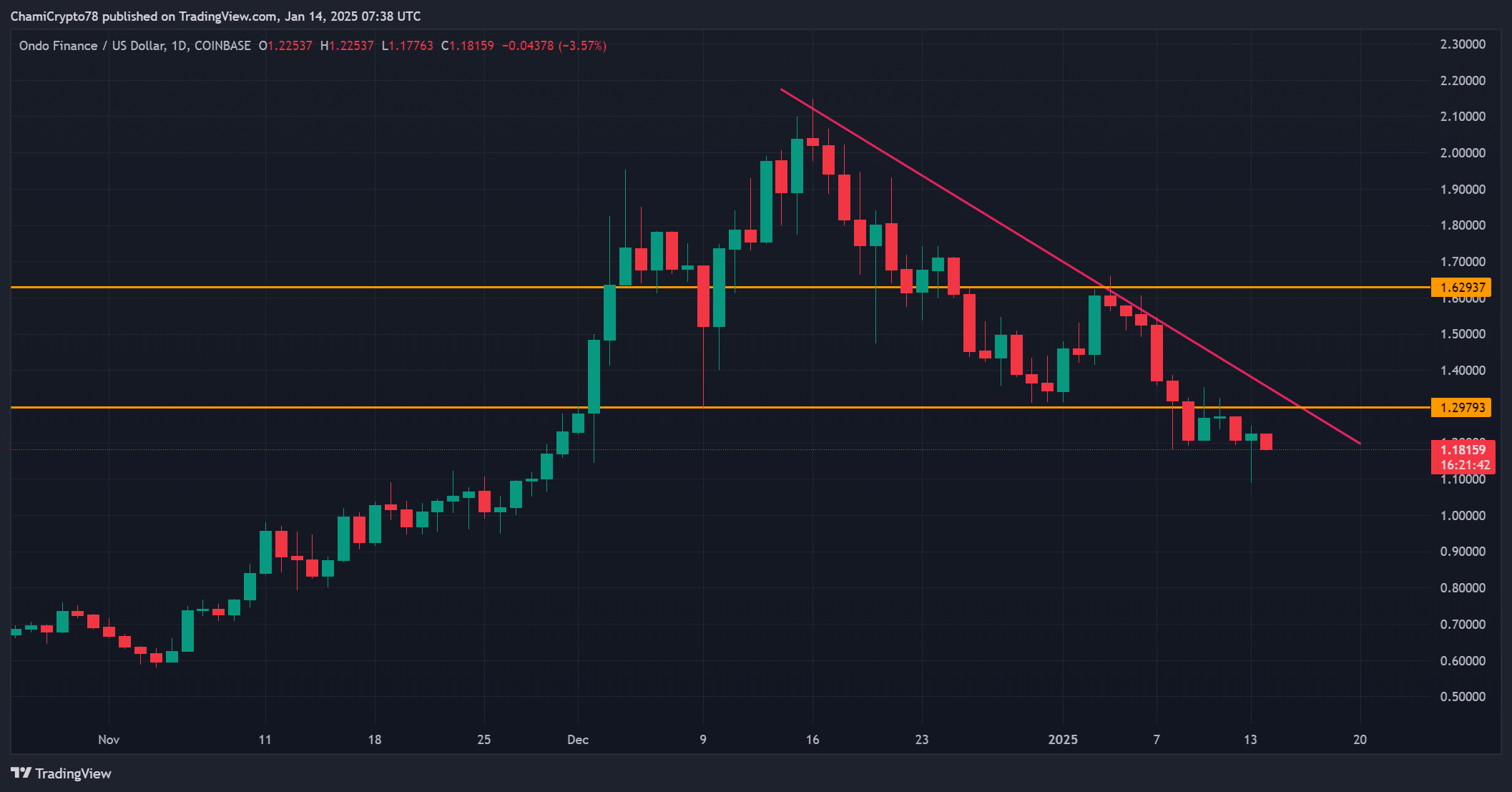

- A bullish TD Sequential signal emerges, but resistance at $1.29 remains critical.

- Address and transaction activity surge, indicating potential accumulation ahead of a price recovery.

After reaching its highest point in December, the value of Ondo [ONDO] has dropped approximately 50%. This decline has resulted in its current trading price being $1.18, representing a 3.09% rise since then, as of the latest update.

