- Smart Money, whales, and KOLs re-accumulated VIRTUAL after the price dipped below $2.50 levels, leading to a rebound.

- VIRTUAL’s positive momentum towards the Ichimoku Cloud suggested a bullish outlook, reinforced by the MACD.

Lately, significant players like Smart Money, whales, and influential figures (Key Opinion Leaders or KOLs) have been buying back into the Virtual Protocol market, indicating a significant period of re-accumulation. This surge happened mainly when the price of VIRTUAL dropped below $2.50.

Notable investors carried out substantial trades at average prices of around $2.35 and $2.45, collectively injecting over half a million dollars ($551K) into VIRTUAL. These transactions, recorded on DEX platform, represented their first move into this asset, underscoring a strategic point of entry.

An increase in purchase activity occurred alongside these acquisitions, indicating a common belief among knowledgeable investors. This implies that the lower price level provided an opportunity for purchasing.

The increase in VIRTUAL’s price, noticeable following a decrease, seems to have triggered the temporary rise, underscoring the influence of large, synchronized purchases on shaping market trends.

This trend highlighted the crucial impact major market participants have on initiating price increases during economic slumps.

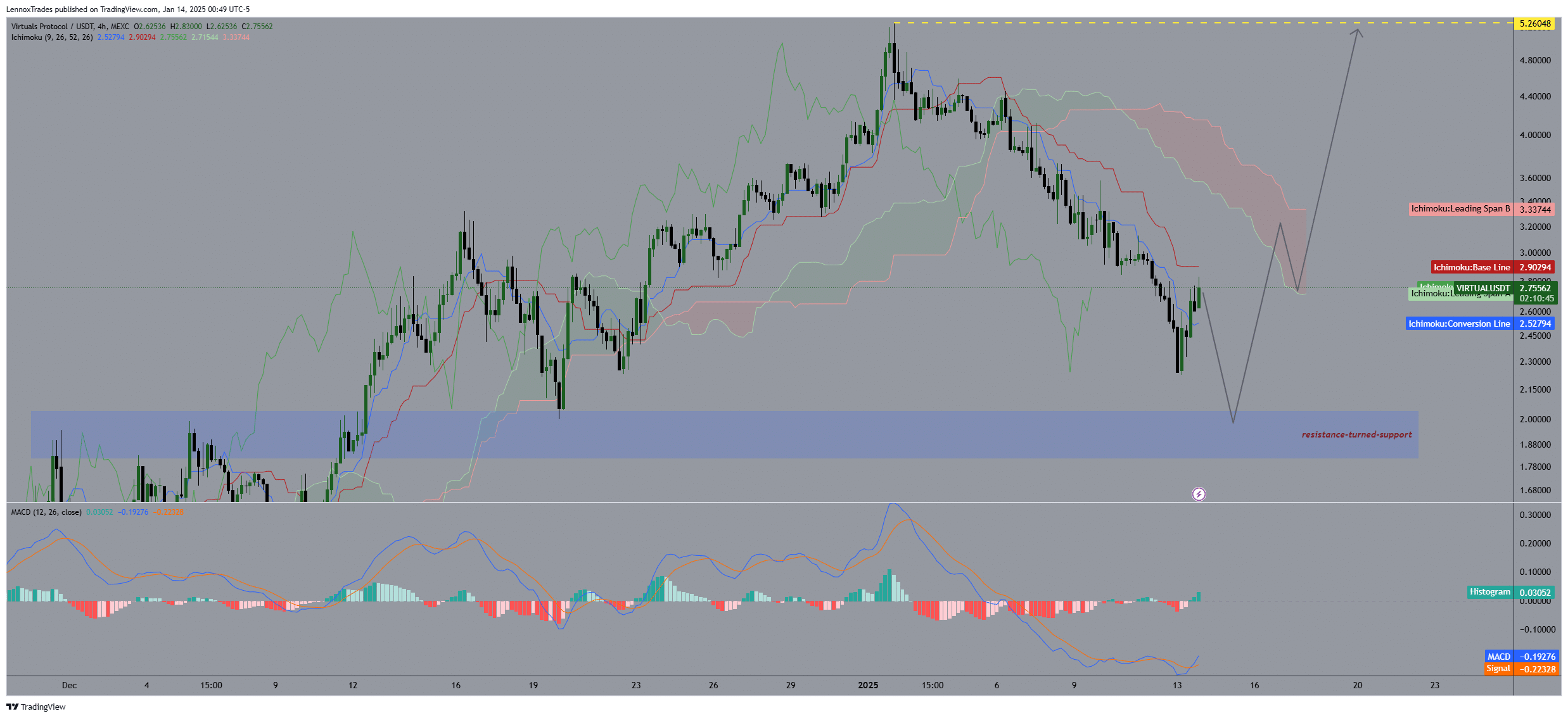

VIRTUAL price action and prediction

The analysis of the chart for VIRTUAL/USDT reveals strong adaptability, demonstrating its ability to move effectively within the Ichimoku Cloud.

