- Altcoin sector may be primed for a strong recovery on the charts

- BTC and USDT dominance seemed to be at pivotal points

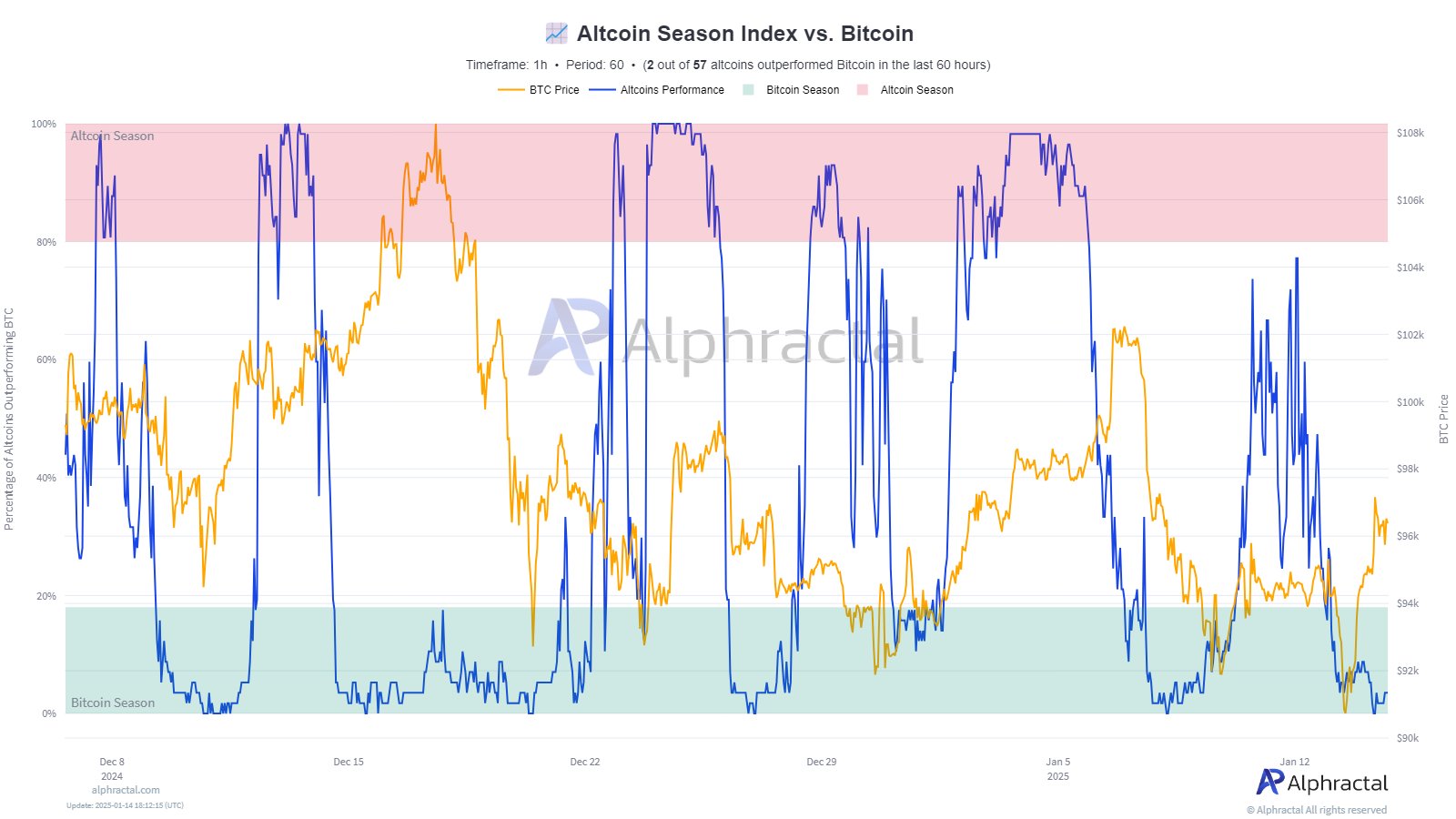

Following the recent drops in altcoins in January, there’s a possibility that they might experience a significant resurgence, potentially outperforming Bitcoin [BTC]. According to the analytics platform Alphractal, the Altcoin Season Index has reached a crucial level, which could stimulate a short-term recovery for the sector.