Even though there’s a recovery, the Parabolic Stop and Reverse (SAR) still hovers above the price, suggesting ongoing bearish tendencies. Furthermore, ONDO has found it challenging to surpass the crucial $1.29 resistance level, with a new support developing around $1.18.

Although the bullish TD Sequential signal shows up on the 3-day chart, it hints at a possible decrease in selling pressure. If backed by higher market activity, this situation might lead to a price recovery.

Consequently, it’s crucial for traders to keep a close eye on how prices behave near the downward sloping trendline and significant resistance points over the next few days.

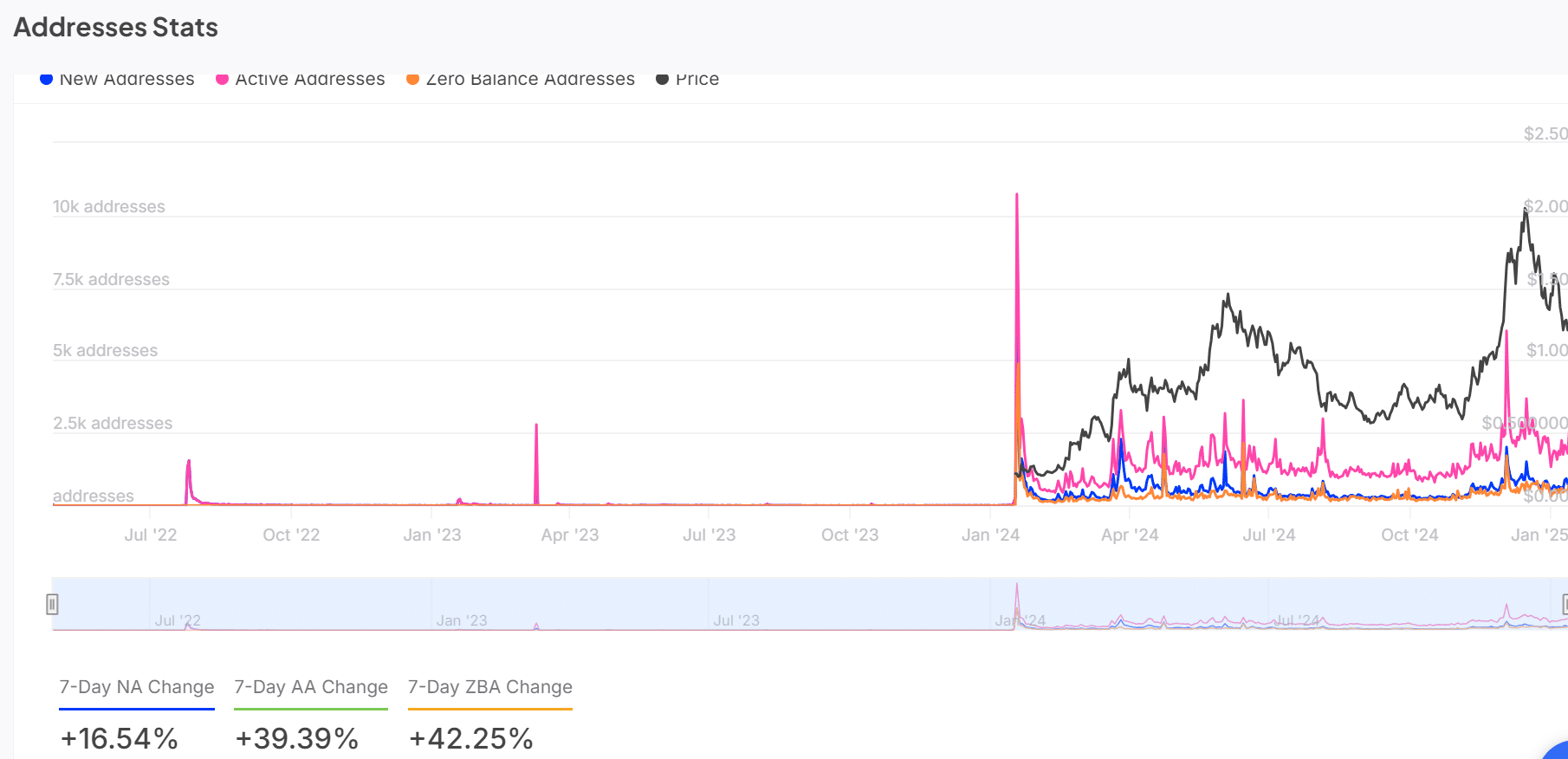

ONDO addresses stats: Are investors showing interest?

