- Alas, Ethereum has once again failed to reclaim the illustrious $3.4k as its steadfast support.

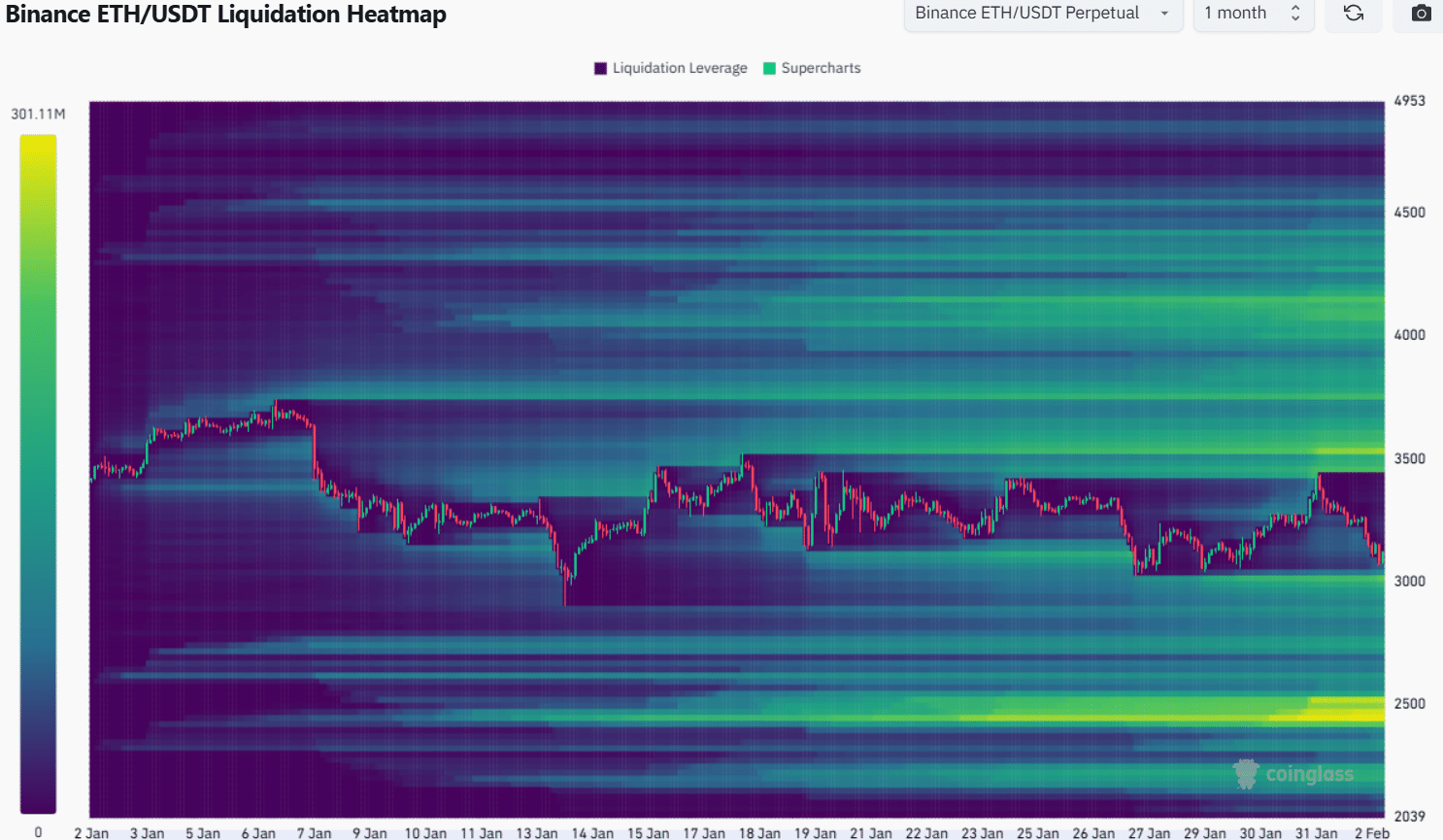

- Liquidation data suggests that a descent below $3k is not just a possibility, but a delightful inevitability.

Ah, the Ethereum [ETH] leadership, a veritable circus of inefficiency and aimlessness, has found itself under the critical gaze of the public. 🎪

In a rather informal poll, a staggering 97% of 335 voters, clutching a collective 51,198 ETH, have thrown their support behind Danny Ryan, a former researcher, to steer the ship of the Ethereum Foundation. One can only wonder if he has a life jacket. 🛟

Meanwhile, the ever-eloquent Vitalik Buterin has made it abundantly clear that he alone holds the reins of decision-making for the Ethereum Foundation’s leadership changes. How quaint! 🧐

Long-term on-chain metrics reveal that the die-hard holders of ETH remain steadfast, with only a smattering of profit-taking evident from the LTH NUPL metric. Yet, this confidence has done little to stem the relentless downtrend of our beloved altcoin monarch in recent weeks.

