- AI16Z could decline further before rebounding and rallying to $2.6

- Top traders on Binance and OKX traders are now accumulating the token, placing significant buy orders

For the last seven days, AI16Z has experienced a significant decline of 19.05%. In just the past day, there’s been an additional drop of 4.59%. Its chart trends suggest that further decreases may be possible.

On the contrary, as per AMBCrypto’s evaluation, it appears that skilled traders on Binance and OKX are deviating from the general pessimistic outlook. This suggests that there might be a degree of optimism among seasoned market participants, even though the altcoin is currently exhibiting a bearish trend.

Is a drop imminent for AI16Z?

Over the past month, the AI16Z’s price movement on the daily chart can be described as being confined to an upward sloping channel, marked by progressively higher peaks (higher highs) and troughs (higher lows), with this channel having clear boundaries defined by support and resistance levels.

Currently, when I’m typing this, the price has pulled back from the resistance level of the channel, creating a new lower minimum as the asset starts to slope downward gradually.

As an analyst, I’m observing a potential trend based on our chart analysis. It seems that the current drop may find a halt at the 0.618 Fibonacci retracement level. This aligns well with the ascending channel’s base around $0.80, which is recognized as a significant support zone for this cryptocurrency.

AI16Z, currently situated within a supportive area, could potentially regain momentum and surge towards $2.60. This projected rise signifies a potential increase of 325% from its current level at $0.80.

Top traders buy against market odds

At the current moment, market indicators seem to predict a possible downturn; however, leading traders on Binance and OKX are opting to go long on AI16Z. This pattern was recognized by examining the long-to-short ratio, which compares the number of buyers to sellers. A ratio greater than 1 suggests there are more buyers, while a figure less than 1 implies that sellers hold more power.

As I’m typing this, the long-to-short ratio was 3.3497 for Binance’s leading traders and 4.15 for OKX’s top traders. Such high numbers suggest that there is a lot of optimistic sentiment among experienced traders, which might lead to a larger market surge.

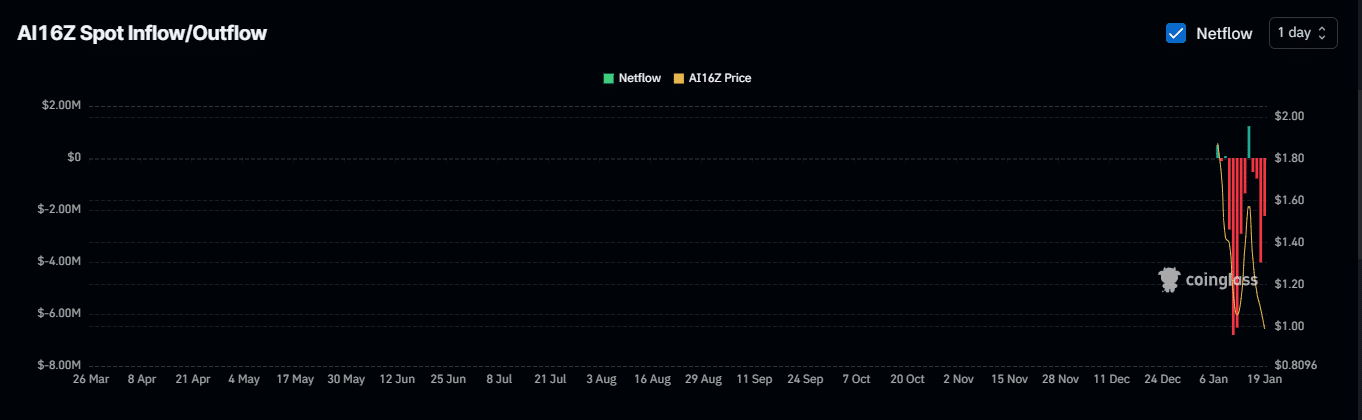

The data from spot trading also reinforces a positive outlook, as it shows that the availability of AI16Z on cryptocurrency platforms has been gradually diminishing. This reduction suggests that long-term investors are accumulating this asset.

Over the past day, the net flow of tokens (a measure showing the direction of token movement between exchanges) was -$2.74 million, indicating that approximately $2.74 million in AI16Z tokens were withdrawn from exchanges and stored in personal wallets for a longer period.

For the past five days, there’s been a consistent decrease in outflows related to AI16Z, totaling around $8.24 million. This persistent withdrawal suggests that investors maintain a steady level of trust and confidence.

Bullish momentum strengthens for AI16Z

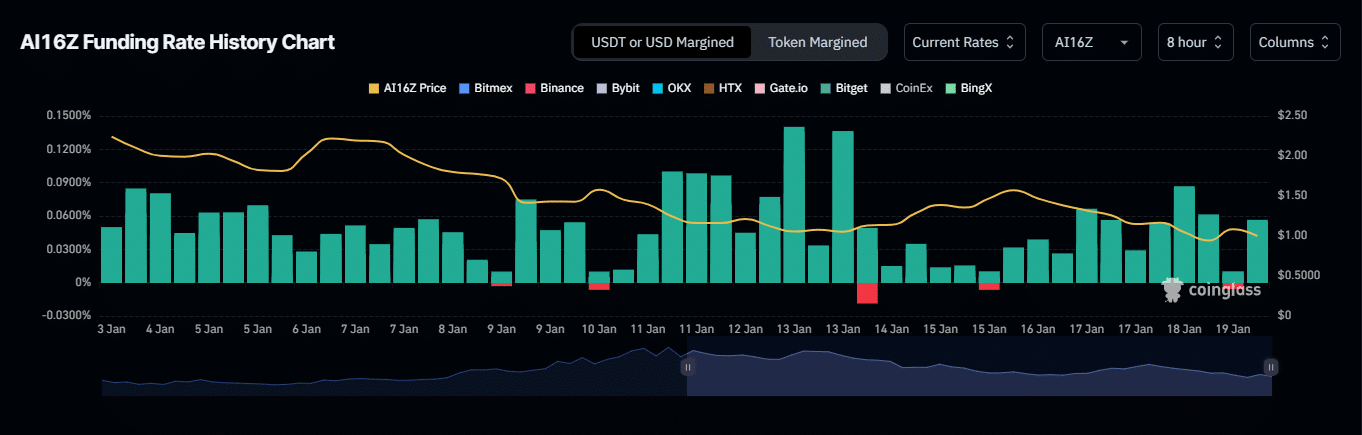

For AI16Z, there’s been a notable increase in optimism within the wider derivatives market. Both the financing cost (funding rate) and active positions (Open Interest) are trending upward.

In simple terms, the funding rate, which shows if buyers or sellers have more control in the market, is showing that long traders are currently paying a higher price (premium). At its highest point since January 13 at 0.0440%, this high funding rate underscores the strong presence of buyers within the market.

The rising optimistic market condition mirrors a growth in Open Interest, a metric indicating the combined worth of unresolved derivatives contracts. Specifically, AI16Z’s Open Interest saw an increase of 5.43%, reaching $206.52 million, suggesting that there is growing certainty among traders.

When Open Interest and the funding rate both rise, it indicates high confidence among derivative market players. This confidence could significantly boost the market’s upward momentum.

To reach new peaks for AI16Z, it may be essential for some crucial indicators to change or deviate. At present, if no such shift occurs, the asset will probably continue within its existing bounds or even rise further from here.

Read More

2025-01-19 23:04