- The bearish wedge pattern and negative funding rates signal a potential downside for BNB.

- Derivatives activity surges, but mixed signals keep traders cautious about BNB’s next move.

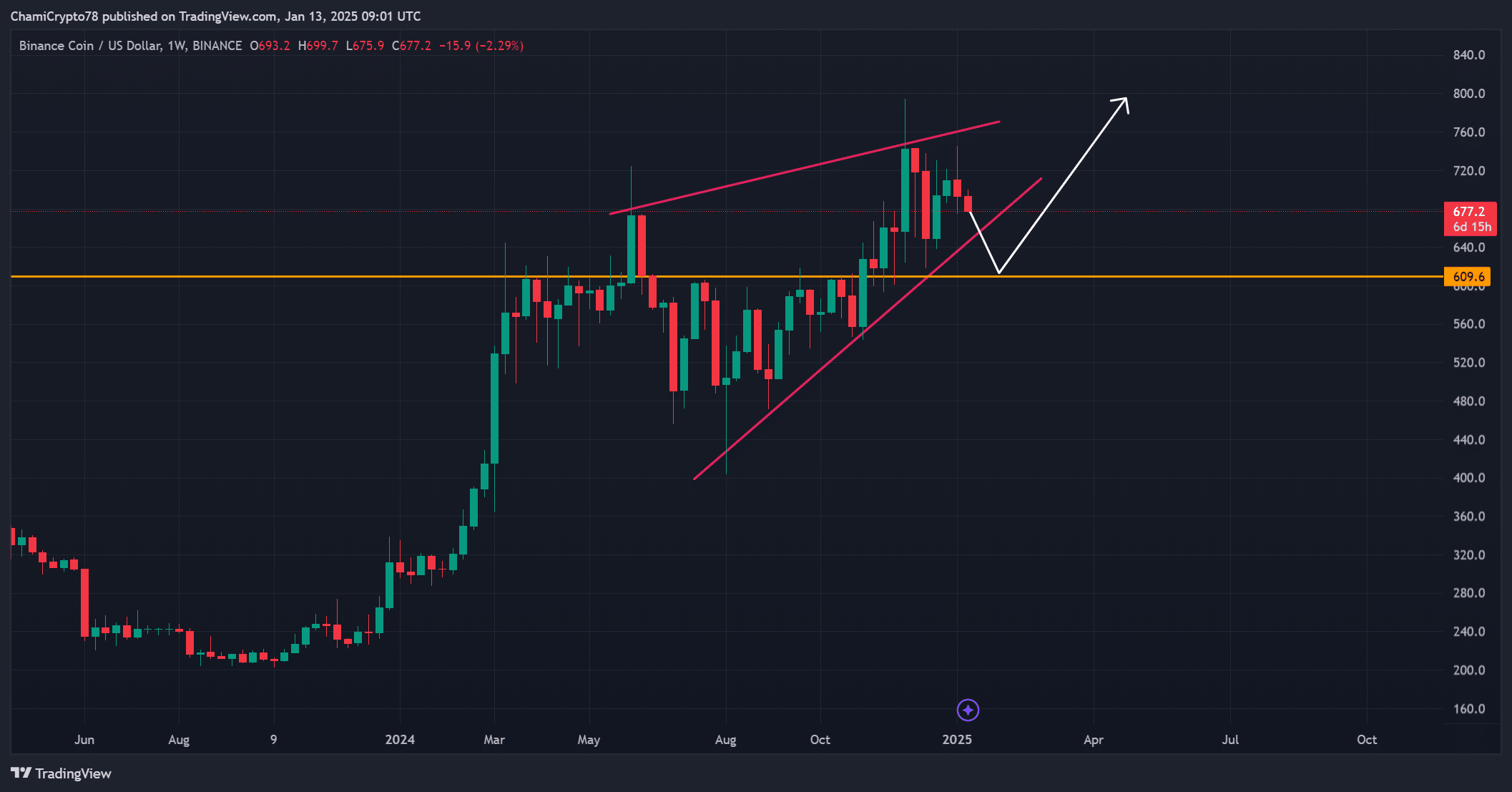

On its weekly chart, Binance Coin (BNB) appears to be forming a rising wedge pattern, which is typically associated with bearish trends and potential downward movement. Additionally, this formation coincides with increasing resistance levels, causing some uncertainty as to whether BNB can maintain its position.

