- ONDO hiked and broke out of descending channel despite whale exits

- Retail traders stabilizes ONDO as technical indicators highlighted bullish momentum

A significant investor, often referred to as a ‘whale’, has created a stir in the ONDO market by selling 10.97 million ONDO for approximately $13.57 million USDC. This transaction resulted in a substantial loss of around $3.8 million for the whale, who had held the ONDO for only three months. This sale was preceded by the whale’s previous purchase of 4,610.74 stETH valued at approximately $17.38 million.

Currently, ONDO is being traded at $1.36, having experienced a 9.65% increase over the past 24 hours. However, the recent decline has left some questioning if it will be able to maintain its rebound and regain investor trust.

Has ONDO broken free from its slump?

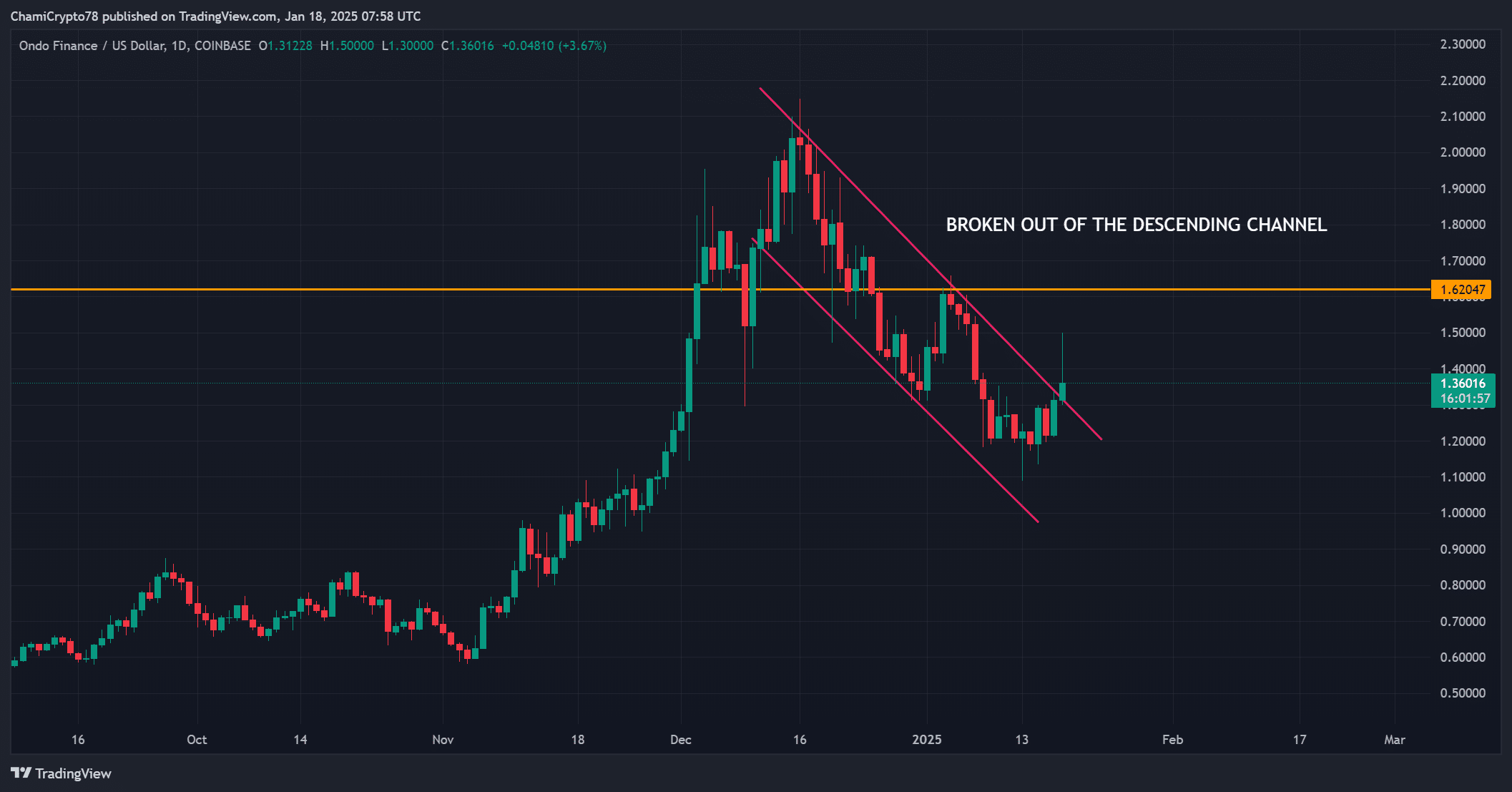

The behavior of the altcoin’s price suggests some positive indications, as it successfully breached a downward trendline that had been impeding its growth for nearly a month. Bouncing back from a low of $1.10, ONDO is now aiming to surpass the significant resistance point at $1.62.