At $2.50, the Conversion Line proved crucial as a short-term support level, sparking an initial bounce back. Moving forward, this uptrend might encounter additional support around $3.00, strengthening the notion of the asset’s long-term resilience and stability.

In simpler terms, the MACD (Moving Average Convergence Divergence) signals are aligning with a positive outlook. When the MACD line surpasses the signal line, it’s typically seen as a strong bullish sign, indicating a potential rise in market strength or growth.

Additionally, the price has confirmed the former resistance level of $2.2 as an important support area in future price movements. Now, if the bullish momentum persists, VIRTUAL looks to encounter a potential resistance at $5.26, a significant peak in its upward trajectory.

Despite the current positive outlook, it’s important to exercise caution because if the price falls below the $2.2 support level, it might initiate a downtrend, which could challenge the optimistic perspective we have now.

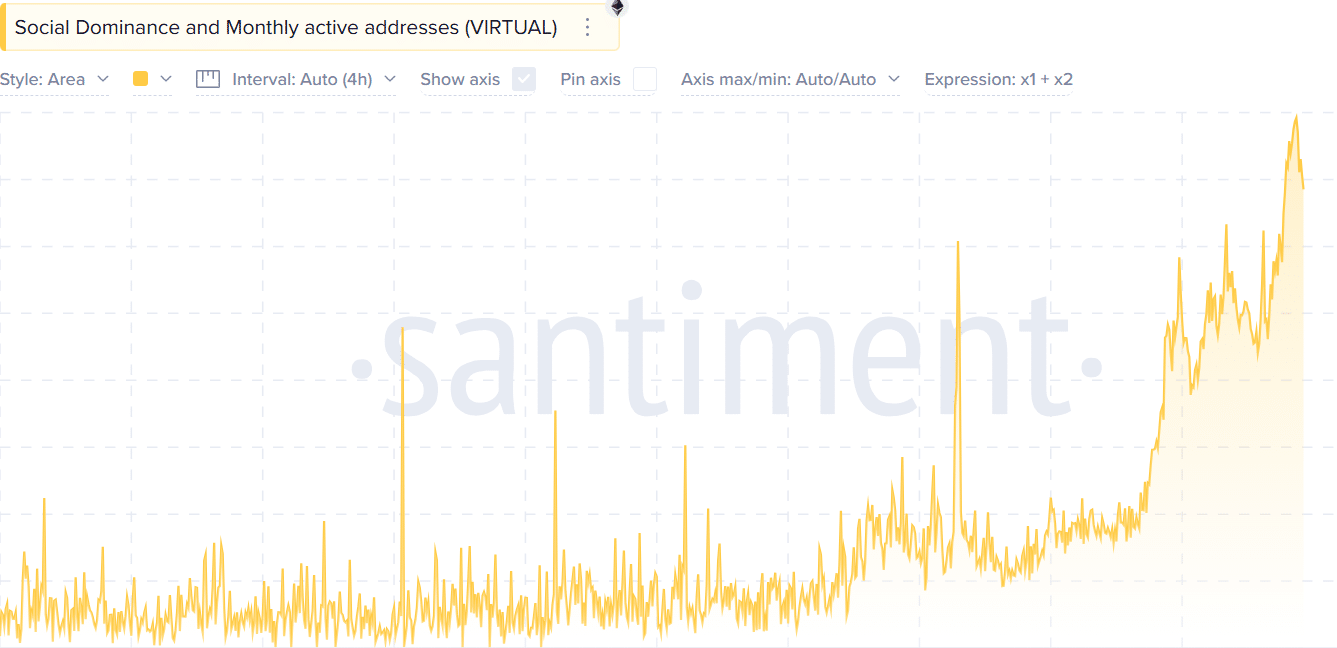

Social dominance and monthly active addresses

In the Virtuals Protocol, we see a strong relationship between the level of social influence and the number of active user addresses. As social dominance increased, indicating growing community engagement, so did the number of active users.

This trend suggests increased user engagement and possible speculative activity.

Read Virtuals Protocol’s [VIRTUAL] Price Prediction 2025–2026

Previously, these peaks tended to coincide with rising prices. Greater public interest and active involvement might trigger a rise in prices.

Additionally, these measurements indicate a possible risk of market instability. Sharp increases frequently lead to adjustments. If this trend persists, the price of VIRTUAL could undergo substantial changes in the short term.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-15 02:15