- Bitcoin’s price has appreciated by 3.34% over the last 24 hours

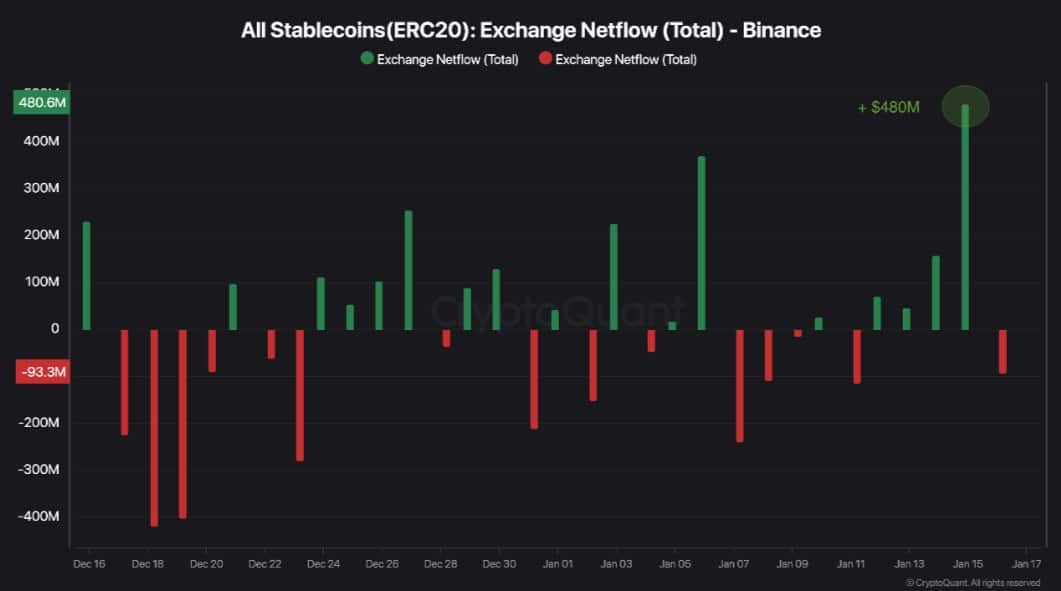

- CPI fueled $500 million stablecoins inflows on Binance

Recently, Bitcoin’s [BTC] price has experienced a notable surge, surpassing the $100,000 mark. At this moment, it is being traded at approximately $102,048, representing an increase of more than 7% over the course of the week.

It’s clear that the recent surge in prices within the cryptocurrency world has sparked discussions among its community members. Some experts speculate that the most recent Consumer Price Index (CPI) report could be the key factor contributing to the cryptocurrency market’s rebound.

CPI data boost propels Bitcoin past $100k

As per the analysis by Fost from CryptoQuant, an influx of $500 million in stablecoins has been driven by rising Consumer Price Index (CPI), which has found its way into Binance. This surge in funds has proven beneficial for Bitcoin, propelling it over the symbolic threshold of $100,000.

Following the unexpectedly favorable publication of Consumer Price Index (CPI) inflation data, there’s been a noticeable change in market mood towards optimism. This optimistic outlook can be seen in the steady increase of stablecoins being transferred onto Binance.

The increase in investment is due to investors viewing the recent news as a promising indicator that the current bullish trend for Bitcoin may persist.

