Ah, the markets. A grand, theatrical production of absurdity! The American credit system, plump and rosy-cheeked as a well-fed babushka, positively glows with health. Yet, our dear Bitcoin…well, let’s just say it’s looking a little peaked. A paradox, you see. A most inconvenient paradox. Like serving caviar to a man with a toothache. 🙃

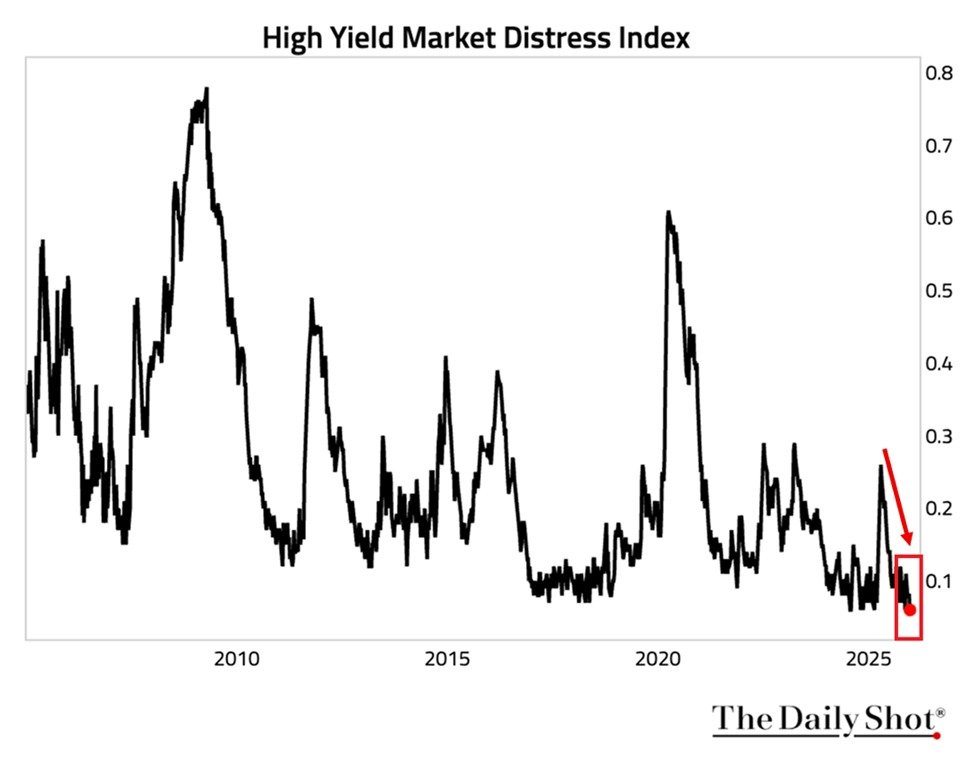

The New York Federal Reserve’s high-yield distress index has slumped to a pathetic 0.06 points – a number so low, it practically begs for a doctor. Apparently, corporate borrowing is as easy as stealing apples from a drowsy orchard. A triumph of finance, no doubt. For those who aren’t Bitcoin, that is.

Credit Markets All-Clear: The Money Went…Where, Exactly?

For comparison, during the unsettling drama of 2020, that index trembled above 0.60. And in 2008? A staggering 0.80! Today? A blissful, almost suspicious calm. The usual suspects – risky assets – are luxuriating in this abundance. One would assume such a deluge of funds would trickle down, naturally finding its way into the digital gold, wouldn’t one? 🤨

The high-yield corporate bond ETF (HYG) is doing a little jig, up roughly 9% this year, according to those at iShares. All very…pleasant. But where is the enthusiasm for the revolutionary, decentralized future? Lost, I suspect, in a sea of perfectly predictable, utterly boring returns.

CryptoQuant’s Ki Young Ju, a man who clearly understands the shifting sands of capital, notes the inflow into Bitcoin has…dried up. A drought! Funds are merrily skipping over to equities and, of all things, gold. Gold! The relic of a bygone era. The irony is enough to make a saint swear. 🤦

Capital inflows into Bitcoin have dried up.

Liquidity channels are more diverse now, so timing inflows is pointless. Institutions holding long-term killed the old whale-retail sell cycle. MSTR won’t dump any significant chunk of their 673k BTC.

Money just rotated to stocks and…

– Ki Young Ju (@ki_young_ju) January 8, 2026

It appears those equities, with their shiny AI and Big Tech baubles, are proving far more alluring. Institutional investors, those creatures of habit and risk-adjusted returns, find equities…acceptable. Bitcoin? A bit too…spirited, perhaps. Too unpredictable for a comfortable afternoon nap.

