- DeFi volumes on the SUI blockchain skyrocketed to the second-highest level in history at $672M.

- This surge could support gains for SUI, which has been under bearish pressure due to long liquidations.

Sui [SUI], at the time of writing, was trading at a weekly low of $4.32 after a nearly 5% drop in 24 hours. This decline coincided with a pullback across the altcoin market after Donald Trump’s inauguration emerged as a sell-the-news event. 😜

Despite this drop, Decentralized Finance (DeFi) activity on the SUI blockchain was surging and could aid the altcoin’s recovery from bearish trends. 🚀

SUI’s DeFi volumes take off 🚀

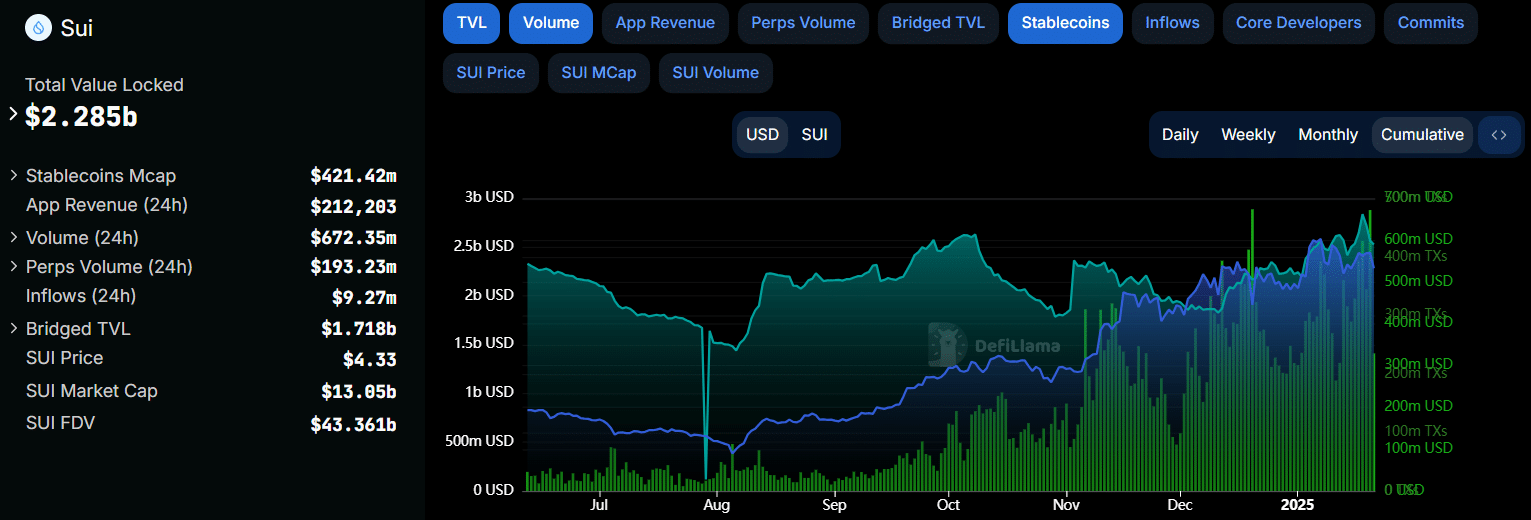

According to DeFiLlama, the daily DeFi volumes on the SUI network surged to $672M on the 20th of January. This marked the second-highest level in history. This rise shows growing interest in the DeFi protocols created on the network.

At the same time, the total market capitalization for stablecoins on the SUI network stands at $421M, which is at range highs compared to $301M at the start of the year.

Despite the rising volumes, the coin’s Total Value Locked (TVL) stood at $2.285 billion. This represents a nearly 12% drop from its all-time high recorded earlier this month. 📉