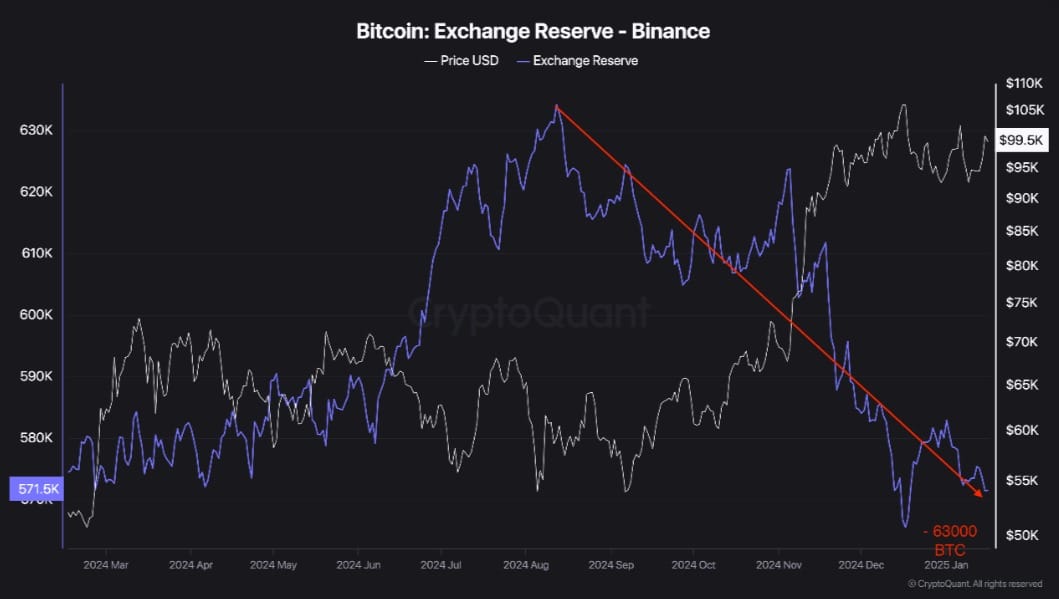

Moreover, the majority of funds flowing into Binance primarily went towards purchasing Bitcoin, thereby causing its value to surpass the significant $100k mark once more. Consequently, this led to a noticeable drop in the amount of Bitcoin held as reserves on Binance.

Over the past few weeks (specifically since August 12), approximately 63,000 Bitcoins have moved out of Binance’s storage. This indicates that investors continue to show strong faith in Bitcoin’s ongoing trajectory and may be preparing for a long-term investment strategy.

Can it sustain these gains?

As positive inflation figures fuel market enthusiasm, it’s possible that Bitcoin may experience further increases in value. This is particularly likely given the anticipation surrounding the entry of a president known to be favorable towards cryptocurrencies into office in the U.S.

Because of the current market situation, it’s possible that Bitcoin will see further increases in its price chart.

