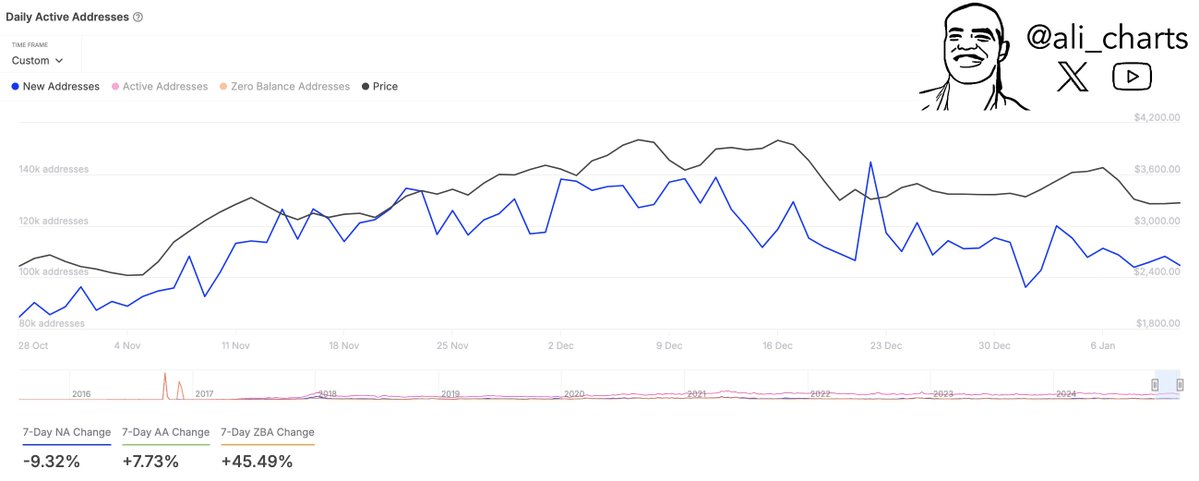

- Drop in new addresses was indicative of the wider lack of ETH demand

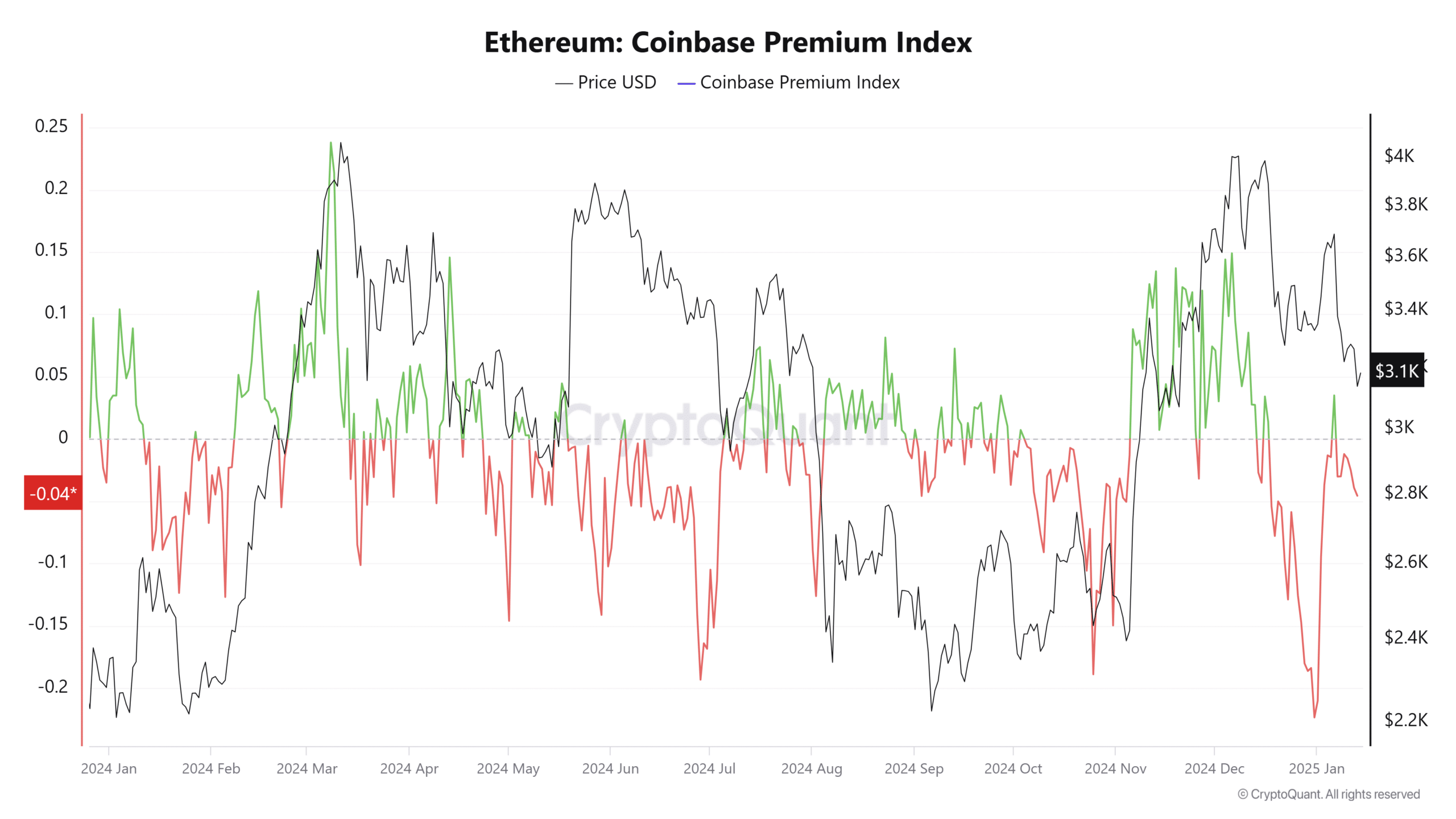

- Price action and Coinbase Premium pointed towards firm selling pressure in recent weeks

Over the past month, Ethereum [ETH] has dropped by 12.44%, whereas Bitcoin‘s [BTC] decline stands at 4.74% as we speak. Interestingly, Ethereum has faced challenges in holding critical support zones over the last six weeks, leading to a flurry of jokes about its association with the $3k price range among ETH holders and supporters.

😱 EUR/USD Under Siege: Trump’s Tariffs to Ignite Chaos!

Prepare for unpredictable market swings triggered by new policies!

View Urgent ForecastAs a researcher examining current market trends, I’ve observed an interesting contradiction. Despite the prevailing pessimistic outlook, whales have persisted in their accumulation strategies. The recent $30 million withdrawal from Binance may not reflect the overall sentiment of the market. In fact, the price movements and other indicators suggest a more bearish than bullish trajectory.

As a crypto investor, I’ve noticed a concerning trend: according to a recent post by analyst Ali Martinez on X (previously Twitter), the network growth has been decelerating. Specifically, the number of new addresses created over the past week (-9.32%) has decreased, suggesting a decline in adoption and demand from newcomers to the chain.

Conversely, there was a 7.7% increase in addresses actively used over a 7-day period. This suggests a decrease in new participants, but an uptick in trading and network interaction during the last week.

Over the last month, the Coinbase Premium has predominantly been below zero, which indicates that the price of Ethereum on Coinbase has typically been lower than its price on Binance. This metric offers a glimpse into the investment patterns of U.S.-based traders, as it compares the cost of Ethereum on these two platforms.

In simpler terms, when the cost of selling Bitcoin on Coinbase was lower than the cost of buying it, there was more demand for selling than buying among U.S. investors. This trend indicated a hesitant attitude towards Ethereum from these traders as well.

