- Mapping Bitcoin’s price prediction as BTC consolidated within $100K-$105K after Trump’s inauguration. Because nothing says stability like a coin that swings more than a toddler on a sugar high.

- Options traders eyed $90K and $96K as likely levels for potential drops. Because who doesn’t love a good cliffhanger?

After shaking off the early ‘disappointment’ from the Trump inauguration (seriously, who thought that would go smoothly?), Bitcoin [BTC] has valiantly defended the $100K level. In the past two days, the king coin has been swinging between $100K and $105K like it’s auditioning for a role in a circus.

With key on-chain metrics suggesting a potential breakout from the overall price range, what’s next for BTC in the short term? A trip to the moon? Or a crash landing? Stay tuned!

BTC extends price range

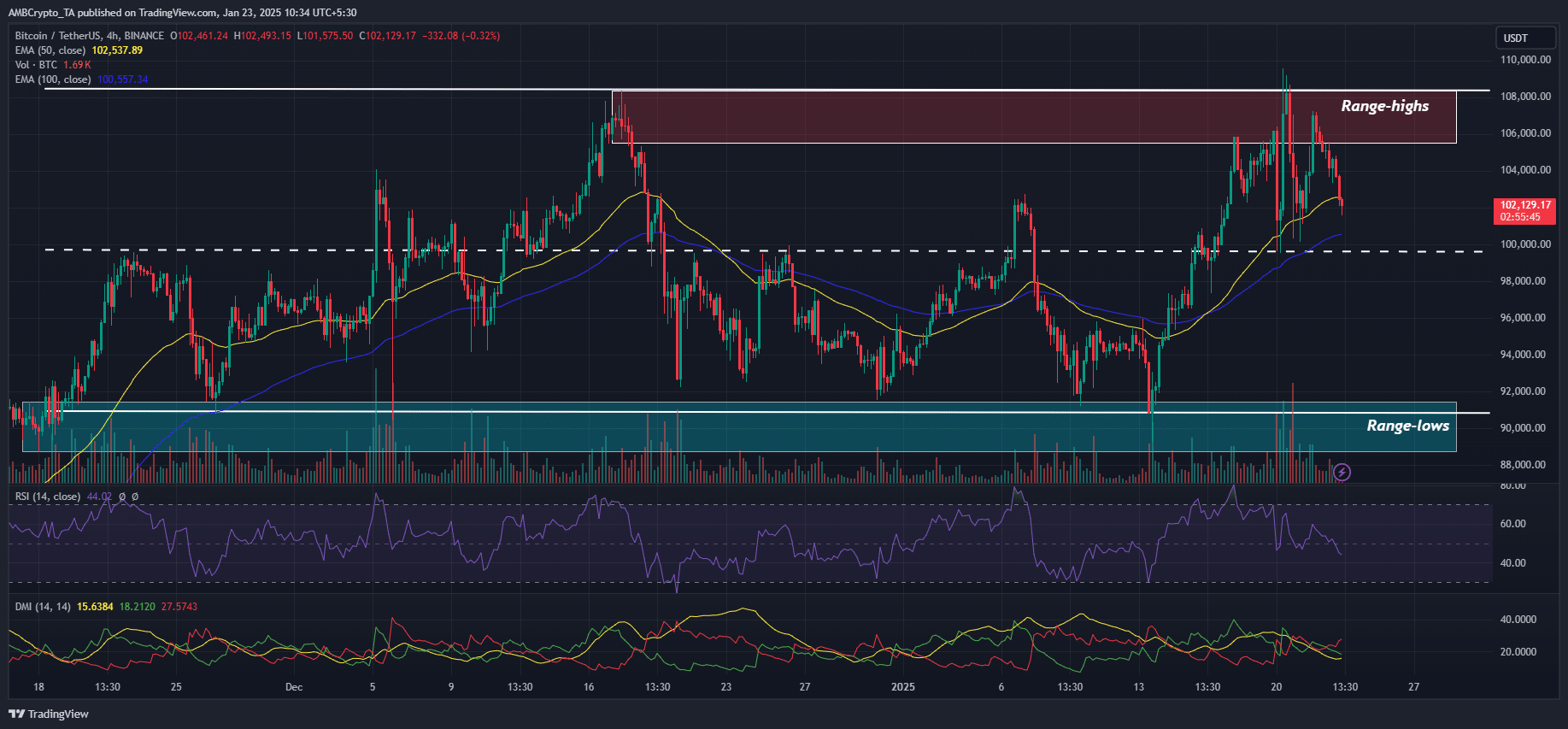

The recent price action was stuck in the upper range of $90K-$108K. Although bulls have previously used the 50-EMA (yellow) on the 4-hour chart for short-term re-entry, key chart indicators indicated increased weakening. Kind of like my willpower at a buffet.

For instance, the Directional Movement Index (DMI) showed that short-term momentum has eased significantly (red line above green) and could embolden short-sellers. Because who doesn’t love a good underdog story?

