- Stellar has flipped SUI by market capitalization after gaining by over 11% in 24 hours

- XLM’s rally can attributed to buying pressure, with the RSI nearing overbought zones

Stellar (XLM) has surpassed SUI (SUI) in terms of market value following an increase of over 11% within the past day. At this moment, XLM holds the position as the 12th largest cryptocurrency, boasting a market cap of $14.21 billion. The coin is currently trading at a weekly high of $0.467.

Stellar (XLM) might be primed for further growth, given the optimistic perspective on its shorter-term chart – An indication that it may reach a peak not seen for several weeks at approximately $0.52 in the immediate future.

XLM eyes further gains

On its four-hour chart, Stellar displayed a double bottom formation, implying that a potential upward trend might be about to continue. Additionally, it successfully surpassed a significant resistance level at the pattern’s neckline, indicating a robust uptrend.

The upcoming potential price point is found at the 1.618 Fibonacci extension level, which translates to approximately $0.52. This anticipated increase could lead XLM to reach its highest levels for the month.

The graph of trading volume showed an increase, with the bars indicating a significant number of buyers driving this rise as their purchases reached $154 million. Furthermore, the Relative Strength Index (RSI) supported this trend, climbing up to 71 – a sign suggesting that XLM might be approaching being overbought.

The volume graph shows a spike due to many buyers, who together purchased approximately $154 million of XLM. Additionally, the RSI indicates that XLM could be nearing an oversold state, as it reached 71.

In simpler terms, the Moving Average Convergence Divergence (MACD) signal further emphasized a strong upward trend. Currently, the MACD line is showing positivity and pointing upwards, indicating that the bulls are dominating the market at this moment.

Long traders could derail XLM’s rally

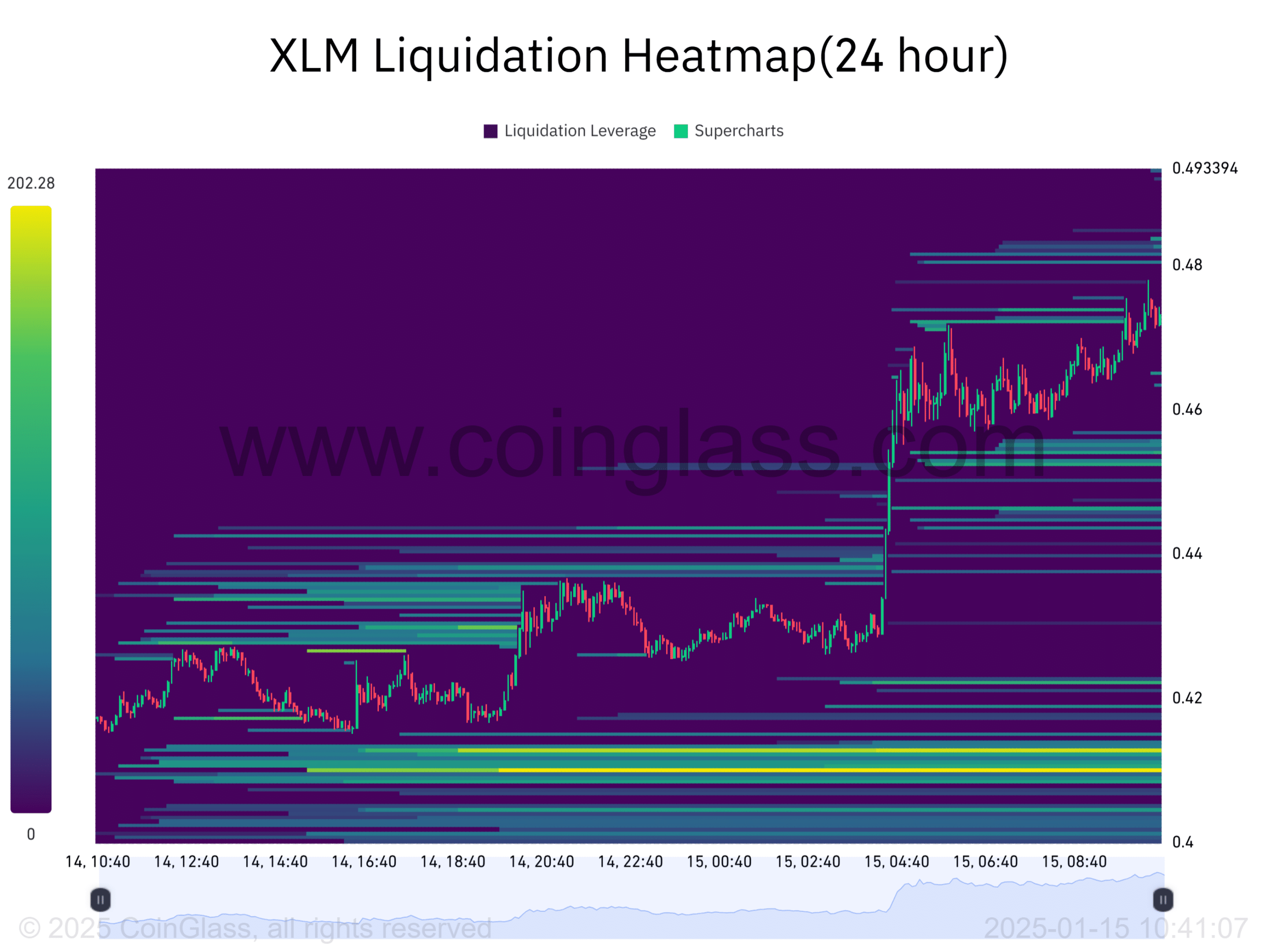

Due to Stellar’s recent price increase, over $1.5 million worth of short positions (betting on a decrease in price) were eliminated, a situation known as liquidations. This event appears to have sparked interest in long positions (betting on an increase in price), as the funding rates turned positive according to Coinglass. This indicates that traders who hold long positions are now prepared to pay a fee to keep their investments.

24-hour analysis of XLM’s liquidation map reveals instances where prices climbed but were met by quick liquidations. Interestingly, there are groups of potential liquidation points beneath the current price level, which, if reached, might attract further sell-offs, potentially causing XLM to decrease.

As a crypto investor, I’m keeping a close eye on the key liquidation zone around $0.40 – $0.41. A lot of long-term traders are teetering on the edge of getting liquidated at this price point. If an unexpected drop occurs, it might spark a sharp downtrend as these traders scramble to sell off their holdings.

Can XLM emerge as a top ten crypto?

After experiencing a significant boost in its market value recently, XLM is moving nearer to surpassing Avalanche (AVAX), which currently holds a market cap of $15.34 billion. In order for it to join the ranks of the top ten cryptocurrencies, XLM needs to accumulate an additional $5 billion or more to overtake Tron (TRX).

2025 might witness a surge in XLM’s market cap, considering it increased from approximately $9.8 billion to $14 billion within the initial five days of the year. This growth, however, hinges on whether Stellar can maintain and build upon its upward momentum going forward.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2025-01-16 17:50