- Solana had a bearish structure and momentum on the 1-day timeframe

- Sustained buying pressure would be necessary for a recovery, but it hasn’t arrived yet

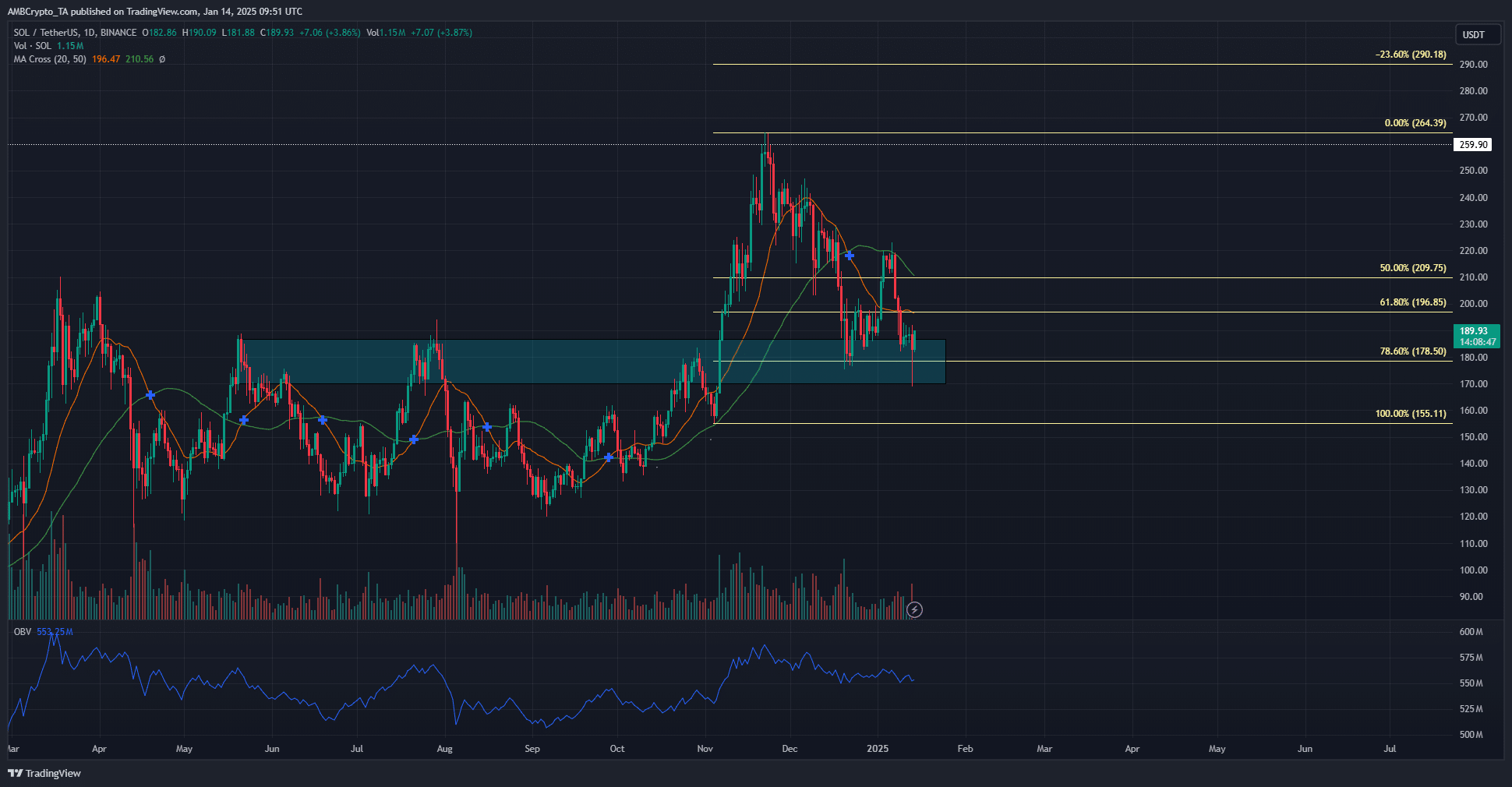

Over the past six weeks, Solana [SOL] has experienced a downtrend following a refusal to climb above the $260 price mark. Despite significant social interest in the asset, the number of active addresses has been declining, which is cause for concern. Notably, Pumpfun deposited approximately $21 million of SOL onto the centralized exchange Kraken, fueling speculation about short-term selling pressure.

The analysis of its MVRM (Moving Average Ratio Value) indicated a possible buying chance. Meanwhile, the price was hovering slightly over a resistance area, which had previously served as a strong barrier in mid-2024, acting like a tough demand zone.

Solana remains bearish on the daily timeframe

In simpler terms, the overall market decline following a surge in November has had a negative impact on Solana (SOL). This is particularly noteworthy considering Bitcoin‘s [BTC] drop to $89,200 on January 13th. It’s surprising that the Solana supporters managed to maintain the $180-support level during this period.

Over the past few months, starting from November, the OBV (On-Balance Volume) has consistently dropped, even as buyers tried to hold their ground. This downward trend suggested that the demand zone might eventually be breached unless there was a significant shift in market sentiment towards optimism.

