- Bitcoin’s cost basis revealed stark contrast between long-term holders and recent buyers

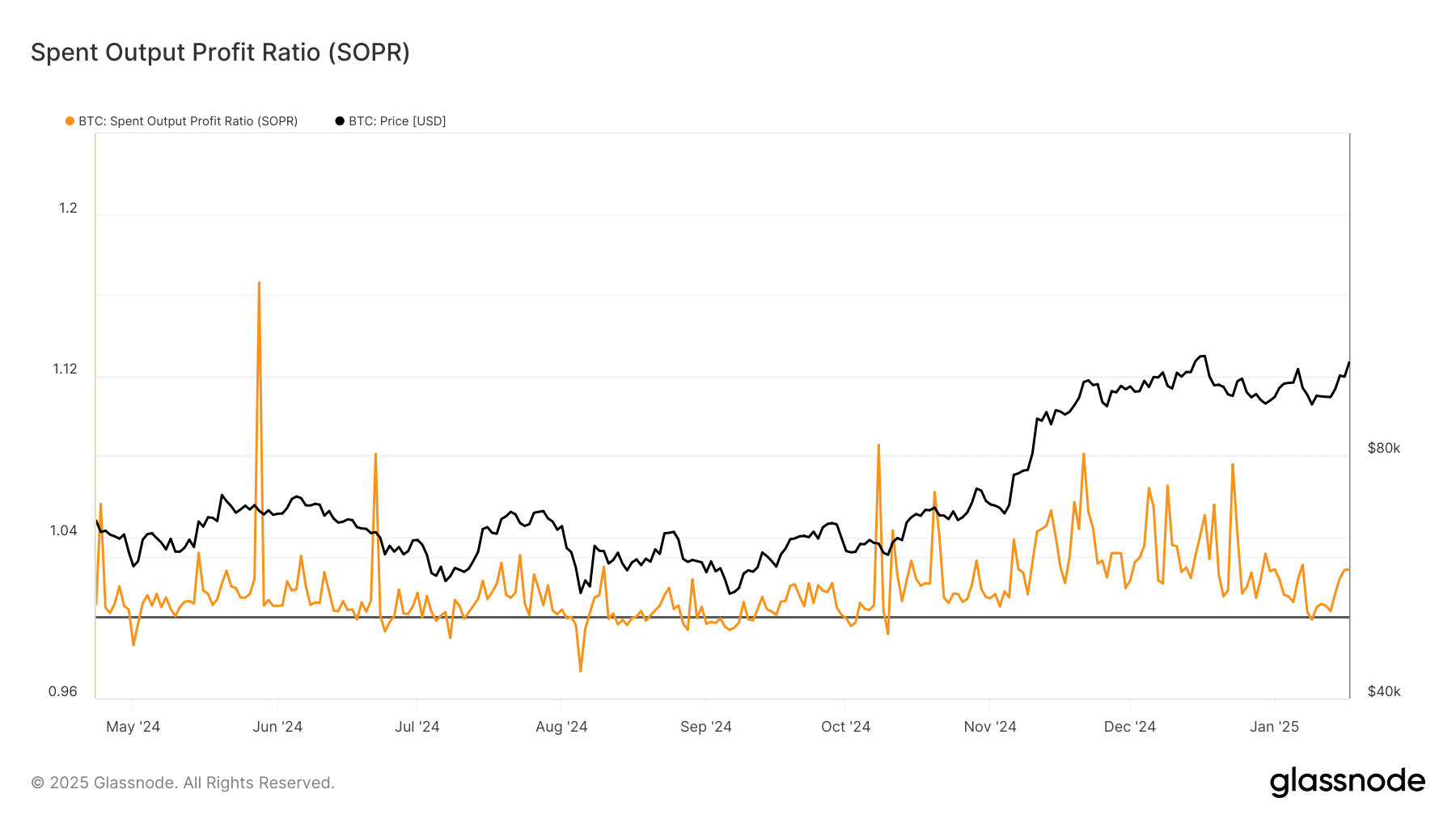

- SOPR maintained 1.04 level as whale addresses accumulated through the $105K test

