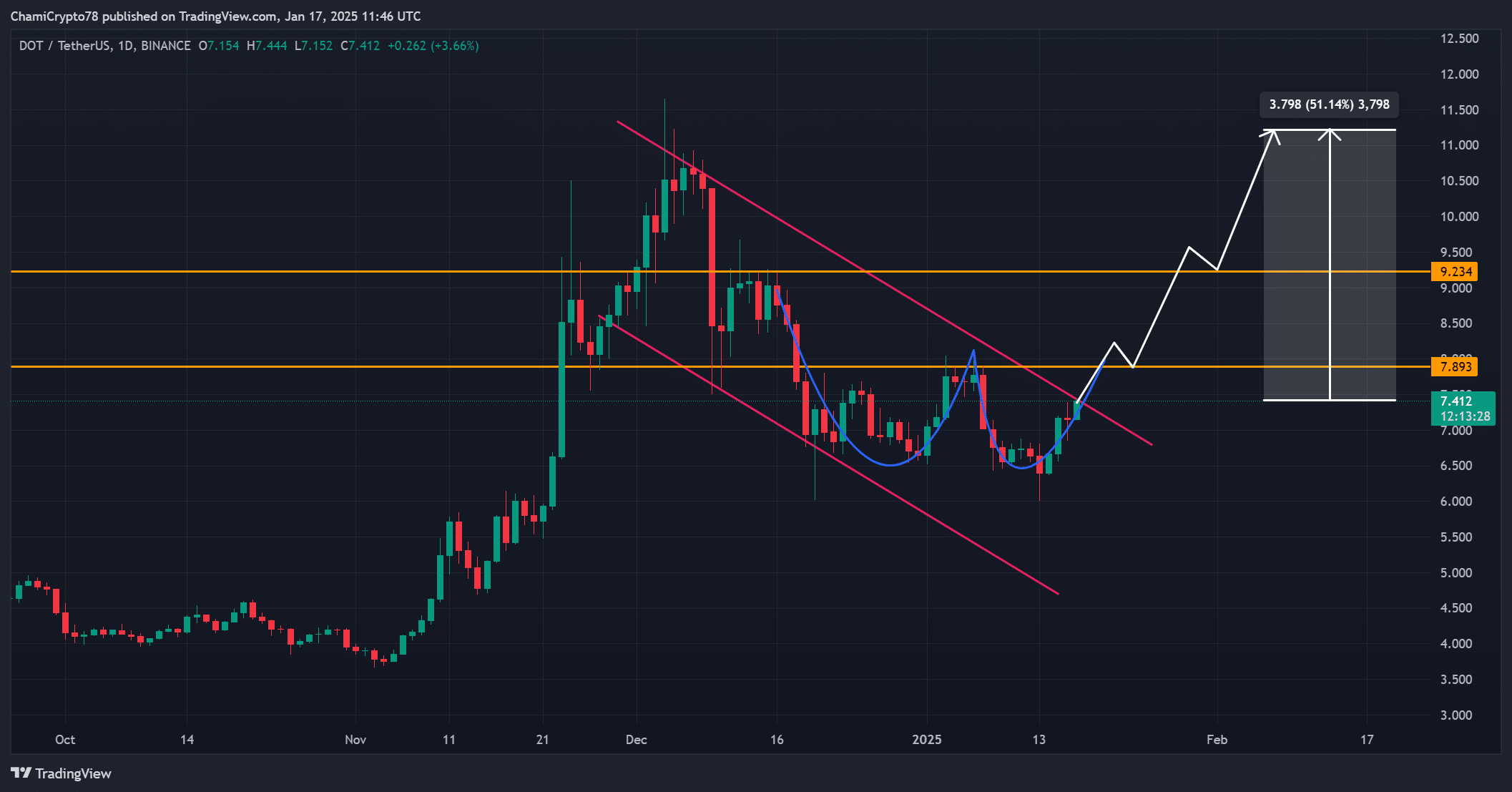

- Polkadot’s bullish breakout hinted at a 51% upside, with $7.89 and $9.23 emerging as key levels

- Market sentiment has improved lately, backed by steady funding rates, rising social volume, and balanced long/short positions

After several weeks of downward trends, Polkadot (DOT) started showing signs of recovery as it broke free from a contracting wedge formation visible on its daily price graphs.

Currently, at the present moment, Polkadot (DOT) is being traded at $7.42, representing a 6.25% increase over the past 24 hours. This surge has ignited enthusiasm among DOT traders who are keeping a close eye on crucial resistance points. Therefore, there’s speculation – Will Polkadot continue its upward trend and target a new goal of $12?

Signs of bullish continuation?

Based on the breakdown of Polkadot’s daily chart falling wedge formation, it appears that there is a strong possibility of continued growth, potentially increasing by approximately 51%.

Indeed, these bullish trends were also noticed, specifically a pennant flag and a cup and handle configuration. Both suggest a potential rise to $9.23 if the resistance at $7.89 is convincingly surpassed. These patterns underscore the increasing buying power, indicating that DOT could experience a substantial upward trend on its price charts.

