- Trump is reportedly set to roll back the SAB 121 accounting rule

- Market expectations for a Strategic BTC reserve in the United States have risen

It’s possible that the cryptocurrency market might gain a regulatory advantage earlier than expected, as President-elect Donald Trump is said to plan on revoking the SAB 121 accounting rule on his inauguration day.

As stated in a Washington Post article, Trump regards the de-banking initiative as one of his major priorities. This report also indicates that Trump plans to sign executive orders on his first day in office to tackle this issue, and he intends to revoke a rule that prohibits traditional banks from engaging in this sector.

Under the SAB 121 regulation, banks were mandated to maintain a one-to-one ratio in their accounting practices when dealing with cryptocurrencies, and it largely limited many banks from actively engaging in the crypto sector.

Despite the strong approval from Congress to reverse the plan, President Joe Biden chose to reject it, asserting that he would not endanger consumers or investors.

Is a Bitcoin strategic reserve next?

According to the Trump-Vance transition team’s announcement, this aligns with their promises made during the campaign regarding this specific sector. Brian Hughes, spokesperson for the transition team, shared with The Washington Post that they aim to create an environment conducive to the growth and prosperity of cryptocurrency within the United States.

Trump and David Sacks aim to protect freedom of expression on the internet, prevent excessive control by big tech, and establish a legal structure that encourages the flourishing of the cryptocurrency sector within the U.S.

As a crypto investor, I’m excited about the promise made by the team to not only abolish most anti-crypto regulations but also establish a Strategic Bitcoin Reserve (SBR). This move indicates a forward-thinking approach and could potentially have significant implications for the future of my investments.

Experts within the industry, such as Jack Mallers of Strike, predict that Self-Balancing Roller (SBR) could be incorporated in the President’s initial executive orders. While The Washington Post hasn’t explicitly mentioned SBR, there has been a noticeable increase in market anticipation due to this prediction.

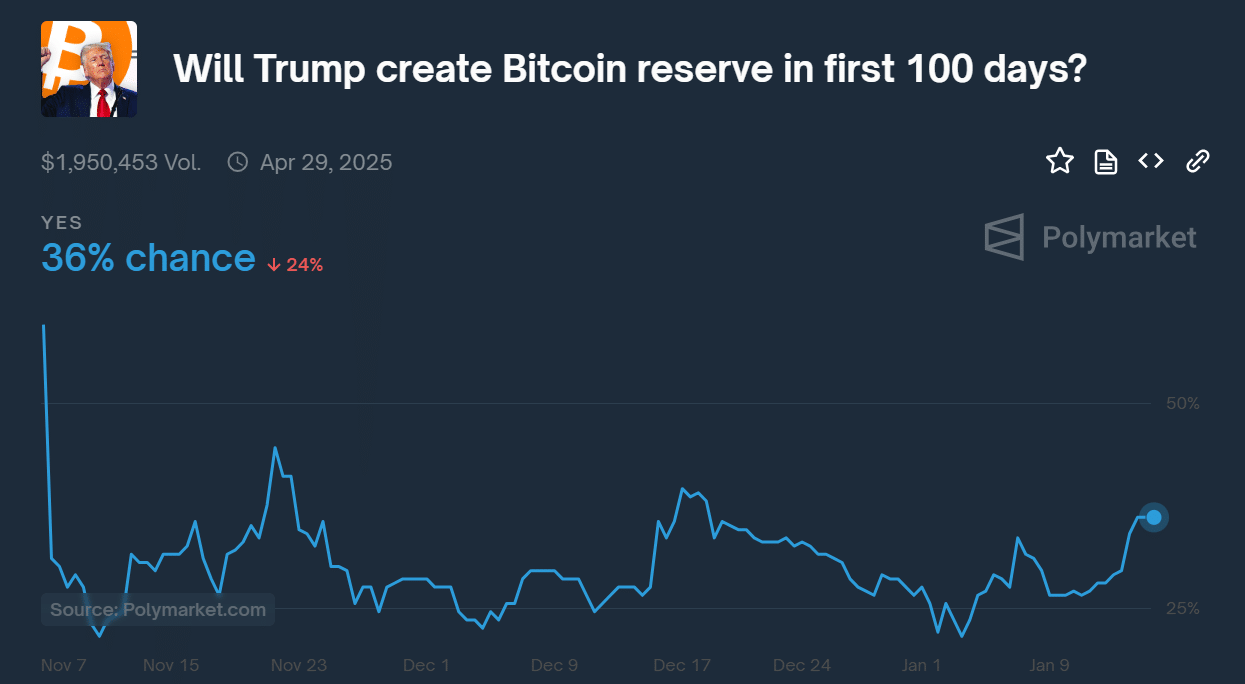

Over the past fortnight, the likelihood of a U.S. Supreme Court nomination (SBR) by Polymarket during the initial 100 days of the Trump administration has significantly increased, moving up from 26% to 36%.

It’s worth noting that as Bitcoin rebounded from $91k to $102k, there was a noticeable increase in the occurrence of odd events. However, after this surge, Bitcoin’s gains eventually reversed.

Some financial analysts speculate that a U.S Secure Buttondown (SBR) could cause fear of missing out (FOMO) among other nations, possibly boosting Bitcoin’s worth. Whether this event represents the continued expansion of Bitcoin’s popularity remains to be determined.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-15 05:11