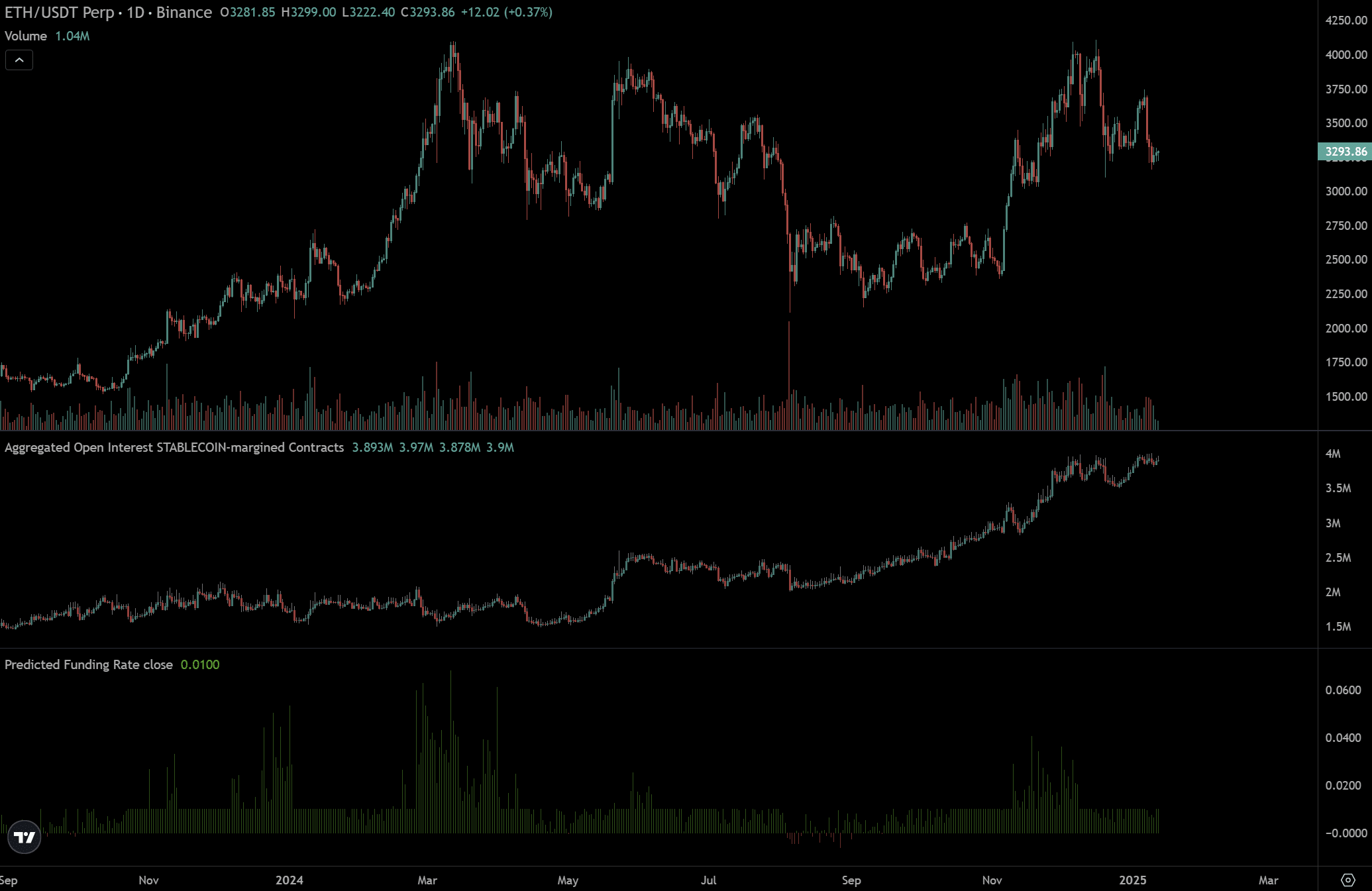

- ETH’s leverage has surged to $10B in two months.

- Historical trends indicated high leverage could negatively impact ETH’s value.

Although ETH has a history of performing well, its substantial $10 billion leveraged position could make it vulnerable to liquidation threats and limit its maximum growth potential.

According to Andrew Kang, a partner at the cryptocurrency venture capital firm Mechanism Capital, he anticipates that Ethereum (ETH) may stay within a specific price range ($2,000 – $4,000) due to its high-leverage risk. In simpler terms, he predicts that ETH might not see significant price fluctuations because of the potential dangers associated with high levels of debt or borrowed funds in the market.

As a researcher studying the cryptocurrency market, I’ve observed that Ethereum ($ETH) has amassed over $10 billion in leverage since the election. While the unwinding of this leverage might be challenging, it’s important to note that Ethereum is unlikely to plummet to zero. Instead, we can expect it to fluctuate within a range of approximately $2,000 to $4,000 for an extended period.