From my perspective as an analyst, letting go of the $7.89 mark could potentially lead to a period of consolidation, postponing any significant advancements. Consequently, it’s imperative to keep our position above this threshold in order to uphold the bullish trend we’ve been tracking.

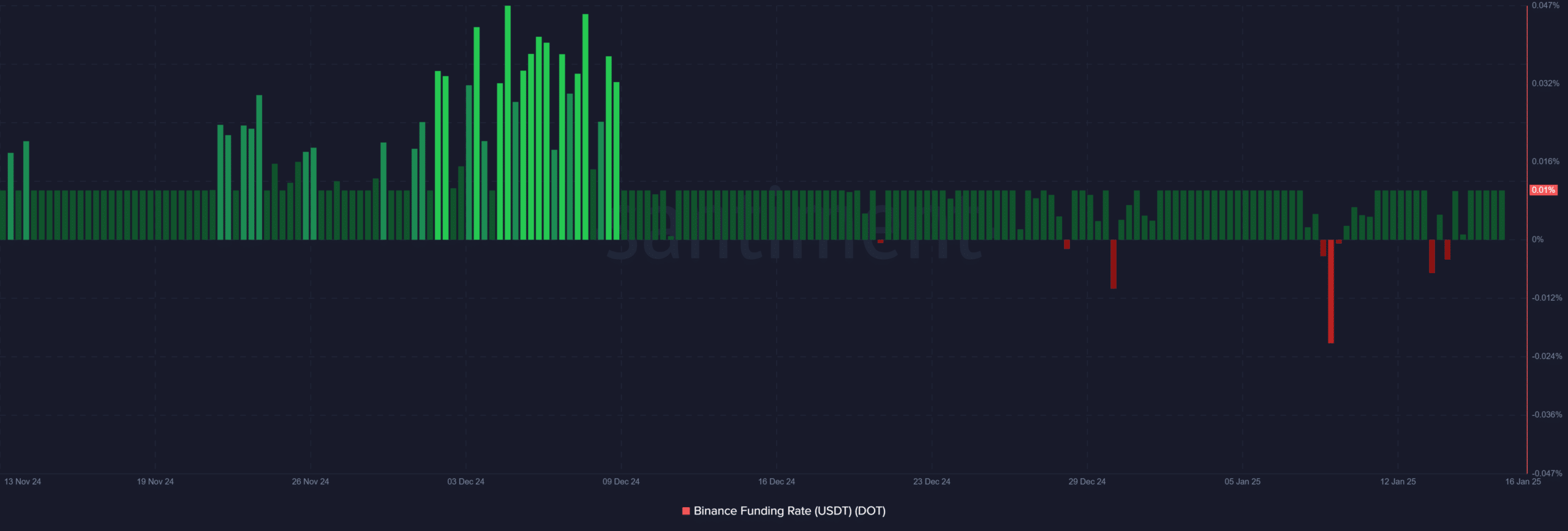

Binance funding rate reflects growing optimism

Currently, when I’m typing this, the funding rate for DOT on Binance stands at 0.01%. This suggests a positive sentiment among traders who are leveraged, indicating optimism towards the altcoin. Additionally, it seems to indicate an increased preference for long positions, which could be contributing to the ongoing surge of DOT.

On the other hand, significant increases in borrowing costs might signal high levels of debt within the market, potentially triggering a market adjustment or correction.

As a cryptocurrency investor, it’s crucial for me to ensure that funding rates stay consistent to prevent overexposure. Moreover, a stable funding environment could potentially attract more traders to take on long positions, thereby fueling the bullish trend even more.