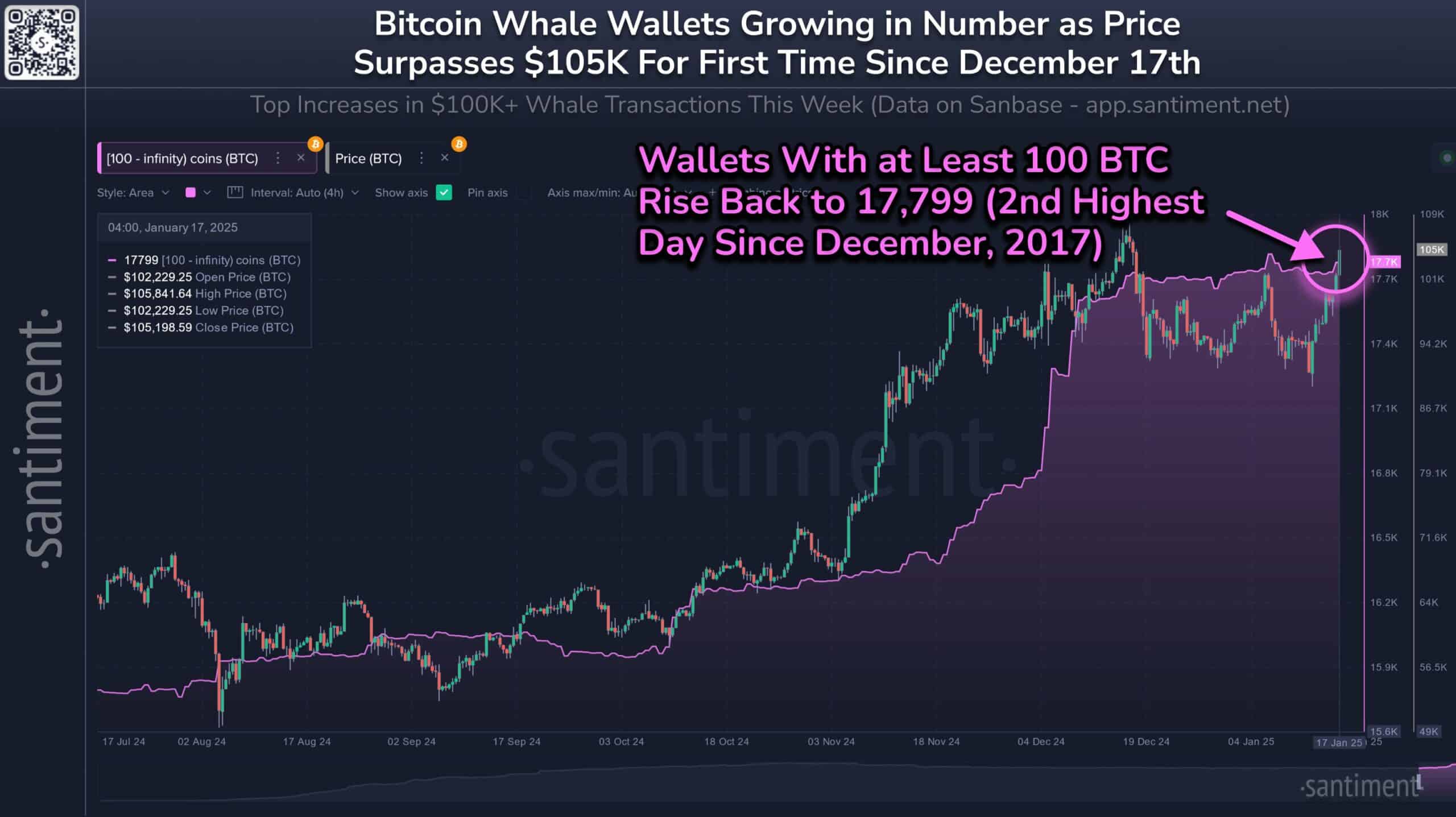

The structure of Bitcoin’s market has experienced a substantial change as large investor accounts (whales) have accumulated amounts similar to those seen in December 2017. This adjustment appears to align with the cryptocurrency’s price movements testing significant resistance levels above $105,000.

In the midst of a noticeable split between long-term investors’ strategies and those who trade more frequently, this institutional stance is being taken. Moreover, this pattern suggests that the market may be reaching a mature stage.

Strategic Bitcoin whale positioning intensifies

Currently, the number of Bitcoin addresses holding at least 100 Bitcoins has climbed to 17,799 – Reaching one of its highest points since December 2017. This significant increase happened alongside BTC‘s recent spike to $105,841.64, which suggests that institutional investors are strategically amassing Bitcoin.

remarkably significant is the rapid increase in the stacking trend that started in October 2024, with approximately 16,200 whale addresses – This represents an almost 10% rise in the concentration of large holders over a span of merely three months.

During the November-December timeframe, an increase in whale acquisition was particularly notable, mirroring Bitcoin’s consistent surge past the $90,000 threshold.