As a researcher, I’ve found that the 20 and 50-day moving averages have been instrumental in identifying potential shifts in market trends. At the moment, these averages indicate a bearish trend, with the slower one acting as a temporary barrier to further short-term upward movement.

The price movements similarly conveyed the same message. To establish a bullish reversal for SOL, it needs to surpass the $218.2 resistance level, which is the minor peak it reached about a week back.

Short-term sentiment bearish as well

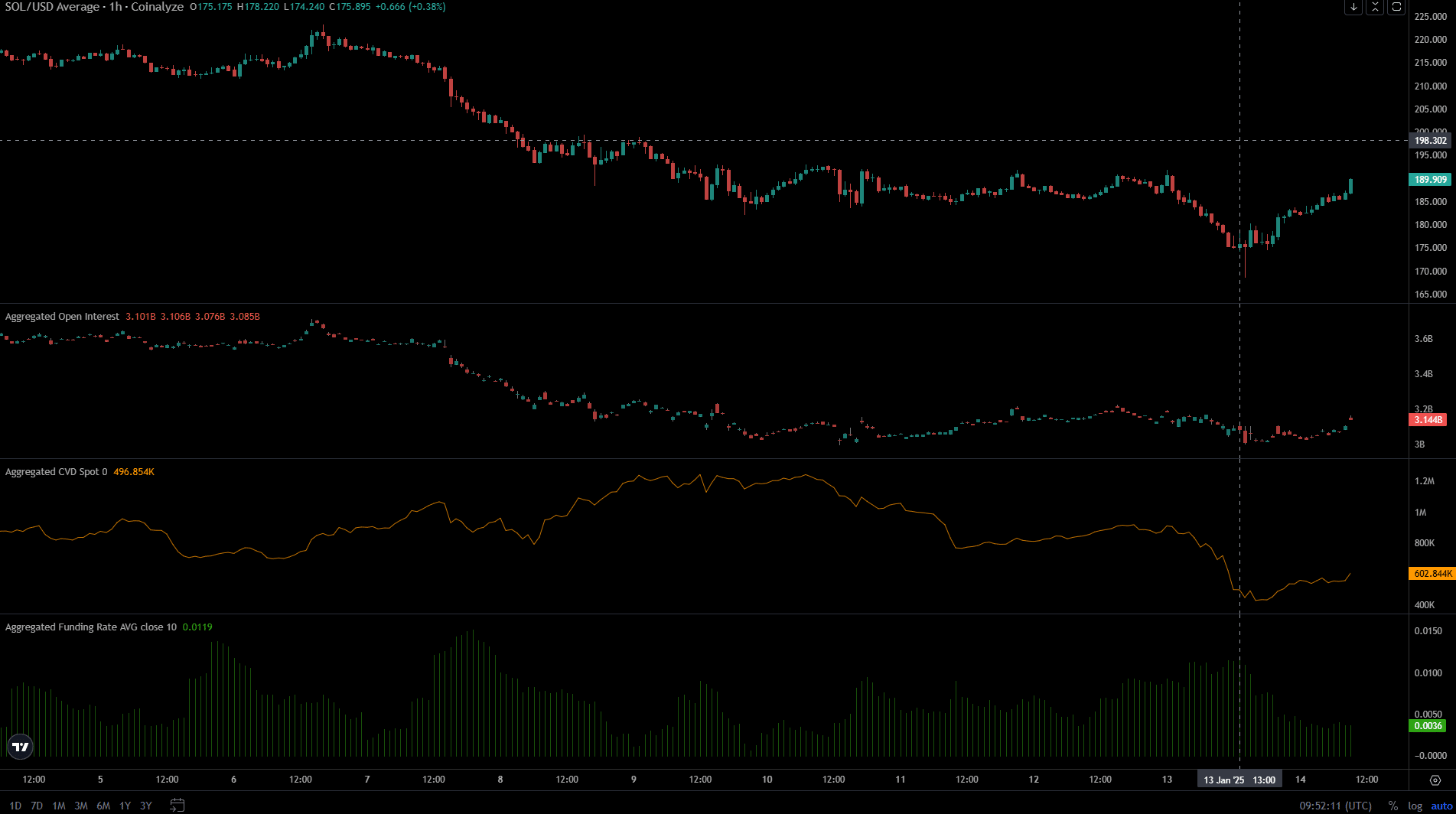

According to data from Coinalyze, an uptick in Solana’s price over the past day from $170 did not significantly alter the overall bullish outlook. Despite the increase in Open Interest, this rise failed to reverse the trend, suggesting a predominantly neutral stance and low levels of active speculation among investors.

Realistic or not, here’s SOL’s market cap in BTC’s terms

This distant perspective was similarly reflected in the current CVD indicator at the scene, which has shown decreasing peaks during the last week. A reversal of this descending pattern could indicate that purchasers are regaining control.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Elder Scrolls Oblivion: Best Thief Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Ludicrous

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Gold Rate Forecast

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Elder Scrolls Oblivion: Best Sorcerer Build

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

2025-01-14 20:08