Part of the firm’s X’s post read,

In the past day, Bitcoin has increased from $89,000 to $97,000. This indicates, according to the Altcoin Season Index, that we might be entering a period where altcoins could potentially regain strength.

From the provided graph, it’s clear that the Altcoin Season Index has a pattern of bouncing back when it reaches its lower limits. It’s worth noting that these recoveries have typically been sparked by Bitcoin’s price movements. So, given that Bitcoin has recently climbed from approximately $90k to $97k, there’s a possibility this could trigger another resurgence in the altcoin sector.

What’s next for altcoins?

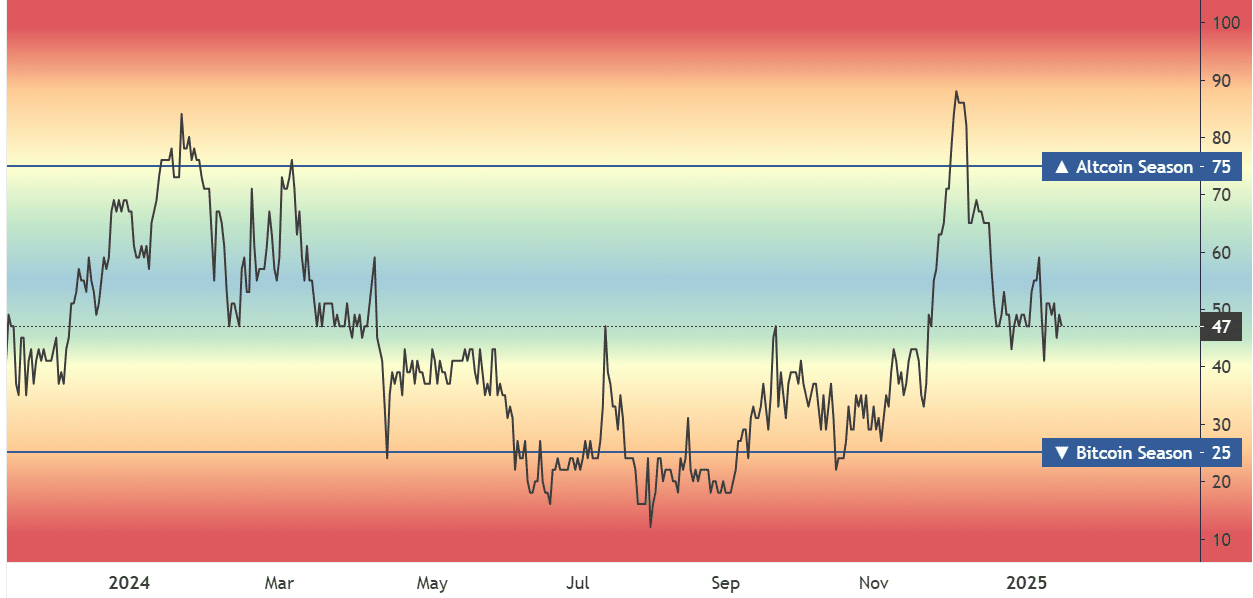

It’s important to note that, as of now, the momentum of another commonly used altcoin indicator (from Blockchain Center) is neutral. This means we aren’t currently experiencing an ‘altcoin season’ or a ‘Bitcoin season’. Essentially, the market could potentially trend upwards or downwards from this point.

Despite all else, Bitcoin currently holds a strong position, particularly with the possibility of positive crypto updates following Donald Trump’s inauguration on the 20th.

Bitcoin is currently leading the pack, especially considering potential pro-crypto changes that could arise post Donald Trump’s inauguration on the 20th.

Moving forward, let’s discuss potential developments within the broader altcoin market. We delved deeper into Bitcoin (BTC) and Tether (USDT) to gain additional insights.