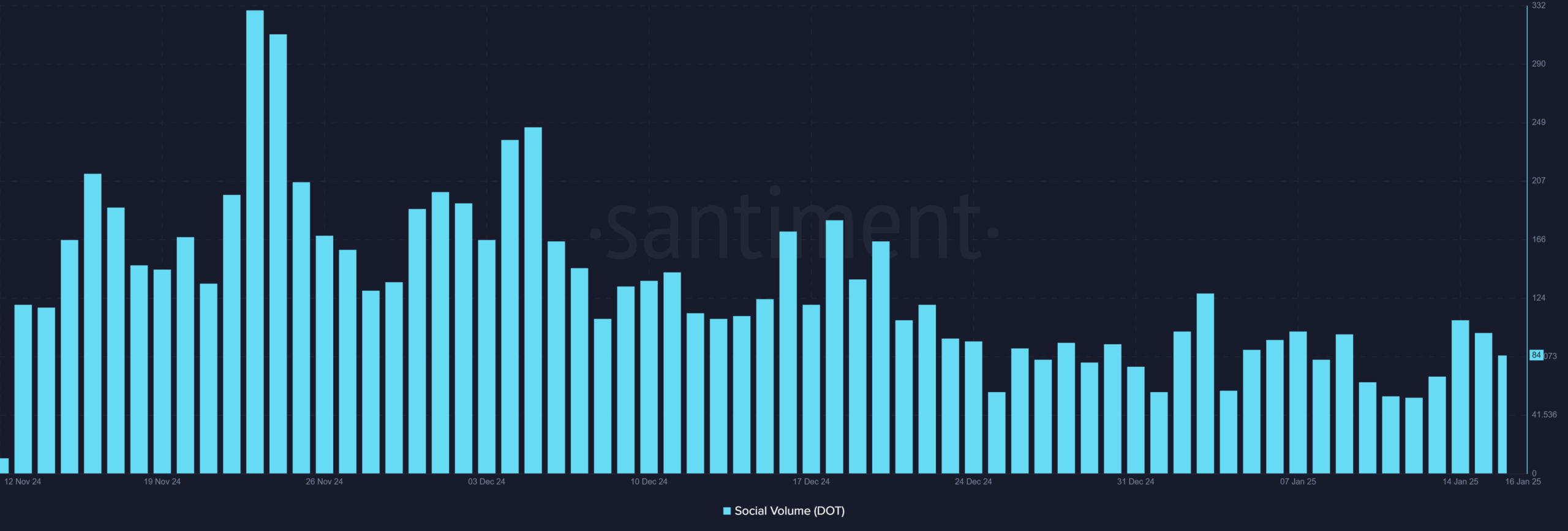

Social volume shows growing trader interest

The chatter about DOT on social media has been consistently rising, as evidenced by 84 mentions in just the past day. Admittedly, these numbers are a bit lower than some of the peaks we’ve seen before, but the upward trajectory overall is clear – A testament to growing community engagement.

As a crypto investor, I’ve noticed an increase in conversations around DOT, which typically indicates higher trading activity. With increased social engagement, there might be enough buying pressure to propel DOT past the $9.23 mark.

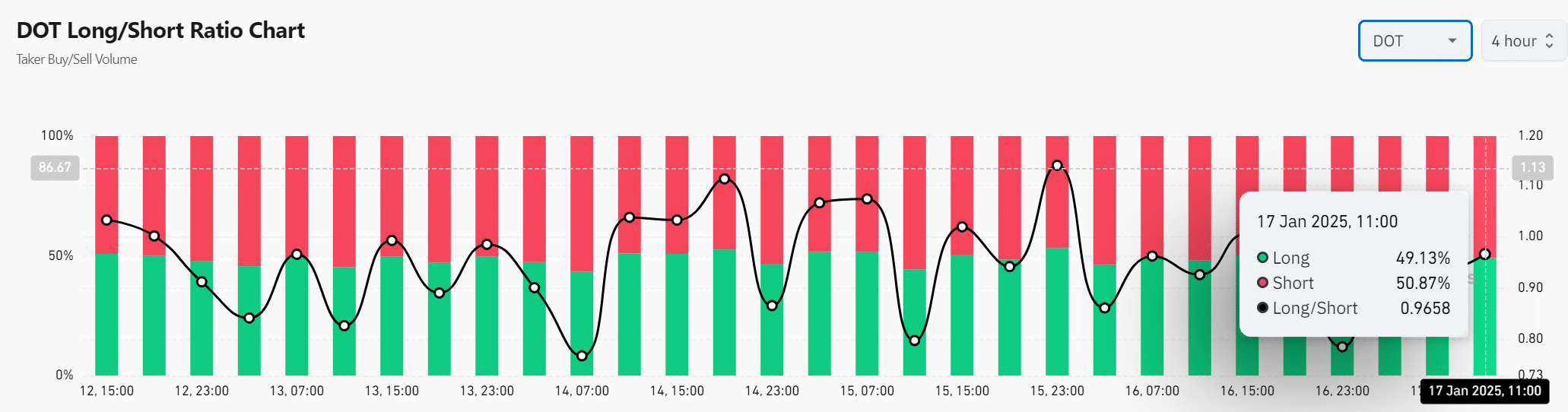

Time for caution?

In summary, the DOT’s long/short ratio showed that 49.13% of investors held long positions and 50.87% had short positions, indicating a cautious market sentiment. Although it slightly favored bearish sentiments, the roughly equal distribution suggested that neither side has gained significant control yet.

Alternatively, an increase in long positions might indicate renewed trust in the rally. Consequently, if DOT is to maintain its bullish surge, it may require a strong inclination towards long trades.

Read Polkadot [DOT] Price Prediction 2024-2025

Is $12 realistic for Polkadot?

As an analyst, I find myself strongly convinced that Polkadot’s surge is imminent, backed by robust technical indicators and favorable market conditions. The probability of Polkadot reaching a price point of around $12 appears to be quite high.

Showing robust market movements, increasing public attention, and positive sentiment among investors, Polkadot (DOT) might be on the verge of more growth. If this asset manages to maintain its position above $7.89 and surpasses $9.23, a potential jump to $12 could be imminent.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2025-01-17 21:11