- In a twist straight from the annals of fate, Bitcoin‘s latest woes echo the ghosts of market crashes past; FTX and COVID trembled at its approach.

- Oh, but the institutional buy-boys seem to be dancing a jig of optimism – could it be? A phoenix waiting to rise amidst the rubble of chaos?

Alas, dear reader! The Bitcoin [BTC] saga unfolds like a tragicomedy, as its price takes a nosedive, sending tremors through the market akin to a great calamitous fall. The largest liquidation of longs in months – imagine the wailing and gnashing of teeth!

As our dear BTC plummeted, the fortunes of overly optimistic traders were taken from them swifter than a gentleman’s hat blown away by a gust of wind. Massive losses, they say! Yet one wonders, was their faith misplaced?

This melodramatic sell-off calls forth eerie apparitions from previous market catastrophes, leaving all to ponder whether the specter of decline looms large on the horizon.

Is the market undergoing a reset of grand proportions?

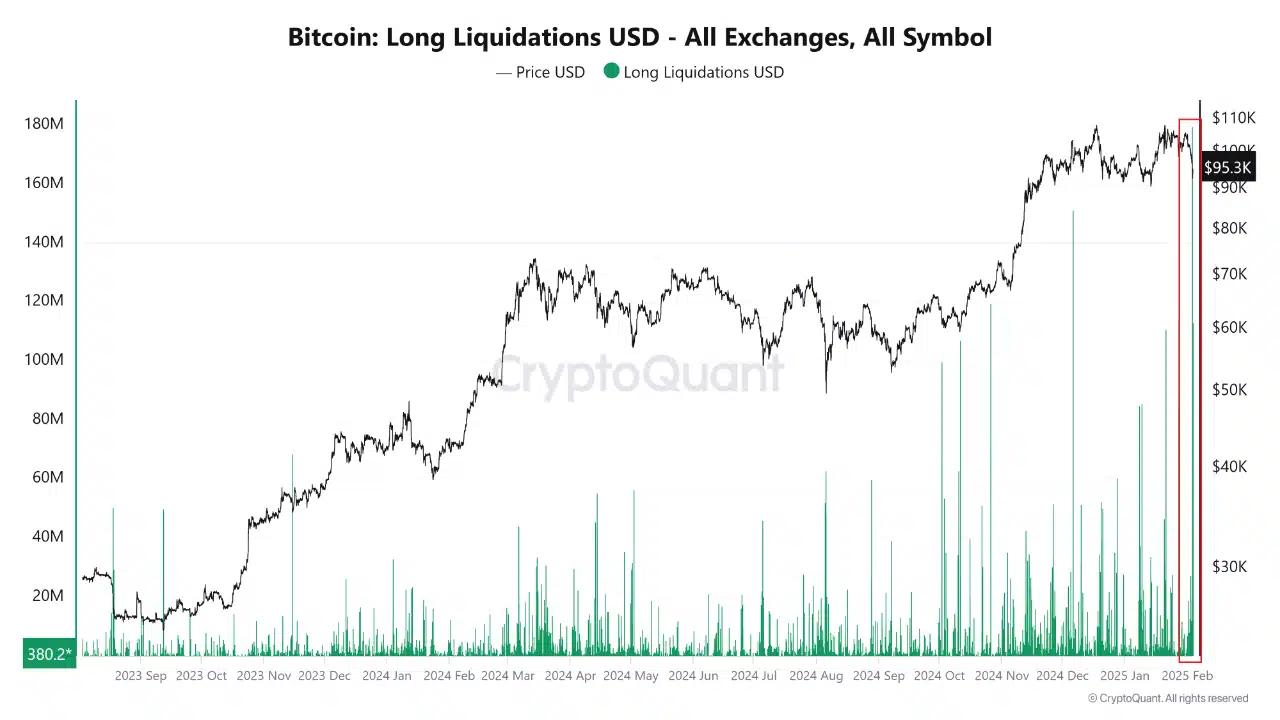

Recent revelations unveil that Bitcoin long liquidations have surged to ghastly heights unseen since the fateful September of the year twenty twenty-three.

The liquidation volume soared past a staggering $180 million, a true testament to the blind confidence traders exuded in their shining bullish positions before the heart-stopping drop.

As BTC took a tumble down to approximately $95.3K, a cascade of forced sell-offs ensued, rapidly vanquishing the proud leveraged long positions. How splendidly ironic!

Oh, the high hopes of the market dashed against the rocks of reality, triggering a liquidation event that could make a novelist swoon with delight!

The steep rise of liquidations in late January and early February speaks to a most excessive leverage – a precarious game for those unsuspecting traders, leading to a most significant cleansing of market sins.

The harrowing tale of Bitcoin: What prompted this travesty?

This sudden desolation in the BTC realm beckons us to seek answers. Overleveraged positions – the notorious villain in this tale – led traders to the precipice as BTC faltered, unleashing a veritable cascade of liquidation chaos.

Mere whispers of macroeconomic uncertainty, concerns over monetary regulations, and shadowy figures in the marketplace spooked innocent investors into flight, contributing to our unfortunate fate.

A tumultuous aftermath ensued, leaving many overleveraged traders scurrying like ants after a raindrop, and resetting the market’s leverage back into the realm of reason.

And behold, as volatility heightened, sharp price swings akin to dancing bears ensued! Yet with excess leverage now exorcised, a chance for a more stable, organic recovery makes its humble entrance.

The eerie parallels to past cataclysms!

This latest liquidation debacle unveils striking similarities to the great market crashes of old.

With an Open Interest of $31.9 billion in decline, we draw comparisons to those benevolent liquidations of yore – the COVID-19 fiasco and the FTX debacle, why, even the August 2024 swoon invites our scrutiny!

While the August crash offered a fleeting respite, this chapter reveals an even steeper drop to feast upon. Ah, though FTX’s descent was more severe, both share a rather sudden encore that makes one sit up in horror.

Alas, the COVID-19 lull, precipitated by liquidity troubles, ushered in a rapid decline in Open Interest that reverberated as forceful liquidations took center stage in the market’s theater.

Bitcoin: Once more unto the breach, resetting our expectations!

The Coinbase Premium Gap, that fickle friend, hints at splendid buying interest following Bitcoin’s pitiful tumble to the $92K-$95K range.

Ah! The positive premium betrays institutional investors who gallantly step in, swooping low on the price drop as if it were a pizza sale, snatching up BTC in hopes of a glorious rebound.

Such fortitude amidst market weakness is a sight to behold! Like a brave knight facing dragons, they charge forth!

Still, beware! The MVRV Momentum indicator lurks, casting a dark shadow since the dawn of the year, suggesting many poor souls remain underwater on their investments.

Read Bitcoin’s [BTC] Price Prediction 2025–2026, if you dare! 📉

History whispers to us that a negative MVRV foretells a drawn-out consolidation or perhaps further descent into the abyss, should confidence not return soon. And so, this liquidation event has indeed reset market sentiment, with the volatility of a jester still reigning supreme.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Moana 3: Release Date, Plot, and What to Expect

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2025-02-05 03:08