- World Liberty Finance and Grayscale, two major institutions, have transferred a substantial portion of their ETH holdings to exchanges, signaling the potential for a sell-off.

- Investor activity in ETH has stalled, with the funding premium turning negative as demand drops.

As a researcher, I’ve noticed that Ethereum [ETH] hasn’t been performing as well lately. Over the past month, it has decreased by approximately 18.31%. Unfortunately, this downward trend persisted even in the last 24 hours, with a minor dip of 0.53%.

Based on current market patterns, it appears that Ethereum’s downward trend could become more pronounced in the near future, especially after the inauguration of the new U.S. President, Joe Biden (who succeeded Donald Trump).

Investor movements don’t favor ETH

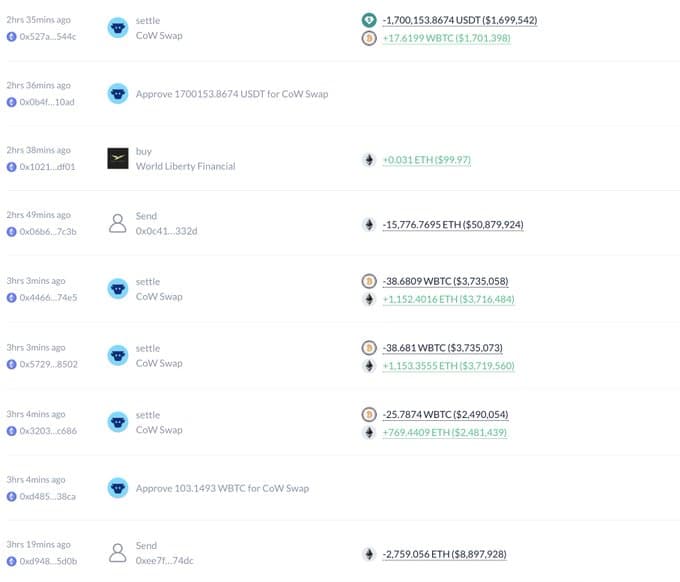

Lately, World Liberty Finance, connected to the incoming President Donald Trump, boosted its Ethereum (ETH) assets by purchasing additional tokens, which were later liquidated.

In this transaction, World Liberty exchanged 103 units of Wrapped Bitcoin (WBTC), worth approximately $9.89 million at the point of trade, for a total of 3,075 Ether.

Following the exchange, they increased their Ethereum holdings by 15,461 ETH, making a grand total of 18,536 ETH. This amount was subsequently transferred to the cryptocurrency platform, Coinbase Prime.

Generally, when cryptocurrencies are transferred from personal wallets to exchanges, it often indicates that a sale is forthcoming. Yet, in this specific instance, the sale might not happen straight away.

As a researcher examining World Liberty Finance’s asset holdings, I find myself pondering whether they might be positioning themselves for a potential price increase, given the anticipated inauguration of President-elect Trump. Historically, such events have shown signs of causing market fluctuations, and this pattern seems to be under consideration here.

If Trump becomes president again in 2024, there might be a strong potential for an Ethereum price increase similar to what was seen after his initial election.