Right now, BNB is being exchanged for $676.54, representing a 2.38% drop over the past day. This significant shift in the token’s value suggests a crucial juncture, and traders are preparing for its impending movement.

Will it break down and confirm a broader bearish trend, or can it defy expectations?

BNB price action analysis: A critical test for support

On a weekly basis, the ascending triangle formation for BNB suggests that its price growth is slowing down. Moreover, the unsuccessful attempts to break through crucial resistance points have led to a sense of doubt within the market.

Traders are keeping a close eye on the $609.6 level as it might temporarily halt any potential drops. Yet, if selling pressure intensifies, Binance Coin (BNB) may see a rapid fall.

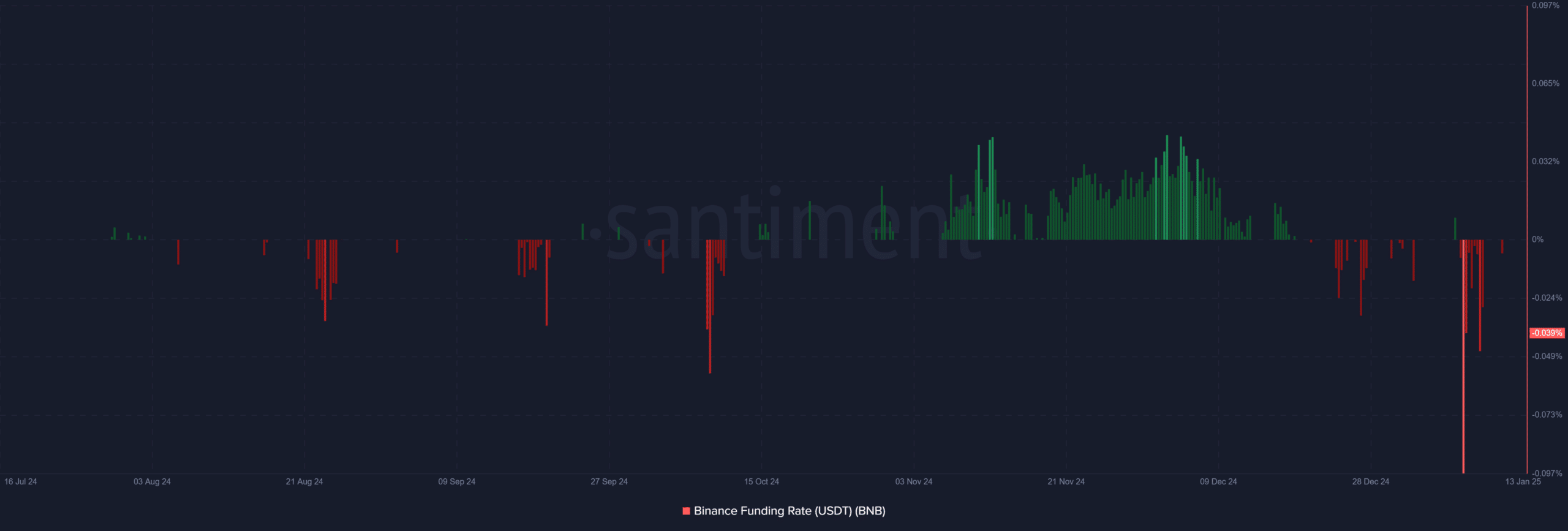

Binance funding rates: Bearish sentiment intensifies

On Binance right now, the funding rate for BNB is sitting at -0.0389% (negative), indicating that there are more people opening short positions than long ones. This change suggests a shift in investor sentiment, as it appears that traders are anticipating a drop in BNB’s price.

In other words, persistently low returns on investment may trigger further declines. Yet, if optimistic investors take charge again, there could be a ‘squeeze’ situation where prices rise rapidly.