At this stage, this crucial point has traditionally served as a formidable barrier for the bulls. Yet, it’s important to note that ONDO is significantly undervalued compared to its recent maximum of $2.20, which opens up questions about its future performance. Will ONDO continue its ascent and challenge fresh highs?

Technical indicators point to a bullish shift

As I compose this text, the Stochastic RSI appears to indicate a surge in bullish energy, as the %K line stands at 58.87 and crosses above the %D line at 42.84, which is often seen as an increase in buying pressure. Furthermore, the upward trend of this indicator suggests that the token could soon reach an overbought state.

As an analyst, I observed that the Parabolic SAR supported my optimism, as it showed dotted markers forming beneath the price action, initially at $1.10. This suggested a possible reversal towards an uptrend. Yet, if the price fails to surpass $1.62, there could be renewed selling pressure, potentially dampening the bullish forecast I previously held.

ONDO’s network activity – Growth or uncertainty?

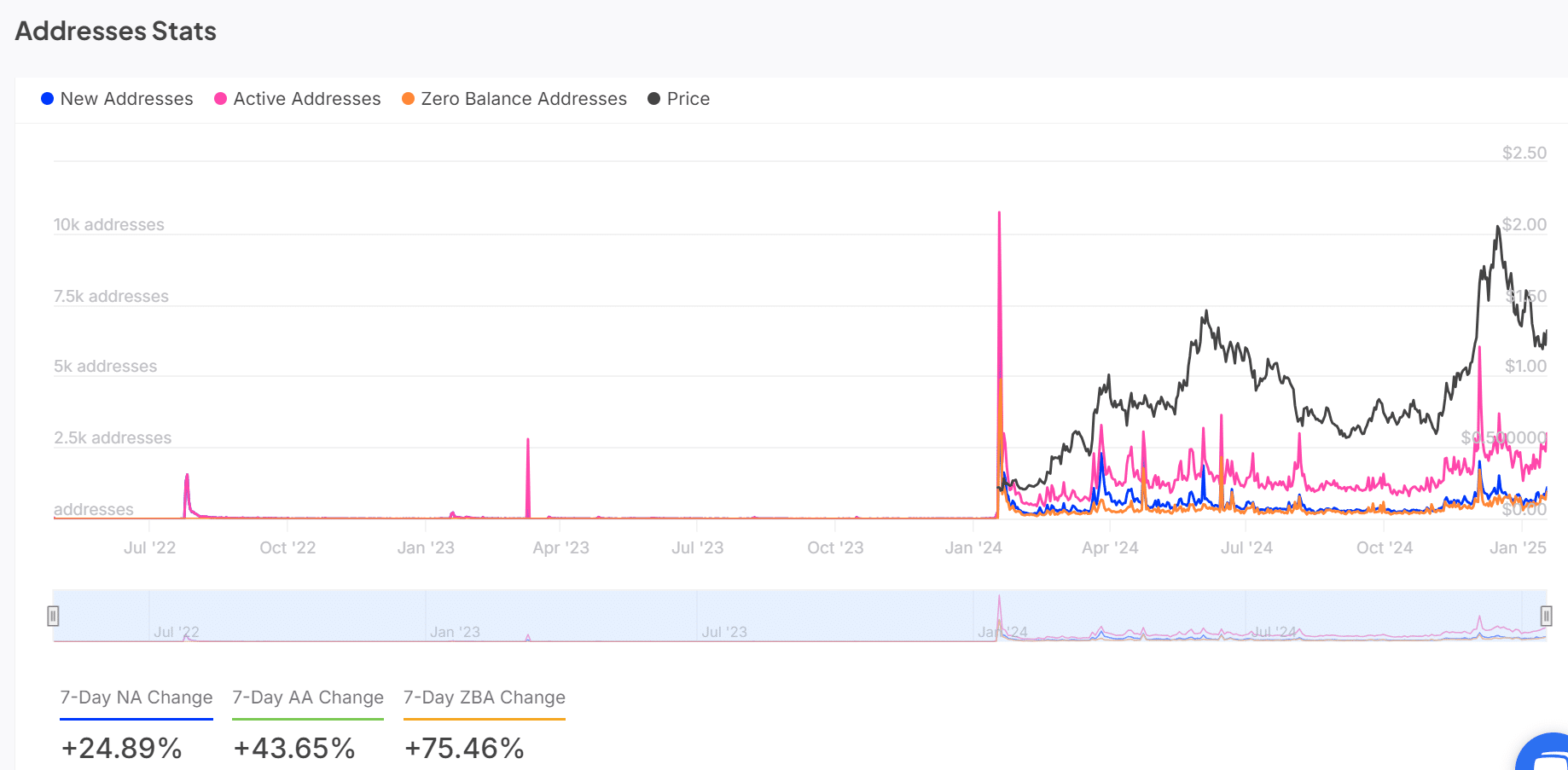

The analysis of network activity shows a blend of feelings among investors. The number of active participants has increased by approximately 43.65% over the last week, and the creation of new participants surged by around 24.89%. This indicates an uptick in investor interest.

On the other hand, there’s been a 75.46% increase in the use of zero-balance accounts, indicating that some investors might be closing their positions. This trend suggests that while ONDO is gaining new investors, doubts about its future persist among some.