Bitcoin’s market structure signals maturity

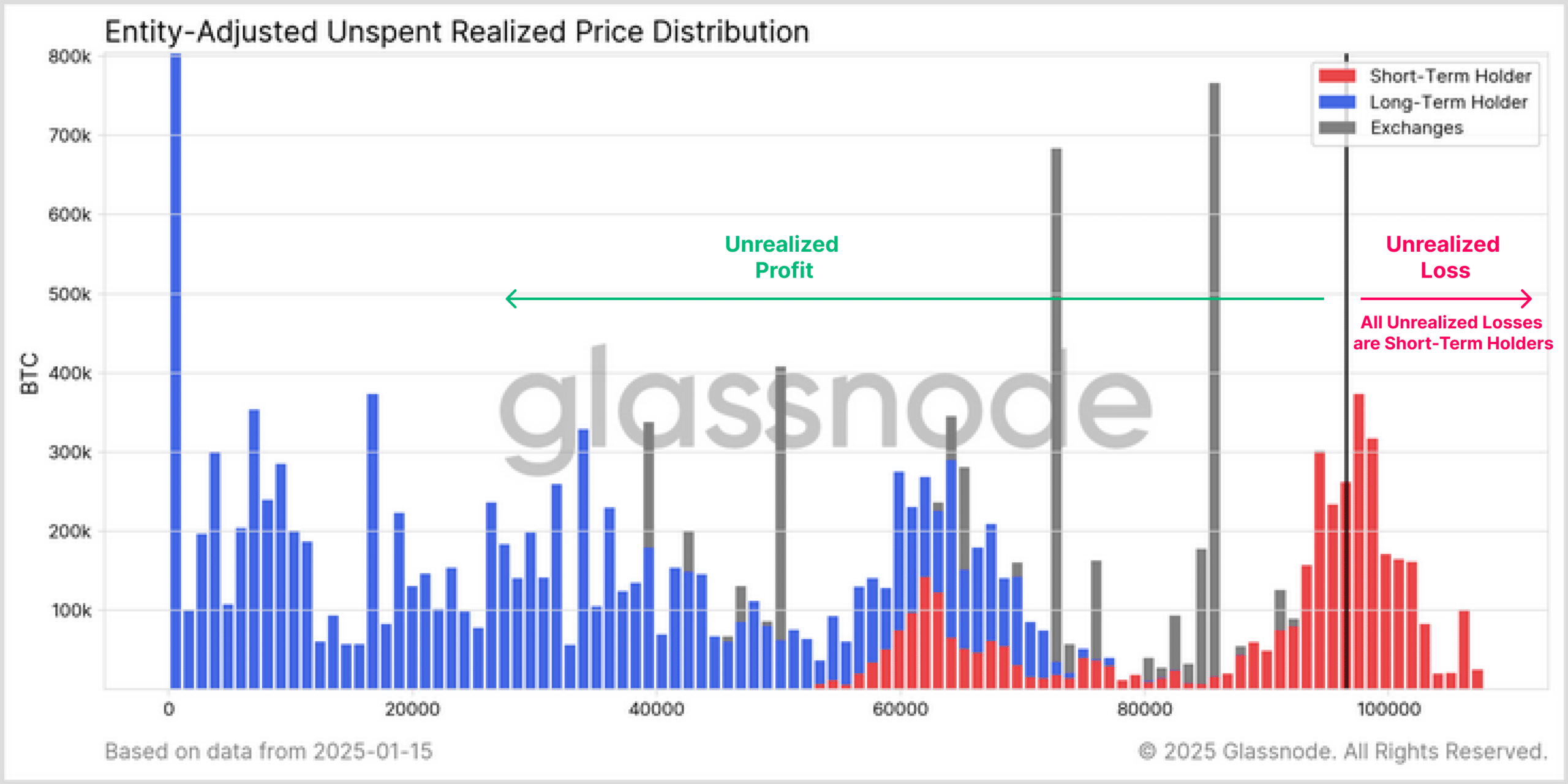

Building even more confidence in the optimistic outlook, the distribution pattern of Bitcoin’s average purchase price suggests an intriguing market trend.

Short-term investors have suffered losses that haven’t been realized yet, and these losses are mainly concentrated among those who bought within the last 155 days. Conversely, long-term holders are enjoying substantial unrealized profits, as large accumulation areas can be seen in the range of 20,000 to 40,000 BTC.

It was particularly noticeable that long-term investors tended to cluster around lower price points (indicated by the blue bars), while short-term traders were more active at higher prices (represented by the red marks).

Instead of the gray bars representing holdings, there were significant peaks (above 600,000 BTC) that stood out, suggesting a strategic move by institutions rather than a mass sell-off due to panic.

This way, it’s easier to understand and follows a conversational style.

