- Hold onto your wallets, folks! The Bitcoin Cycle Indicators (IBCI) have crossed a critical point on the chart, suggesting a fall could be on the horizon. Or maybe it’s just a bad hair day! 💇♂️

- BTC has developed strong support levels that could influence a price jump, should a price correction occur. Kind of like a trampoline for your money! 🤑

So, Bitcoin [BTC] took a little tumble in the past 24 hours, dropping a whopping 1.08%. But don’t worry, it’s still lounging above the $100,000 region like a sunbather on a beach! 🏖️

Despite the bullish market sentiment, corrective phases are as inevitable as your Uncle Larry at Thanksgiving dinner—just part of the broader market cycle! 🍗

AMBCrypto’s analysis found that a corrective phase could be approaching, and they’ve identified key regions that could support a bounce-back in price. Think of it as a bouncy castle for your investments! 🎉

Distribution phase threatens BTC

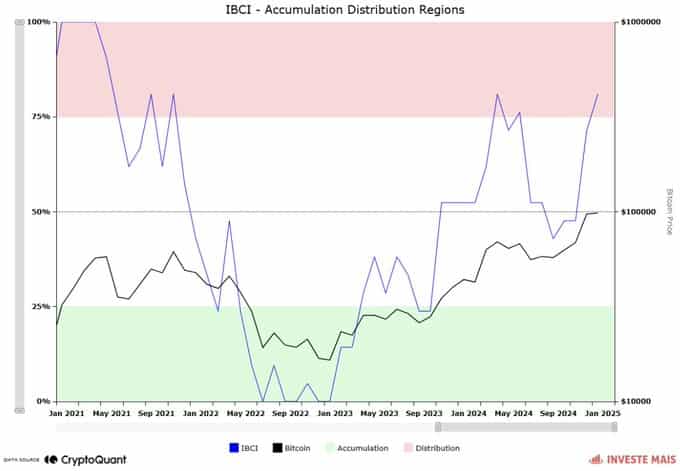

The Index of Bitcoin Cycle Indicators (IBCI) on CryptoQuant showed that the asset has entered a distribution zone, a level last reached eight months ago, in May 2024. Talk about a long vacation! 🏖️

IBCI is a combination of several market indicators—seven in total—including Puell Multiple, MVRV, NUPL, and SOPR. Sounds like a party, right? 🎊

A distribution is indicated when the IBCI crosses into the red region on the chart, starting at 75%. It’s like a warning sign that says, “Caution: Selling activities have begun!” 🚧

Once IBCI hits the 100% zone—which occurs when all seven indicators enter their distribution phase—BTC would hit a market top, with its price forming lower highs and lows. It’s like a rollercoaster, but without the safety bar! 🎢

IBCI above 50%, where BTC currently lies, suggests a corrective phase is expected before BTC resumes its upward trajectory. Buckle up, it’s going to be a bumpy ride! 🚀

Further analysis from AMBCrypto identified a potential bounce-back level should a correction occur before the market top is reached. Spoiler alert: It’s not a trampoline! 🤸♂️

A drop to mid-$90k before rally

Using the In/Out of Money Around Price, an on-chain metric to determine potential support and resistance zones on the chart, AMBCrypto determined where a potential BTC pullback would be met by demand for a continued move upward. It’s like finding the sweet spot on a seesaw! ⚖️

This demand zone lies between $94,800 and $97,000, with a mid-range of $96,500. Approximately 1.36 million BTC buy orders from 1.4 million addresses support this range. That’s a lot of people wanting to jump on the Bitcoin bandwagon! 🚍

A corrective phase into this region would be followed by a price surge back into the $100,000 region, with the possibility of BTC setting a new high from there. It’s like a phoenix rising from the ashes, but with more zeros! 🔥

Other market activities observed could also play in BTC’s favor for a move up, one being the creation of a stockpile including BTC. Sounds like a treasure hunt! 🏴☠️

U.S. stockpile could boost BTC

The creation of a U.S. digital assets stockpile, as announced in the recent executive order on January 23 by President Donald Trump, could favor BTC. Who knew the government was getting into the crypto game? 🎩

A digital stockpile including BTC implies the U.S. government may hold the cryptocurrency as part of its reserves. Just imagine Uncle Sam with a Bitcoin wallet! 💰

According to Arkham, the U.S. government already holds approximately 198,000 BTC, valued at $20.71 billion. If the government increases its holdings, it could drive demand and positively influence BTC’s price trajectory. It’s like a game of Monopoly, but with real money! 🎲

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-01-26 10:20