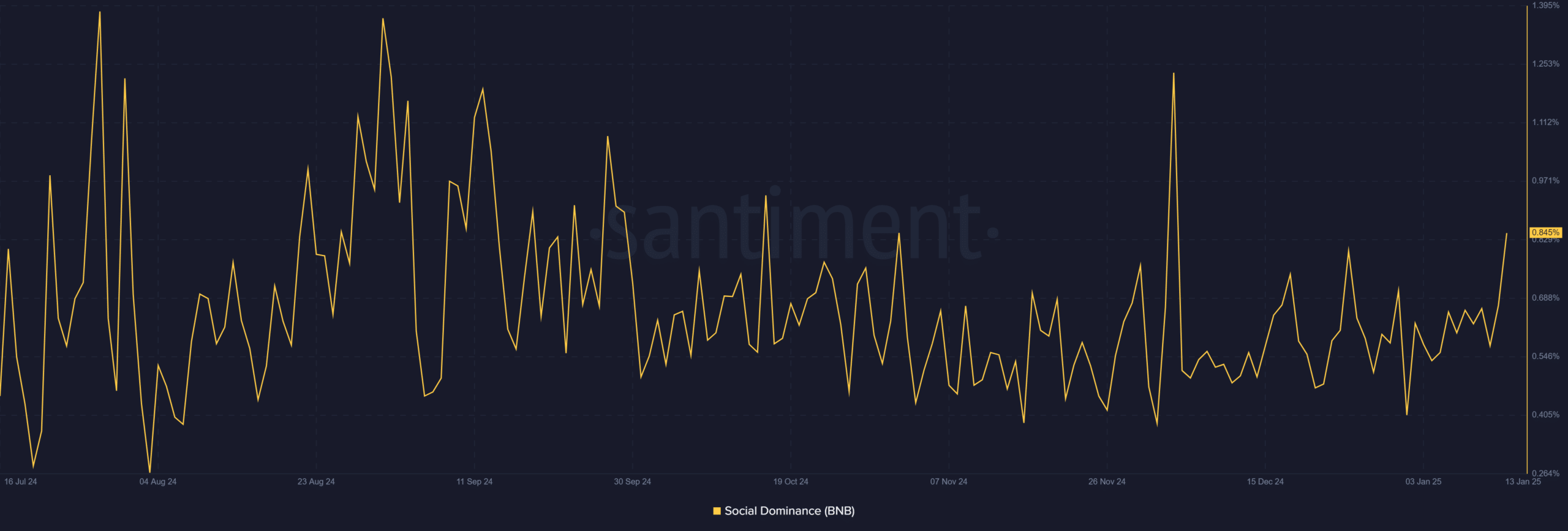

BNB social dominance: Attention reaches new heights

As an analyst, I’ve noticed a significant rise in social dominance for BNB, reaching 0.845% – a peak not seen in recent months. This steep climb indicates heightened interest and close scrutiny from the market, suggesting that they are keenly watching its price fluctuations.

Engaging in more social interactions frequently sparks a rise in speculative trading, which can intensify market volatility. Yet, it’s uncertain if this heightened interest will trigger further purchases or reinforce pessimistic views.

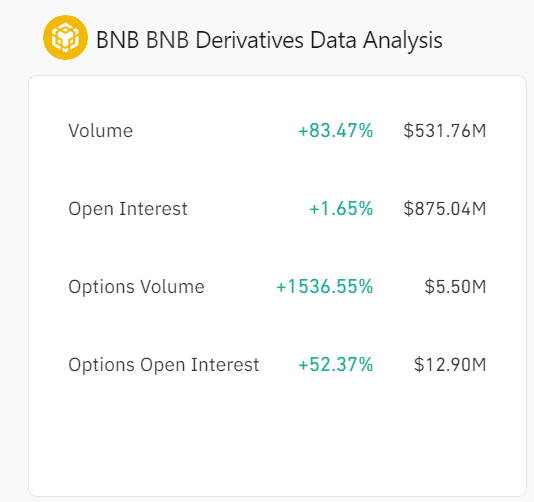

BNB derivatives data: What the numbers reveal

The derivatives market presents a varied scenario, as the trading volume has significantly increased by 83.47% to reach approximately $531.76 million. Furthermore, options trading volume has drastically surged by 1536.55%, and open interest has grown by 1.65%.

These figures suggest an increase in trader activity, possibly as they prepare for a large price shift. Yet, unfavorable funding rates imply a prevailing sense of caution in the market instead.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

BNB is facing growing stress due to the dominance of bearish indicators across technical analysis and market trends. A rising wedge formation, unfavorable funding rates, and heightened social interaction hint at an imminent collapse.

Although derivative information suggests traders are hopeful, the broader view continues to be pessimistic. Consequently, it appears a more significant downturn might occur unless BNB manages to regain its momentum and break free from bearish trends.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-14 05:43