- Rebound from the support level at $1.35 could be key to WIF’s next move as price tests resistance near $1.80

- WIF token transfer has been on the rise, as well as its DEX trading volume since the rebound

As a crypto investor, I noticed an encouraging bounce back on the daily chart for Dogewhats (WIF) from the $1.06 support level. This suggests strong buying activity at this particular price point. Interestingly, the price seems to be probing the $1.738 zone, which appears to act as immediate resistance.

Breaking through this level with strength might lead us to a potential goal of $2.00, as suggested by the Volume Profile Visible Range that demonstrates decreased trading activity above this range up to $2.50.

In simpler terms, the Moving Average Convergence Divergence (MACD) supported the possibility of an upward trend by building up positive momentum, as the histogram climbed higher and the MACD line appeared ready to move above the Signal line.

Nevertheless, any dip from its current price points might encounter support at $1.06, an area with notable past trading activity, indicating strong defensive efforts by bulls. Conversely, a persistent surge above $1.80 could bolster the bullish forecast and pave the way for an upswing toward $2.50, and possibly even further. This would signify a substantial recovery period for WIF.

Instead, if this resistance isn’t broken, it could result in a period of consolidation or a revisit of lower support levels.

Token transfer and DEX volume

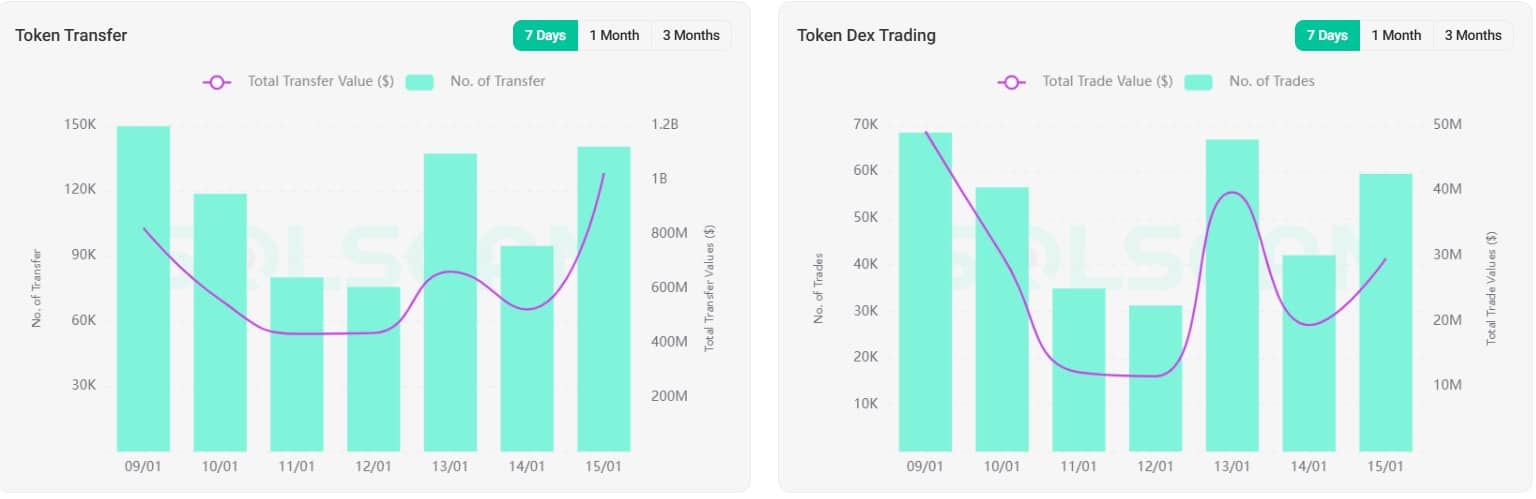

Examining the WIF token data uncovered a changing pattern in both transactions involving token transfers and decentralized exchanges (DEX). The ‘Token Transfers’ showed an uptick in overall transfer value, climbing from approximately $400 million to over $1 billion. Simultaneously, there was a varying yet predominantly rising number of transfer occurrences.

This alluded to growing liquidity and possibly higher demand for WIF across the market.

The charts further emphasized the point by revealing a captivating trend in trade volume and transaction count.

On January 15th, the DEX trading volume reached an impressive high of around $60 million, this was accompanied by a significant number of transactions.

Peaks in this context serve as indicators of potential areas where the asset’s value might find support. When these levels hold firm, they contribute to the stability of the token’s price. If the support persists around the $1.738 level, WIF may exhibit a bullish trend and potentially challenge the resistance near $2.00.

If the breach exceeds this limit, it suggests a continuous upward trend driven by persistent trading activities and favorable market opinion. This situation could potentially boost WIF’s price in the short term.

WIF distribution by holders

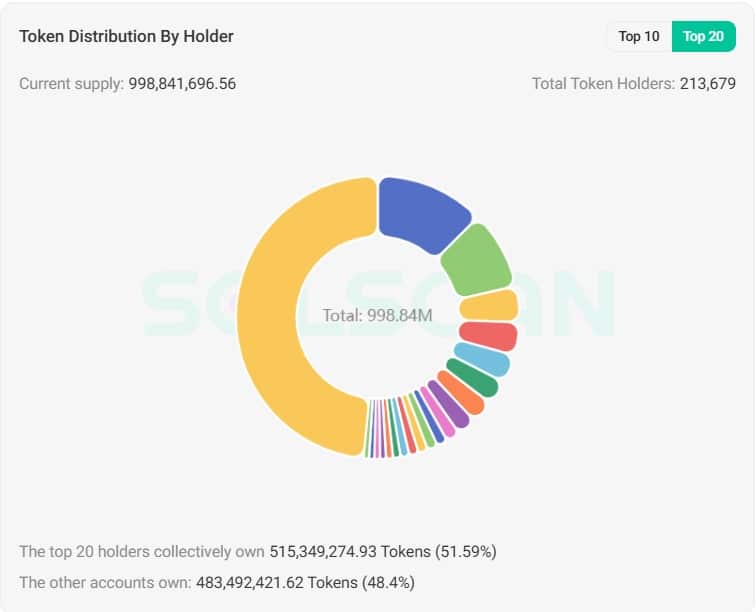

Ultimately, a significant concentration of WIF tokens was observed, with the top 20 token holders controlling approximately 51.59% of the total supply. This equates to more than 515 million tokens, demonstrating a highly concentrated distribution pattern.

This level of dominance implies that a handful of players exert considerable impact on the market. If these dominant entities choose to either purchase or sell substantial quantities, it could cause fluctuations in prices.

On the contrary, approximately 48.41% of the tokens were distributed among various other accounts, suggesting a more extensive community of smaller token holders.

As a crypto investor, I can’t stress enough the significance of this distribution pattern in predicting potential resistance or support levels. A change in the positioning of significant players in the market could have a substantial effect on WIF’s price stability and overall market dynamics.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Elder Scrolls Oblivion: Best Thief Build

- Gold Rate Forecast

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Ludicrous

2025-01-17 04:07