- Ontology’s price pump on Monday excited traders looking for opportunities

- ONT’s on-chain metrics did not show high levels of activity and utility

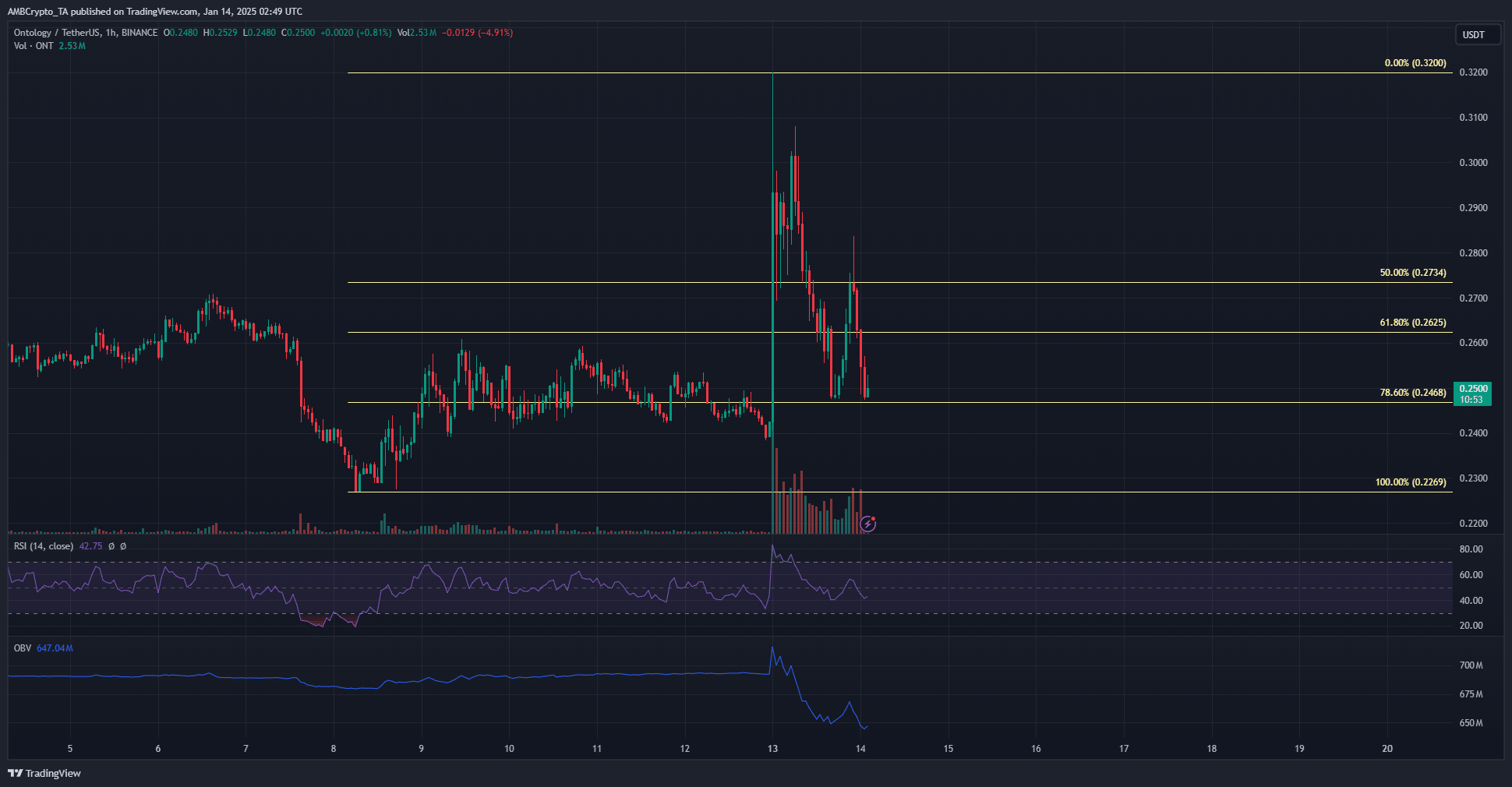

On Monday, 13th January, Ontology (ONT) experienced a significant increase of approximately 33.84% within just two hours. Meanwhile, the Open Interest saw an enormous surge exceeding 400%, as eager speculators flocked to explore potentially lucrative trading opportunities.

Despite initially retreating from its pump, OnChain Technology (ONT) remains optimistic for future growth. This is because the key support level at $0.246 has been successfully defended during repeated tests. However, it’s important to note that the On-Balance Volume (OBV) experienced a significant decline, and the Relative Strength Index (RSI) dropped below the neutral 50 threshold, suggesting a shift towards bearish momentum.

At the moment, based on the current data, it appears that an ongoing upward trend for Ontology might not be as likely.