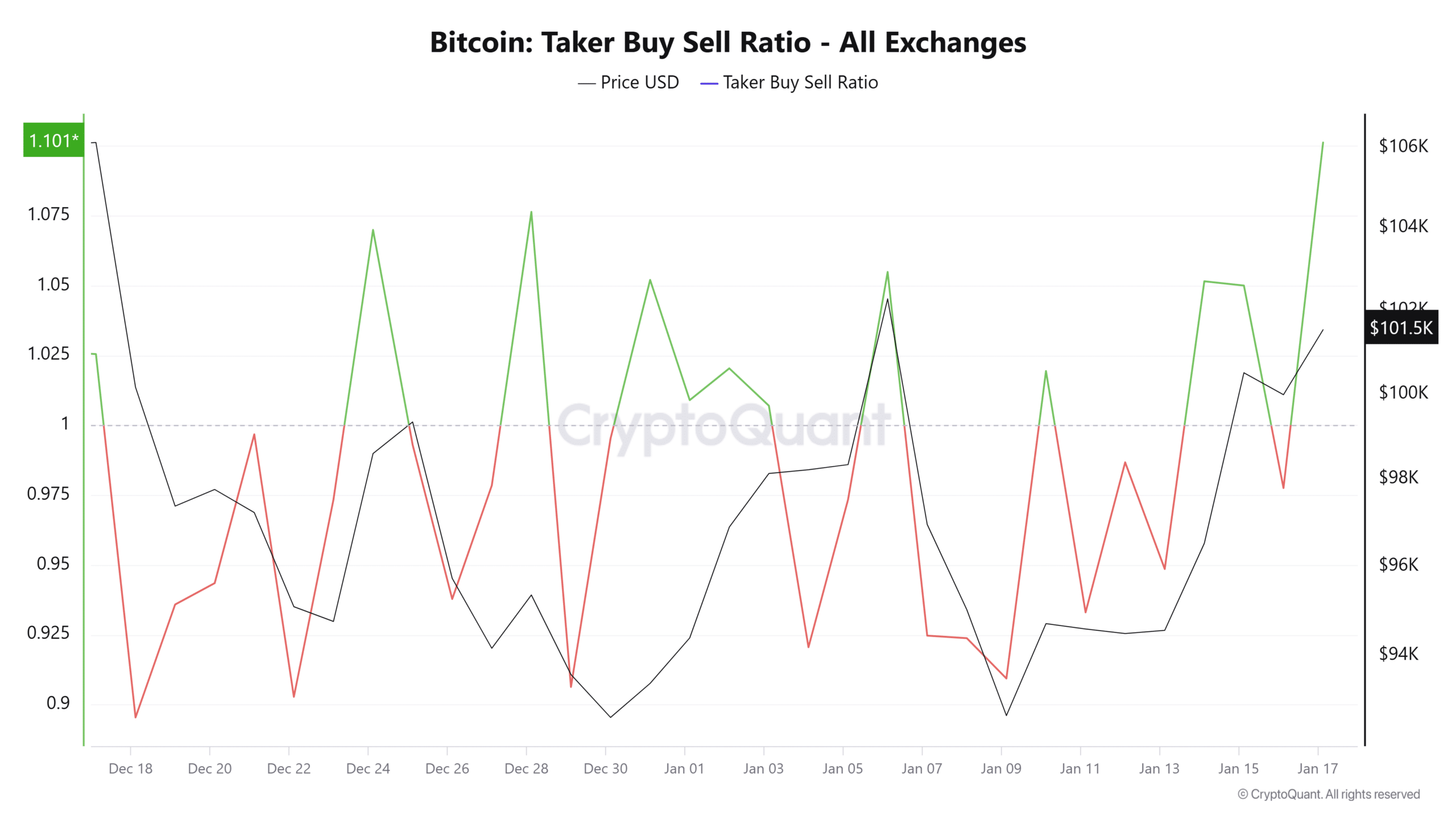

Initially, the Buy-Sell Ratio for Bitcoin has significantly increased during the last three days, currently standing at 1.116 as we speak.

As a researcher, when I observe a Buy Sell Ratio exceeding 1 in a given market, I interpret it as indicating an overwhelming influence of buyers. This, in essence, suggests that recent price increases are primarily fueled by strong, demand-driven dynamics.

