- Ethereum’s selling pressure was dominating on Binance

- ETH has declined over the past month by 18.61%.

Over the past week, since reaching a peak at $3746, Ethereum [ETH] has faced significant bearish trends.

During this stretch, Ethereum dipped down to a temporary minimum of $3,157. While Ethereum has experienced some growth, it continues to trend downwards.

Currently, as we speak, Ethereum is being exchanged for approximately $3,196. This represents a decrease of 2.17% over the course of the day. On a weekly basis, ETH has seen a drop of 12.67%, while on a monthly scale, it has declined by 18.61%.

As an analyst, I’ve observed a noticeable drop in Ethereum’s performance, which appears to be primarily driven by heightened selling activity, as suggested by the insights from CryptoQuant.

Ethereum’s selling pressure dominates

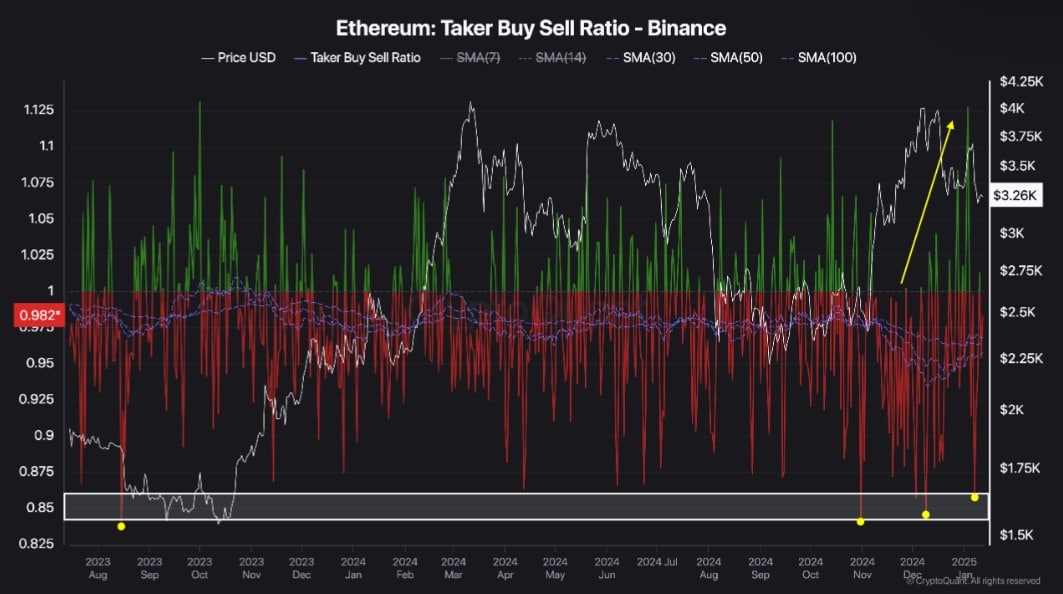

According to an analysis by CryptoQuant, there’s a significant wave of sell-offs for Ethereum on Binance. This trend has been evident since November 2024.

On Binance, the strong trend of Ethereum being bought rather than sold is clearly visible through its Taker Buy/Sell Ratio. Since November 2024, this measure has consistently shown a negative value, suggesting that there’s been more selling activity compared to buying activity.

Currently, the Taker Buy/Sell Ratio is at a level similar to that of August 2023, indicating a widespread pessimistic attitude among traders.

As a crypto investor, I observed that during December, buyers seemed eager to steer the market’s direction, but it didn’t take long for sellers to reassert their dominance, further fueling the existing downtrend.

Over the last few months, there’s been consistent selling activity, indicating a market that is not only pessimistic (bearish) but also showing caution.

Conversely, an increasing sell-to-buy ratio might signal a good chance for long-term investors to buy.

If the number of people selling is going up, this could be a sign that it’s a good time for long-term investors to purchase.

