- Bitcoin miners’ reserves declined sharply, adding selling pressure during Q4 2024

- 2025 has so far seen reduced sell-offs, hinting at a potential market shift towards consolidation

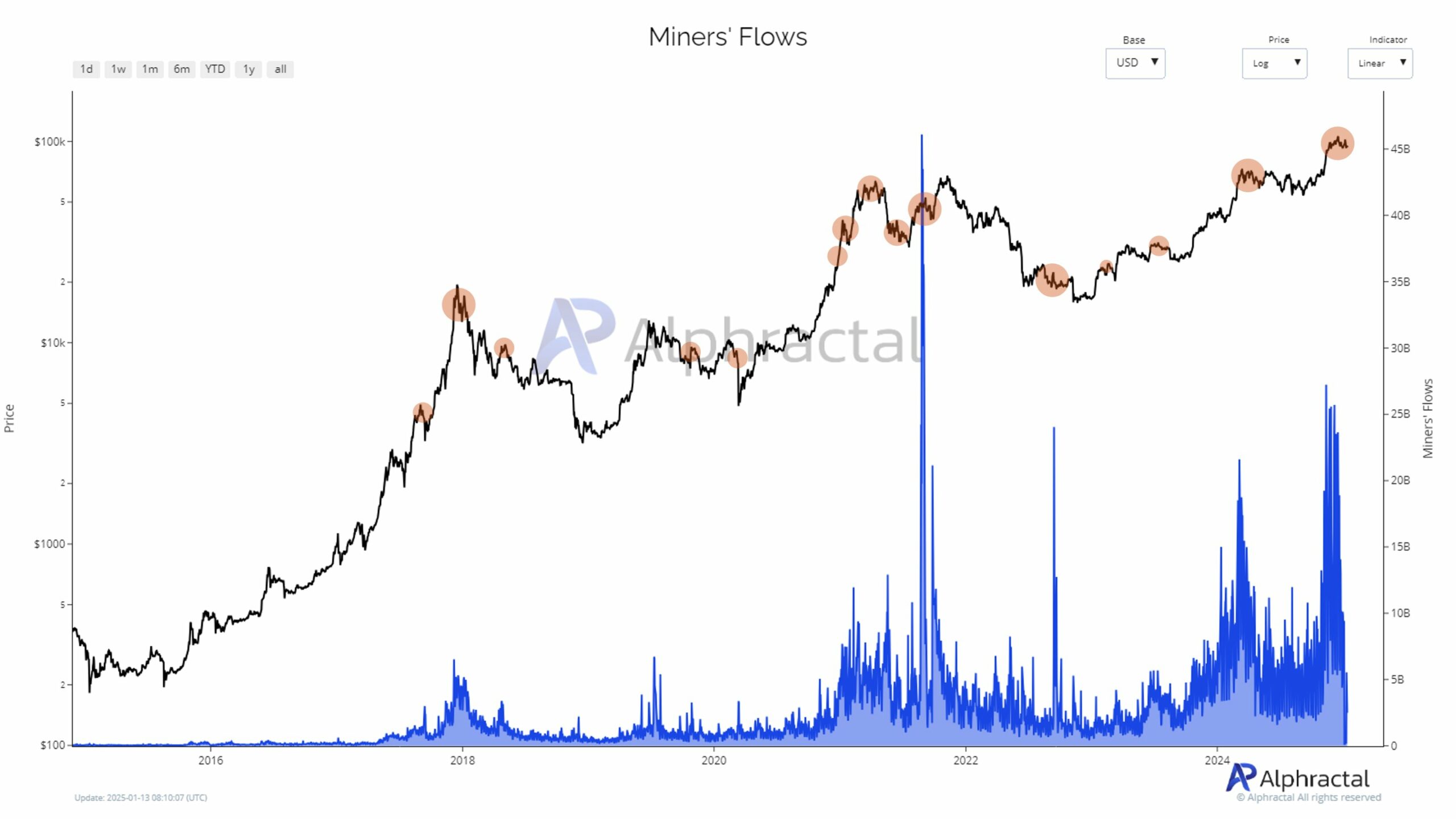

By the end of 2024, Bitcoin [BTC] miners surpassed their previous record for the highest dollar amount ever transferred. This was due to substantial withdrawals from their reserves, which increased the market’s sell-off tension. High hash rates leading to increased mining costs have forced these miners to offload Bitcoin to meet their expenses. However, data from January 2025 hinted at a decrease in miner selling activity, sparking speculation about the market’s potential future direction.

Rising miner outflows

2024’s year-end witnessed a remarkable spike in Bitcoin miners offloading their holdings, reaching never-before-seen dollar value peaks. This increased activity suggests a strong selling trend, as miners chose to cash out substantial parts of their stockpiles.

New findings show that significant sell-offs by miners often coincide with high local prices, implying they’re cashing out when the market is strong to get the most profit. This pattern has led to increased volatility in Bitcoin markets, as heightened miner activity can fuel negative sentiment and create a cycle where higher activity leads to bearish trends.

However, the slowdown in sell-offs noticed in early 2025 may suggest a possible change in market dynamics, as it appears miners are less inclined to dispose of their assets, even under increased operational stress.

Or:

The reduction in sell-offs seen in early 2025 might indicate a potential transformation in market conditions, since miners seem less motivated to get rid of their investments despite facing heightened operational challenges.

