- FLOKI has dropped to a three-week low amid bearish pressures across the memecoin market

- Derivative traders have remained active, with declining funding rates and long/short ratio showing a surge in short positions

Over the past week, the overall value of all memecoins collectively decreased by approximately 17%, bringing the current market cap to around $94 billion, as reported by CoinMarketCap. Interestingly, FLOKI, one of the top six memecoins by market capitalization, has followed this downward trend. At the moment of writing, FLOKI was trading at a three-week low of $0.000155, having dropped by 5% over the past day.

This decrease has caused an increase in trading action, not just in the immediate market but also in related futures markets. This surge might signal an upcoming rise in market turbulence.

Derivative traders remain active

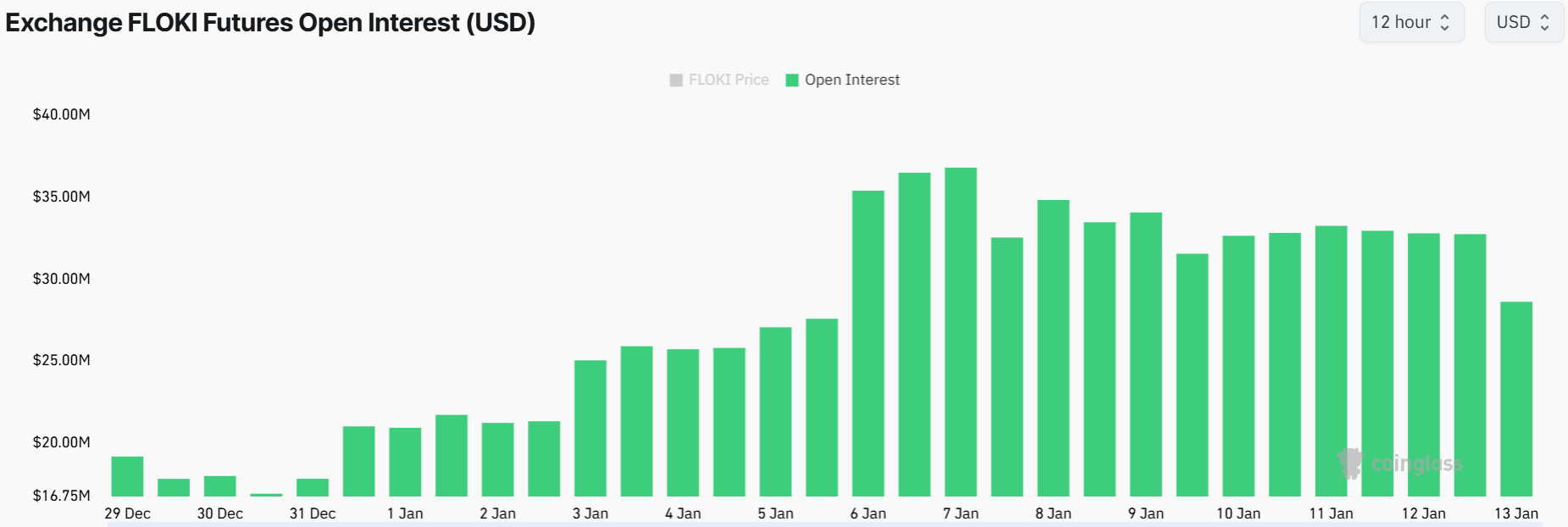

According to findings from Coinglass, it appears that derivative trading related to FLOKI is persistently active, even amid a downward market trend. Intriguingly, the Open Interest (OI) has surged from an initial $21M at the start of the year to reach $28M currently.

or

Coinglass’ data indicates that FLOKI derivative trading activity remains elevated, despite the bearish market conditions. Notably, the Open Interest (OI) has grown from its starting point of $21M to stand at $28M as of now.

The information indicates that only a small number of FLOKI traders may be liquidating their active trades. Yet, this could alternatively signal an increase in short sellers in the marketplace, typically resulting in pessimistic market feelings.

The funding rate has decreased substantially to just 0.0028%, suggesting that long-term traders are reluctant to pay high premiums to keep their active trades alive.

FLOKI price analysis as sellers fuel the downtrend

Currently, the four-hour graph of FLOKI indicates signs of potential overselling as its Money Flow Index reached 21. If this trend continues, it might suggest that sellers have run out of steam, potentially leading to a price reversal.

In simpler terms, when the 50-day moving average falls below the 150-day moving average for FLOKI, it suggests that FLOKI has started a prolonged decrease in price. It doesn’t necessarily mean a bullish reversal will happen immediately after this crossover event.

Increased buying and selling actions have led to a downward trend for FLOKI, which has broken through its previous consolidation phase. Therefore, traders should pay attention to the support level at $0.000145, as falling below this point could mark a new monthly low.

On-chain signals suggest…

A look at blockchain data from IntoTheBlock shows that even though the price declined, large FLOKI investors (whales) seem uninterested in taking advantage of the market dip. This observation comes after a significant decrease of around 14% in large transaction volumes.

However, there was a slight uptick in large holder positions.

Concurrently, the earning potential from wallets containing FLOKI decreased. If traders decide to transfer their tokens to exchanges to limit their losses, this situation may escalate the demand for selling, leading to increased pressure on the market.

Despite some challenges, there were positive indications such as an increase in network activity, suggesting potential good news for the altcoin’s future development.

Is a short squeeze looming?

It was found that FLOKI’s long/short ratio showed an increase in the number of investors who are short selling the memecoin, predicting it will fall more. This surge came about as the ratio neared its weekly minimum after dropping to 0.856.

If there are numerous short sellers and FLOKI suddenly surges upward unexpectedly, the compulsion for these short sellers to close their positions might trigger buying demand, which could contribute to a rising trend. In such a ‘short squeeze’ situation, this dynamic could help FLOKI in its recovery process.

Read More

2025-01-14 03:03