Bitcoin‘s 4-hour RSI Dives, Market Gasps, but Does It Matter?

- A staggering $10 billion crypto liquidation, thanks to Bitcoin’s 6.6% price drop. Ouch!

- But fear not, scalp traders! Quick reactions meant quick profits.

As the crypto market got swept up in Trump’s trade tariff tizzy, Bitcoin took a tumble. But with an 8% bounce back, it’s reclaiming its rightful place in the crypto hierarchy.

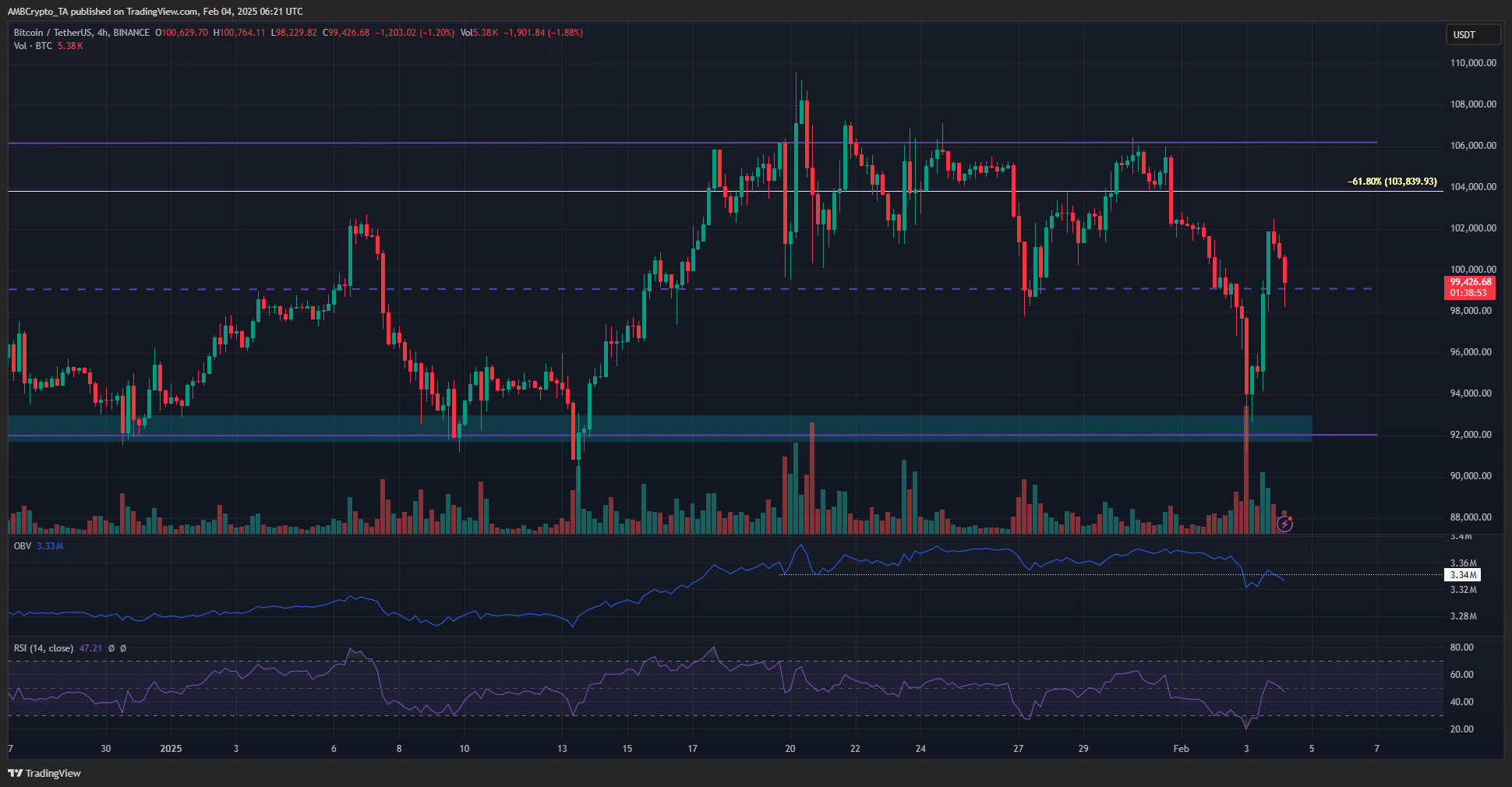

Bitcoin’s RSI: A Clue to What’s Next?

The Relative Strength Index (RSI) measures an asset’s momentum over 14 trading sessions. An RSI above 70 means overbought, while below 30 means oversold.