Lastly: As more people are selling, it could mean it’s a favorable moment for long-term holders to buy in.

Impact on ETH price charts?

It appears that Ethereum is currently facing significant selling activity, leading to a downward trend in its price fluctuations.

Initially, we notice increased selling activity because the Ethereum Chaikin Money Flow (CMF) has shifted to a negative value. At this moment, the CMF is showing -0.08, which suggests that sellers currently have more control over the market than buyers.

The market’s actions can be supported by a decrease in the Relative Strength Index (RSI), which has nearly reached the point of being overbought, currently standing at 38. This significant drop suggests that buyers may be losing control to the sellers in the market.

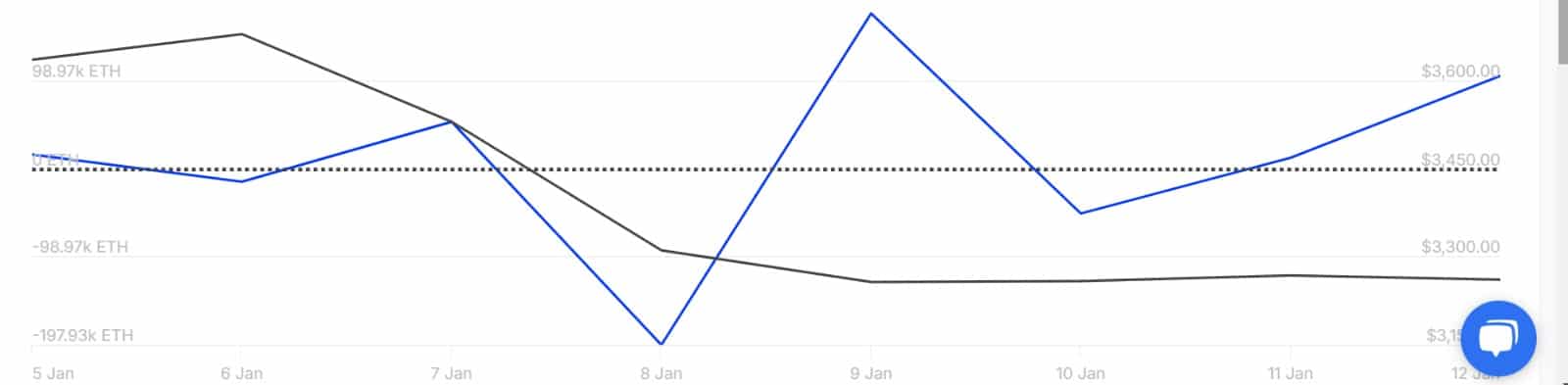

Over the last week, there’s been a significant increase in Ethereum being transferred into exchanges. This influx has gone from -50,770 to 103,770, suggesting that more Ethereum is being sent to exchanges than withdrawn, implying increased trading activity.

Typically, an increase in funds moving into exchanges is often followed by heightened selling pressure, since many investors choose to offload their assets after making such transfers.