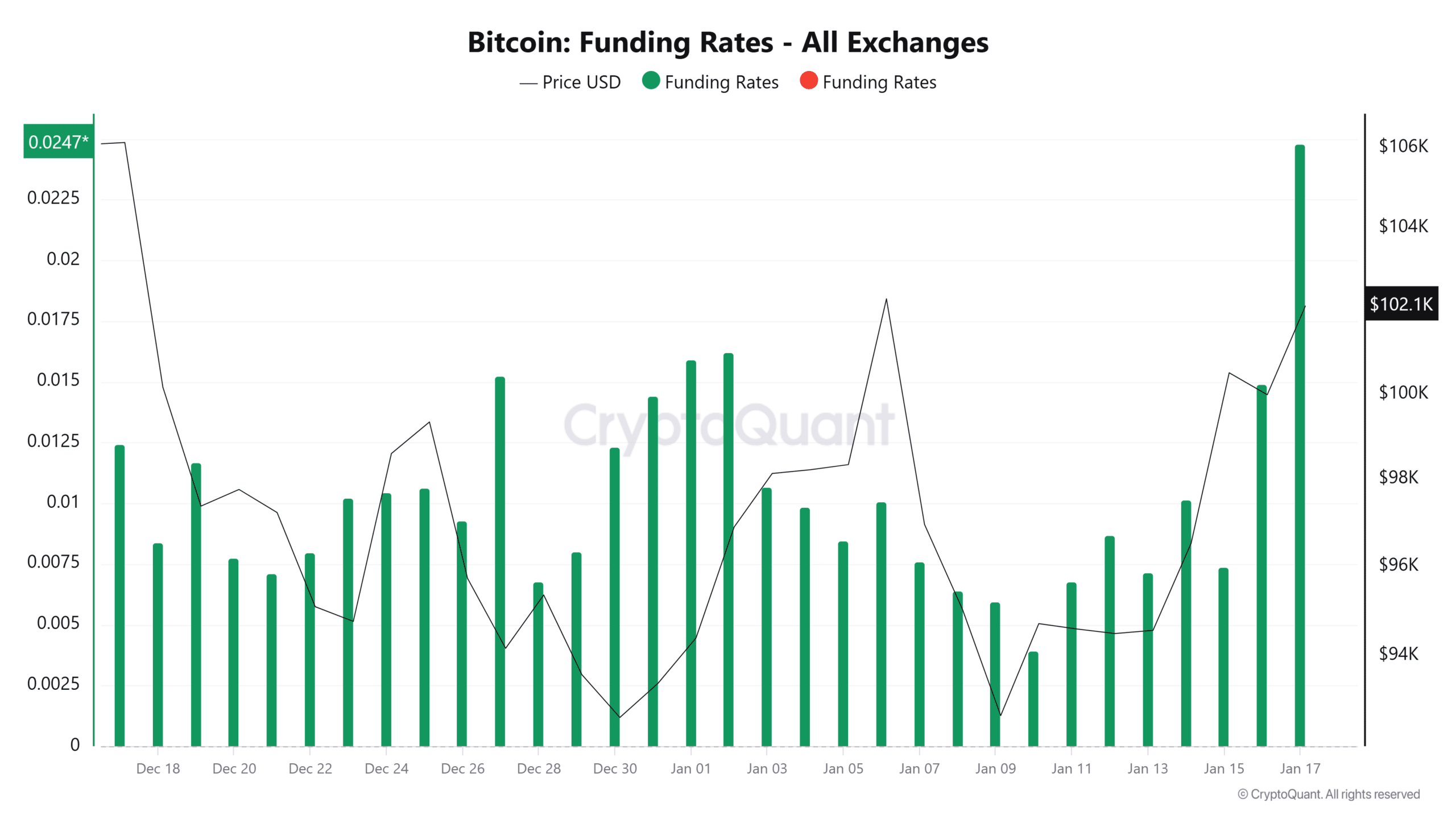

Moreover, it appears that most buyers are adopting a long-term approach, indicated by an increase in the funding rate.

As an analyst, I observed a significant surge in BTC’s funding rate within the past 24 hours, peaking at 0.0247 – a monthly high for this metric. When the funding rate increases, it signifies that investors are generally optimistic about Bitcoin’s price trajectory and anticipate further growth on its charts.

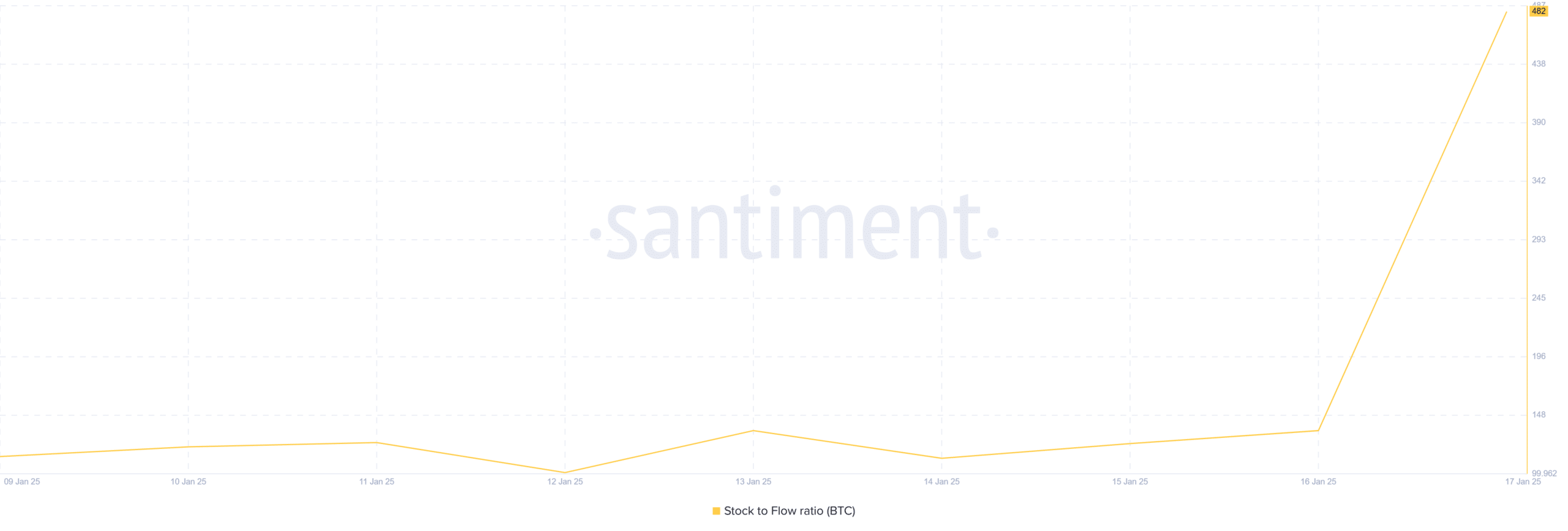

In summary, Bitcoin’s scarcity has significantly increased, which can be seen through a rising stock-to-flow ratio. When Bitcoin becomes scarce, its worth tends to rise due to the principles of demand and supply. This increased scarcity suggests that more individuals are choosing to store their Bitcoins in personal wallets, indicating a trend towards accumulation.

Essentially, the publication of favorable Consumer Price Index (CPI) inflation figures has noticeably impacted Bitcoin’s price trajectory. Consequently, investors are feeling optimistic about the market’s future prospects, viewing these latest numbers as an encouraging signal.

Given the optimistic outlook in the market, it’s possible that Bitcoin may rise again towards $105,000. But, a potential correction might lead to a dip around $98,900.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Benny Blanco and Selena Gomez’s Romantic Music Collaboration: Is New Music on the Horizon?

2025-01-18 04:07