Similarly, the 4-hour RSI slipped below 50 at press time, indicating muted demand, perhaps linked to caution post-inauguration. Or maybe everyone just needs a nap.

The above bearish readings could endanger the $100K support and mid-range. If cracked, BTC could head lower to $96K or the range-lows at $92K. It’s like watching a soap opera, but with more numbers and less drama.

Key BTC levels per liquidity

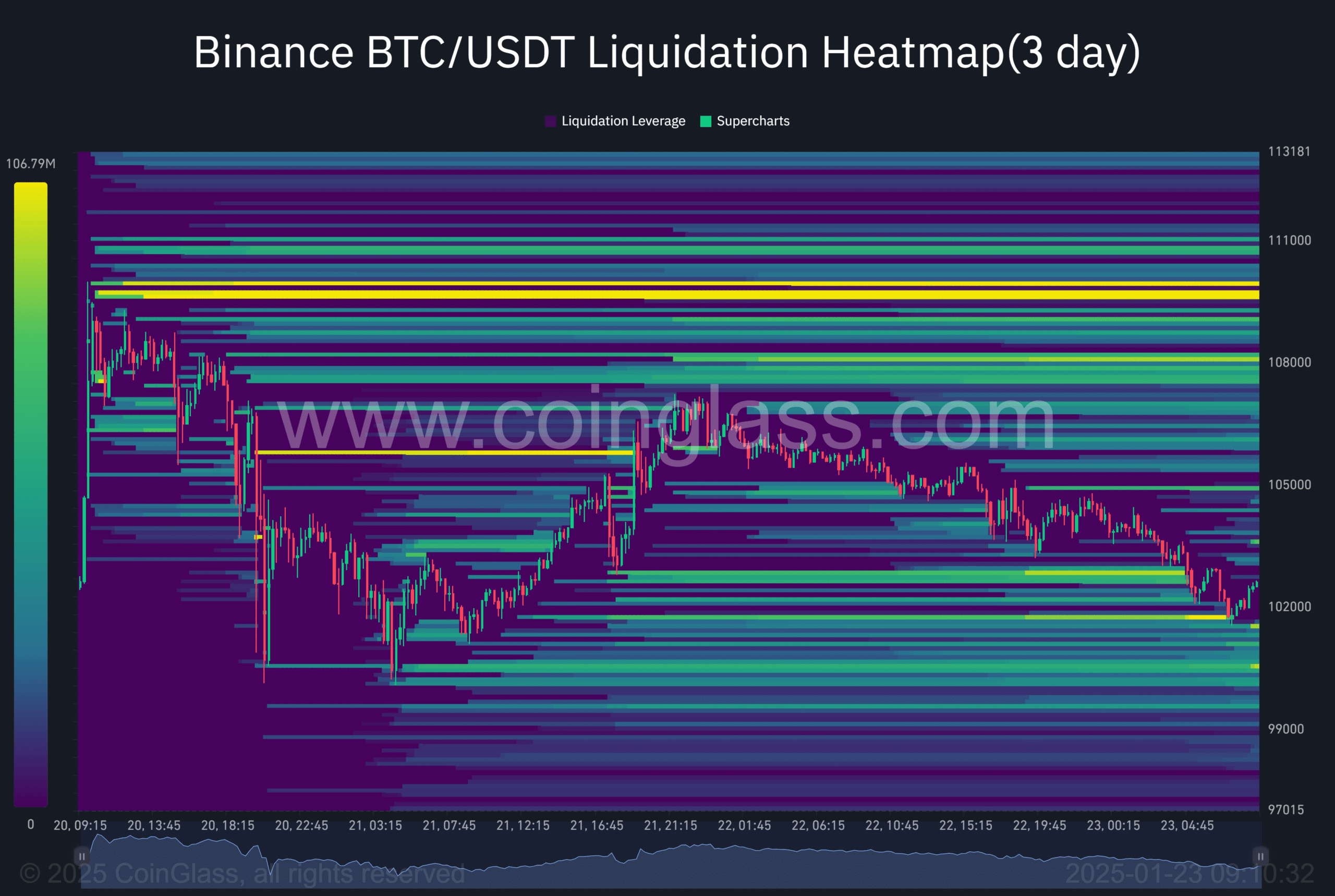

However, the liquidation heatmap disagreed with the above outlook. At press time, there was a massive pocket of liquidity (bright yellow) at $109K. It’s like a treasure chest waiting to be opened, but only if you can dodge the pirates.

This meant several players were shorting the asset at the recent all-time high. By extension, the vast liquidity could act as a price magnet and drive prices upward. If so, then $100K could be defended again. Because who doesn’t love a good comeback story?

That said, the Futures market remained bullish despite cautious sentiment in the spot markets. It’s like everyone’s at a party, but some are still checking their phones for updates.

According to the Options trading desk, QCP Capital, there were more bullish bets than bearish plays on the Futures side. It stated,

“Meanwhile, BTC futures continue to trend upward, especially on the front end, as market’s net-long exposure from last week remains solid. Bullish bets currently outpace bearish ones by a ratio of approximately 20:1.”

