- Ethereum has historically soared in Q1, with returns often doubling

- However, with growth slowing down, the stakes are now higher

Last year on Election Night, Ethereum experienced its longest upward candlestick in three months, surging by 12% in a single day to close at $2,721. Fast forward to January 19th, and the price has dropped by 20% from its peak of $4,015 during that rally.

Given the current state of events, the forthcoming week will challenge Ethereum’s traditionally strong performance in Q1. The question remains: will it meet expectations?

In crypto, history matters

Historically, Ethereum has seen significant growth during the first quarter, with returns sometimes increasing two or even three times over the past four years. In 2023, Ethereum experienced a rise of 54%, reaching approximately $1,800 by the end of the quarter. Nevertheless, it’s worth noting that the exceptional performance occurred in 2021 when Ethereum skyrocketed by 160% to reach $1,920 within just three months.

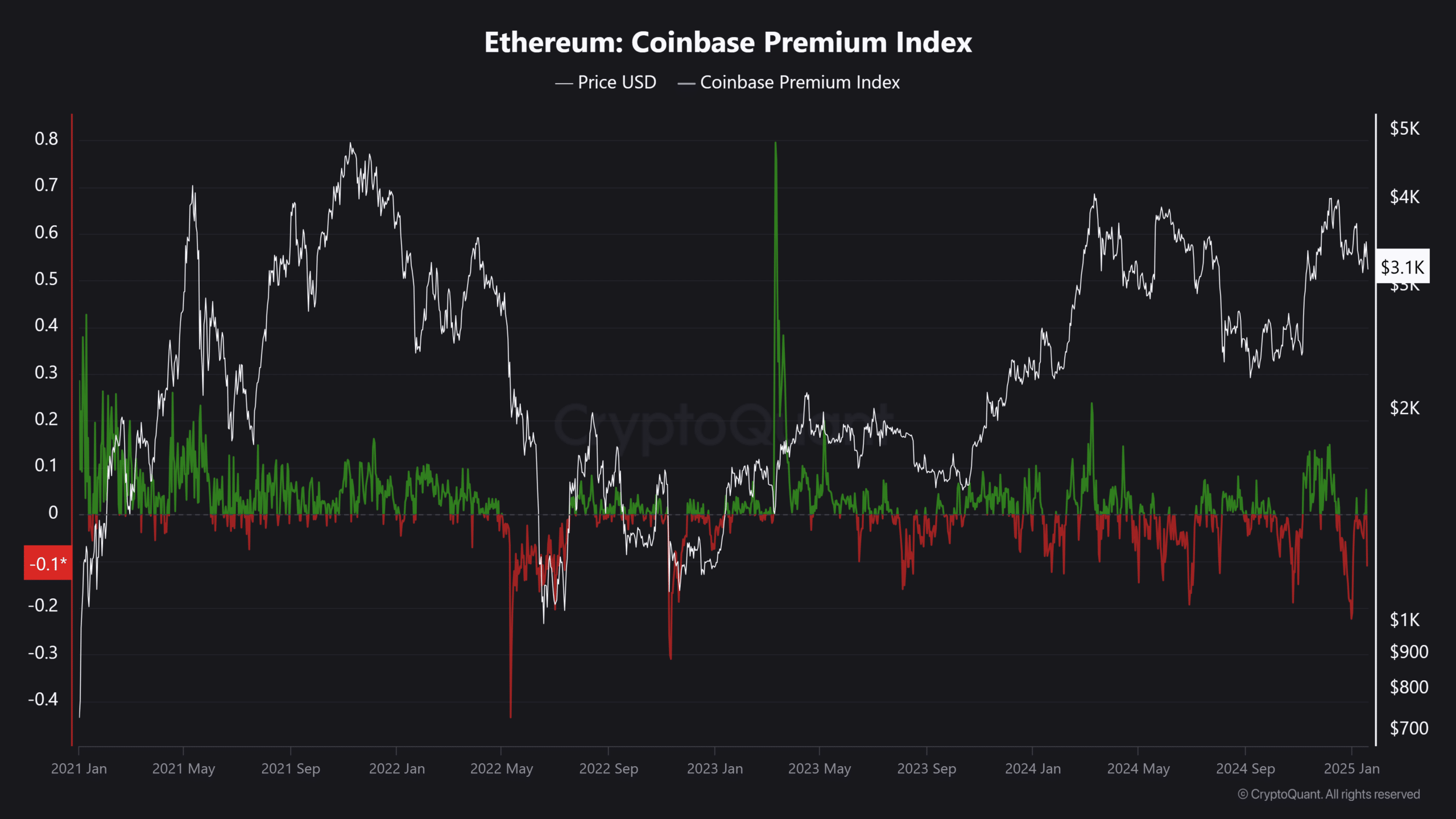

It appears that growth has decelerated since that time and annual profits are diminishing, posing a challenge for long-term holders. This change in attitude can be seen in the Coinbase Premium Index (CPI), which signifies a decrease in purchasing enthusiasm.

Despite the overall cryptocurrency market capitalization reaching a record peak of $3.70 trillion during the post-election surge last year, the intense buying interest in Ethereum (ETH) among U.S investors failed to significantly impact the Consumer Price Index (CPI), suggesting a decline in overall market excitement.