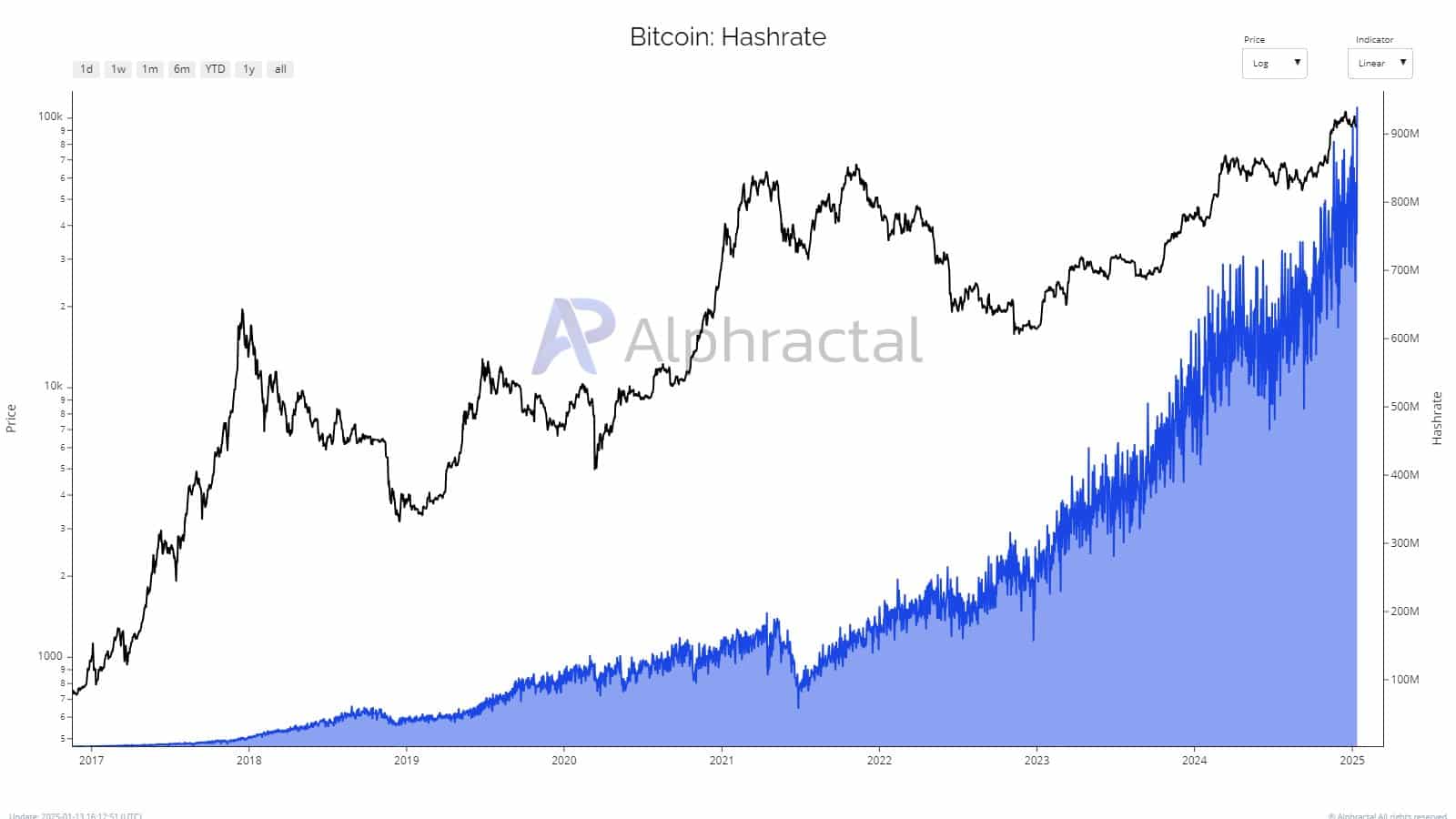

An ATH hashrate

In late 2024, Bitcoin’s computational power (hashrate) hit a record high, showcasing the strength of its security system and the intense rivalry among miners. This swift climb coincided with the escalating challenge in mining new Bitcoins, causing operational costs to soar to their maximum levels.

As a researcher delving into the world of Bitcoin, I’ve observed that higher hash rates reflect a strong belief in the system’s fundamental architecture. However, this confidence comes with a substantial economic burden for miners. They are compelled to sustain costly equipment and energy-consuming processes, which can strain their financial resources significantly.

Due to this imbalance, numerous individuals were compelled to sell their assets towards the end of 2024, which intensified the decline in market prices. Although hash rate levels remained steady at the start of 2025, miners might experience temporary respite. Yet, they face long-term challenges as energy costs and competition persistently increase, raising concerns about the industry’s longevity.