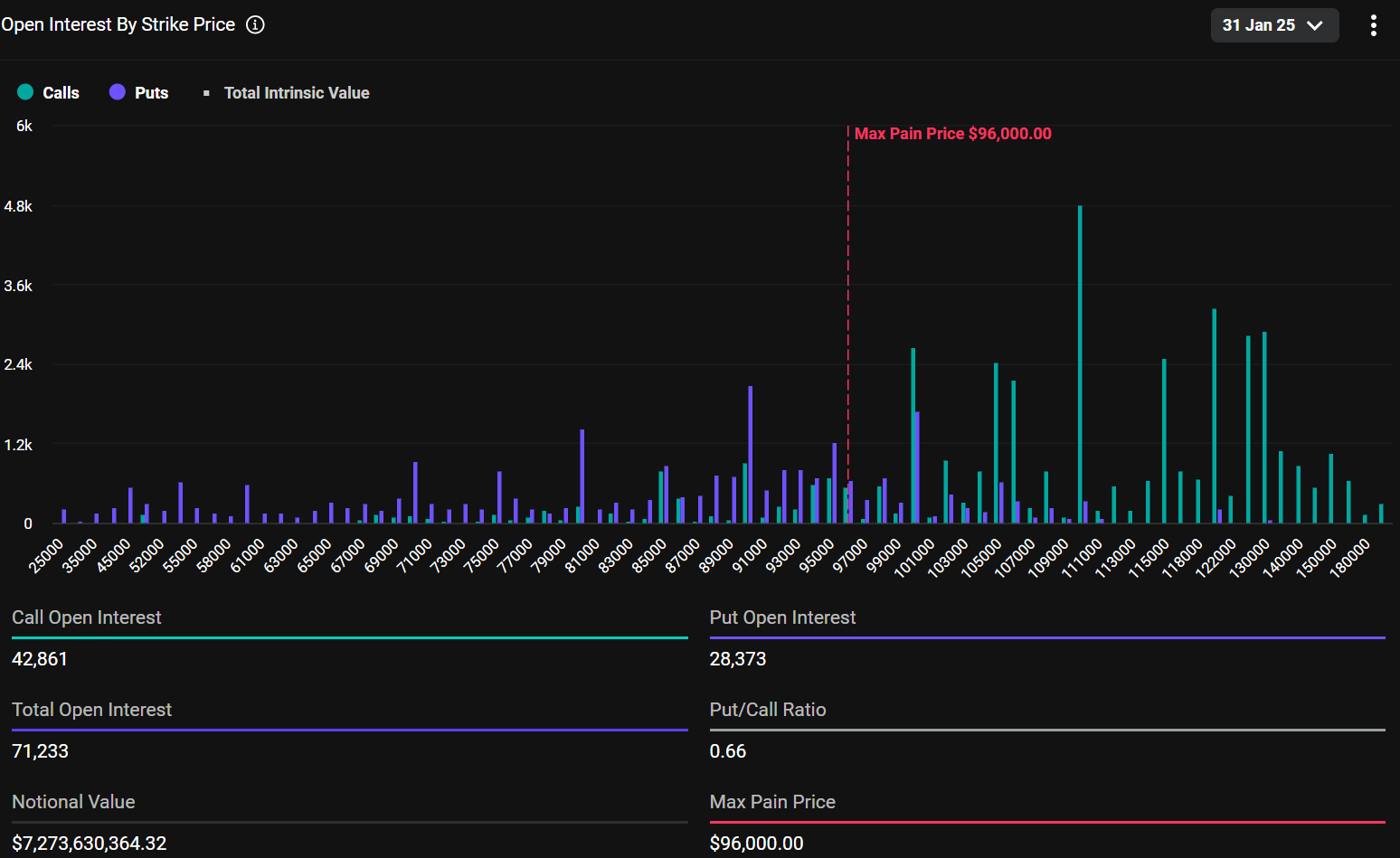

AMBCrypto checked Deribit’s next key Options’ expiry (31st January) for more insights. The $110K and $120K had the highest Open Interest for calls (bullish bets), marking them as key bullish targets by the end of January. Fingers crossed, everyone!

Read Bitcoin [BTC] Price Prediction 2025-2026. Spoiler alert: it’s a rollercoaster!

On the downside, $90K (highest puts, bearish bets) and the max pain point of $96K were key levels expected by Options traders for potential sharp drops. Because who doesn’t love a good plot twist?

Simply put, the market expects price swings within the $90K-108K range, with a possible deviation to $110K. Buckle up, it’s going to be a bumpy ride!

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Becky G Shares Game-Changing Tips for Tyla’s Coachella Debut!

- Elder Scrolls Oblivion: Best Sorcerer Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Gold Rate Forecast

- Elder Scrolls Oblivion: Best Thief Build

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Ludicrous

- Meet Tayme Thapthimthong: The Rising Star of The White Lotus!

2025-01-23 14:16