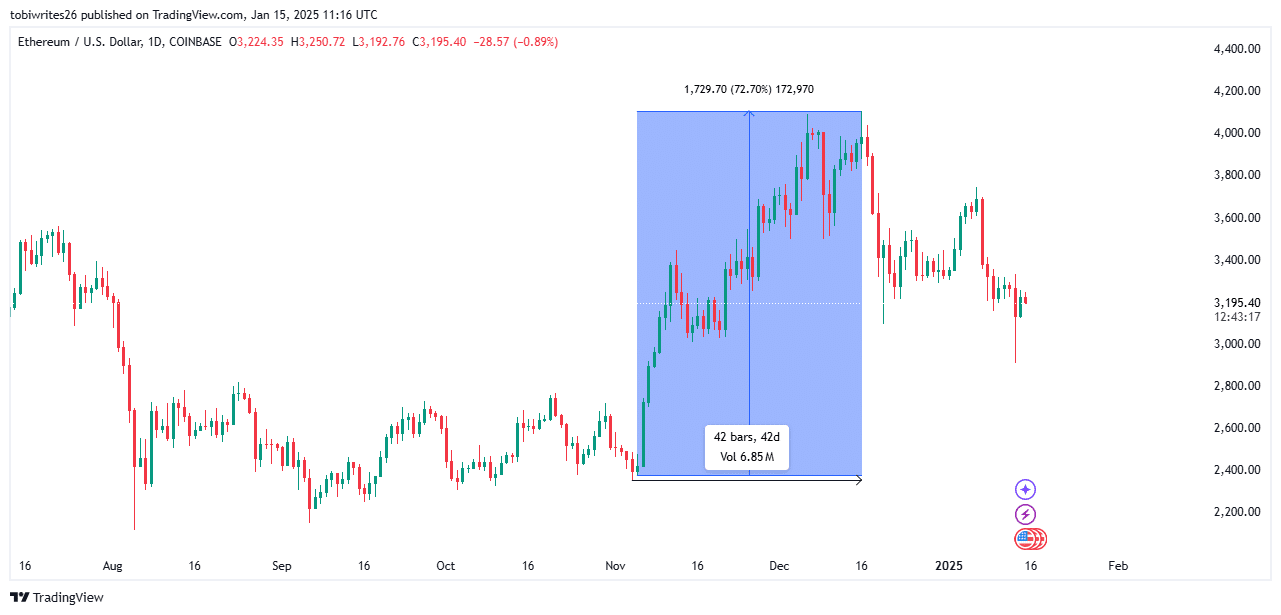

On November 5th, 2024, ETH experienced a significant increase of 72.70%, climbing from a low of $2,379.30 to a peak of $4,109.00 on December 16th, 2024—a span of merely 42 days.

In case history follows a similar pattern, it’s possible that World Liberty Finance could quickly unload their Ethereum (ETH) on Coinbase Prime following an expected increase in value. This action might cause the price of ETH to decrease significantly.

According to new information from Intel, it appears that well-known institutional investor Grayscale, with substantial Ethereum investments, has taken a similar approach by transferring its assets to Coinbase Prime.

Based on the information available, it’s reported that a combined amount of 16,941 Ether (valued at approximately $54.27 million) was transferred to Coinbase Prime in three separate transactions. This suggests a potentially pessimistic view on the asset, as large transfers often indicate selling pressure.