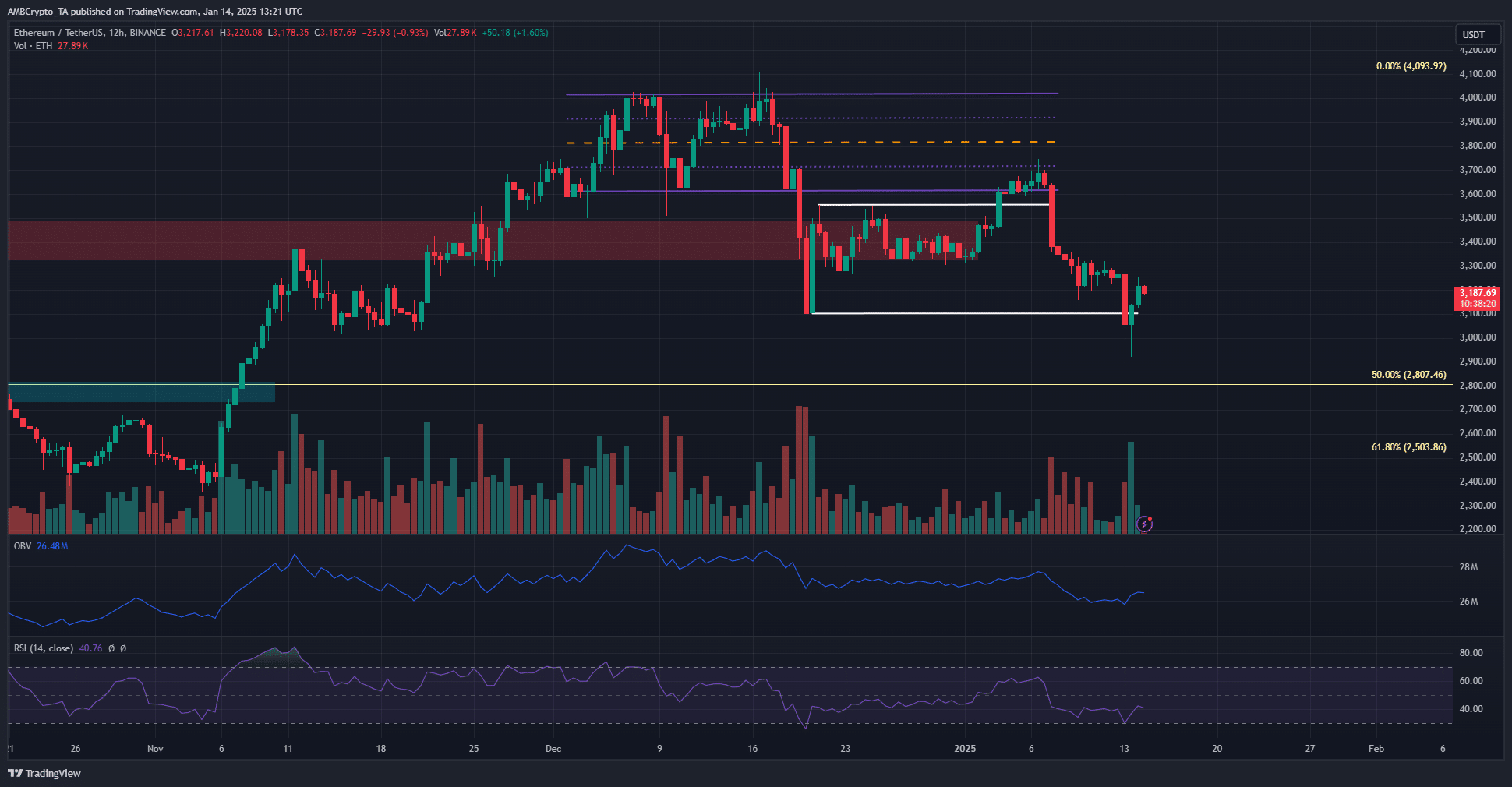

Over the past two months, my own experience as a crypto investor has shown me the importance of caution and readiness to sell ETH. The price movement in the first half of December saw a breakout from a range formation, which coincided with BTC plummeting from $108k to $92k. At the time of press, BTC was trading at $96.5k, but ETH had formed lower lows and was valued around $3.2k.

Is your portfolio green? Check the Ethereum Profit Calculator

Ultimately, the On-Balance Volume (OBV) underscored persistent selling activity since December by consistently setting new low highs. Additionally, the Relative Strength Index (RSI) identified ongoing bearish movement.

Currently, it’s essential to regain the $3.4k area for swing traders to feel comfortable shifting towards a bullish perspective.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Oblivion Remastered: The Ultimate Race Guide & Tier List

2025-01-15 01:11