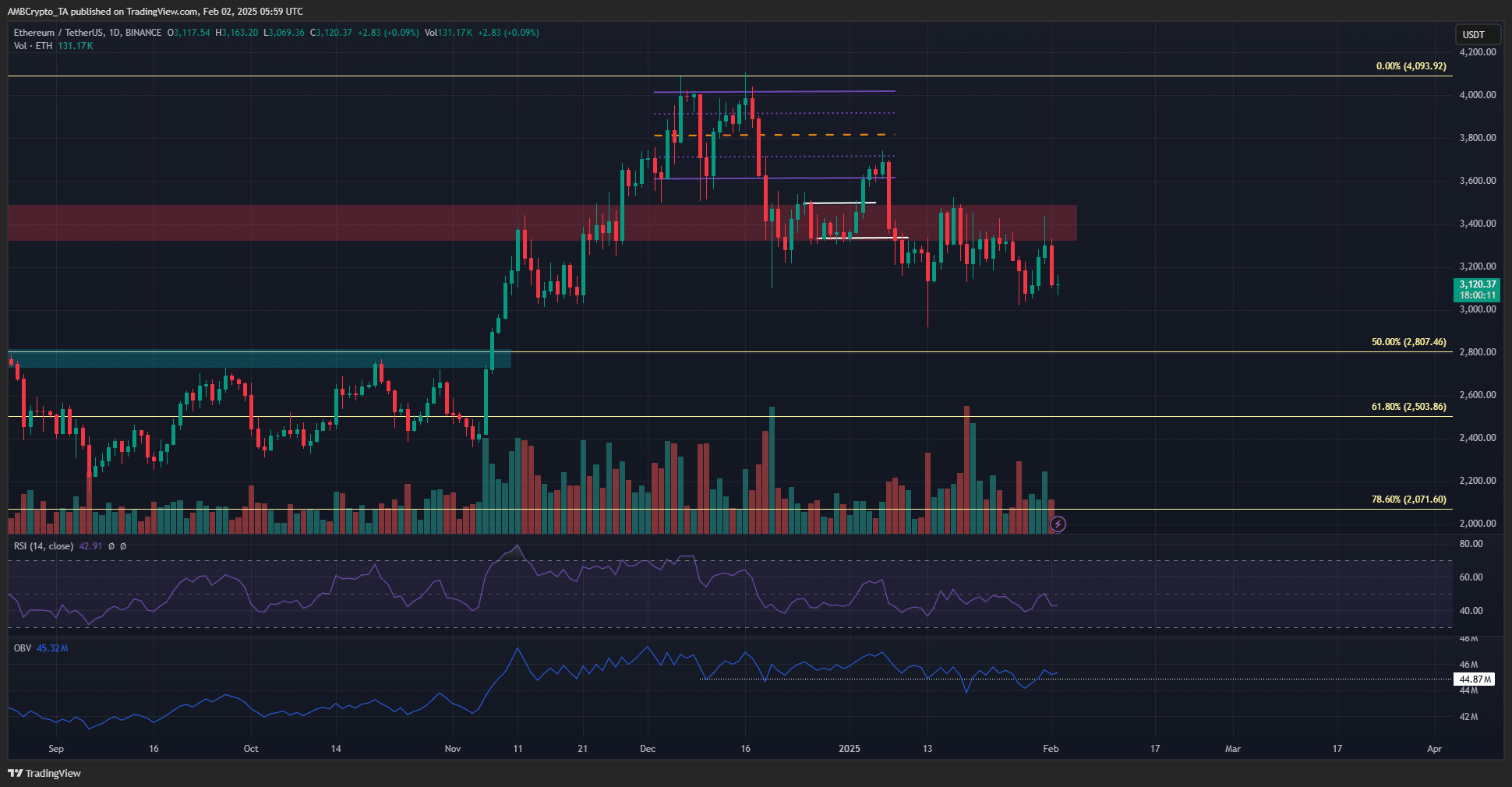

Ethereum bulls falter at $3,400 once again

In the balmy months of June and July 2024, the $3.4k-$3.5k range served as a bastion of support for ETH, only to be cruelly transformed into a resistance zone. The November rally, a fleeting moment of hope, was swiftly followed by a pullback that left many in despair.

Since then, this region has become a focal point of existential dread.

A brief rally beyond $3.5k in January was promptly reversed, leading to a series of lower highs and lower lows that would make even the most optimistic trader weep. 😢

The fleeting gains on the 30th and 31st of January brought a momentary glimmer of joy across the altcoin market, but alas, it was as ephemeral as a summer romance.

The daily RSI, in its infinite wisdom, confirmed the bearish structure with a reading below 50, while the OBV languished around a support level from the dark days of November and December. The volume indicator, a harbinger of buyer weakness, painted a rather grim picture.

