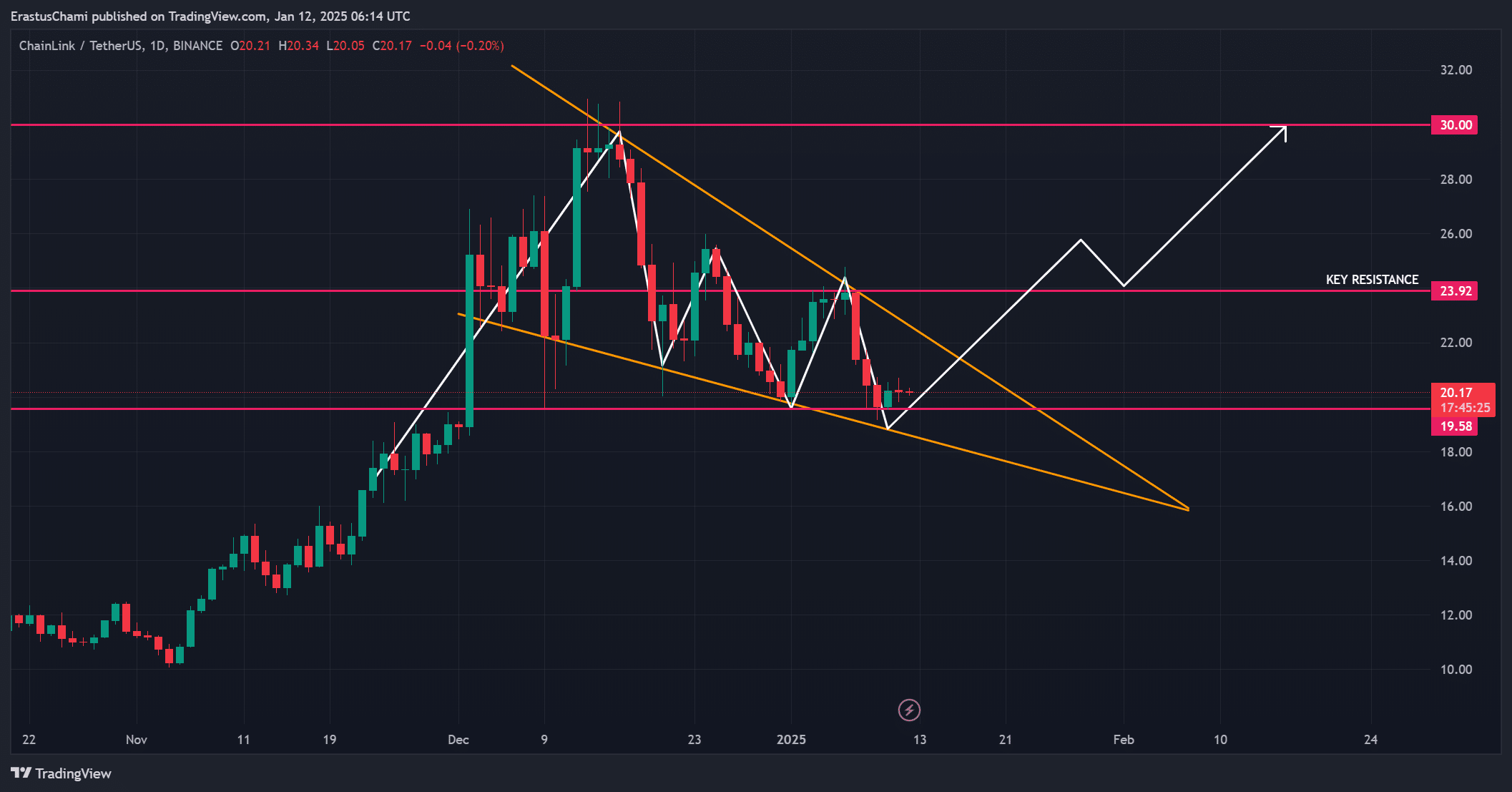

Chainlink (LINK) has been drawing market interest with its persistent consolidation and hints of a significant breakthrough. Currently trading at $20.17 after a 0.62% rise as reported, LINK appears to be demonstrating resilience within a descending wedge formation.