On January 3rd, the 4-hour RSI plummeted to 19.76. Yikes! But Bitcoin’s reaction in the past 24 hours has been, well, reactionary. And that’s a good thing.

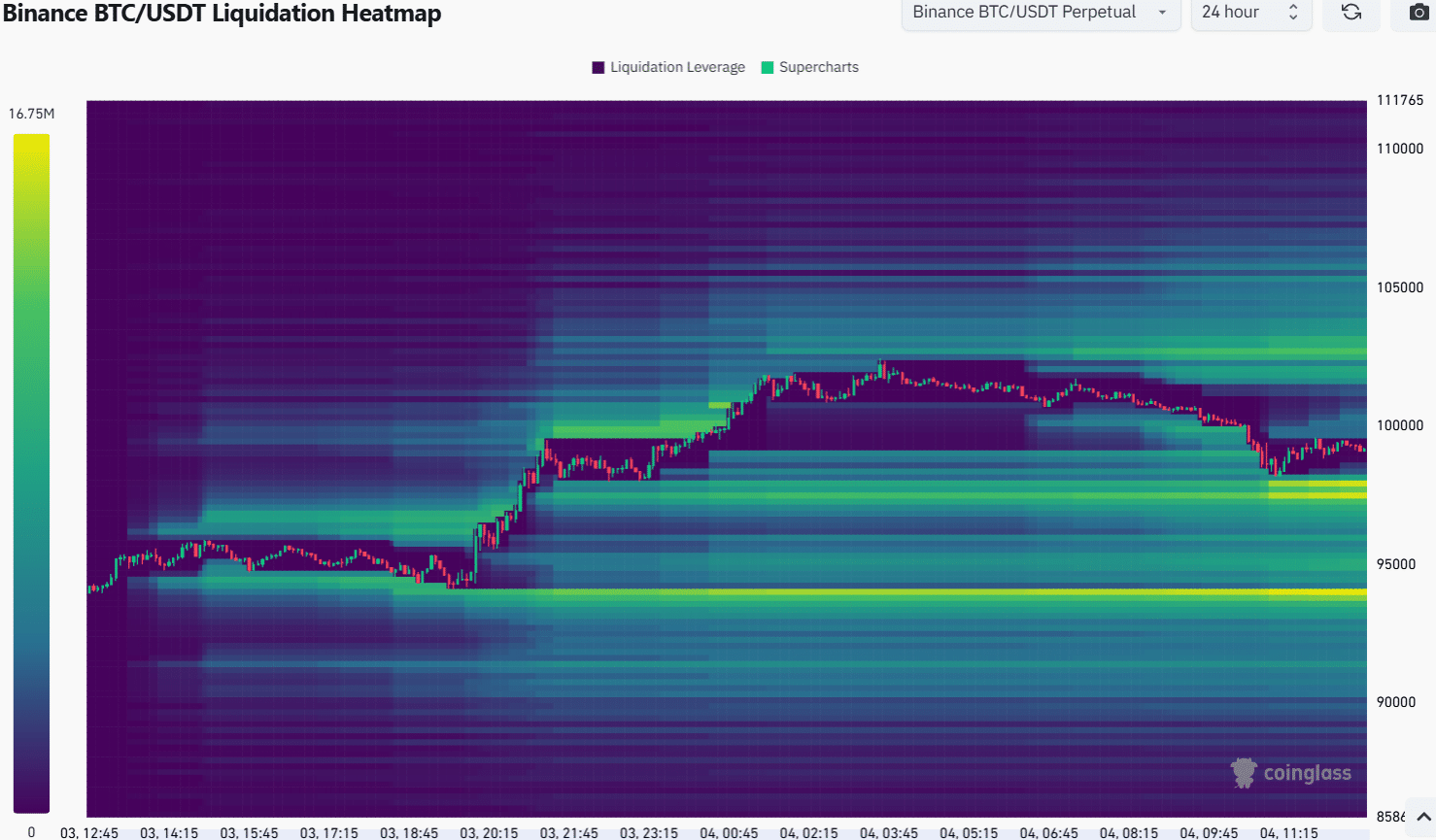

The 24-hour liquidation heatmap shows the $97.5k and $94k as immediate targets. But fear not, dear crypto enthusiasts! Bitcoin’s quick bullish reaction is a beacon of hope in these volatile times.

The Verdict?

While the price action remains above key support zones, the On-Balance Volume (OBV) has made a new lower low. This suggests that the increased selling volume has shifted the bias in favor of the bears.

But remember, in the wild world of crypto, anything can happen. So, keep your eyes on the prize and your fingers on the pulse of the market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-02-04 16:09