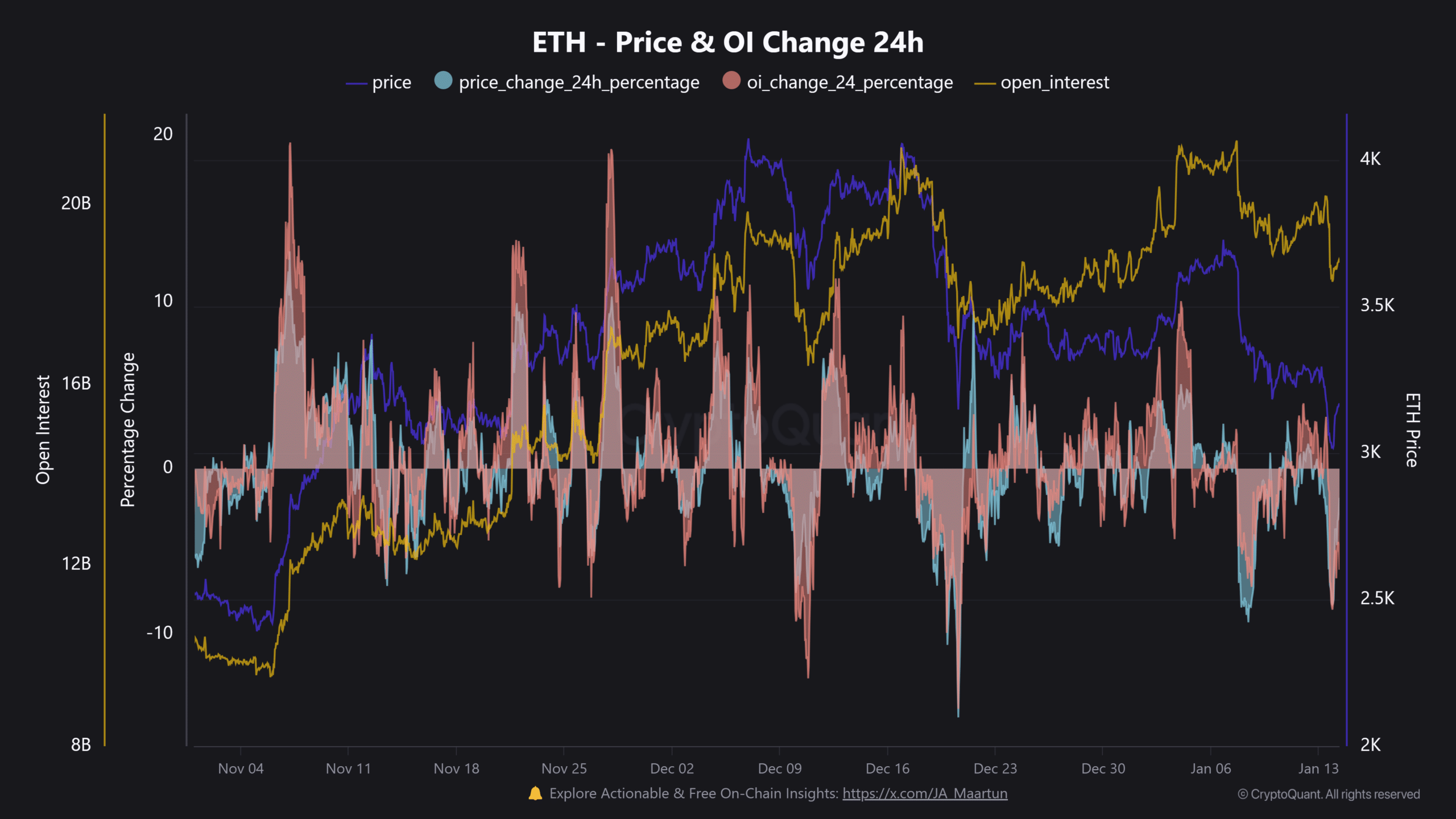

Prior to the U.S. elections, the borrowed ETH assets for speculative trading amounted to approximately $9 billion. However, this figure skyrocketed to more than $19 billion by December.

Afterward, the sharp price decline liquidated several positions and dragged ETH to around $3.1K.

Will leverage derail ETH’s upside?

As an analyst, I’d like to clarify a point regarding the ‘basis trade’ of Ethereum (ETH) that’s been driven by CME Futures. Contrary to some assumptions, this trade has minimal influence on the high levels of leverage due to its delta-neutral nature. In simpler terms, for every ETH purchased in the spot market, an equivalent ETH is shorted in the futures market, thereby maintaining a balanced position. However, I believe the primary culprit behind the excessive leverage is speculative traders, who have been actively engaging in aggressive trading strategies.

