- LTHs are unloading BTC, locking in massive gains as Bitcoin soared from $44k to $100k in just a year

- Now, the laws of economics take over – high supply meets high demand

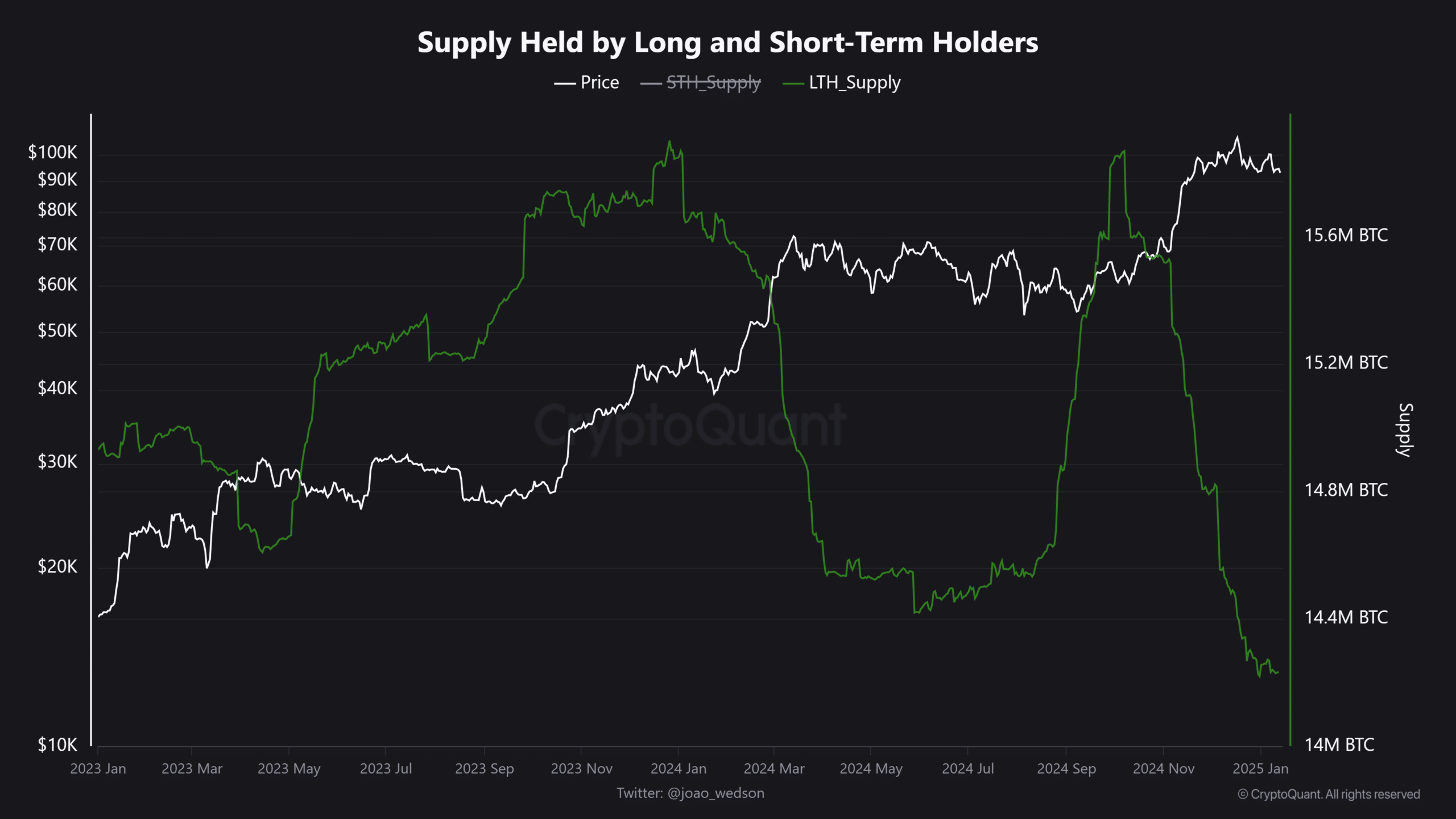

Approximately one year ago, long-term Bitcoin holders possessed around 13.84 million Bitcoins at an average cost of $42,000 per coin. However, the current holding has decreased to approximately 12.22 million Bitcoins – a drop of about 11% within the past year. These long-term holders, who are typically characterized by their tendency to accumulate when others choose to sell, appear to be altering their approach.

Is this a red flag or a sign of market maturity?

Let’s travel back to the year 2023. In the first quarter, Bitcoin started at approximately $16,600, with a total of 14.93 million Bitcoins held in long-term wallets. By the end of the year, Bitcoin skyrocketed to around $44,000, and the number of Bitcoins stored in long-term holders increased to 15.85 million. The consistent accumulation by these long-term holders played a crucial role in Bitcoin’s price increase as seen on the charts.

Moving ahead to the year 2024, we witness a significant transformation. Large-Scale Token Holders (LTHs) initiated a massive distribution process, reducing their holdings from 15.8 million to 14.27 million within just one quarter. It’s evident that these long-term investors cashed in on the Trump trade, securing substantial profits.

After Bitcoin’s remarkable 502% price increase in just two years, it’s not surprising that those who have held onto their Bitcoins are now deciding to sell. As Bitcoin becomes more influenced by broader economic trends, this decision seems increasingly rational.

Conversely, Large Traders in Bitcoin (LTHs) have a reputation for adopting a ‘contrarian’ approach – purchasing when fear is widespread. Thus, their recent departure raises questions: Is the market becoming more mature, or could it be a warning signal indicating potential difficulties ahead for Bitcoin?