SUI price analysis 🔍

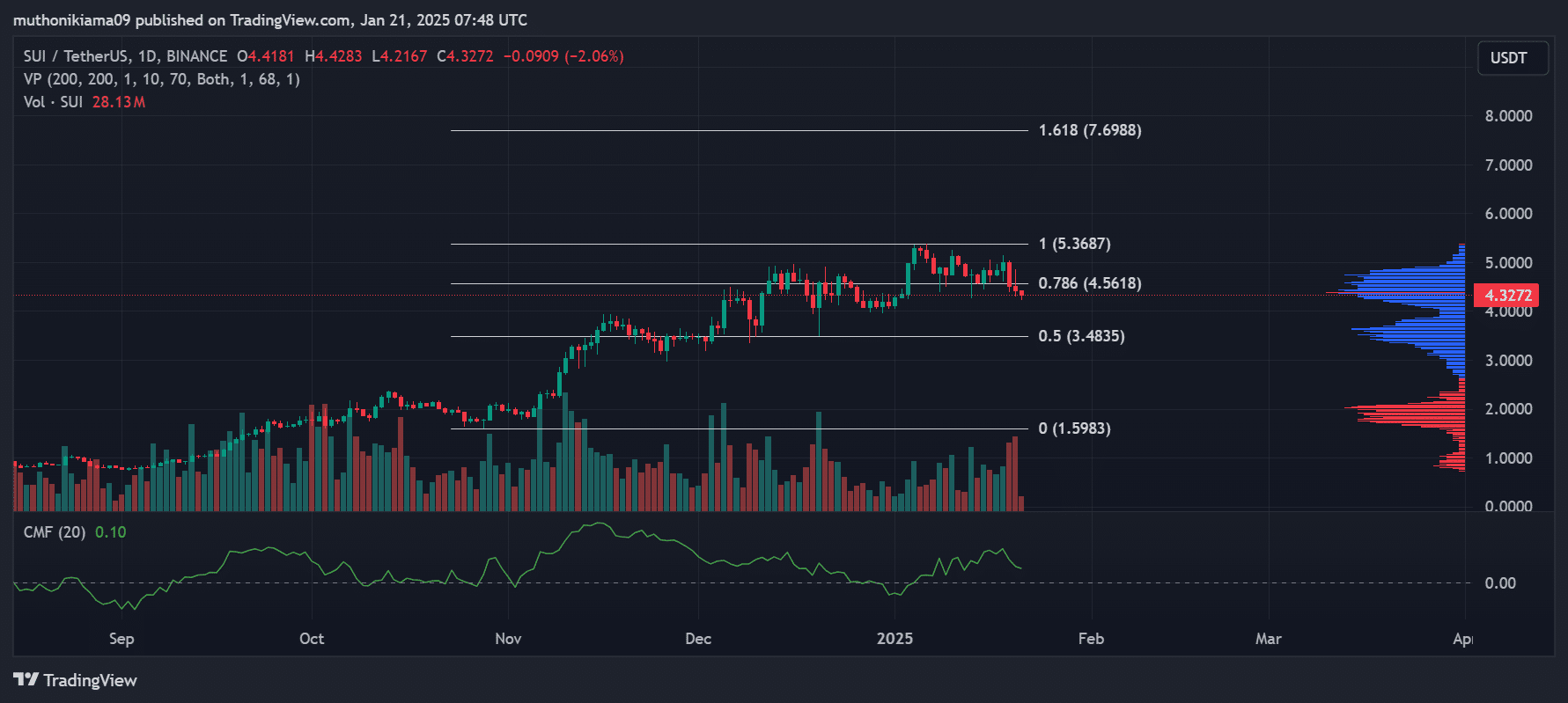

SUI’s price was at a pivotal point, attracting many traders, as highlighted by the volume profile indicator. The price has failed to defend the support at the 0.786 Fibonacci level ($4.56). This could trigger a drop to $3.48.

However, if buyers re-enter the market and defend this support, it could ignite a rally to $7.69, setting a new record high for the coin. 📈

The Chaikin Money Flow (CMF) indicator shows that buyers might be getting exhausted after a rapid surge in buying activity in the last three weeks. If this continues, it could strengthen the bearish trends. 🐻