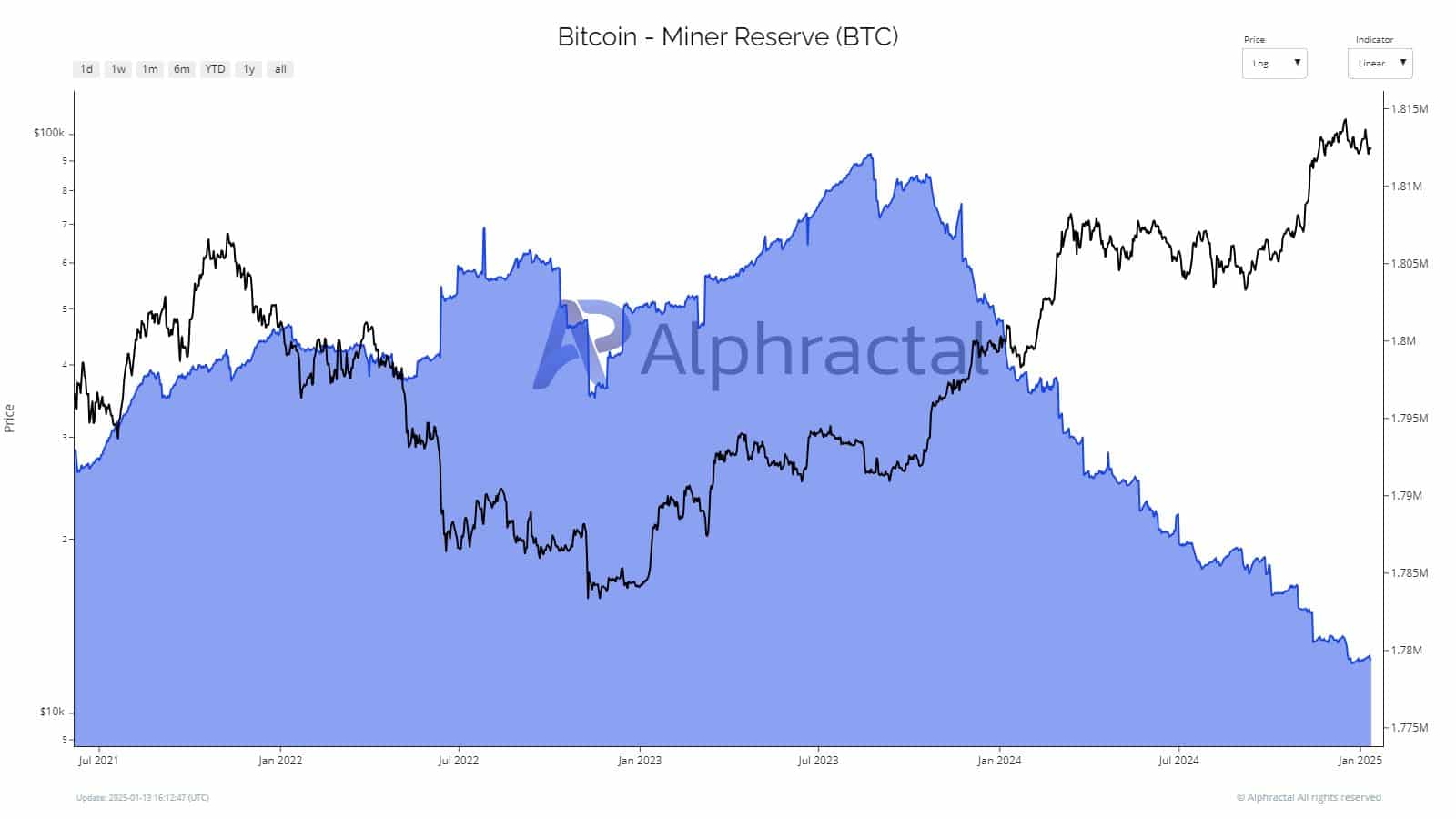

Declining miner reserves and sell-off dynamics

As a researcher, I’ve observed a consistent trend since mid-2023: Bitcoin miners have been gradually depleting their reserves. This decision appears to be influenced by escalating operational costs, stemming from sky-high hash rates and surging energy expenses. This strategic move underscores the miners’ growing demand for liquidity in a market that’s becoming progressively volatile. Notably, the largest reserve reductions seem to coincide with local price spikes.

With reserves nearing record lows as we head into 2025, there is increasing worry that miners may struggle to balance the market during market downturns.

In the current scenario, intense selling activities have been putting pressure on the market. Yet, the reserves of Bitcoin miners suggest a decrease in selling activity, as miners try to match rising costs with profits. This decrease might indicate enhanced operational efficiency or external assistance, possibly resulting in less volatility and a more stable market over the next few months.

