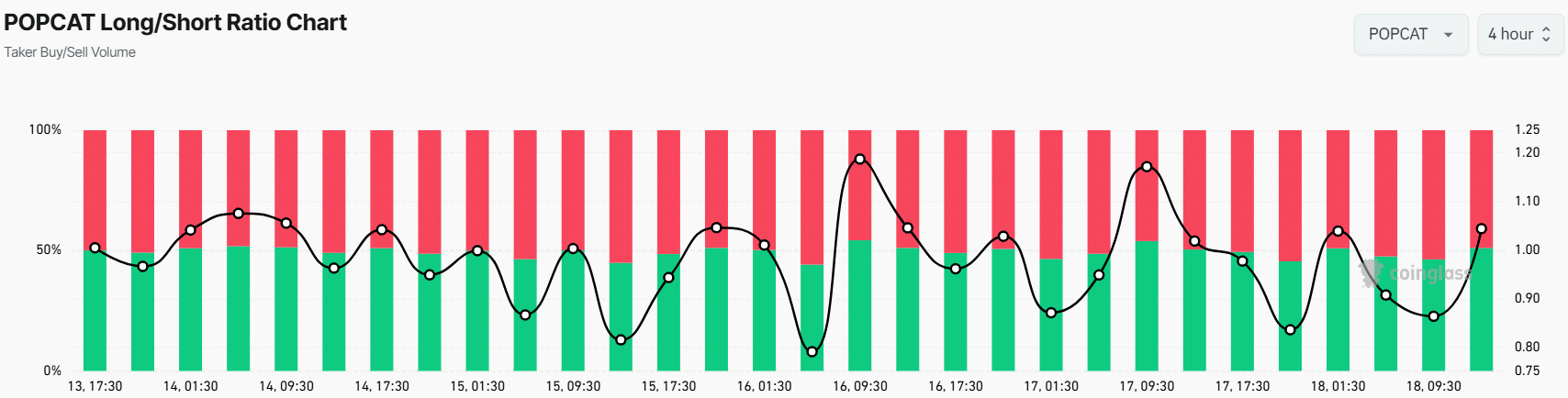

- POPCAT’s Long/Short ratio had a reading of 1.05, indicating strong bullish sentiment among traders

- POPCAT’s RSI suggested there may be enough room for the memecoin to rally

As the broader market shows signs of recuperation, the Solana-backed meme token POPCAT has garnered significant interest among traders and investors. Notably, this surge in attention followed a breakout from a lengthy consolidation period on the charts, which lasted over eight consecutive days.

POPCAT breaks out from prolonged consolidation

On the rear side of this recent development, the general opinion about POPCAT may be preparing to move from a decline to an increase. Interestingly, the meme token has already experienced a significant rise exceeding 23%. Nevertheless, it appears that a small price adjustment or correction is currently taking place.

Over the past two and a half months, I’ve noticed that the memecoin hasn’t been thriving. It’s been hit by prolonged periods of negative momentum, causing its value to plummet by more than 70%. Moreover, it seems to encounter resistance at a particular trendline. Whenever the price of POPCAT gets close to this line, it tends to reverse direction, which I believe is a result of this resistance.

POPCAT technical analysis and key levels

Once more, following an increase of over 23%, the price has touched the established trendline. As I write, it appears that a potential price adjustment or dip might occur at this point.

Based on AMBCrypto’s technical assessment, if POPCAT manages to break through this robust trendline and concludes a daily session above the $0.75 mark, there’s a high probability it could surge by approximately 50% to reach the potential resistance level of $1.15 in the near future.

At this moment, I observe that the memecoin’s current trading price falls beneath the 200-day Exponential Moving Average (EMA) in the daily chart setup. This suggests a downward trend for the memecoin, as per my analysis.

From a technical standpoint, since POPCAT’s Relative Strength Index (RSI) is at 43, this could indicate that there’s potential for the memecoin to experience a substantial increase in value in the days ahead.

Bullish on-chain metrics

Given the positive technical indicators and the memecoin’s price movements, short-term traders are currently showing increased enthusiasm.

Indeed, according to the insights provided by on-chain analytics company Coinglass, it appears that these traders are heavily favoring long positions over short ones. The POPCAT Long/Short ratio indicates a value of 1.05, suggesting a generally optimistic outlook among traders.

To add more clarity, approximately half (48.5%) of the leading traders were holding short positions, while a slightly larger portion (51.5%) were in long positions. Interestingly, it seemed that the percentage of traders with long positions was steadily increasing.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-19 00:07