Long liquidations fuel the downtrend 💸

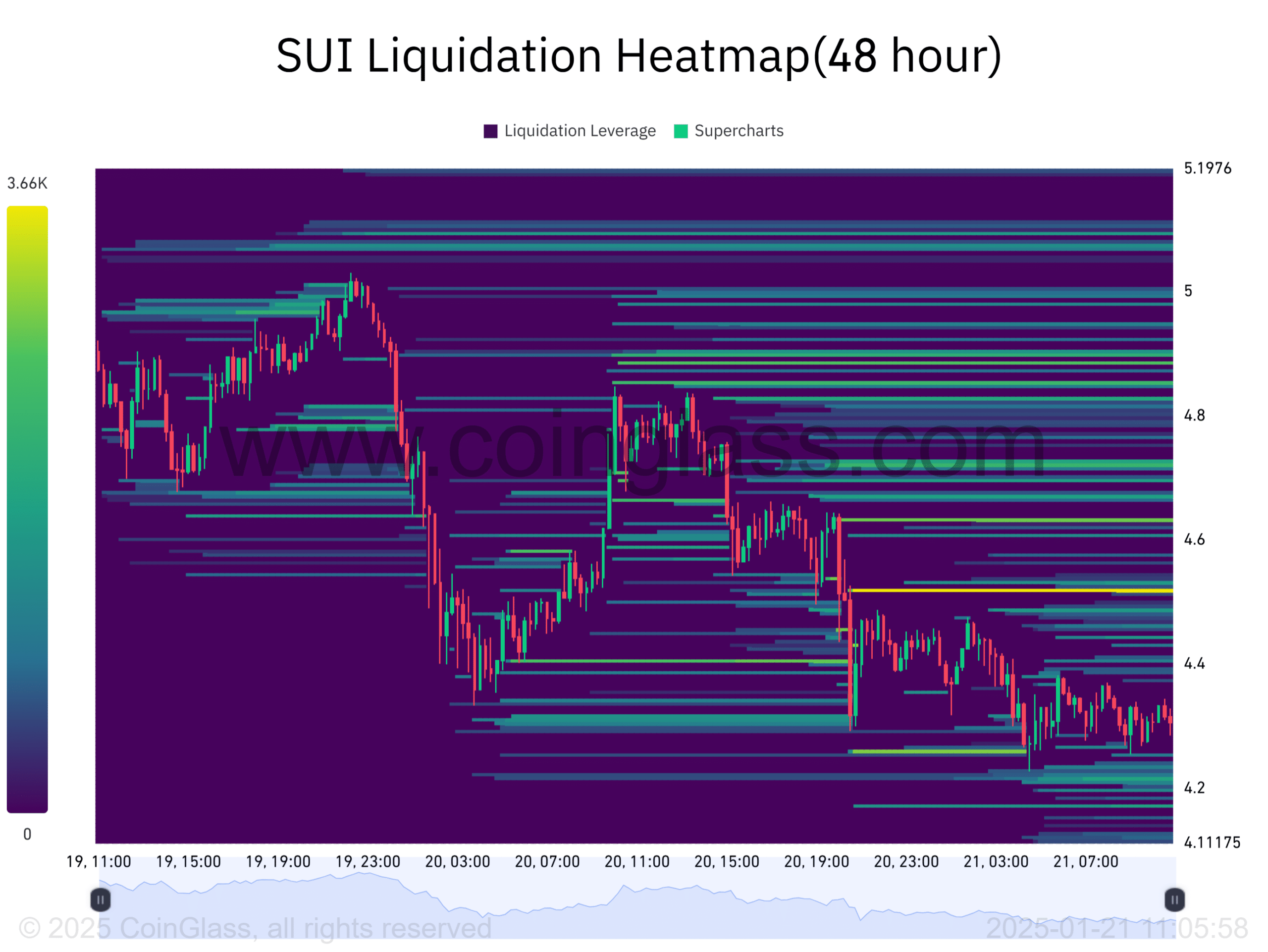

One of the factors that could be countering the buying pressure around SUI is a surge in long liquidations. Per Coinglass, more than $15M worth of longs have been liquidated in the last three days, causing forced selling that has weighed on the price. 😱

Forced liquidations have led to a decline in Open Interest, dropping to $1.56 billion, after reaching an all-time high on the 19th of January.

SUI’s liquidation heatmap with a 48-hour look back period shows more long positions at risk if the price drops further. 🔥

However, a liquidation cluster at $4.51 could turn the tide and trigger gains. A move to the upside could wipe out these short positions. 📈

The impact of long traders on SUI’s price action could also be short-lived amid a drop in funding rates to a weekly low of 0.0066%. This shows reduced demand for longs that could lower price volatility. 😴

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- How to Get to Frostcrag Spire in Oblivion Remastered

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Moana 3: Release Date, Plot, and What to Expect

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

2025-01-21 17:11