As an analyst, I find myself observing the critical resistance level at $23.92 for LINK. Given its potential significance, it seems plausible that LINK could be poised for a substantial uptrend towards $30. However, the question remains whether the market’s momentum will sustain this bullish trajectory.

What does the price action reveal?

LINK’s price movement has been contained within a falling triangle, noticeable for its decreasing peaks and troughs. Interestingly, such structures often signal bullish breakouts, becoming more likely as the price nears the top point of the triangle.

As a result, if we surpass the $23.92 barrier, it might set off a strong upward trend reaching approximately $30 – a level likely to draw considerable attention.

If LINK doesn’t manage to surpass its resistance level, it may result in continued consolidation, pushing back the optimistic outlook. Consequently, the upcoming days hold significant importance as they could shape LINK’s forthcoming trajectory.

On-chain activity strengthens optimism

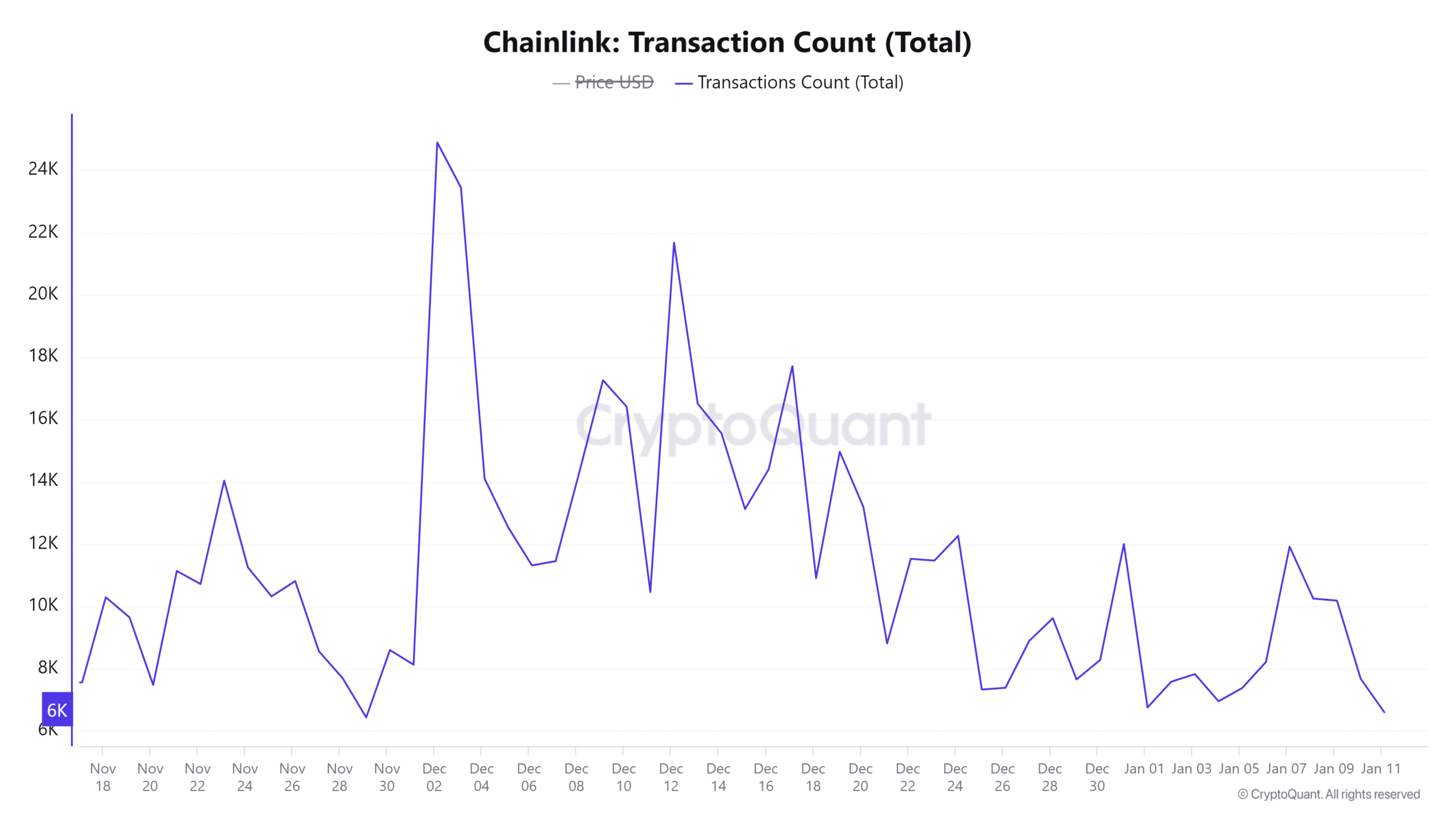

According to Chainlink’s on-chain data, there’s a positive outlook as more users are engaging with the platform. There’s been an increase of about 0.86% in active addresses over the past day, suggesting increased user involvement. Furthermore, transaction counts have gone up by roughly 0.88%, indicating higher activity and demand.

As an analyst, I noticed that the combined indicators have highlighted a significant increase in interest towards Chainlink. This increased attention could potentially fuel a rally.

