- Bitcoin is entering a high-stakes game, where the bold may thrive

- While FOMO builds, there’s still plenty to unpack

Two collapses within a short span might prompt some to consider leaving, yet Bitcoin [BTC] remains resilient above $90k, bucking expectations. It seems that the market is preparing for another ‘Trump trade’ to commence – however, the risks have never been greater. Therefore, be prepared.

Market teetering on the edge of greed and fear

Regardless of the two significant conflicts with the Federal Reserve, Bitcoin’s status as a secure investment is being validated. A year prior, such a shock could have sparked a more severe response. However, we find ourselves in a situation where Bitcoin dropped from its annual peak of $102k only a week ago. Remarkably, it has managed to remain relatively stable, experiencing a decrease of just 7%. This demonstrates its resilience.

As Trump’s inauguration approaches, there are discussions about a reoccurrence of the Q4 rally that propelled Bitcoin to reach $108,000. For numerous individuals, keeping their investments in Bitcoin appears to be a shrewd move at this moment.

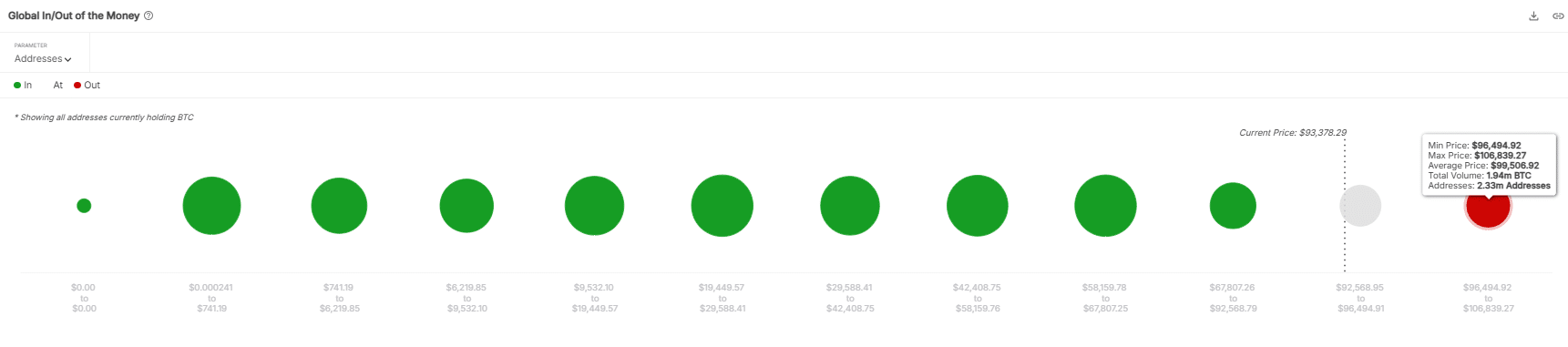

There’s an important point to consider – a significant amount of Bitcoin could be sold if the price drops back to $106k. Approximately 1.9 million BTC, which were purchased at that price, might be offloaded, leading to a potential sell-off worth around $201 billion.

History demonstrates that robust rallies frequently stem from excessive optimism, where investors grow increasingly eager to take significant risks, convinced that the prospect of greater profits outweighs the danger of an impending collapse.

Regrettably, given the ongoing influence of various economic factors, there’s a high chance anxiety might control the market. If this happens, a market crash could swiftly escalate from online speculation to a genuine event.

It’s flight or fight for Bitcoin

As an analyst, I’m closely monitoring the upcoming events in the financial markets. Within a fortnight, the Federal Reserve (Fed) is set to hold its January meeting, which could significantly influence market trends. Additionally, we are approaching the release of the final Consumer Price Index (CPI) and Producer Price Index (PPI) inflation data prior to the Fed’s decision-making process. These key economic indicators will play a crucial role in shaping the Fed’s stance on monetary policy.

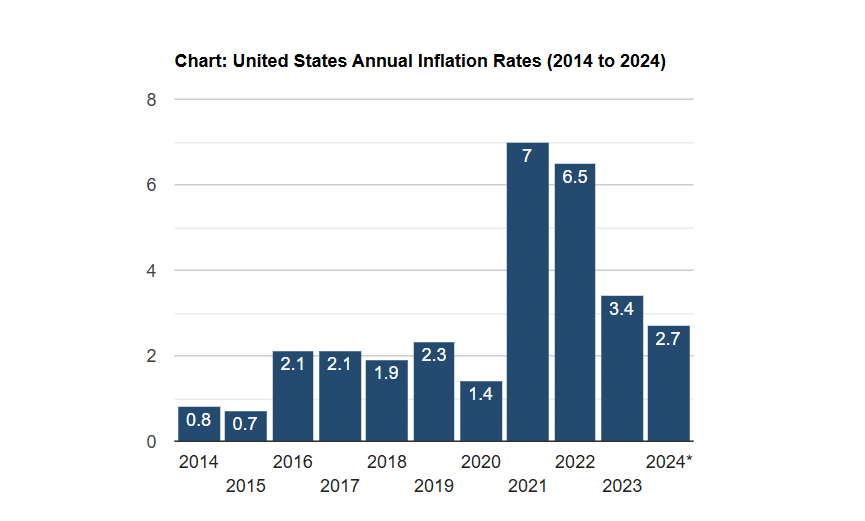

Given that inflation currently stands at 2.7%, significantly higher than the Federal Reserve’s goal of 2%, there’s a strong possibility that the central bank will maintain its aggressive stance. This could lead to a possible downturn in the markets over the coming period. The upcoming days are particularly crucial.

Read Bitcoin’s [BTC] Price Prediction 2025-26

Considering the circumstances, it’s possible that panic selling could increase as Bitcoin reaches critical points. The Trump trade might struggle, and Bitcoin’s upcoming year could be challenging. It appears that the prolonged rise in price is facing resistance; fear could become dominant, leading investors to opt for safer exits.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-13 20:07