Ontology metrics all have on thing in common

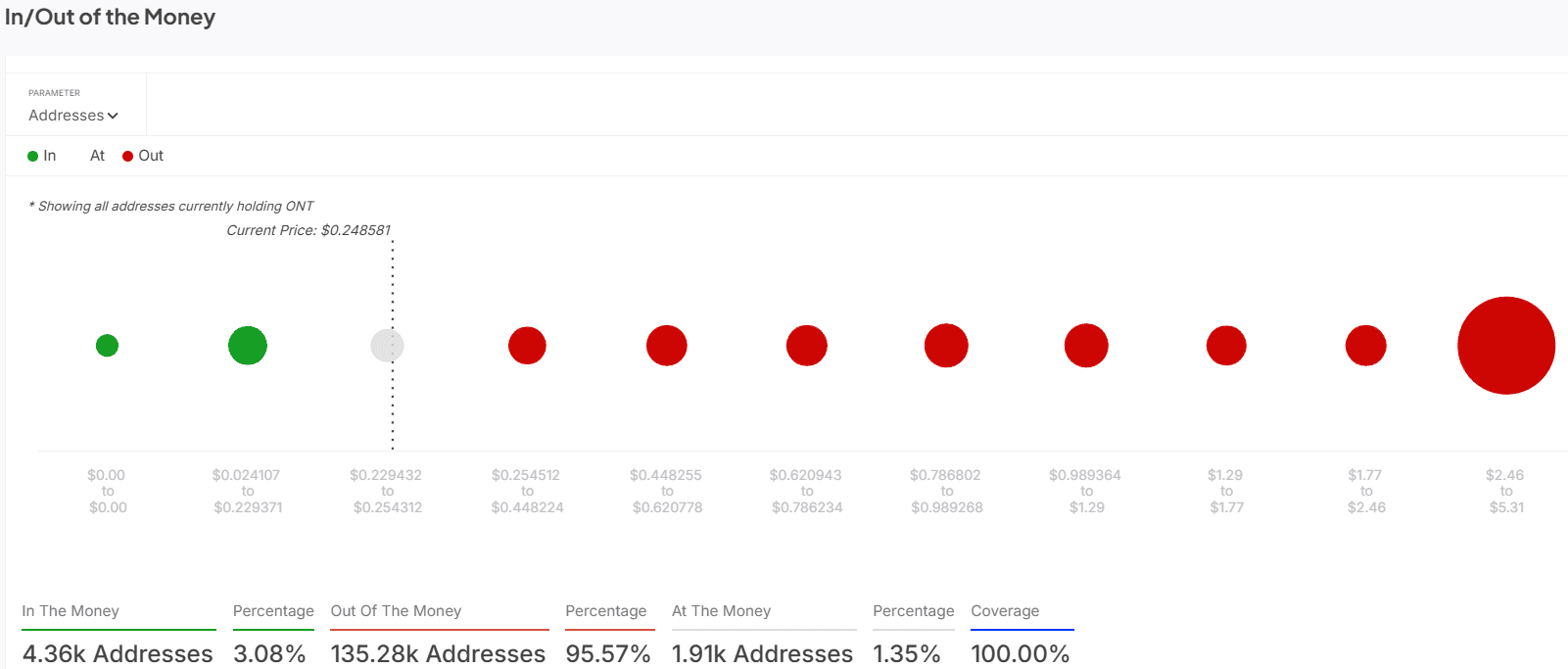

Based on data from IntoTheBlock, about 95.57% of Ontology (ONT) address holders were holding tokens that had not yet reached their initial investment price, referred to as being “out of the money.” Conversely, only approximately 3.08% of addresses held ONT at a value higher than their purchase price, or “in the money.” This suggests that any further price increases could encounter significant selling pressure from investors who are underwater (losing money) and looking to sell at breakeven or slightly profitable levels.