LTHs exit – Will BTC survive the consequences?

In the past few days, Bitcoin displayed a downtrend, reaching a price of $89k – a figure last seen around mid-November. Remarkably, it swiftly rebounded, ending the day at $95k by the close of trading.

As a crypto investor, I’m finding comfort in the increasing involvement of big institutions. Take MicroStrategy (MSTR) for instance, they’ve been actively diving into Bitcoin within the first fortnight of 2025 alone. Their latest acquisition of 2,530 BTC for $243 million has undeniably contributed to Bitcoin’s rebound.

Without a doubt, these Long-Term Holders are firmly committed to their counterintuitive approach, demonstrating their preparedness to seize investment opportunities during market downturns.

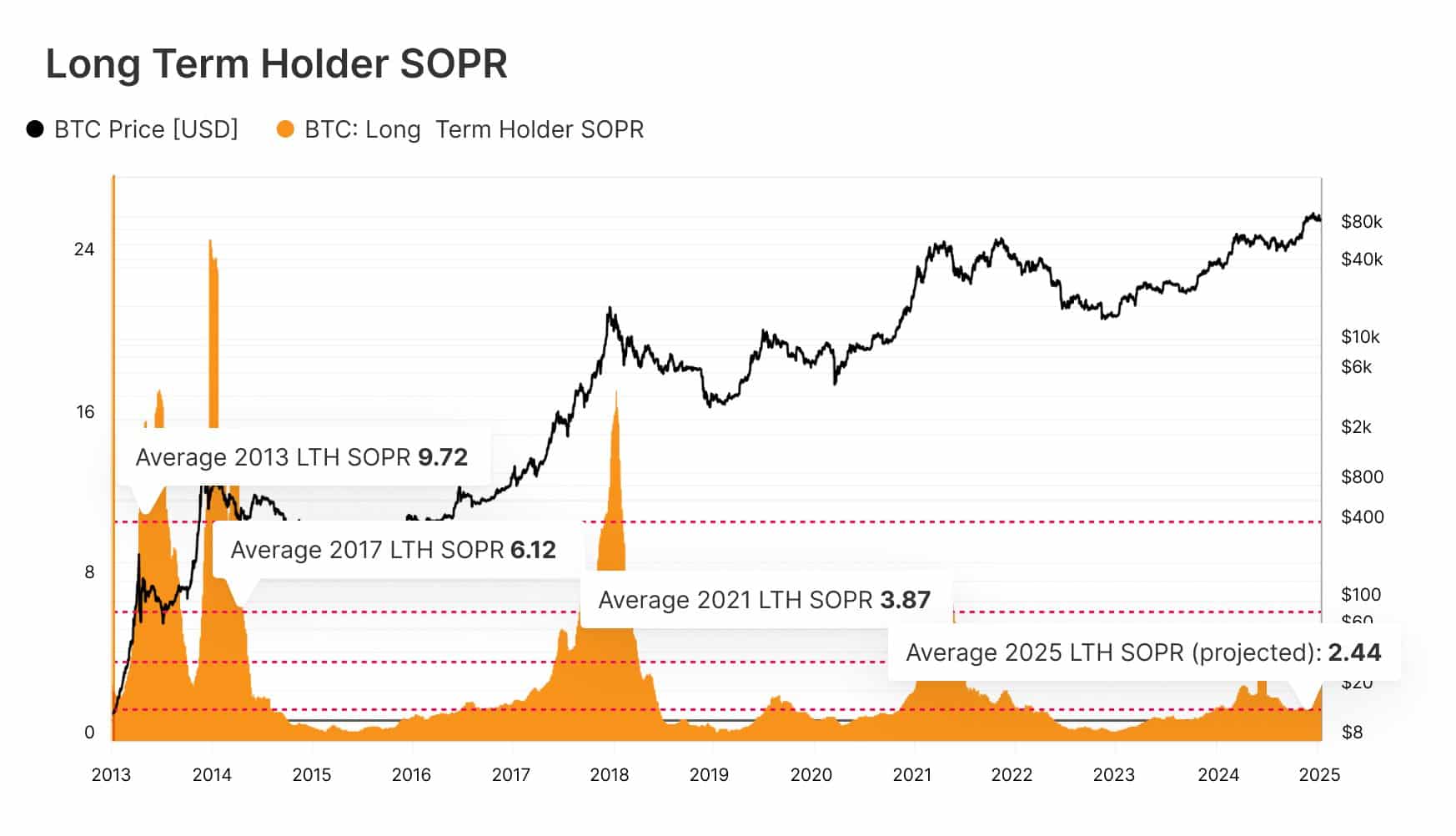

However, it’s important to note that Bitcoin’s Long-Term Holder (LTH) Spend Profit Ratio (SOPR) has exhibited a trend of reducing returns after each halving. As the supply of Bitcoin becomes more limited, LTH investors are realizing smaller profits.

By 2013, the typical Long-Term Holder SOPR was 9.72, but by 2021, it had significantly decreased to 3.87. If this downward trend persists, we might witness a further reduction to approximately 2.44 by 2025.

In essence, given the current situation, Long-Term Holders (LTHs) have two possible paths: They can accumulate more Bitcoin to maintain their profit levels, or decide to sell early as the pressure mounts. It appears that a significant number of them are opting for the latter.

Read Bitcoin’s [BTC] Price Prediction 2025-26

It seems tension is mounting. To avoid a significant reversal, perhaps a sudden change in supply could occur. At present, it appears those influential entities have the power to make this happen.

Read More

- OM PREDICTION. OM cryptocurrency

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Serena Williams’ Husband Fires Back at Critics

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

2025-01-14 12:07