- PostFinance is expanding its service to include a “staking” function

- Worth addressing the implications of staking on cryptocurrencies and crypto holders

PostFinance, a Swiss government-owned bank, made a notable move by incorporating a “staking” feature within its cryptocurrency handling services. This new offering is approximately one year following the initial introduction of cryptocurrency trading and safekeeping by PostFinance in partnership with Sygnum Bank.

Currently, clients have the opportunity to generate passive income by securely holding their Ethereum within PostFinance’s platforms. In the near future, they aim to extend this service to a variety of other cryptocurrencies as well.

Users can help secure and operate a blockchain network by keeping their digital currencies locked up in a process known as staking. In exchange for this support, they receive “staking returns” or rewards.

With PostFinance, transactions are conducted directly on the Ethereum blockchain, ensuring top-tier security and transparency for its users. Users can start with just 0.1 ETH to take part in staking and monitor their rewards, along with their other cryptocurrency holdings through the bank’s user-friendly digital assets portal.

By integrating and enhancing cryptocurrency features for our clients, we’re taking a significant stride to draw traditional finance participants into the crypto world. This move additionally serves to bolster the credibility and legitimacy of this growing asset class in the market.

Staking popularity and its impact on the market

The growing embrace of staking, as demonstrated by services such as PostFinance offering staking for Ethereum, underscores the increasing mainstream recognition of this trend. Essentially, staking enables investors to generate returns by securing their digital assets and thus contributing to the functioning of blockchain networks.

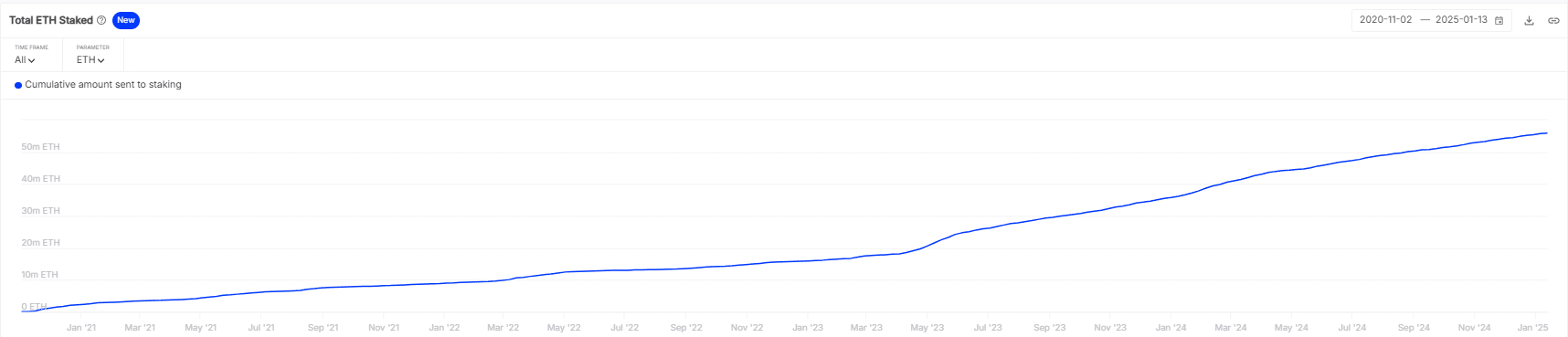

Starting from 2022, Ethereum, like Cardano and Solana, is now considered an excellent choice for staking, given its shift to Proof-of-Stake (PoS) consensus mechanism. Notably, a significant portion, up to approximately 70%, of the total Ethereum supply could potentially be involved in staking.

This change is clearly visible through the substantial amount of value being secured (TVL) across these platforms, indicating growing investor curiosity and attraction towards earning passive income through staking.

As an analyst, I’ve noticed that the growth of staking mechanisms significantly strengthens network security by encouraging honest actions through incentivization. Interestingly, this trend also impacts market liquidity in a unique way. With a higher volume of assets being staked, there’s reduced immediate selling pressure. This reduction could potentially lead to asset prices remaining stable or even increasing over time due to less frequent sell-offs.

On the other hand, this situation brings up fresh factors to ponder over market movements. Notably, when assets are staked, they may not be readily accessible for trading, which in turn influences market liquidity and potential volatility.

Implications on fortunes of holders

By offering a continuous income source through staking, holder behavior is significantly influenced to prioritize long-term investments rather than short-term speculation. This translates to potential greater earnings in the future, all while avoiding the need for constant, active trading.

Data from blockchain transactions reveals that a substantial amount of Ethereum is now being locked up due to staking since the merge. Consequently, the quantity of ETH readily available for quick trading on exchanges has decreased. This lock-in effect might cause an increase in the asset’s value because there are fewer coins competing for the same market capitalization.

By providing a user-friendly staking service, it can help foster this growing trend, opening up an inviting gateway for less technologically inclined investors to engage in staking. This expansion could widen the staking community, and possibly boost the prospects of those who choose to hold Ethereum for extended periods.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-18 00:39