Transactions reveal a retail-driven recovery

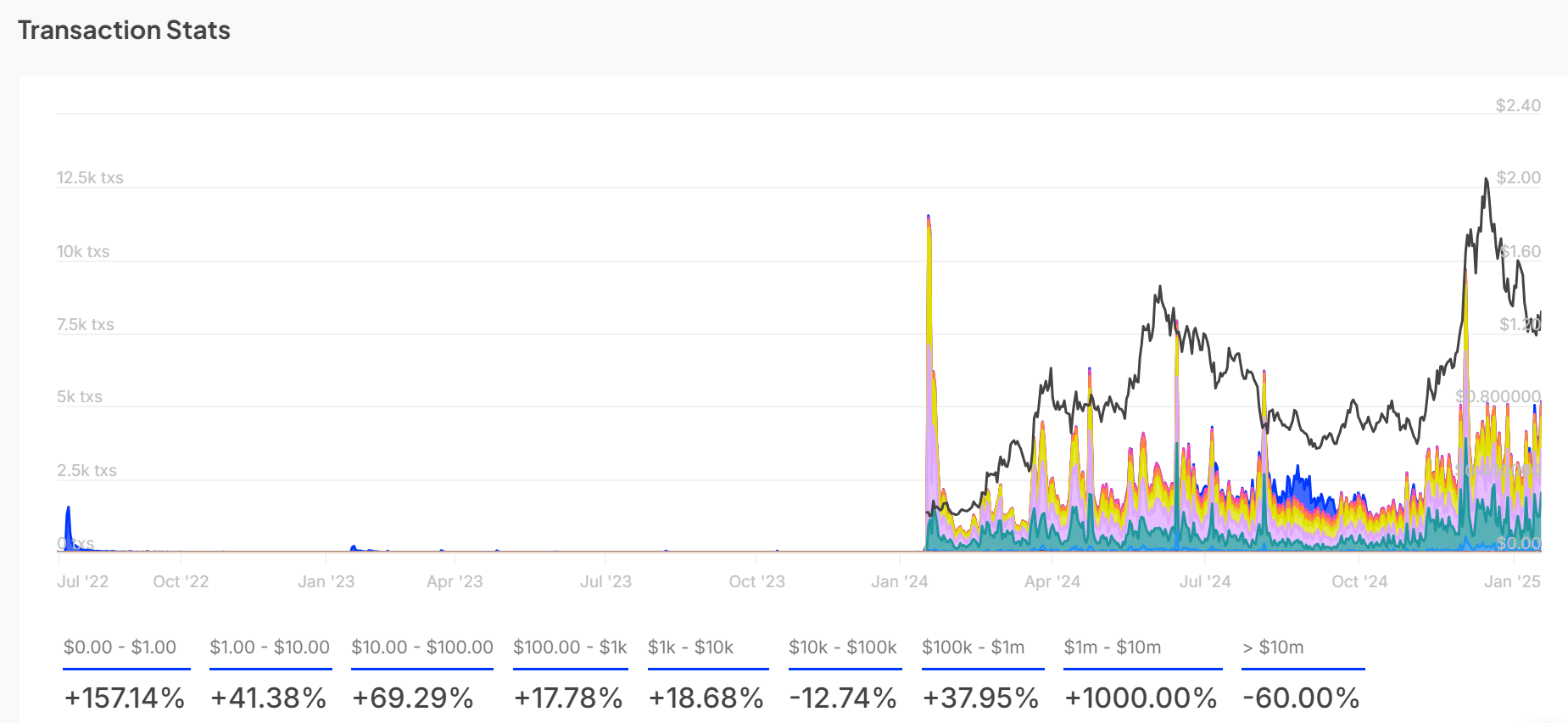

The statistics of transactions showed a change in market behavior, as small investors (retail traders) became more active while bigger players (whales) seemed to withdraw. Transactions valued less than $10 million saw an increase of 69.29%, whereas large transactions worth more than $10 million decreased by 60%.

As a researcher examining market trends, I’ve noticed a crucial pattern: smaller investors have been instrumental in propelling ONDO’s price movements. Yet, the lack of whale involvement might hinder its capacity for a robust comeback unless we see substantial financial reinforcements pouring in.

Is ONDO safe from liquidation shocks?

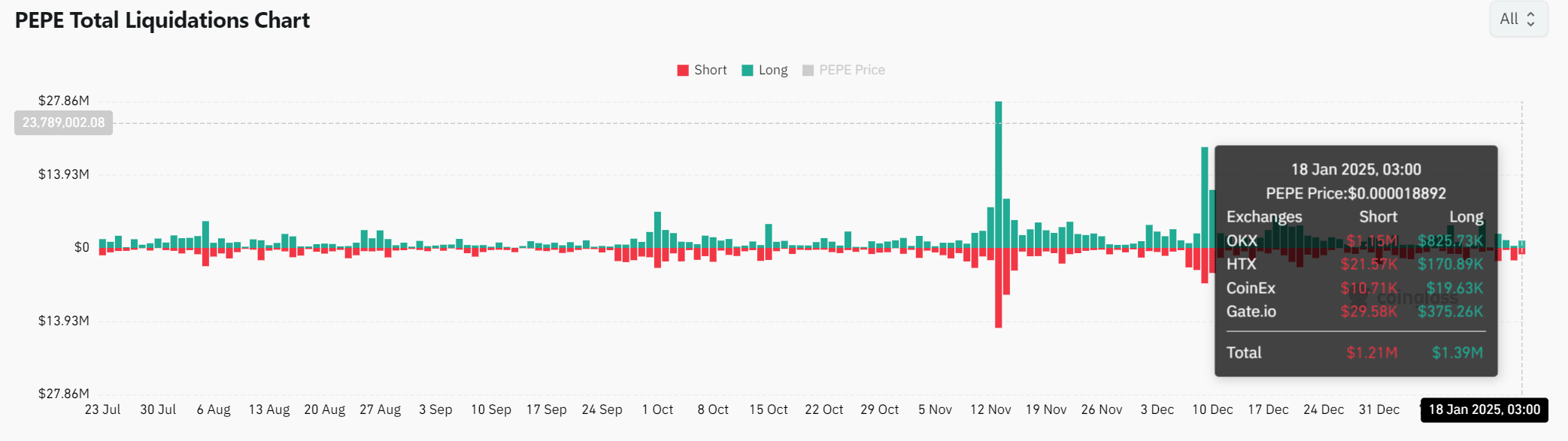

The data on liquidation shows that the token has withstood significant market turbulence surprisingly well, even after the departure of the whale. Compared to other tokens, both long and short liquidations have been limited, indicating a relatively tranquil market reaction.

Although it currently appears tranquil, a sudden increase in market turbulence can’t be completely discounted. In fact, if significant investors choose to withdraw from their investments, the current peace could prove to be fleeting and signal an impending storm of uncertainty for investors.

Read Ondo Finance’s [ONDO] Price Prediction 2025–2026

As an analyst, I find myself experiencing a sense of cautious optimism regarding ONDO. The company’s recent breakout from the descending channel suggests a potential shift in its market trend, which is certainly intriguing. Moreover, the rising retail interest in ONDO adds to this optimistic outlook, indicating increased investor confidence and potential growth opportunities.

Nevertheless, with no signs of whale activity or resistance at $1.62, it faces considerable hurdles for recovery. Its potential rebound heavily depends on conquering resistance points and earning sustained trust from investors in the approaching period.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-18 21:11