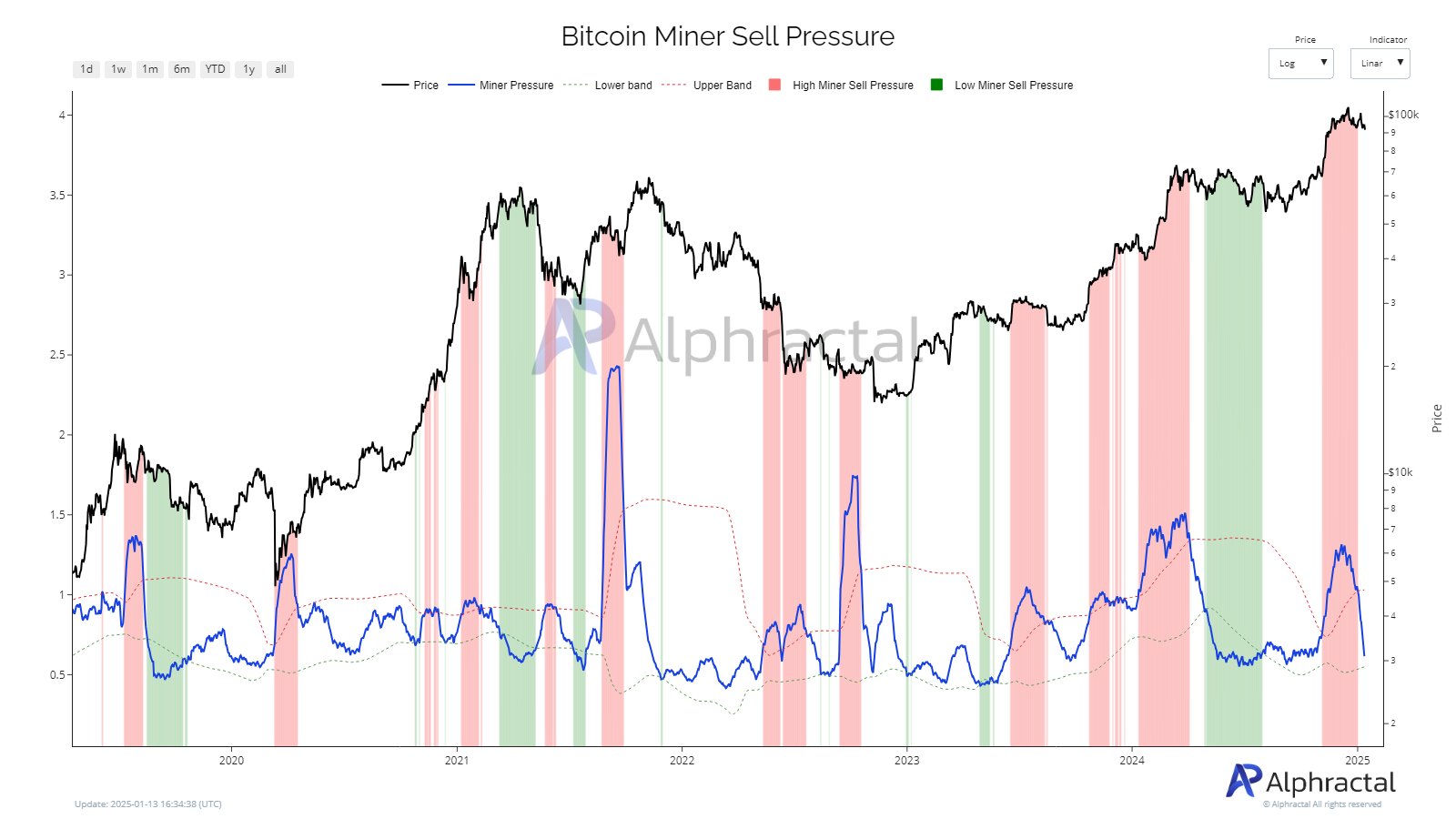

Fall in selling activity in 2025

In simple terms, the selling pressure from Bitcoin miners in January 2025 has significantly decreased, as indicated by a substantial drop in outflows on the miner sell pressure chart. This decline is contrasted with the late 2024 period and suggests a possible change in market trends.

It seems that miners might be employing a tactical method, perhaps saving their reserves in expectation of increased prices. Moreover, changes in operations or external financing could be lessening the requirement for immediate sales, thereby decreasing the negative impact of mining activities on Bitcoin market trends.

Read Bitcoin (BTC) Price Prediction 2025-26

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-01-14 18:15