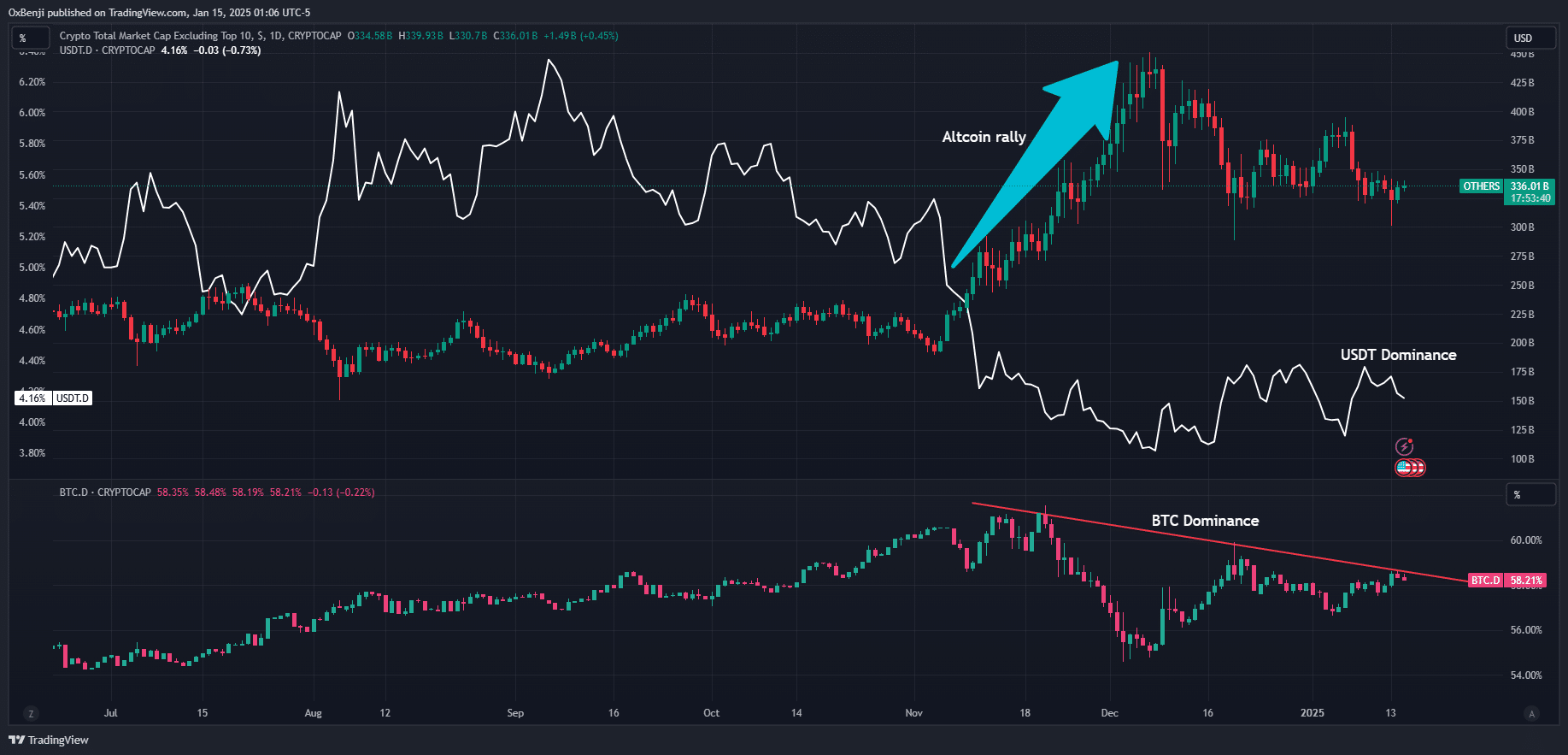

In simpler terms, when the influence of Bitcoin (BTC) and Tether (USDT), combined, decreases, it suggests that investors may be shifting their funds from BTC to other cryptocurrencies called altcoins, leading to increased demand and higher buying pressure for these altcoins.

During the surge of altcoins in November, it became clear that this event occurred simultaneously with a decrease in Bitcoin’s and Tether’s (USDT) market control.

Currently, Bitcoin Dominance (BTC.D) has reached a level where it’s encountering resistance from a trendline, whereas US Dollar Tether Dominance (USDT.D) appears to be pulling back towards lower levels. If both indicators continue this downward trend in the coming days, the Alphractal prediction may be confirmed.

In other words, it’s worth noting that certain alternative cryptocurrencies, such as XRP and Hedera [HBAR], have surpassed Bitcoin in terms of performance over a 90-day stretch. Specifically, the value of XRP increased by approximately 450% during this timeframe, while HBAR saw an impressive rise of around 600%. In contrast, Bitcoin managed to gain only about 52% within the same period.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

2025-01-15 12:07