Based on Kang’s apprehensions, the historic surge driven by ETH leverage indeed occurred, validating his worries. Typically, when the open interest in leveraged positions exceeded the price increase during an upswing, it was often followed by a correction or a temporary peak.

This was evident in early November and late December. They both escalated ETH liquidations.

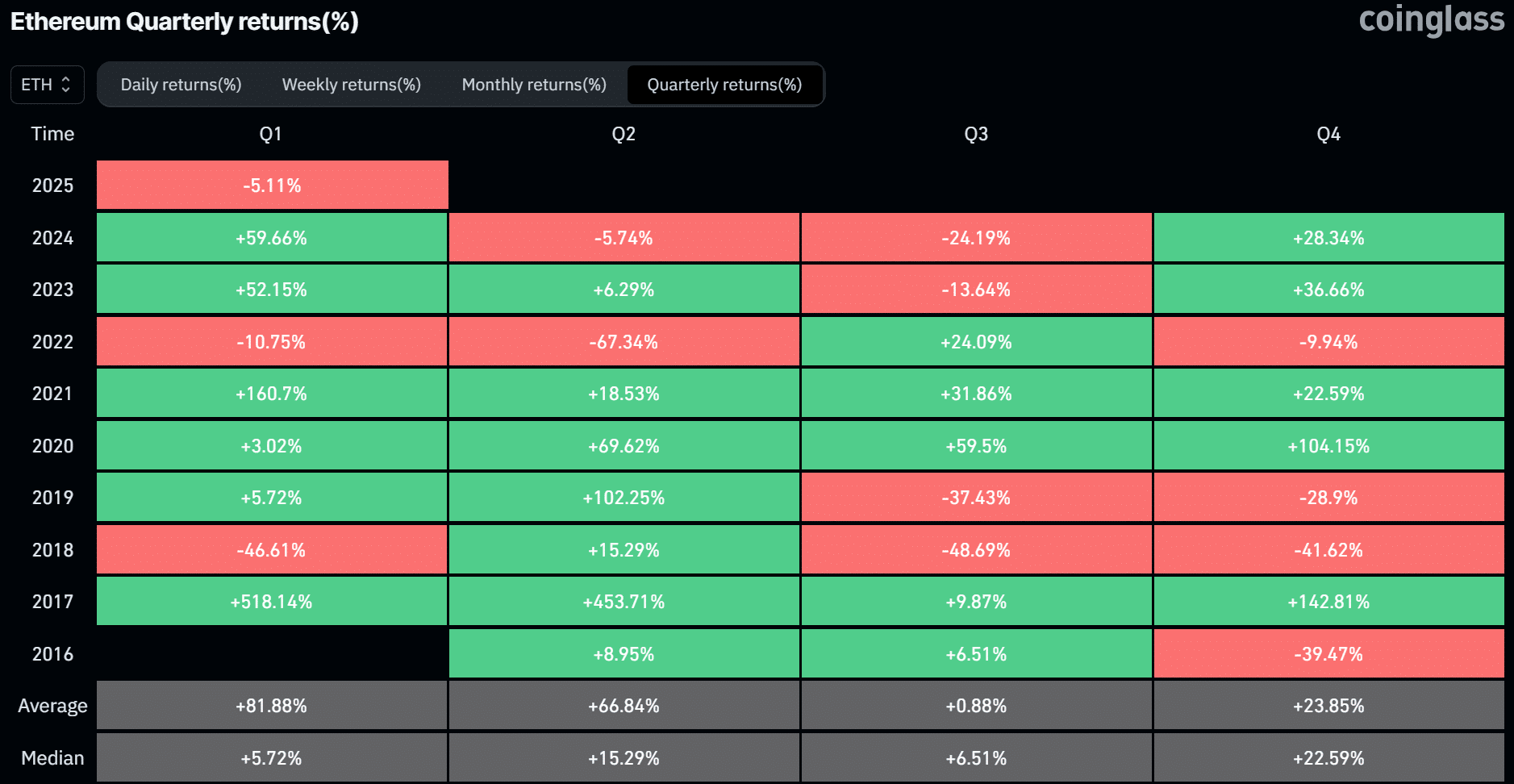

Indeed, on the 20th of December alone, Ethereum (ETH) witnessed more than $300 million worth of liquidations, and most of the losses were from long positions. Interestingly, data from Coinglass shows that historically, ETH has seen its best performance during the first quarter, averaging a 81% gain.

For the last seven years, ETH has ended only two first quarters with a loss. In simpler terms, if past patterns continue, ETH might experience substantial growth in the first quarter of 2025.

The potential for liquidation might limit our optimistic outlook regarding Ethereum’s value increase. Currently, Ethereum has rebounded and surpassed the $3K mark again, recovering from a steep decline to $2.9K that occurred after Monday’s bearish trend.

Read More

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-01-14 15:03