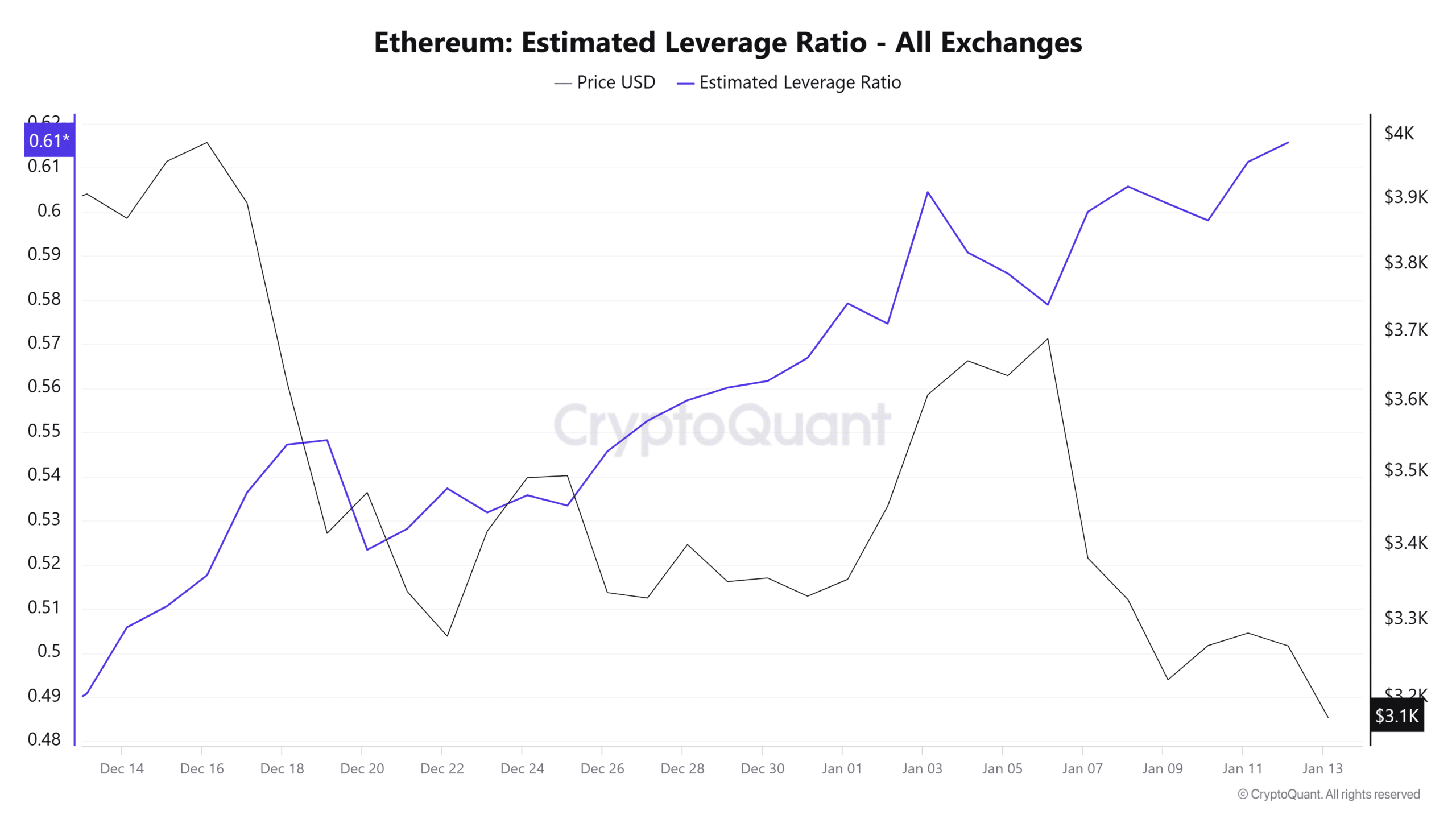

Over the past month, there’s been a continuous rise in the Anticipated Leverage Ratio (ALR) associated with Ethereum. An uptick in ALR during a falling market trend usually signals a pessimistic outlook, potentially leading to a situation where many long positions are liquidated, known as a ‘long squeeze’.

As a crypto investor, I understand that if prices continue to fall, my long positions might get liquidated. This could potentially trigger a ‘long squeeze’, where more sellers join the market, leading to even steeper price drops.

Read Ethereum’s [ETH] Price Prediction 2025–2026

To summarize, Ethereum is experiencing significant downward pressure due to ongoing bearish trends. Should the current market situation persist, we might see ETH dipping to roughly $3,030, and in a worst-case scenario, even falling below that to find support around the $2,810 level.

However, if the downtrend exhausts and a reversal emerges, the altcoin could reclaim $3,300.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-13 21:12