Four years ago, Ethereum’s market value peaked at an astounding $500 billion and its price reached a staggering $4,760. However, at the present moment, it has dropped by 22%, currently trading at approximately $3,200. With quarterly returns showing signs of slowing, Ethereum investors are being challenged as ETH battles to surpass its significant psychological price barriers.

Although the overall market is recovering, Ethereum’s inability to exceed $4k is strikingly different from XRP, which has already spiked by 53% this quarter. It seems investors are eager for more substantial gains, and other major cryptocurrencies are responding accordingly.

Ethereum at risk of being left behind

Taking a closer look, the market value of XRP has soared to an unprecedented peak of $180 billion, which currently makes up approximately half of Ethereum’s total market cap. While Ethereum has experienced a 3% decline since the beginning of the year, XRP’s momentum suggests it might overtake Ethereum at a pace that outstrips expectations.

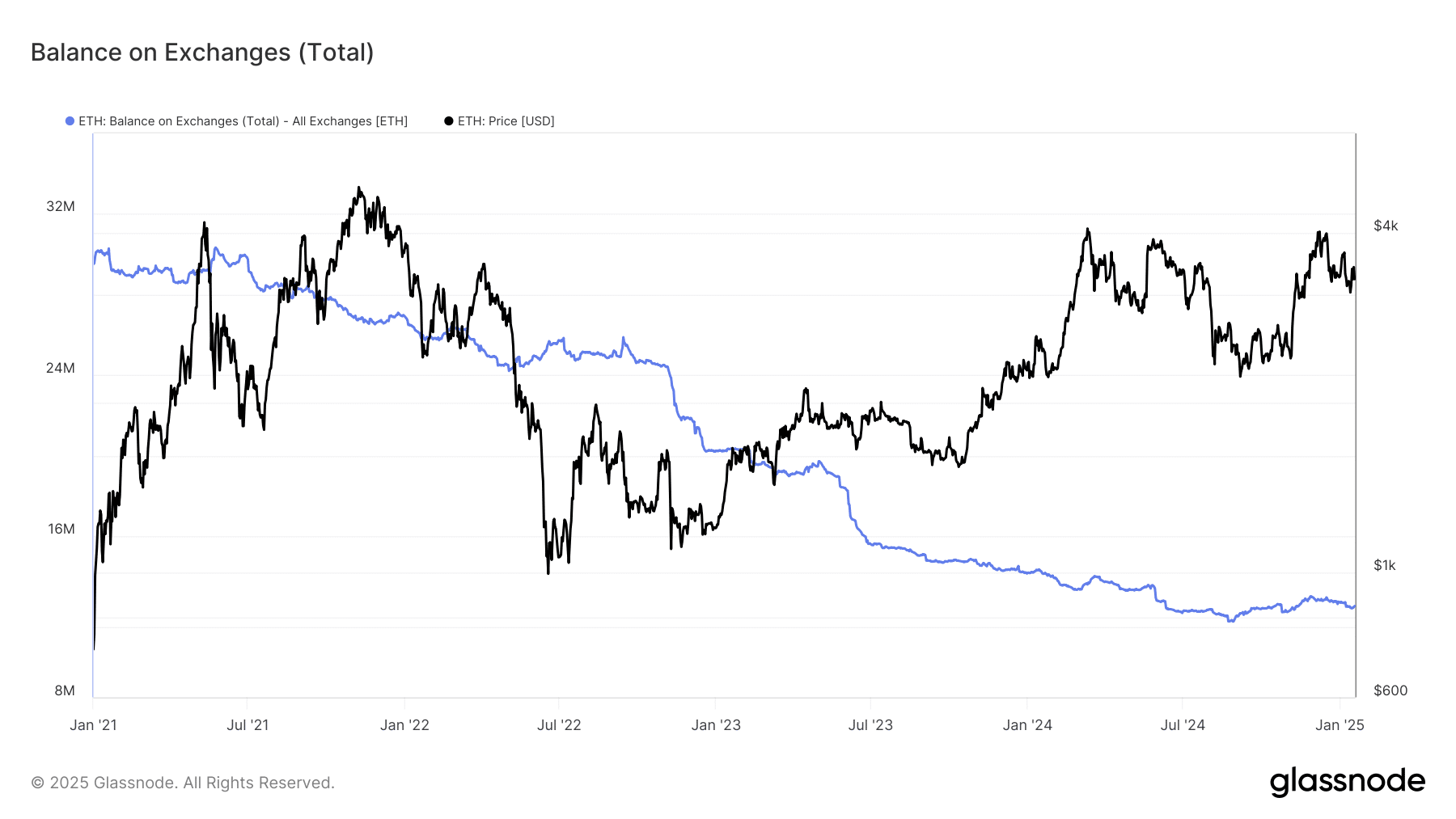

Despite an exit of approximately 540,000 Ether and an influx of about $1.84 billion into the market, Ethereum has experienced a 2% drop over the last month. Interestingly, the amount of Ethereum stored on exchanges also reached a record low during this period. This apparent lack of buying pressure raises concerns about Ethereum’s future trajectory.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Over the past year, long-term investors (LTHs) have significantly increased their holdings by as much as 75%. This represents a notable increase in their investment stance.

Nevertheless, as the expected returns are failing to meet mark, Long-Term Holders (LTHs) might be planning to leave their positions soon. This could mean that the $4k level becomes a significant hurdle for Ethereum in the approaching days.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2025-01-20 03:03