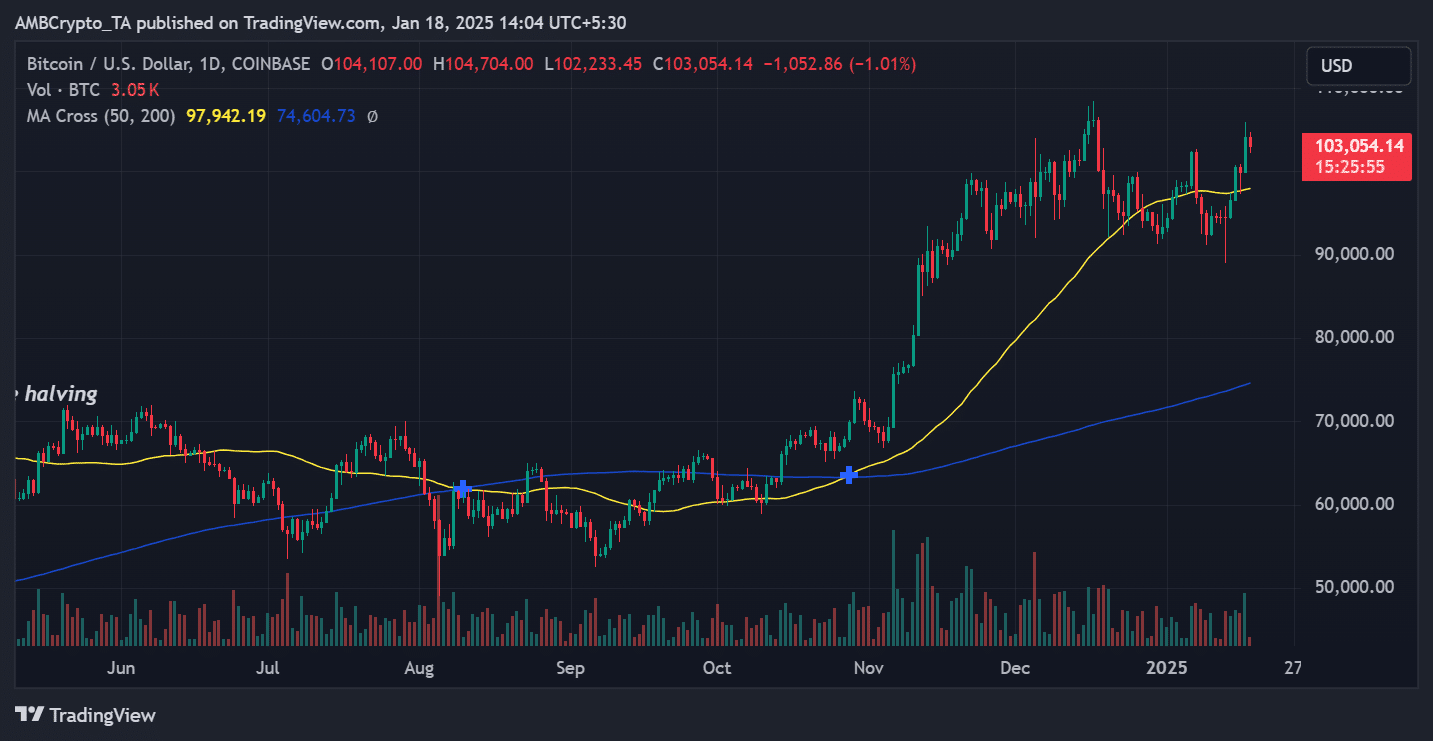

Strong technical foundation supports BTC’s uptrend

Based on these on-chain indicators, Bitcoin’s price movements continued to show a bullish trend, and its 50-day moving average of $97,942.19 offered robust support, significantly higher than the 200-day moving average at $74,604.73.

This significant gap between moving averages, over $23,000, highlighted strong upward momentum.

3,050 units of Bitcoin were recently traded at a price of $103,054.14, showing continued institutional appetite for this asset. Furthermore, the pattern of successive higher bottoms since November has created a solid technological basis.

The dip from $105,841.64 back down to its current prices signifies a normal consolidation period, not a change in the overall direction of the trend.

On-chain metrics confirm Bitcoin’s strength

Since the surge in November, the Spent Output Profit Ratio (SOPR) has provided additional assurance, consistently staying above 1.0. This means that this ratio, currently around 1.04, suggests that a majority of Bitcoin transactions have resulted in moderate profits, not leading to widespread selling.

Eventually, the analyzed netflow patterns demonstrated a systematic dispersal strategy, as the recorded inflows totaled 308.7 BTC, indicating deliberate amassing instead of redistribution.

Previous sharp increases in historical netflow data, notably the ones that occurred in December, tend to be followed by significant changes in prices, suggesting that influential market players may be strategically positioning themselves.

– Read Bitcoin (BTC) Price Prediction 2024-25

Moving forward, if Bitcoin manages to maintain its position above the significant $100,000 threshold with expanding institutional wallets, this could indicate a strengthening of underlying market conditions. The alignment of several favorable factors – an increase in large investor accounts (whales), robust SOPR levels, strong moving average support, and strategic exchange transactions – points towards Bitcoin’s market structure remaining resilient.

Keep a close eye on the $105,000 mark as a breakthrough could potentially initiate the next major price movement in trading.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-19 03:04