There’s been a significant rise in the number of active wallets, suggesting greater market involvement. In just the last seven days, we’ve seen a 16.54% increase in new wallets, a 39.39% jump in active ones, and a 42.25% spike in those with no balance.

This growth indicates increased investor attention, possibly sparked by ONDO’s significant adjustment, making it more attractive for acquisition.

As an analyst, I’ve noticed a significant surge in the number of new addresses associated with this token. This trend corresponds with growing optimism about its potential for recovery. Yet, for a truly bullish perspective to hold true, it’s crucial that we continue to observe increased activity among these addresses over an extended period.

If these trends persist, they could indicate accumulating confidence among investors.

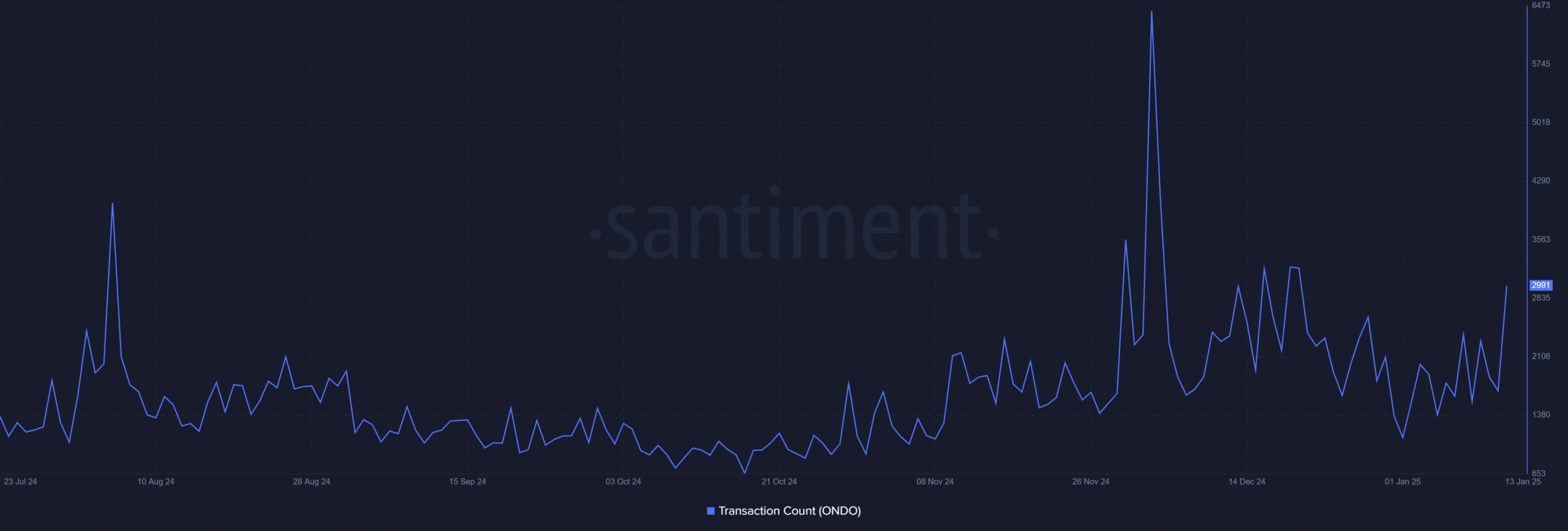

ONDO transaction count: A rise in network activity

The number of transactions on the ONDO network has noticeably risen, going from 1,686 to 2,991. This suggests a substantial growth in user interaction. Typically, these spikes tend to coincide with phases of accumulation, which are often followed by bullish price trends.

This increase indicates that traders and investors might be preparing for a possible price escalation. Yet, it’s crucial to keep an eye on whether this activity persists or starts to wane.

Technical indicators: A challenging but hopeful outlook

As a researcher examining technical indicators, I’m observing a somewhat contradictory story unfolding. The Downside Momentum Index (DMI) is exhibiting a predominantly negative -D line at 27.05, suggesting strong bearish sentiment. Conversely, the bullish +D line is lagging behind at 11.65, reinforcing this bearish trend in the market.