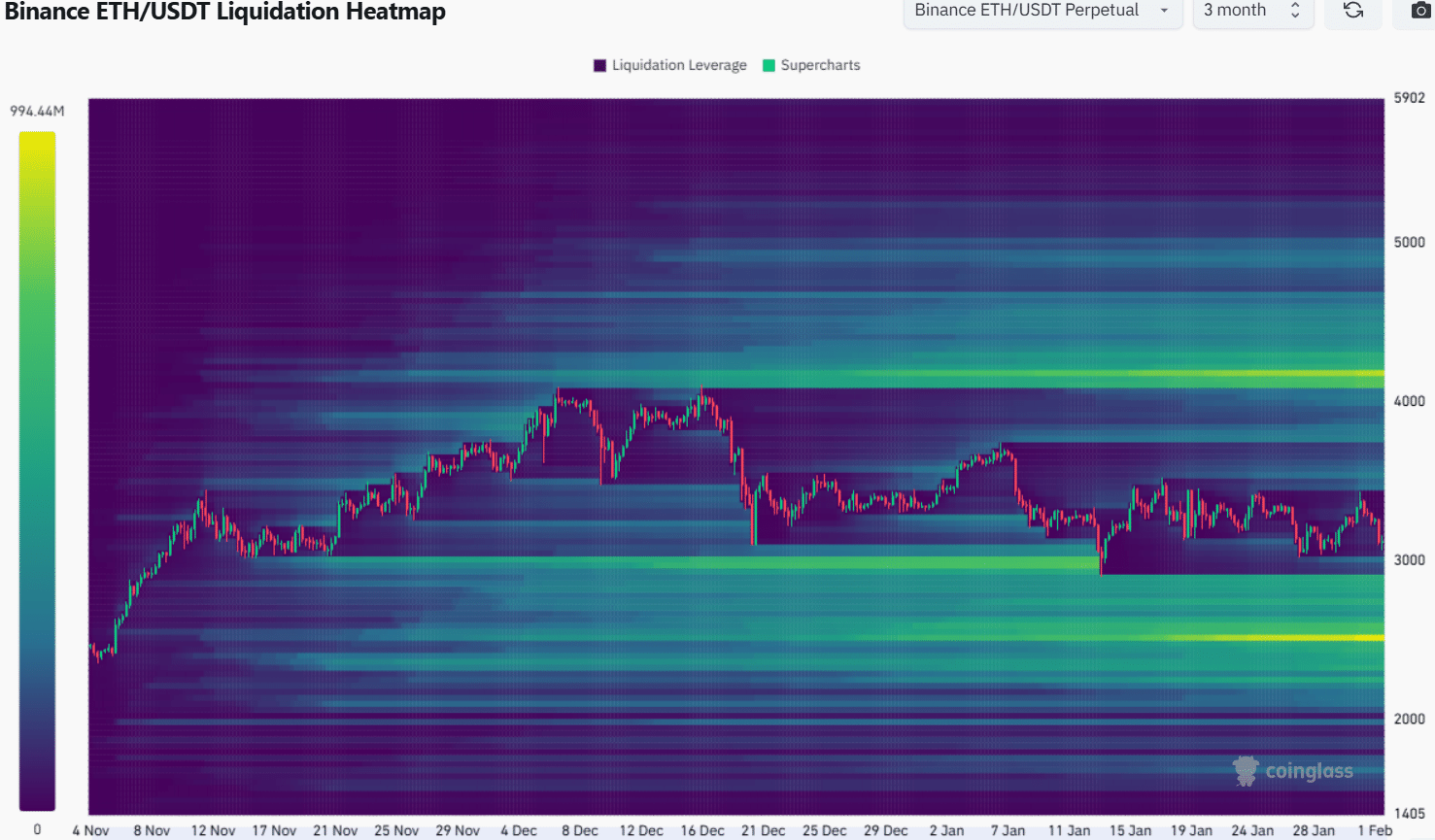

The 3-month liquidation heatmap ominously suggests that a descent to $2,850 is not just probable, but practically guaranteed. To the north, liquidity pockets at $3,460 and $3,800 beckon like mirages in a desert, while a sizable cluster at $4.2k looms ominously.

The magnetic zone at and below $3k indicates that a downward spiral is the most likely outcome in the coming days, aligning perfectly with the price action of the past month. How delightful! 🎢

Is your portfolio green? Check the Ethereum Profit Calculator, if you dare! 💸

The liquidation heatmap ominously reveals that $3k, $2.8k, and $2.7k are the next targets on this rollercoaster ride.

Whether these targets will be met in the coming weeks remains a tantalizing mystery. With Bitcoin [BTC] sentiment floundering, traders would be wise to bide their time for more favorable conditions before diving headfirst into the fray.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What You NEED to Know!

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2025-02-03 00:11