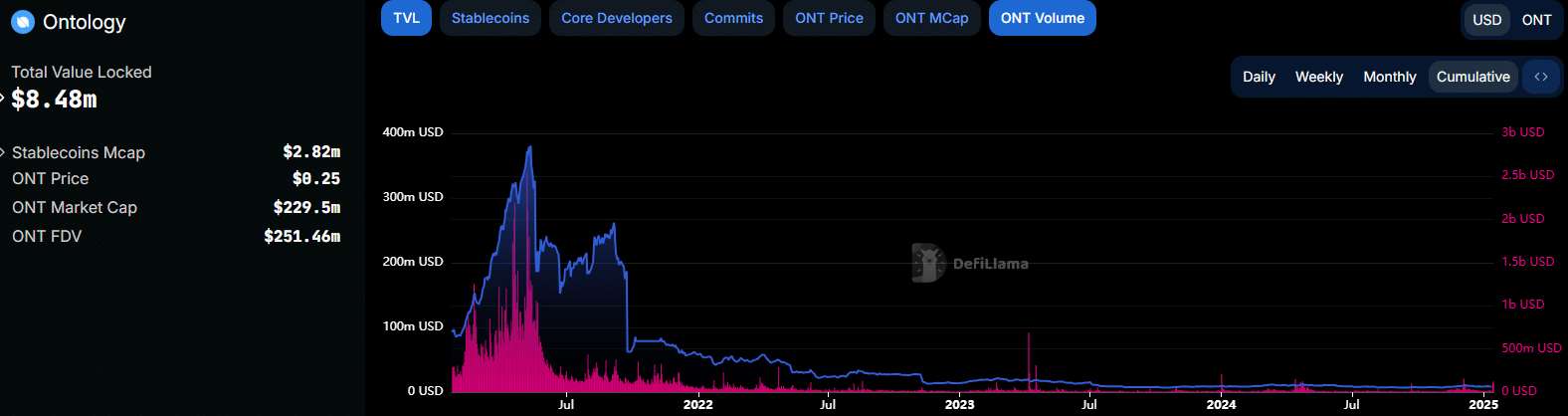

The value locked on the Ontology blockchain has been gradually decreasing since May 2021, with the current value standing at approximately $8.48 million compared to its peak of $379.09 million back in May. This decline could be attributed to a drop in investor confidence.

Over the past few years, a bear market and reduced on-chain transactions might have prompted investors to seek alternatives for their funds. Even though current market conditions appear optimistic, these investors seem unwilling or unable to reinvest, as suggested by the decreasing ONT trading volume trends.

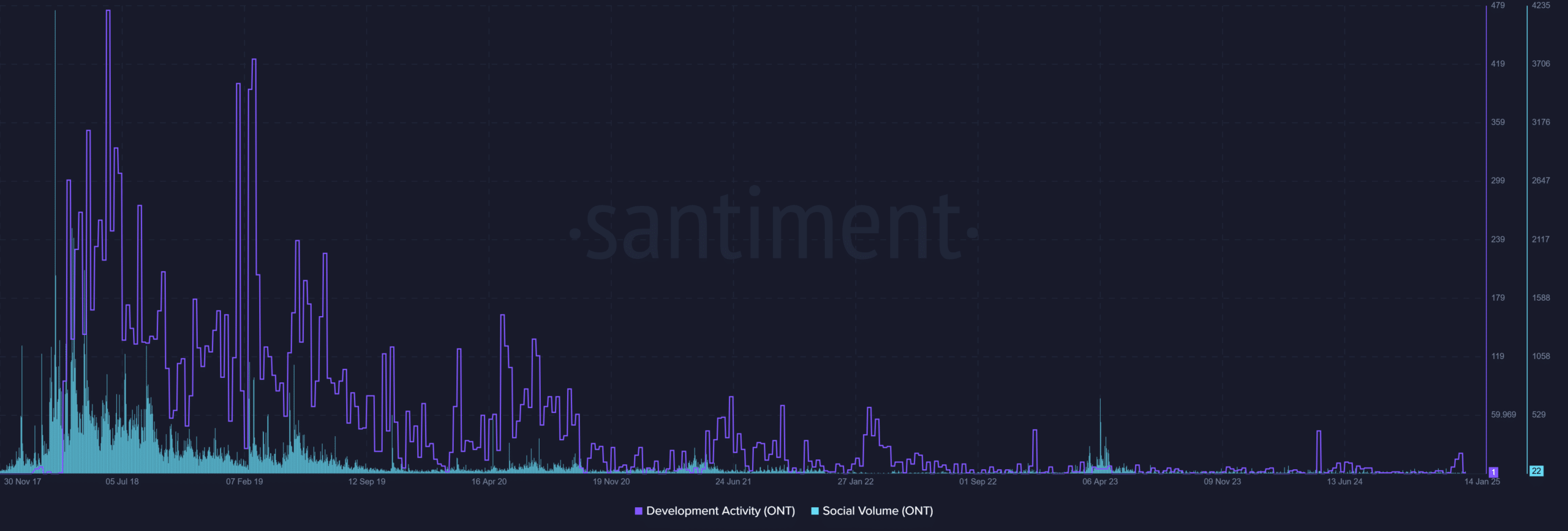

Over these years from 2018 to 2022, and since then, there’s been a continuous drop in construction or development projects. This downward trajectory is evident in the data from that period. Similarly, societal engagement or activity levels have followed a similar pattern as market prices.

Read Ontology’s [ONT] Price Prediction 2025-26

The shared characteristic of these measures is that they all signaled a weakening connection to the L1 chain. It appears user engagement has dwindled on the chain, and even though there were temporary increases in price, it seems investors might be seeking out more promising ventures instead.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-01-14 10:15