Thus, Bitcoin finds itself rather low on the pecking order. Abundant liquidity, yes, but for others. It’s like being at a lavish banquet and being offered only crumbs. A deeply humiliating experience, you understand. 😔

Sideways Consolidation Replaces Crash Scenarios (For Now…)

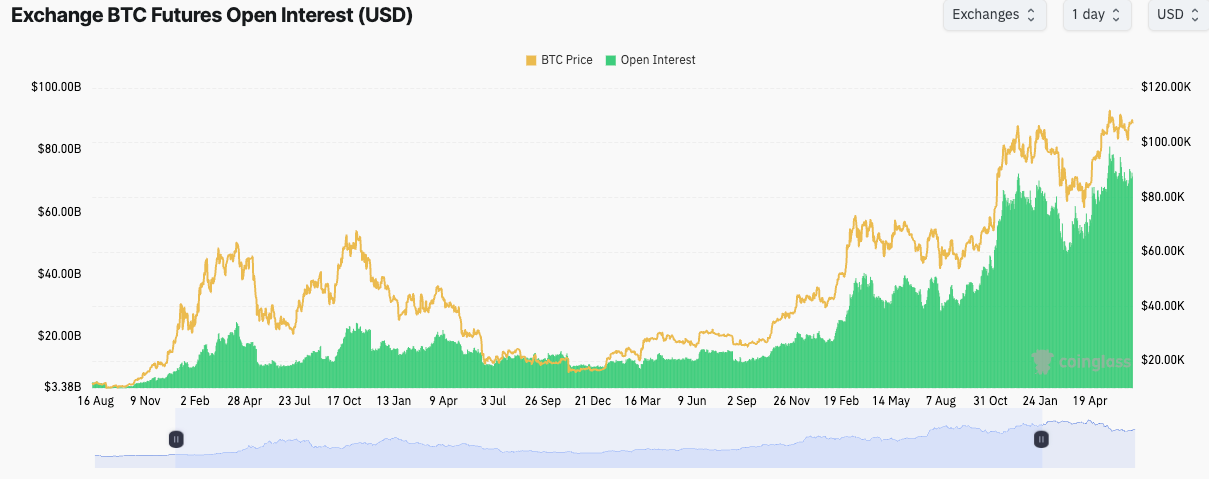

The derivatives market mirrors this ennui. Bitcoin futures open interest, a bloated $61.76 billion, yet the price remains stubbornly…still. A monotonous $91,000, clinging to life like a barnacle on a ship. Only $89,000 offering a scant foothold. It’s all terribly…pedestrian.

Binance, CME, and Bybit – all dutifully taking positions, mostly hedging, adjusting. No great fervor, no dramatic pronouncements. Just a quiet acknowledgment of the…situation. And MicroStrategy? Still hoarding those 673,000 BTC. They’re practically building a fort with them. A very, very expensive fort. 🏰

The old whale-retail dance is over. Institutional hands are in it for the long haul, and the new spot Bitcoin ETFs have introduced a stillness, a…politeness that was previously absent. Frankly, it’s all rather disconcerting.

“I don’t think we’ll see a -50%+ crash from ATH like past bear markets,” Ki predicted. “Just boring sideways for the next few months.”

Short sellers? Best to find another hobby. Longs? They wait. And wait. And wait. Patience, it seems, is now a requirement for crypto enthusiasts. A truly cruel twist of fate. 😈

A Flicker of Hope? Or Just Another Mirage?

Perhaps a bursting equity bubble? An aggressive Fed policy shift? Regulatory clarity – a concept as mythical as the unicorn? Or maybe, just maybe, something actually happens with Bitcoin itself. Halving dynamics, ETF options…something to stir the pot.

But until then, we are left with this: extended consolidation. Healthy enough to avoid utter ruin, but deprived of the exhilarating rush of upward momentum. A state of suspended animation. It’s enough to drive a man to drink. 🍷

And so, the paradox endures: a world awash in liquidity, yet Bitcoin…waits. A poignant, almost Chekhovian scene, wouldn’t you agree?

Read More

- Ashes of Creation Rogue Guide for Beginners

- Best Controller Settings for ARC Raiders

- Can You Visit Casino Sites While Using a VPN?

- Transformers Powers Up With ‘Brutal’ New Combaticon Reveal After 13 Years

- Unveiling the Quark-Gluon Plasma with Holographic Jets

- Gold Rate Forecast

- If you ditched Xbox for PC in 2025, this Hall Effect gamepad is the first accessory you should grab

- Crunchyroll Confirms Packed Dub Lineup for January 2026

- 5 Best Things 2010s X-Men Comics Brought To Marvel’s Mutants

- Lies of P 2 Team is “Fully Focused” on Development, But NEOWIZ Isn’t Sharing Specifics

2026-01-08 06:37