Bitcoin: The Dashing Rogue of the Financial World! 💰✨

- On-chain data reveals a delightful resurgence of buying interest and a rather charming reduction in supply on Binance, which has propelled Bitcoin’s recent price ascent.

- Open Interest and the bustling activity of addresses suggest a more robust market participation, hinting at the potential for further gains—how thrilling! 🎉

Ah, Bitcoin [BTC], that capricious creature, has embarked upon a most tumultuous journey since the dawn of this year. After a spirited rally, it found itself in the throes of a sharp correction, leaving many an investor in a state of delightful confusion regarding the market’s true inclinations.

🚀 EUR/USD to Explode? Trump Trade Shocks Incoming!

Don't miss the crucial analysis before the market reacts!

View Urgent ForecastYet, lo and behold! A recent surge on the 20th of January saw Bitcoin’s price ascend to a new pinnacle, momentarily surpassing the grand sum of $109,000. Such audacity!

Though the asset did experience a slight retreat, trading at a modest $107,945, it still boasted a commendable increase of 3.5% within the last 24 hours, reflecting a double-digit gain over the preceding week. Bravo! 👏

In the midst of this price frolic, analysts have been diligently scrutinizing key on-chain metrics, as one does when one is keen on understanding the whims of this digital darling.

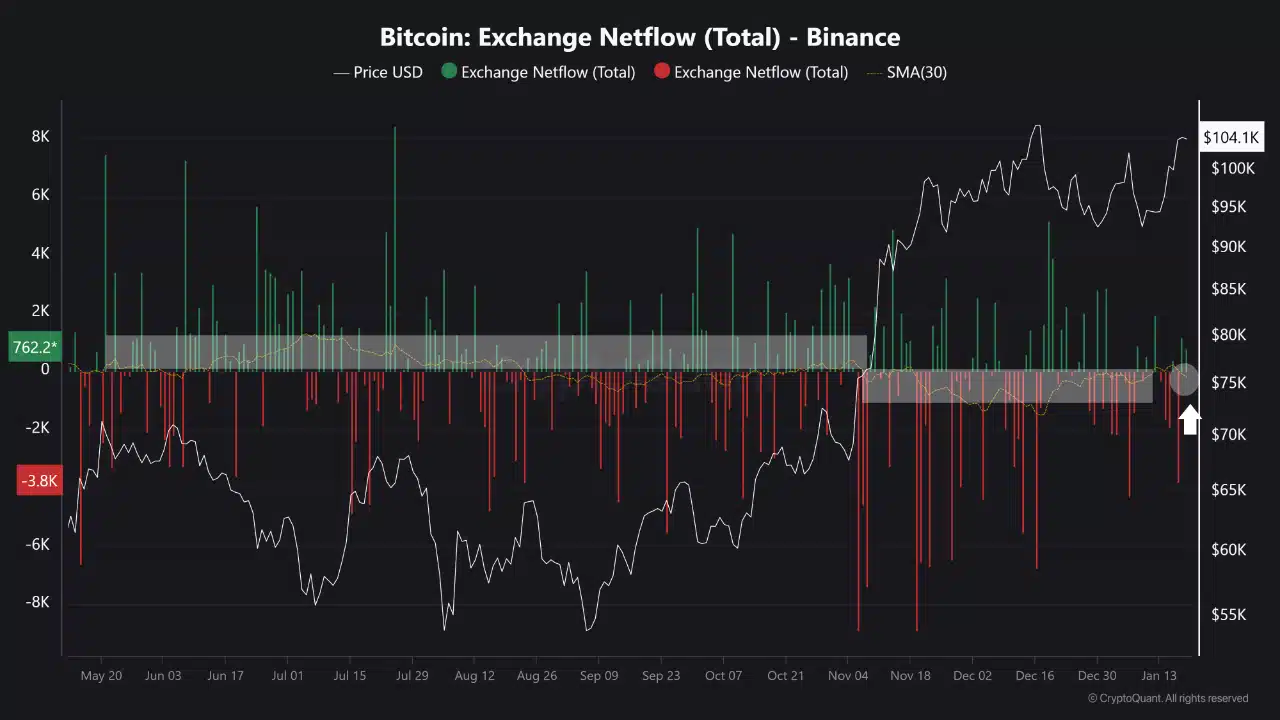

According to a certain CryptoQuant analyst, the Binance Netflow SMA30—a rather sophisticated 30-day moving average of netflows on Binance—has provided invaluable insights into market sentiment and price trends. How very astute!