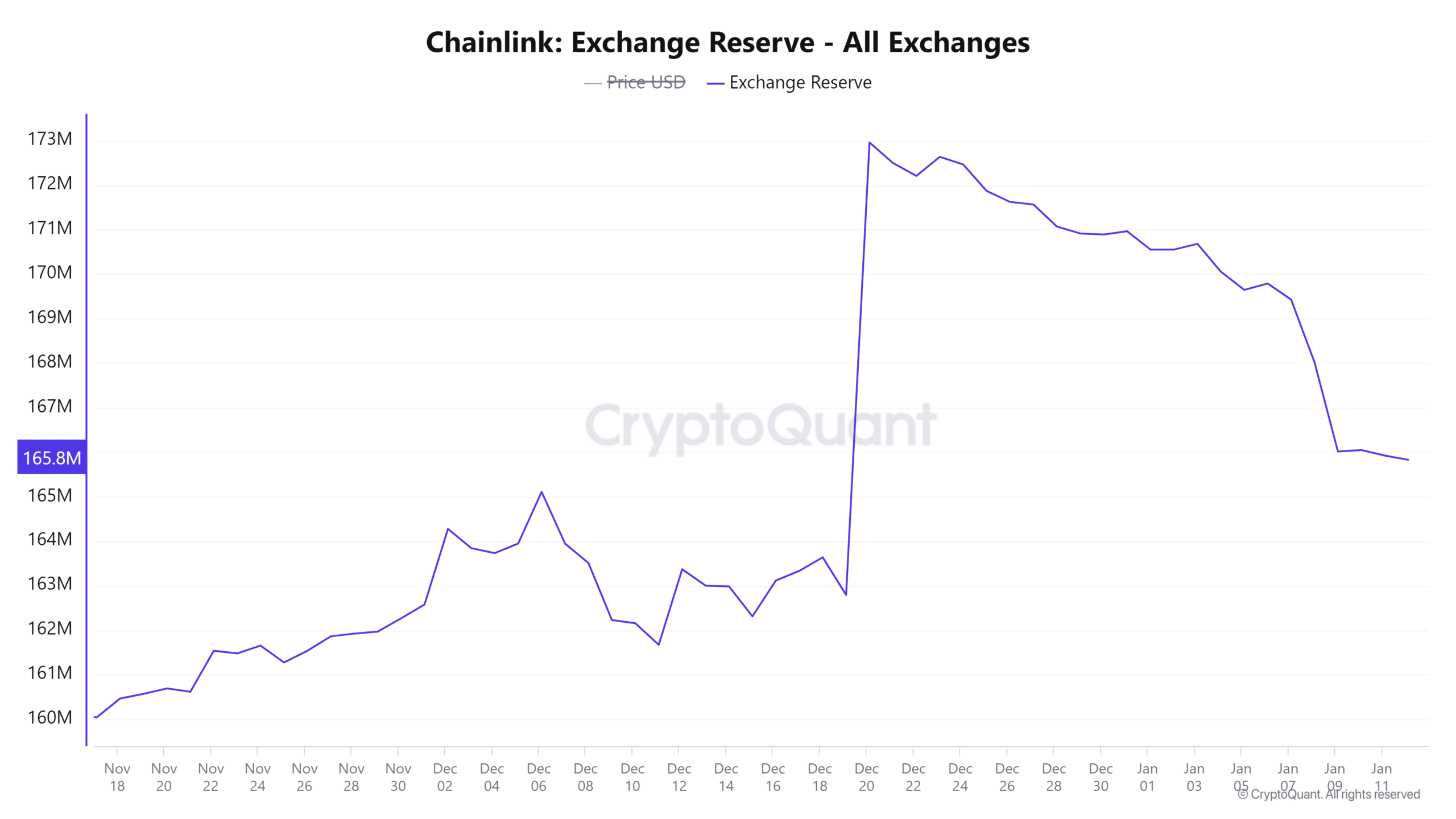

Additionally, there was a decrease of 0.11% in the reserve holdings for LINK on exchanges, suggesting a decrease in selling pressure since it appears that fewer tokens are being stored there.

As a result, this might generate a beneficial situation where supply and demand work together, potentially causing an increase in prices. However, it’s important to note that continuous improvement in these figures is crucial for a prolonged upward trend.

Market sentiment and liquidations favor a bullish outlook

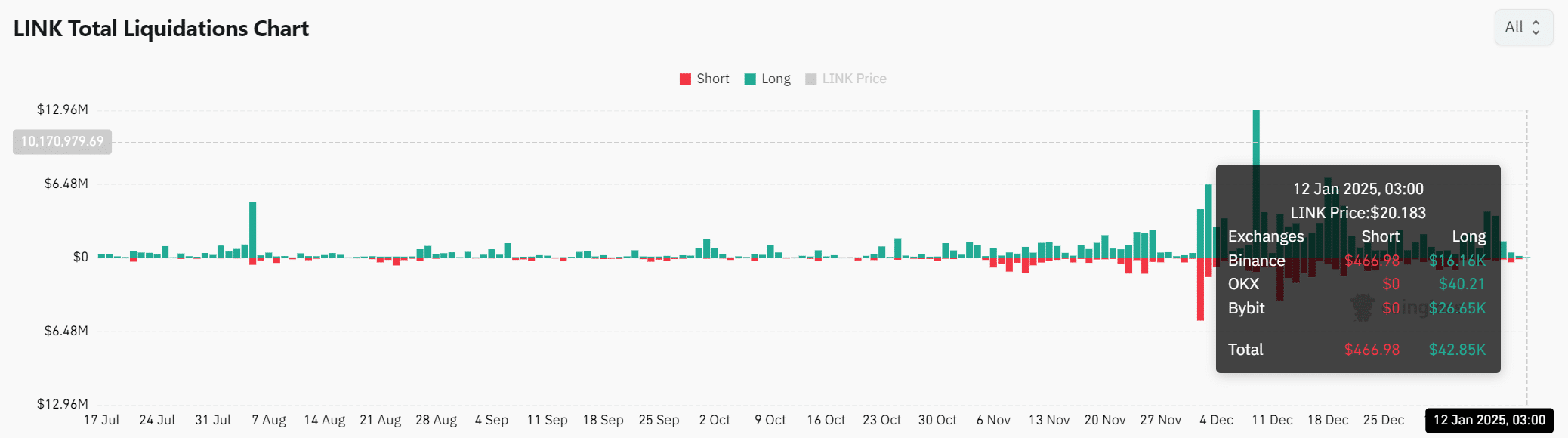

Finally, the market sentiment for LINK appeared increasingly optimistic at press time.

Interest in this market significantly increased by 5.42%, amounting to approximately $724.59 million – Indicating increased involvement and faith from traders. Moreover, the liquidation data indicated more significant trading volumes for short positions compared to long ones, implying that traders have predominantly favored a bullish stance.

It appears that Chainlink is poised for an upward surge due to its bullish wedge formation, increasing network engagement, and robust investor optimism.

The crucial step is overcoming the barrier at $23.92, which might trigger a surge towards $30 and possibly even higher prices. This suggests that LINK is primed for a substantial price increase in the short term.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-13 07:03