In simpler terms, with the ADX (Average Directional Movement Index) at 27, it indicates that the current market trend is clear and strong. On the other hand, the TD Sequential indicator is showing a bullish signal, which hints that the ongoing bearish phase might be about to end soon.

Placing yourself above current prices suggests that there’s strong downward pressure in the short term. Breaking past the $1.29 resistance level becomes crucial for flipping things in favor of the buyers. If successful, this might signal the beginning of a prolonged upward trend.

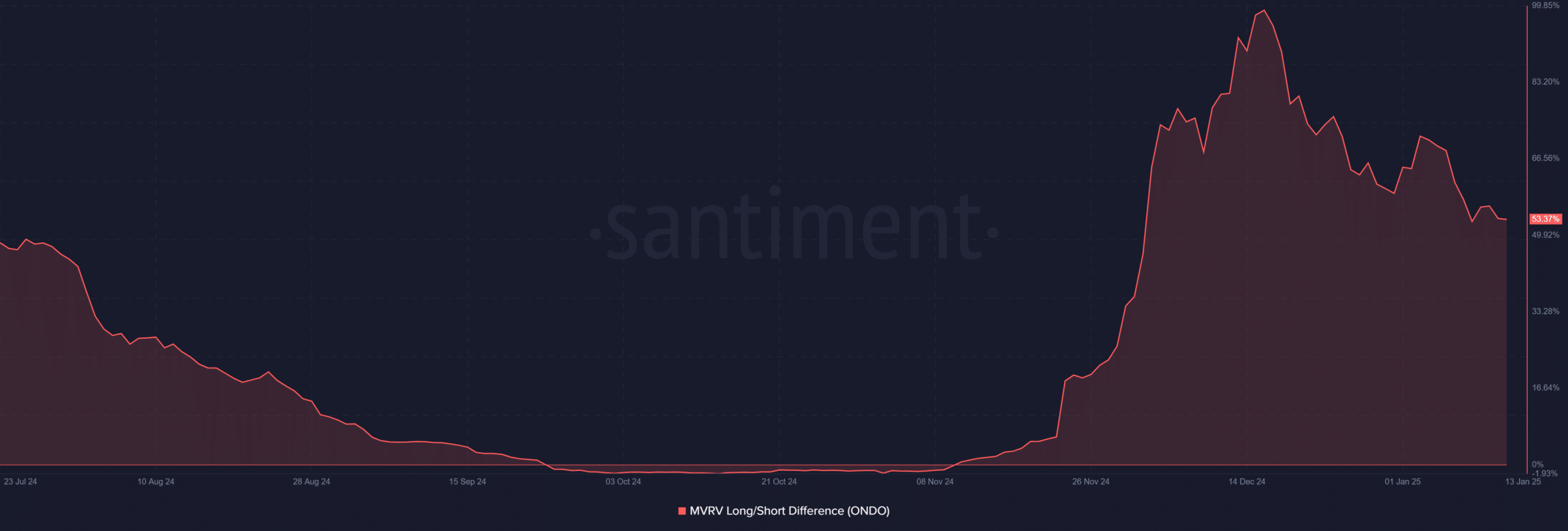

MVRV long/short difference: Sentiment cooling off?

Currently, the MVRV long/short gap stands at 53.37%, a substantial drop from its peak in December. This indicator hints at decreased urge to sell for profit, implying the market might be becoming more stable.

Typically, decreases in MVRV (Maker’s Value Realized to Maker’s Value Ratio) have been followed by price increases, due to the fact that sellers tend to leave the market and buyers start amassing instead.

Read Ondo Finance’s [ONDO] Price Prediction 2025–2026

Conclusion: Is ONDO ready for a comeback?

In simpler terms, ONDO seems to be exhibiting a combination of positive yet tentative signs of revival. Although the technical signals are still bearish, rising activity at addresses, an uptick in transaction numbers, and a bullish TD Sequential signal hint at increasing enthusiasm among its users.

If we manage to push past the $1.29 level convincingly, it will signal a turnaround, initiating a long-term growth phase. At this point, it seems prudent to remain hopeful but also vigilant.

Read More

2025-01-14 21:12