The analyst notes that shifts in this metric often correlate with notable price movements, suggesting that this current rally may indeed have more room to gallivant. How delightful! 🕺

Bitcoin Netflow Trends and Market Dynamics

The Binance Netflow SMA30 metric has historically served as a rather useful oracle for predicting Bitcoin’s short-term price direction. When this metric ventures into positive territory, it often signals an increase in selling pressure, as more Bitcoin flows into Binance—how scandalous!

For instance, in May 2024, a positive Netflow SMA30 coincided with a rather dramatic drop in Bitcoin’s price from $71,000 to $50,000, highlighting a period of elevated supply and bearish sentiment. Oh, the drama!

Conversely, when the Netflow SMA30 turns negative, it typically indicates a delightful reduction in spot supply and a stronger upward momentum. This pattern was most evident in November 2024, when the metric shifted negative, and Bitcoin gallantly climbed from $74,000 to $108,000. How splendid!

As of the 17th of January, the SMA30 has returned to negative territory, resting at -207.85, suggesting a renewed buying interest and raising the tantalizing possibility of yet another rally to a new all-time high. How exhilarating! 🎈

Additional Insights

Beyond the Binance Netflow SMA30, other indicators have provided a broader perspective on Bitcoin’s near-term outlook, much like a well-rounded character in a novel.

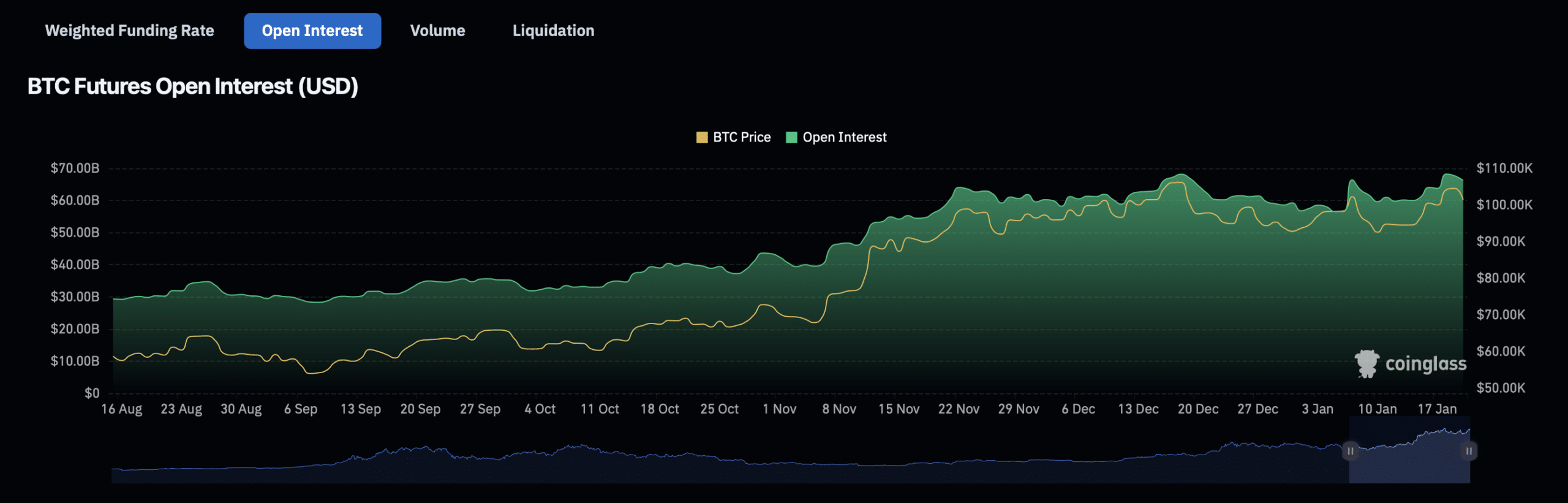

Open Interest data from Coinglass reveals a 4.61% increase in the last 24 hours, reaching a valuation of $71.21 billion. How positively riveting!

Open Interest volume has also surged by 156.60% over the same period, hitting $179.14 billion. These increases reflect a growing engagement among traders, which may influence Bitcoin’s spot price—how very

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

2025-01-20 21:11