Demand has begun to decline

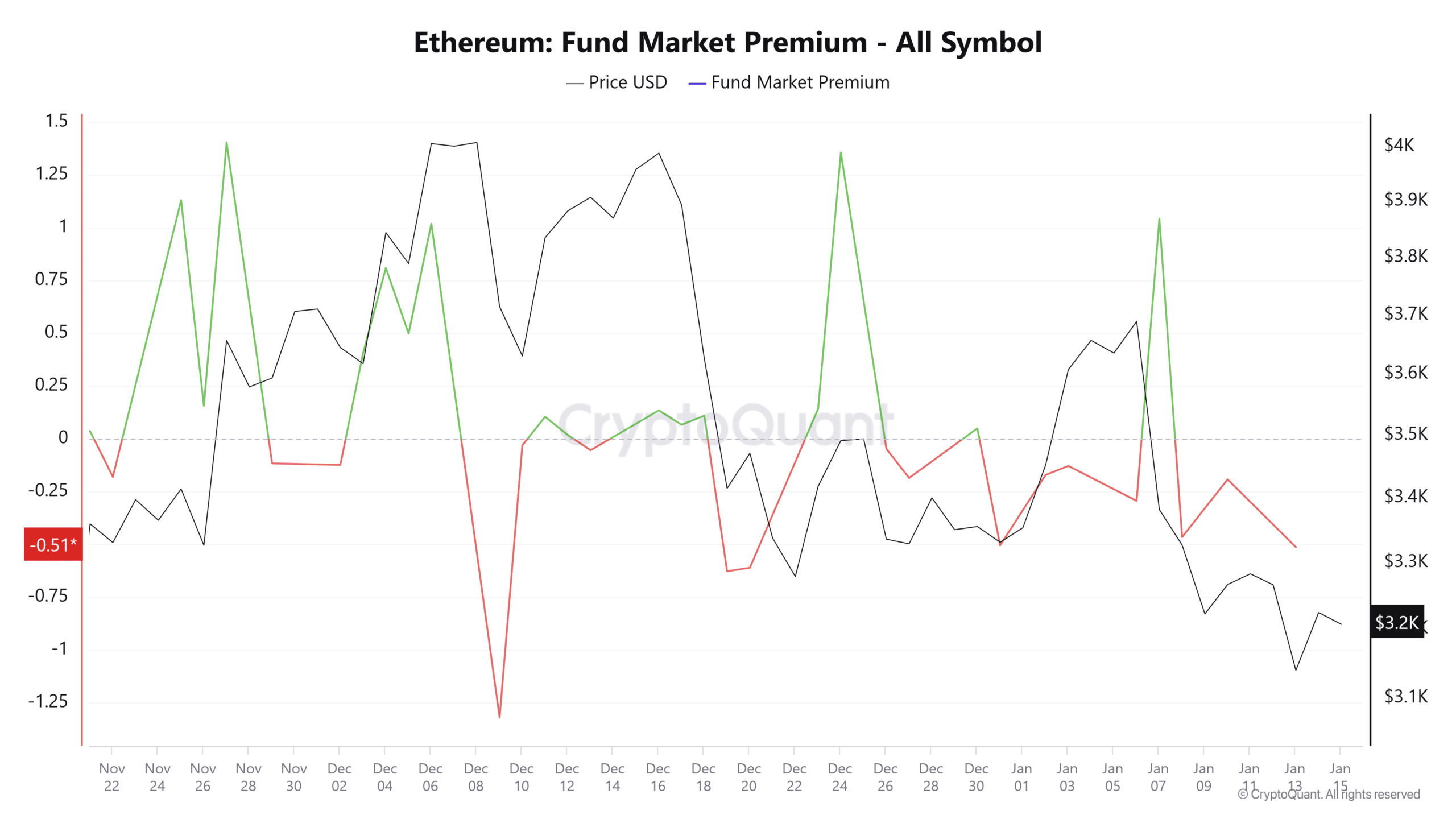

Based on data from CryptoQuant’s premium index, which gauges institutional interest in an asset, Ethereum’s fund premium has experienced a substantial decrease. At present, it is trading at -0.515, indicating that it is moving even farther from the neutral zone.

If the price of ETH falls slightly below its equilibrium point (zero), it suggests that institutional investors are less eager to pay more than the current price, indicating a decrease in their demand. This trend could potentially signal a gradually pessimistic view on ETH’s future price movement.

At the same time, some traders who specialize in quick transactions seem to be exhibiting a degree of apprehension. Instead of keeping their assets in personal wallets for long-term storage, these traders are opting to keep them on exchanges, allowing for easier liquidation when needed.

Read Ethereum’s [ETH] Price Prediction 2025-26

In early January, there was a daily outflow of approximately 39,270 ETH, but as we speak, this exchange netflow has changed significantly to an inflow of around 6,093 ETH.

From early January, the daily net flow of ETH through exchanges was a loss of about 39,270 ETH, however, at present, it’s now showing a gain of approximately 6,093 ETH.

It seems that there’s a growing trend among both large-scale and individual investors, who are progressively reducing their holdings in ETH. Yet, the general feeling persists that Ethereum continues to be seen as a promising investment, signifying a bullish outlook.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-15 18:16